Turning 18 can bring about several changes in your life, and one of them is insurance. Insurance companies consider age as one of the most important factors when determining insurance rates. Younger drivers are generally seen as riskier to insure due to their inexperience, making them more prone to accidents. As a result, insurance rates tend to be higher for younger drivers and lower for older, more experienced drivers.

| Characteristics | Values |

|---|---|

| Insurance Type | Car Insurance |

| Age | 18 |

| Insurance Change | Insurance rates decrease |

| Reason | Teen drivers are seen as riskier to insure due to their overall inexperience behind the wheel |

| Average Savings | $1,595 per year |

What You'll Learn

Car insurance for 18-year-olds

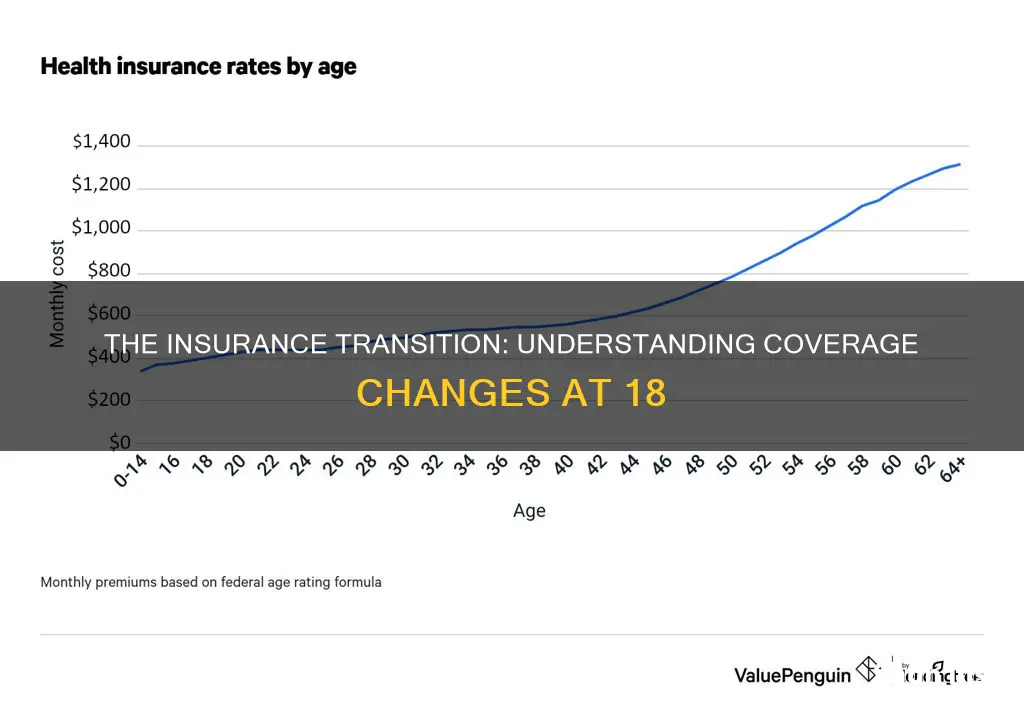

Car insurance rates are determined by several factors, and age is one of the most significant. Typically, younger drivers pay more for car insurance than older drivers due to their lack of driving experience, which makes them more likely to cause accidents. This trend begins to reverse after the age of 25, with rates gradually decreasing until the age of 60.

Insurance Rates for Teen Drivers

Teen drivers often pay three times more for car insurance than middle-aged drivers. The exact rates vary depending on the insurance company and other factors, but on average, a 16-year-old driver pays around $613 per month for full coverage insurance. This rate decreases as the driver gets older, with 19-year-olds paying 24% less than 18-year-olds.

Adding a Teen Driver to an Existing Policy

Adding a teenage driver to an existing car insurance policy is usually more affordable than having them get their own policy. However, it can still result in a significant increase in premiums, ranging from 70% to 150%. It is essential for parents to be prepared for these higher costs and to consider the various discounts that may be available, such as good student discounts and safe driver discounts.

Insurance Rates at Age 18

At the age of 18, car insurance rates typically start to decrease. On average, 18-year-old drivers pay $1,595 less per year than 17-year-old drivers. This decrease in rates is because insurance companies consider older drivers less risky to insure as they gain more experience behind the wheel.

Cheapest Insurance Companies for Teen Drivers

According to recent data, GEICO, American Family, and USAA offer the lowest rates for teen drivers. However, it is important to note that insurance rates can vary depending on location and individual driver profiles. These companies offer various discounts and features that can help reduce rates for young drivers, such as good student discounts and driver training program discounts.

Ways to Save on Car Insurance for Teen Drivers

- Shop around: Compare quotes from multiple insurance companies to find the most competitive rates.

- Join a family policy: Adding an 18-year-old driver to their parents' policy can result in significant savings, often around 62% less than purchasing their own coverage.

- Look for discounts: Many insurance companies offer discounts for young drivers, such as good student discounts, safe driver discounts, and discounts for completing defensive driving courses.

- Choose an older vehicle: Newer cars are typically more expensive to insure, so opting for an older vehicle can help reduce insurance costs.

Uncovering the Mystery of 'Cappers': Understanding Insurance Terminology

You may want to see also

Staying on your parents' health insurance

In the United States, the Affordable Care Act (ACA) allows young adults to stay on their parents' health insurance plans until they turn 26. This applies even if you are not a dependent, are married, have your own dependents, or have another job that offers health insurance. If your parents' insurance covers dependents, you can usually be added to their plan.

If your parents' insurance is job-based, you can stay on their plan until you turn 26, though you may be removed from the plan on your 26th birthday, at the end of that month, or at the end of the calendar year. If their insurance is through the ACA marketplace, you can remain on the plan until 31 December of the year you turn 26.

There are seven states that allow individuals to remain on their parents' insurance plans until they are 30 or 31: Florida, Illinois, New Jersey, New York, Pennsylvania, South Dakota, and Wisconsin. However, there are caveats to remaining on the plan after the age of 26, which vary by state. For example, in New York, individuals must be unmarried to remain on their parents' insurance plans.

If you are removed from your parents' insurance plan when you turn 26, you qualify for a Special Enrollment Period, which lets you enrol in a health plan outside of Open Enrollment.

Understanding the Ins and Outs of Billing Insurance for DME

You may want to see also

Cheapest car insurance companies for 18-year-olds

Car insurance for 18-year-olds is expensive, with an average cost of $4,958 per year or $413 per month for full coverage. This is because insurance companies consider teens to be high-risk drivers due to their lack of experience on the road. The cost of car insurance for 18-year-olds varies depending on factors such as gender, driving history, location, and credit score. Male drivers tend to pay more than female drivers, as they are seen as more likely to take unsafe risks.

- GEICO: GEICO offers solid coverage and good customer support. It is the cheapest option for full coverage when adding an 18-year-old to a family policy, with an average rate of $2,431 per year. GEICO also offers discounts for good students and those who participate in driver safety and training programs.

- USAA: USAA is the cheapest option for adding an 18-year-old to a parent's policy, with an average annual cost of $634 less than the average. USAA is only available to military members, veterans, and their families.

- Erie: Erie Insurance is another affordable option, with average rates of $2,888 per year or $241 per month for full coverage. Erie is only available in about a dozen states.

- State Farm: State Farm offers discounts for students and teens, such as the Steer Clear® program, which provides a discount for young drivers who complete an educational course. State Farm's good student discount of up to 25% is available until drivers turn 25.

- Auto-Owners Insurance: Auto-Owners offers a variety of coverage options and discounts for teen drivers, including a good student discount and a teen driver monitoring discount. Their rates are about 41% cheaper than the national average for 18-year-olds.

To save money on car insurance, 18-year-olds can:

- Stay on their parents' policy or be added to it.

- Look for discounts, such as good student discounts, student away from home discounts, and driver training discounts.

- Shop around and compare quotes from multiple insurance companies.

- Choose a higher deductible to lower their rates.

- Drive an older or cheaper vehicle, as collision and comprehensive insurance is less expensive for these cars.

- Take advantage of usage-based insurance programs, which offer discounts based on current driving habits rather than past driving history.

The Intricacies of PIP Insurance: Unraveling the Benefits and Its Vital Role in Road Safety

You may want to see also

Discounts for young drivers

Insuring a young driver can be expensive, but there are several ways to get discounts on their insurance. Here are some of the most common discounts available for young drivers:

- Good student discount: Many insurance companies offer discounts for students who get good grades. For example, State Farm offers a discount of up to 25% for full-time students with a 3.0 GPA or above, and Allstate offers a discount for unmarried students under 25 with at least a B- average.

- Driver training discount: Some companies offer discounts for students who complete a driver training program. For example, Geico, State Farm, Allstate, and Travelers all offer discounts for students who complete approved driver safety courses.

- Student Away at School Discount: If a student moves away to school and only uses the car while they are at home, some insurance companies will offer a discount. For example, State Farm offers this discount to students under 25 who only use the car during school vacations and holidays.

- Telematics programs: Some insurance companies offer discounts for customers who install a telematics device in their car or download a telematics app. These programs monitor driving behaviour and can lead to discounts for safe driving. For example, Progressive offers its Snapshot program, and Allstate offers Drivewise.

- Multi-vehicle family plans: Adding a teen driver to a family plan is usually cheaper than getting them a separate policy.

- Safe car discount: Buying a safer car for your teen can lead to insurance discounts. Older, used cars may be cheaper to insure, but they may lack important safety features, so it's important to weigh these considerations when choosing a vehicle.

The Intricacies of Insurance: Unraveling the Concept of Contribution

You may want to see also

How to save on insurance as a young adult

Turning 18 is a significant milestone, and it's also when you'll first be able to get your own insurance. However, insurance for young adults can be expensive. Here are some ways to save on insurance as a young adult:

- Stay on your parents' policy: If possible, staying on your parents' insurance policy will likely be cheaper than getting your own policy. This is because insurers see younger drivers as riskier to insure due to their inexperience.

- Shop around for quotes: Don't just settle for the first insurance quote you get. Compare quotes from at least three insurance providers to find the best rate for your needs.

- Take advantage of discounts: Ask your insurer about any discounts you might qualify for. For example, you might be eligible for savings if you're a student living away from home, getting good grades, or completing a driver's education course.

- Consider non-traditional insurance: If you won't be driving much, you could save money by switching to pay-per-mile insurance. Alternatively, if you're a safe driver, consider usage-based coverage, which tracks your driving behaviour to determine a discount.

- Build your credit: In most states, insurers use credit-based insurance scores to calculate your auto insurance rate. Improving your credit score by paying bills on time and paying down credit card debt can help lower your insurance costs.

- Defensive driving courses: Taking a defensive driving course can save you money on your auto insurance, especially if you're under 25.

- Good student discounts: If you're under 25 and a full-time student, maintaining good grades can often lead to insurance discounts.

- Bundle your insurance policies: If you rent or own a home, consider bundling your auto and renters or homeowners insurance with the same company. Many insurers offer substantial discounts for this.

- Choose the right car: Insurance rates vary depending on the make, model, and year of your vehicle. High-performance vehicles and luxury cars tend to be more expensive to insure, so opt for a more modest car to save on insurance.

- Review your coverage: You may not need as much insurance coverage as you think. Review the different types of coverage and choose the levels that are right for you. Just make sure you meet the minimum requirements for your state and lender.

- Pick the right deductible: A higher deductible will usually result in a lower premium. Just make sure you choose a deductible that you can reasonably afford in case of an emergency.

- Keep a clean driving record: Accidents and moving violations can increase your insurance rates. Practise safe driving habits to keep your record clean and your insurance costs down.

- Pay your bills on time: In most states, your credit score is a factor in setting your insurance premium. Paying your bills on time and maintaining a good credit score can help lower your insurance costs.

Remember that insurance rates are based on many individual factors, so it's always a good idea to compare quotes from multiple companies to find the best rate for your specific situation.

American Airlines Flight Insurance: Flexibility in Times of Change

You may want to see also

Frequently asked questions

Yes, your insurance can change when you turn 18. Insurance companies view older and more experienced drivers as less risky, so you may see a decrease in your insurance rates.

On average, you can expect savings of $1,595 per year when you turn 19. Rates continue to decline as you age, particularly once drivers pass the age of 25.

GEICO, American Family, and USAA are the cheapest insurance companies for teen drivers. However, this can change depending on where you live and your individual driver profile.

In addition to age, factors such as driving experience, gender, and location can impact the cost of car insurance. Young drivers are more likely to have accidents or take risks on the road, which can result in higher insurance rates.