Credit-based insurance scores are used by car insurance companies to determine how likely someone is to file a claim and how much they will be charged for coverage. While this practice is not allowed everywhere, most states allow insurance companies to use credit-based insurance scores when making decisions about whom to insure and how much to charge.

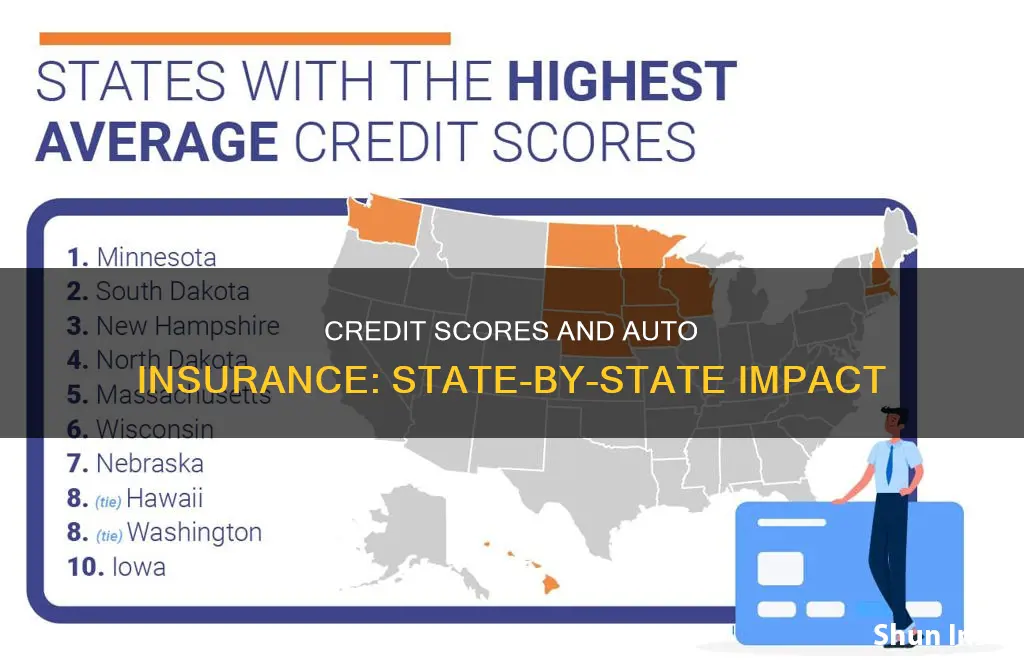

In the US, eight states have strict limitations on the use of credit with auto or homeowners policies: California, Hawaii, Maryland, Massachusetts, Michigan, Nevada, Oregon, and Utah.

| Characteristics | Values |

|---|---|

| Number of states that use credit scores for auto insurance | 42 or 46 |

| States that ban or restrict the use of credit scores for auto insurance | California, Hawaii, Massachusetts, Michigan, Nevada, Oregon, Utah |

| Average increase in insurance rates for drivers with poor credit | 76% or 88% |

| Average increase in insurance rates for drivers with poor credit in dollar amount | $1,180 or $144 per month |

| Average insurance rate for drivers with poor credit | $3,455 per year for full coverage |

| Average insurance rate for drivers with good credit | $2,148 per year for full coverage |

What You'll Learn

- California, Hawaii, Massachusetts and Michigan ban credit-based insurance scores

- Poor credit increases insurance rates by 76% to 88% on average

- Credit-based insurance scores are calculated differently from regular credit scores

- Insurers cannot use credit to increase premiums at renewal in Oregon

- Drivers with poor credit pay an average of $4,262 or more for insurance

California, Hawaii, Massachusetts and Michigan ban credit-based insurance scores

California, Hawaii, Massachusetts, and Michigan have banned or limited the use of credit-based insurance scores for setting car insurance rates. This means that insurance companies in these states cannot use an individual's credit score or credit history to determine whether to offer them an auto insurance policy or how much to charge for that policy.

In California, insurance companies do not use credit-based scores or credit history for underwriting or rating auto policies, or for setting rates for homeowners insurance. As a result, an individual's credit will not impact their ability to get or renew a policy, or how much they pay in premiums.

Hawaii bans auto insurers from using credit ratings when setting standards, including underwriting standards and rating plans, which determine premiums. However, credit can impact an individual's homeowners insurance in the state.

Massachusetts law forbids auto insurance companies from using credit information or credit-based insurance scores when setting rates, underwriting a new policy, or renewing an auto policy. Homeowners insurance rates also cannot be based on credit.

In Michigan, insurance companies cannot use an individual's credit or a credit-based insurance score as part of their decision-making process to deny, cancel, or refuse to renew an auto or homeowners policy. Additionally, auto insurers cannot use credit scores to determine rates. However, insurance companies might consider credit when deciding which installment payment options to offer.

These four states are among a handful of states that have strict limitations on the use of credit with auto or homeowners policies. In most states, insurance companies can use credit-based insurance scores when making decisions about whom to insure and how much to charge. These scores are based on an individual's credit report and are designed to predict how likely they are to file a claim that will result in a loss for the insurer.

Auto Insurance: Bodily Injury Basics

You may want to see also

Poor credit increases insurance rates by 76% to 88% on average

Poor credit has a significant impact on insurance rates, with drivers facing substantially higher premiums compared to those with good credit. On average, drivers with poor credit pay up to 114% more for full coverage car insurance. This translates to an increase of nearly $1,180 per year, or $144 per month, for those with poor credit.

The use of credit scores in insurance pricing is controversial as it has no direct link to driving ability. However, insurance companies argue that credit-based insurance scores are a valid predictor of the likelihood of filing claims. According to their research, drivers with poor credit are more likely to file claims, making them higher-risk and potentially more expensive to insure. As a result, these drivers face increased insurance premiums.

While the impact of poor credit on insurance rates varies across states, it is important to note that California, Hawaii, Massachusetts, and Michigan have banned or limited the use of credit scores in determining auto insurance rates. In these states, insurance companies base rates primarily on driving records, location, and other factors.

The increase in insurance rates due to poor credit can be mitigated by improving your credit score over time. Paying bills on time, minimizing hard credit inquiries, regularly monitoring your credit score, and maintaining a good credit mix can all contribute to enhancing your creditworthiness and reducing insurance costs in the long run.

Lenders Require Gap Insurance to Protect Borrowers

You may want to see also

Credit-based insurance scores are calculated differently from regular credit scores

Credit-based insurance scores and regular credit scores are calculated using similar information, but they are weighted differently. This is because a credit score is meant to estimate the likelihood that you will pay back your debts, while a credit-based insurance score looks at how likely you are to file an insurance claim.

Credit-based insurance scores are calculated using information from your credit report, including:

- Payment history (e.g. credit cards, retail accounts, loans, mortgages, etc.)

- Amounts owed (i.e. the total amount owed on all accounts listed on your credit report)

- The average age of accounts listed on your credit report

- The number of applications for new credit and accounts opened in the past 12 months

- Types of accounts listed on your credit report (e.g. bankcard, auto loan, mortgage, etc.)

The specific weighting of these factors depends on the company calculating the score. For example, FICO weighs insurance credit scores as follows:

- Payment history (40%)

- Outstanding debt (30%)

- Credit history length (15%)

- Pursuit of new credit (10%)

- Credit mix (5%)

In contrast, credit scores typically put slightly more emphasis on credit mix, or the variety of credit accounts you have.

It's important to note that credit-based insurance scores cannot use any personal information to determine your score. This includes race, colour, national origin, income, occupation, location of residence, and more.

Auto Hail Damage: When to Report to Insurance

You may want to see also

Insurers cannot use credit to increase premiums at renewal in Oregon

Credit-based insurance scores are used by insurance companies to better understand their risk when approving a policy. While this practice is allowed in most states, eight states have strict limitations on the use of credit with auto or homeowners policies: California, Hawaii, Maryland, Massachusetts, Michigan, Nevada, Oregon, and Utah.

In Oregon, insurance companies cannot cancel or refuse to renew an insurance policy because of a person's credit history. They can, however, consider credit history as a factor when deciding whether to initially offer a policy. Even then, they are limited to considering certain information from the customer's credit report to underwrite and rate the policy.

Oregon insurers can use a customer's credit history to decline coverage of personal insurance in the initial underwriting decision, but only in combination with other substantive underwriting factors. An offer of placement with an affiliate insurer does not count as a declination of insurance coverage.

In addition, Oregon insurers cannot use the following types of credit history to decline coverage, calculate an insurance score, or determine insurance premiums or rates:

- The absence of credit history or the inability to determine the customer's credit history, unless the insurer presents information that the absence of credit history relates to the risk for the insurer, treats the customer as if they have a neutral credit history, or excludes the use of credit information as a factor and uses only other underwriting criteria.

- Credit inquiries not initiated by the customer or inquiries requested by the customer for their own credit information.

- Inquiries identified on a customer's credit report relating to insurance coverage.

- Multiple lender inquiries from the home mortgage industry or the automobile lending industry made within 30 days of one another, unless only one inquiry is considered.

- The customer's total available line of credit, although the total amount of outstanding debt in relation to the total available line of credit may be considered.

Furthermore, Oregon insurers cannot rerate an existing policy or a customer based on the customer's credit history or the credit history component of their insurance score when the customer's marital status changes due to death or divorce.

Oregon residents can request that their insurer rerate them according to the standards that would apply if they were initially applying for the same insurance policy. The insurer must do this within 30 days of receiving the request, and they may not use credit information from rerating to increase the premium on any personal insurance policy the customer holds. If the customer qualifies for a more favorable rating category, the insurer must reduce the premiums on all the personal insurance policies the customer holds in the related policy line.

Auto Insurance Policies: To Finish or Not to Finish?

You may want to see also

Drivers with poor credit pay an average of $4,262 or more for insurance

In most states, insurance companies can use credit-based insurance scores to determine the rates for auto insurance. These scores are based on consumer credit data and are designed to predict the likelihood of filing a claim that will result in a loss for the insurer. As a result, drivers with poor credit often face higher insurance rates.

According to Bankrate, drivers with poor credit may pay an average of $4,262 or more for full coverage car insurance, compared to $1,988 for those with excellent credit scores of 800 or above. This disparity in pricing is due to the increased risk associated with drivers who have a poorer credit history. The higher rates serve as a reflection of this perceived risk.

The impact of credit history on insurance premiums varies across states. For example, in New York, drivers with poor credit pay one of the highest average rates for full coverage, amounting to $7,506 per year. In contrast, states like California, Hawaii, Massachusetts, and Michigan have regulations that limit or prohibit the use of credit scores in determining insurance rates.

It's important to note that improving your credit history can take time and effort. However, it is worth working on enhancing your credit score to ensure you get the lowest possible rate for your policy. Paying bills on time, minimizing hard credit inquiries, regularly monitoring your score, and maintaining old lines of credit are some strategies that can help improve your creditworthiness.

State Farm's Signature Requirement: Understanding the Auto Insurance Sign-Up Process

You may want to see also

Frequently asked questions

Most states use credit scores for auto insurance, except for California, Hawaii, Massachusetts, and Michigan, which prohibit or limit the use of credit scores for auto insurance.

Drivers with poor credit pay significantly more for auto insurance than those with good credit. On average, drivers with poor credit pay 114% more for full-coverage auto insurance than those with excellent credit.

No, not all auto insurers use credit scores. Root Insurance has pledged to remove credit scores from its pricing model by 2025, and drivers in Texas can get a no-credit-check car insurance quote from Dillo.

A credit-based insurance score is used to determine how likely someone is to file an insurance claim. It helps insurers decide how much to charge for coverage.

Improving your credit-based insurance score involves improving your overall credit score. This can be done by paying bills on time, minimizing hard credit inquiries, monitoring your score regularly, and keeping old lines of credit active.