As of 2022, nearly 304 million people in the United States had some form of health insurance, a significant increase from around 257 million in 2010. However, there were still over 25 million people without any health insurance in the country. The Affordable Care Act (ACA) played a crucial role in reducing the number of uninsured people, but its repeal has led to a rise in those without coverage. Public opinion on a Medicare-for-all plan remains divided. While some advocate for a single payer approach, others prefer a mix of private companies and government programs. Cost is a significant barrier for many, and the issue of government responsibility in ensuring healthcare coverage remains politically divisive.

What You'll Learn

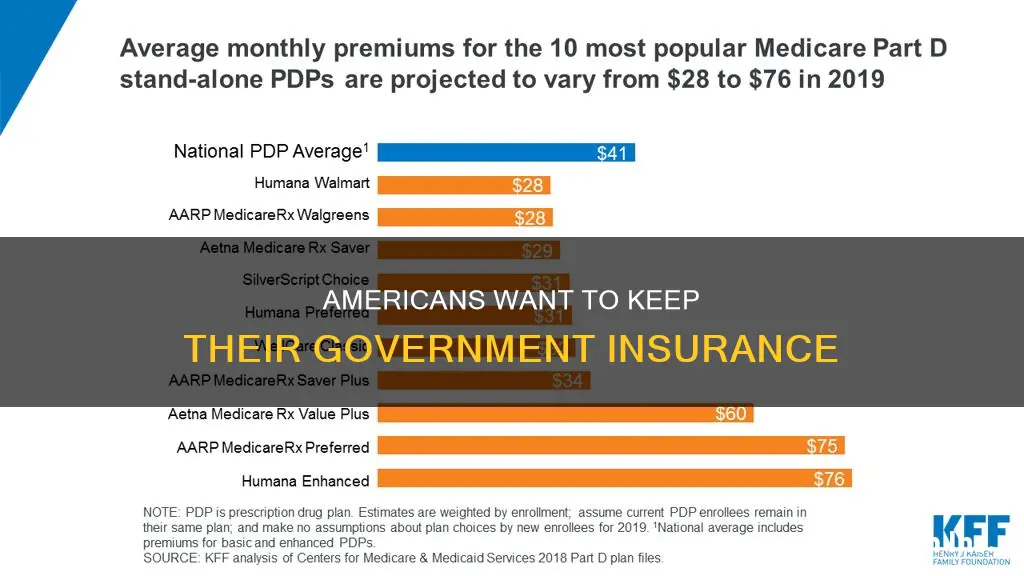

The number of people who want to keep their government insurance

The Affordable Care Act (ACA) has played a significant role in reducing the number of uninsured people in the United States, decreasing from 44.8 million in 2013 to 28.6 million in 2015. However, the number of uninsured people has risen since the repeal of the individual mandate.

In 2022, the number of non-elderly uninsured individuals continued a downward trend, dropping to 25.6 million, a decrease of 3.3 million from 2019. This decrease can be attributed to coverage expansions put in place by the ACA, including Medicaid expansion and subsidized Marketplace coverage. These policies protected people with low incomes and improved the affordability of private coverage.

Despite these gains, racial and ethnic disparities in coverage persist, with people of color comprising 45.7% of the non-elderly US population but accounting for 62.3% of the total non-elderly uninsured population. Additionally, undocumented immigrants are ineligible for federally funded coverage, further contributing to the disparities.

Public opinion on government-provided health insurance varies across political affiliations. According to a Pew Research Center survey, 60% of Americans believe it is the federal government's responsibility to ensure health care coverage for all, including 31% who support a "single-payer" approach. This view is more prevalent among Democrats and Democratic-leaning independents (85%) than Republicans and Republican leaners (68%).

While the issue of government responsibility for health coverage remains politically divisive, a majority of Republicans (55%) still support continuing programs like Medicare and Medicaid for seniors and the very poor. Only 10% of Republicans believe the government should not be involved in providing health insurance at all.

In summary, while there is no consensus on the government's role in providing health insurance, a significant number of people want to keep their government insurance, as evidenced by the high percentage of the population with some form of public or private insurance. The COVID-19 pandemic and associated policies also played a role in decreasing the number of uninsured individuals and protecting low-income individuals from coverage losses. However, disparities in coverage based on race, ethnicity, and immigration status persist, highlighting areas that require further attention and action.

Insured in China: Nearly Universal

You may want to see also

The number of people who have private insurance

Private health insurance is a contract between an individual and a private health insurance company that mandates the insurer pay some or all of an individual's medical expenses as long as they pay their premium. In the US, private insurance is the most common way Americans get coverage. The US Census Bureau estimates that 66% of Americans have a private health plan compared to 36% with public plans.

As of 2022, nearly 304 million people in the United States had some kind of health insurance, a significant increase from around 257 million insured people in 2010. However, as of 2022, there were still over 25 million people in the United States without any kind of health insurance. In 2022, the number of nonelderly uninsured individuals continued a downward trend, dropping by nearly 1.9 million from 27.5 million in 2021 to 25.6 million.

In 2021, almost 50% of the insured population of the United States were insured through employers, while 18.9% of people were insured through Medicaid, and 15.4% of people through Medicare. In 2021, around 60% of Americans had private health insurance. This number has been slowly rising since 2013.

Private health insurance has been a part of American life for nearly 100 years. The need for health insurance emerged in the 1920s, fuelled by increasing hospital care costs. Baylor Hospital in Dallas, Texas, introduced the first pre-paid hospital insurance in 1929, offering medical services to a group of Texas teachers for a premium of 50 cents a month. By the late 1930s, nearly 3 million Americans were enrolled in "Blue Cross" hospital plans.

Private health insurance continues to dominate the US healthcare landscape. Despite attempts by US presidents to implement government-sponsored universal health care, it has never materialized. Although President Lyndon Johnson signed Medicare into law in the 1960s to provide a safety net for citizens over 65, the majority of Americans under 65 continue to get their health care from private insurers.

According to the Kaiser Family Foundation, almost half of all Americans receive employer-sponsored health insurance. Additionally, 5% of non-elderly Americans buy coverage outside of the workplace in the individual health insurance market. Group health insurance plans offered through workplaces are often the most affordable private health insurance plans because employers subsidize costs.

Understanding Short-Term Insurance: Temporary Coverage, Long-Term Peace of Mind

You may want to see also

The number of people who are uninsured

As of 2022, there were 25 million people in the United States without any kind of health insurance. This figure represents 8.4% of the population, a decrease from 16% in 2010. The Affordable Care Act (ACA) has been instrumental in reducing the number of uninsured people, with the number falling from 44.8 million in 2013 to 28.6 million in 2015. However, since the repeal of the individual mandate, the number of uninsured has risen.

The uninsured rate among working-age adults aged 19-64 decreased by 0.8% between 2021 and 2022, partly due to a decrease in uninsured rates for workers. Overall, the number of uninsured individuals continued a downward trend, dropping by nearly 1.9 million from 27.5 million in 2021 to 25.6 million in 2022. This decrease is attributed to pandemic-era coverage protections, a strong job market, and increases in employer-sponsored coverage.

Among nonelderly individuals, 25.6 million were uninsured in 2022, a decrease of 3.3 million from 2019. Most uninsured people are in low-income families, with at least one worker in the family, and are people of colour. Geographic variations also exist, with most uninsured people living in the South or West of the country. Additionally, nonelderly adults are more likely to be uninsured than children due to broader availability of Medicaid and CHIP coverage for children.

The high cost of insurance is the main reason cited by uninsured nonelderly adults for lacking coverage, with 64% stating this as the primary reason in 2022. Many uninsured people do not have access to coverage through their jobs, and some, especially those in non-Medicaid expansion states, remain ineligible for financial assistance. Furthermore, undocumented immigrants are ineligible for federally funded coverage.

STD Testing: Preventative or Not?

You may want to see also

The number of people who support a single-payer system

In the United States, 60% of people believe it is the federal government's responsibility to ensure all Americans have health care coverage. Of these, 31% support a "single-payer" approach to health insurance, according to a survey by Pew Research Center. This equates to approximately 18.6% of all Americans.

A single-payer system is a type of universal healthcare in which the costs of essential healthcare for all residents are covered by a single public system. This means that a single government or government-related source pays for all covered healthcare services. In the context of the US, a single-payer system would be funded by combining current public funding sources (like Medicare and Medicaid) with new taxes based on ability to pay.

Single-payer systems are used in several countries worldwide, including the UK, Canada, Taiwan, and Australia. In these countries, single-payer healthcare is typically available to all citizens and legal residents.

Unraveling the Economics of DNA Testing: Natera's Insurance Billing Strategies

You may want to see also

The number of people who want the government to continue providing insurance

The support for government-provided health insurance is higher now than it was from 2008 through 2016, with 51% supporting it in 2016 compared to 60% today. Among those who believe the government should provide health coverage, 31% support a "single-payer" approach, meaning that health insurance should be provided through a single health insurance system run by the government rather than through a mix of private companies and government programs. This view is more common among Democrats, with 49% supporting a single national insurance system, while 31% support a mix of private and government programs.

While there are varying opinions on the government's role in providing health insurance, the majority of Americans support the continuation of government-provided insurance, and this support has increased over the years. The impact of government-provided insurance, such as the ACA, has also led to a decrease in the number of uninsured individuals, highlighting the importance of this issue for many Americans.

Understanding Your Insurance Bill: A Comprehensive Guide

You may want to see also

Frequently asked questions

60% of Americans believe it is the federal government's responsibility to ensure health care coverage for all. This includes 31% who support a "single-payer" approach.

As of 2022, nearly 304 million people in the United States had some form of health insurance, with 8.4% uninsured. This is a significant improvement from 2010, when 16% were uninsured.

Uninsured individuals often face unaffordable medical bills and are more likely to delay or forgo care due to costs. They also have lower access to care and are less likely to receive preventive services and treatment for chronic diseases.