Gap insurance is an optional auto insurance coverage that protects you from paying for a car you can no longer drive, which can happen if a vehicle is stolen or deemed a total loss after an accident. The cost of gap insurance depends on where you get it. If you purchase it through your regular auto insurer, it will typically cost around $20 per year. If you add it to your auto loan, you'll usually pay a one-time flat rate of $500 to $700. If you buy standalone gap insurance, you'll pay a one-time fee of $200 to $300.

| Characteristics | Values |

|---|---|

| What is auto gap insurance? | A type of auto insurance that covers the difference between a car's worth and the balance the owner owes on its lease or car loan if the vehicle is stolen or can't be repaired after an accident. |

| Who needs auto gap insurance? | People who paid a small down payment on a car loan, drivers whose auto financing covers other products, owners of a vehicle with high mileage, and people who took out a car loan with a long term. |

| Where can you get auto gap insurance? | Banks and credit unions financing your car purchase, insurance companies, and car dealerships. |

| How much does auto gap insurance cost? | The cost of gap insurance depends on the underwriter. Dealerships and lenders charge higher prices, typically a flat rate between $500 and $700. Insurance companies charge an average of $20 to $40 per year when bundled with an existing insurance policy. Standalone gap insurance policies typically cost a one-time fee of $200 to $300. |

| Factors that affect the cost of auto gap insurance | Vehicle's actual cash value (ACV), auto insurance claims history, age, driving record, location, credit score, and vehicle. |

What You'll Learn

Cost depends on the state, driving record, vehicle and other factors

The cost of auto gap insurance depends on a variety of factors, including the state in which you live, your driving record, the vehicle you own, and other factors. Let's take a closer look at each of these factors and how they can influence the cost of your gap insurance.

Firstly, the state you reside in can impact the price of gap insurance. Insurance rates can vary from state to state due to differences in regulations, competition among insurers, and the frequency of claims in each state. Certain states may have higher or lower average insurance costs, which can include gap insurance.

Secondly, your driving record can also play a role in determining the cost of gap insurance. Insurers often consider your driving history when calculating premiums. If you have a clean driving record, with no accidents or violations, you may be offered lower rates. Conversely, if you have a history of accidents or traffic violations, insurers may view you as a higher risk and charge higher premiums.

Additionally, the type of vehicle you own can influence the cost of gap insurance. The value of your vehicle, its depreciation rate, and its mileage can all be factors that insurers take into account. Generally, the higher the value of your vehicle, the higher the cost of gap insurance, as the insurer would potentially have to cover a larger difference in the event of a total loss.

Other factors that can impact the cost of gap insurance include your age, the insurance company you choose, and the specific terms of your insurance policy. Age can be a factor because younger drivers are often considered higher-risk and may face higher premiums. The insurance company you select can also make a difference, as rates can vary between insurers. Additionally, the way you choose to purchase gap insurance, such as through your regular auto insurer or as an add-on to your auto loan, can impact the cost.

It's worth noting that gap insurance is typically more affordable when purchased as an add-on to an existing insurance policy. Buying gap insurance separately or through a dealership or lender can be more expensive and may include additional interest charges.

Chase Auto Insurance: Travel Companion or Just a Car Cover?

You may want to see also

Adding to an auto loan costs $500-$700

Adding gap insurance to an auto loan typically costs a one-time flat rate of $500 to $700. This is a separate option from your overall insurance policy and is usually offered by lenders.

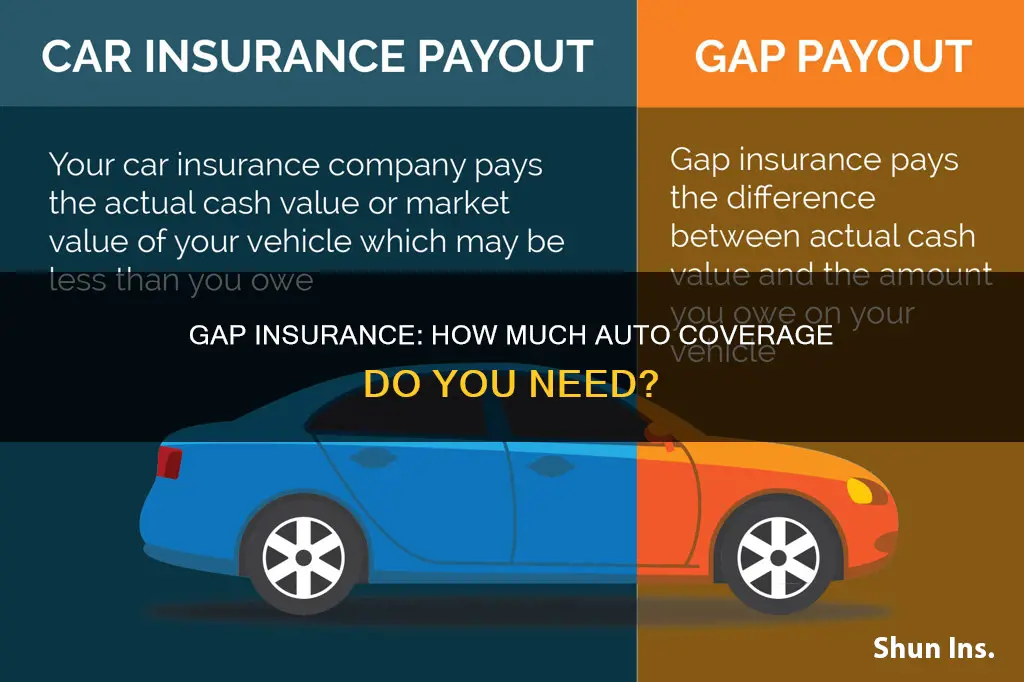

Gap insurance, or General Asset Protection insurance, covers the difference between a car's worth and the balance the owner owes on its lease or loan if the vehicle is stolen or can't be repaired after an accident. This benefit is not provided by standard collision and comprehensive insurance policies. It is not mandatory for drivers to carry gap insurance, but some states require car dealers to offer it to their customers.

Gap insurance covers the gap between the car's current value and the amount the owner owes on the loan. If your car is stolen or totaled, gap insurance will cover the balance left after your standard insurance has paid for the actual cash value of the vehicle. This means you won't owe the lender any money after a total loss.

When deciding whether to add gap insurance to your auto loan, consider the following:

- If you paid a small down payment on your car loan, you may benefit from gap insurance as it will increase the amount owed on the vehicle.

- If your car has a fast depreciation rate, gap insurance can help cover the difference between the actual value of the car and the amount you still owe on it in the event of a serious crash or theft.

- If your auto loan covers other products, such as an extended service agreement or debt from other car loans, gap insurance can cover the difference as these additions increase your debt without affecting your car's value.

- If your car has high mileage, its value will depreciate faster than you can pay off the loan, and gap insurance can protect you from negative equity.

It is important to note that gap insurance is not mandatory, but it might be required by your financing agreement. It is recommended to carefully review the terms of your car loan to see if you need gap insurance. If you are leasing a car, you may be required to buy gap insurance.

U.S. Auto Insurance Eligibility: Unlocking USAA Benefits

You may want to see also

Buying standalone costs $200-$300

If your auto insurer doesn't offer gap insurance as part of your overall insurance plan, you can purchase it as a standalone policy. In this case, the average cost of gap insurance is a one-time fee of $200 to $300.

Standalone gap insurance is a policy you purchase separately from any other policy or product. For example, if you lease a vehicle, the dealer may require you to buy gap insurance along with a full-coverage policy. However, if you buy a car without gap insurance and decide to purchase it later, you would be buying standalone gap insurance.

Gap insurance is a type of auto insurance that covers the difference between a car's value and the balance the owner owes on its lease or loan if the vehicle is stolen or can't be repaired after an accident. It is not mandatory for drivers to carry gap insurance, but some states require car dealers to offer it to their customers.

The cost of gap insurance depends on the underwriter. Dealerships and lenders charge higher prices than car insurance companies. Lenders and dealerships sell gap insurance for a flat rate, typically between $500 and $700, which are the highest rates for this type of policy. Plus, you will pay interest on the sum since it will be rolled into your loan.

Insurance companies, on the other hand, charge an average of $20 to $40 per year for gap insurance when buyers bundle it into an existing insurance policy. This only increases your comprehensive and collision insurance cost by about 5% to 6% on average, making it a lot more affordable.

Factors that can affect the cost of gap insurance include the vehicle's actual cash value (ACV) and auto insurance claims history.

Auto Insurance Policy Components Explained

You may want to see also

Buying through a regular insurer costs $20 per year

If you're considering purchasing gap insurance, you may be wondering about the cost. The price of gap insurance depends on where you buy it. Buying through a regular insurer who provides your comprehensive and collision coverage typically costs $20 per year. This is a very affordable option, and it's a great way to protect yourself and your vehicle in case of an accident.

When you buy gap insurance from your regular insurer, you're adding it to your existing policy. This means you'll only have one insurance provider to deal with, and you can easily bundle your coverage. It's a convenient and cost-effective way to get the protection you need.

Gap insurance is especially important if you've made a small down payment on your vehicle or if you have a long-term loan. It can also be beneficial if you have a vehicle with high mileage, as the value of your car may depreciate faster than you can pay off the loan. In these cases, gap insurance can provide valuable peace of mind and financial protection.

By purchasing gap insurance through your regular insurer, you're ensuring that you're covered in case of a total loss. If your vehicle is stolen or damaged beyond repair, gap insurance will cover the difference between the amount you owe on your loan and the actual cash value of your car. This can save you from being left with a large bill, even though your car is no longer driveable.

Another benefit of buying gap insurance through your regular insurer is the convenience of having all your insurance information in one place. You won't have to worry about dealing with multiple providers or policies. This can simplify the claims process and make it easier to manage your coverage.

In conclusion, buying gap insurance through a regular insurer for $20 per year is a smart choice. It provides essential protection at an affordable price, and it ensures that you're covered in case of an accident or theft. By adding it to your existing policy, you can rest easy knowing that you're fully protected on the road.

Unlicensed to Drive: Navigating Auto Insurance for the Whole Family

You may want to see also

Not mandatory, but may be required by financing agreement

While gap insurance is not mandatory, it may be required by your financing agreement. This is because gap insurance covers the difference between the amount you owe on your auto loan and the amount your insurance company pays if your car is stolen or deemed a total loss.

In the event that your car is stolen or written off in an accident, your car insurance company will reimburse you based on the current value of the car after depreciation. This means that you could be left with a gap between the amount you are reimbursed and the amount you still owe on your loan or lease.

For example, say you owe $20,000 on your financing agreement, but due to depreciation, your car's actual cash value is $15,000. If your car is completely written off as a result of an accident or theft, your car insurance policy will pay out $15,000. You can put that $15,000 toward your car loan, but you'll be $5,000 short of what you owe, even though you no longer have a car. Gap insurance would cover this $5,000 "gap".

Gap insurance is particularly important if you didn't make a down payment on your car or if you chose a long loan term. It is also worth considering if you plan to drive your car in a way that might decrease its resale value, such as taking long road trips or driving on rough roads.

The cost of gap insurance depends on whether you purchase it through your regular auto insurer or add it onto your auto loan. When you purchase gap insurance from your regular auto insurer, the price is typically just $20 per year. If you add it onto your auto loan, you will usually pay a one-time flat rate of between $500 and $700.

If you are told you must purchase gap insurance to qualify for financing, ask where this is stated in the sales contract or contact the lender to find out if this is true. If it is true, the cost of the gap insurance must be included in the finance charge and reflected in the disclosed annual percentage rate (APR). If it is optional, you can decline it.

Gap Insurance: Keep or Toss?

You may want to see also

Frequently asked questions

Auto gap insurance purchased through a regular auto insurer costs around $20 per year.

If auto gap insurance is added to an auto loan, it costs a flat rate of $500 to $700.

If purchased as a standalone policy, auto gap insurance costs a flat rate of $200 to $300.

Auto gap insurance purchased from a dealer can cost hundreds of dollars a year.

The cost of auto gap insurance is influenced by factors such as the loan amount, the vehicle's actual cash value, age, driving record, and location.