As of 2020, about 95% of the population of China has at least basic health insurance coverage. This includes both public and private medical institutions and insurance programs. The country maintains two parallel medical systems, one for modern or Western medicine, and one for Traditional Chinese Medicine (TCM).

The basic medical insurance system in China is divided into two parts: employee medical insurance, which covers the urban employed population, and resident medical insurance, which covers the urban non-employed population and the rural population. In 2020, 25% of people with basic medical insurance were on employee schemes, while 75% were on resident schemes.

The Chinese government has been working to improve access to healthcare, and the percentage of individuals with insurance has been increasing since the late 1990s. In 1997, 24% of individuals were insured, rising to 28% in 2004 and 49% in 2006.

| Characteristics | Values |

|---|---|

| Percentage of population with basic health insurance coverage | 95% as of 2020 |

| Number of people covered by basic medical insurance | 1.351 billion |

| Number of people covered by employee medical insurance | 344 million |

| Number of people covered by resident medical insurance | 1.017 billion |

| Number of poor people covered by medical assistance | 78 million |

| Percentage of medical costs covered by public health insurance | About 50% |

| Percentage of medical costs covered by insurance under the "Healthy China 2020" initiative | 70% |

| Number of people insured under maternity insurance | 235.673 million |

| Percentage of population with health insurance coverage in 9 provinces | 49% in 2006 |

| Number of insurance companies in China | 237 as of 2022 |

What You'll Learn

- Insurance coverage in China rose from 24% in 1997 to 49% in 2006

- In 2020, 95% of the Chinese population had basic health insurance coverage

- China's insurance industry had 237 providers in 2022

- The Chinese government subsidises insurance premiums for rural communities

- China's health insurance schemes cover outpatient and inpatient care

Insurance coverage in China rose from 24% in 1997 to 49% in 2006

China's insurance coverage rate has increased significantly since the 1990s, with the percentage of individuals with insurance rising from 24% in 1997 to 49% in 2006. This growth in insurance coverage is largely attributed to government interventions aimed at improving access to healthcare, particularly in rural areas.

The distribution of health insurance across rural and urban areas in China has historically been uneven, with almost all urban residents covered by health insurance plans in the late 1970s, while only about 90% of rural residents had insurance through the Rural Cooperative Medical System. Beginning in the early 1980s, privatisation reforms led to a decline in insurance coverage and an increase in inequities, with the percentage of insured Chinese dropping to around 20% by the late 1980s or early 1990s.

To address these disparities and increase insurance coverage, the Chinese government implemented several policy interventions in the 1990s. These included the Urban Employee Basic Medical Insurance programme, launched nationally in 1998, and the New Cooperative Medical Scheme, introduced in rural areas in 2003. By 2006, these efforts had resulted in a dramatic upswing in insurance coverage, particularly in rural areas. The percentage of individuals with insurance in nine provinces, home to over 40% of China's population, increased from 24% in 1997 to 49% in 2006. This growth in insurance coverage reflected the government's efforts to develop a new insurance programme and provide increased subsidies for rural participants.

However, it is important to note that despite the impressive gains in insurance coverage, reimbursement rates for inpatient care may have declined during this period. This suggests that while more individuals had access to health insurance, the generosity of coverage may have decreased.

Maximizing Insurance Reimbursement for Vivitrol Injection: A Guide for Medical Billing Professionals

You may want to see also

In 2020, 95% of the Chinese population had basic health insurance coverage

The former, the Urban-Rural Resident Basic Medical Insurance, is financed primarily by central and local governments through individual premium subsidies. It covers rural residents, the urban self-employed, children, students, the elderly, and others. The latter, the Urban Employee Basic Medical Insurance, is financed mainly from employee and employer payroll taxes, with minimal government funding. It is mandatory for urban residents with formal-sector jobs.

In addition to these two main programs, there is also complementary private health insurance to help cover cost-sharing and coverage gaps.

Basic medical insurance includes two systems: employee medical insurance and resident medical insurance. The former covers the urban employed population, while the latter covers the urban non-employed population and the rural population. In total, 25% of the people covered by basic medical insurance are on employee medical insurance, while 75% are on resident medical insurance.

Despite the high percentage of the population with basic health insurance coverage, public health insurance generally only covers about half of medical costs, with lower proportions for serious or chronic illnesses.

Term Insurance: Uncovering the Human Story Behind the Numbers

You may want to see also

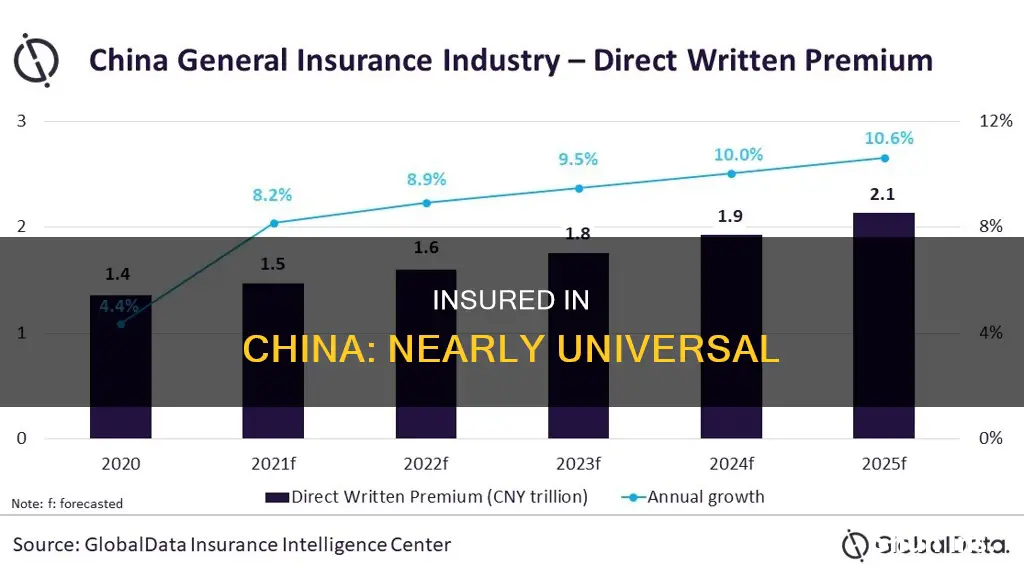

China's insurance industry had 237 providers in 2022

China's insurance industry has been growing rapidly in recent years, with the country's insurance companies generating around 4.7 trillion yuan in premium income in 2022. This is nearly three times the figure from seven years prior. The industry has expanded its range and scope of insurance coverage to meet the demand for insurance services as China's economy has developed and people's material conditions have improved, leading to greater disposable income.

In 2022, China's insurance industry recorded 237 providers. These providers are among the world's largest enterprises, and industry experts project that the size of the Chinese insurance market will surpass that of the United States by the end of the decade.

China's insurance products can be divided into property insurance and personal insurance. Personal insurance includes life insurance, health insurance, and accident insurance, with life insurance contributing the largest share of premium income. However, benefit payments from insurance companies are higher for property insurance.

The Chinese government has played a significant role in improving access to healthcare for its citizens. Since the mid-1990s, the government has promoted policies to increase the proportion of the population covered by health insurance, especially in rural areas. As a result, the percentage of individuals with insurance increased from 24% in 1997 to 49% in 2006.

As of 2020, about 95% of the Chinese population has at least basic health insurance coverage. This includes both employee medical insurance, which covers the urban employed population, and resident medical insurance, which covers the urban non-employed population and the rural population. China's commercial health insurance is also growing, with an average annual growth rate of 20%.

The biggest insurance companies in China rank among the largest in the world in terms of market capitalization. These include Ping An Insurance (Group) of China Ltd., China Life Insurance (Group) Company, and People's Insurance Company of China Group.

Unraveling the MIB Mystery: Understanding Insurance Industry Acronyms

You may want to see also

The Chinese government subsidises insurance premiums for rural communities

The Chinese government has been working to improve access to healthcare for its citizens, especially in rural areas. One way it has done this is by subsidising insurance premiums for rural communities.

Since the early 1980s, the Chinese government has been making efforts to privatise the healthcare sector. This led to a decline in the number of people with health insurance, which fell from over 90% to around 20% by the late 1980s or early 1990s. This was particularly true in rural areas, where the percentage of people with health insurance dropped to between 5.5% and 13% by the early 1990s.

In response to this, the Chinese government implemented policy interventions in the 1990s to promote insurance coverage for everyone and equal enrollment rates between rural and urban populations. A trial of a revised rural insurance program was launched in 1994, which incorporated voluntary contributions from rural residents as well as local government funding. This initiative aimed to provide financial support for poor rural communities, as it was recognised that the government may be the only entity that can provide sufficient funding for an insurance system in these areas.

In 2003, the Chinese government introduced the New Rural Cooperative Medical Scheme, which offered voluntary health insurance to rural residents. This was followed in 2007 by the Urban Resident Basic Medical Insurance, which covered urban residents without formal jobs, including children, the elderly, and the self-employed.

In 2016, the Chinese government announced that it would merge these two schemes to expand the risk pool and reduce administrative costs. This consolidated scheme is now called the Urban-Rural Resident Basic Medical Insurance. The government provides subsidies for insurance premiums, which make up the majority of insurer revenues. In less developed regions, the central government provides a larger share of subsidies than provincial and prefectural governments.

The Chinese government's efforts to subsidise insurance premiums for rural communities have had a significant impact on increasing health insurance coverage in these areas. The percentage of individuals with insurance in nine provinces in China doubled from 24% in 1997 to 49% in 2006, with a dramatic rural upswing. This increase in coverage is likely to have benefited millions of rural Chinese.

GMC Terrain: Insurance Wagon Classification

You may want to see also

China's health insurance schemes cover outpatient and inpatient care

The employee medical insurance scheme is mandatory for urban residents with formal-sector jobs and is mainly financed by employee and employer payroll taxes, with minimal government funding. In 2018, 316.8 million people were covered by this scheme.

The resident medical insurance scheme is voluntary and covers rural residents, as well as urban self-employed individuals, children, students, elderly adults, and others. This scheme is financed through annual fixed premiums, with individual premium contributions being minimal. The central and local governments subsidise the majority of the insurance premiums. In 2018, 897.4 million people were covered under this scheme.

Both insurance schemes cover inpatient hospital care, primary and specialist care, and traditional Chinese medicine. However, dental services, optometry services, home care, and hospice care are often not included or require out-of-pocket payments.

Inpatient and outpatient care are subject to different deductibles, co-payments, and reimbursement ceilings, which vary depending on the insurance plan, region, type of hospital, and other factors. There are no annual caps on out-of-pocket spending, and individuals must cover all costs above certain reimbursement ceilings.

Publicly-funded health insurance does not cover everything, and complementary private health insurance is available to help cover additional costs. This is purchased primarily by higher-income individuals and employers for their workers, and its use is encouraged by the Chinese government.

The Insurance Transition: Understanding Coverage Changes at 18

You may want to see also

Frequently asked questions

As of 2020, about 95% of the population has at least basic health insurance coverage. This amounts to over 1.3 billion people.

China has two main insurance programs: a voluntary, residency-based, basic medical insurance program, and a mandatory, employment-based program for urban residents with formal-sector jobs. There is also complementary private health insurance to cover cost-sharing and additional benefits not covered by the public insurance programs.

Urban employer-based insurance is mainly funded by employer and employee payroll taxes, with minimal government funding. In contrast, residency-based basic medical insurance is mostly funded by central and local government subsidies. As of 2018, urban employee basic medical insurance covered 316.8 million people, while urban-rural resident basic medical insurance covered 897.4 million people.