The average cost of car insurance in the United States is $50 per month for liability-only coverage and $108 per month for full coverage. However, the cost of car insurance varies depending on several factors, including the driver's age, driving record, location, vehicle type and credit score.

| Characteristics | Values |

|---|---|

| --- | --- |

| Average cost of car insurance per month | $50 for state minimum liability-only coverage |

| Average cost of car insurance per month | $108 for full coverage |

| Average cost of car insurance per year | $595 for state minimum liability-only coverage |

| Average cost of car insurance per year | $1,296 for full coverage |

| Average cost of car insurance for drivers with a ticket | $1,621 for full coverage |

| Average cost of car insurance for drivers with an at-fault accident | $1,903 for full coverage |

| Average cost of car insurance for drivers with a DUI | $2,280 for full coverage |

What You'll Learn

How much is car insurance for young drivers?

Car insurance for young drivers tends to be more expensive than for older, more experienced drivers. This is because young drivers are statistically more likely to be involved in a serious road accident. In the UK, 47% of reported road accidents in 2018 involving drivers aged 17 to 19 resulted in casualties, and this figure was 46% for drivers aged 20 to 24. This was higher than any other age group.

The higher likelihood of casualties means insurers see young drivers as a high-risk group, and therefore cover is more expensive to take out. The average car insurance premium for a 17-24-year-old in the UK is £1,197. In the US, the average cost of car insurance for a 20-year-old driver is $3,576 for full coverage and $1,023 for minimum required coverage.

There are several ways that young drivers can reduce the cost of their car insurance:

- Take a recognised advanced driving course: As well as improving your skills and confidence on the road, advanced driver training might also help to reduce your car insurance costs.

- Get insured with a more experienced driver: Adding a more experienced driver, like a parent, to your policy could reduce your risk to insurers and make your cover cheaper.

- Drive a car from a lower insurance group: Insurers group cars by make and model. Premiums for cars in higher groups are more expensive than those in lower ones, so look for a cheaper car with a small engine.

- Estimate your mileage accurately: Driving less over the course of a year can reduce the cost. Don’t pay for more than you need to.

- Keep your car secure: Keeping your car on your driveway or in a locked garage overnight, or installing security measures like a tracking device, can lower the cost of insurance.

- Volunteer a higher excess fee: Opting to pay a higher excess fee on top of the compulsory amount indicates to insurers that you won’t bother making small and frivolous claims.

Auto Insurance: Profits and Losses

You may want to see also

How much is car insurance for drivers with a DUI?

The cost of car insurance for drivers with a DUI varies depending on location, age, gender, vehicle type, and other factors. On average, car insurance companies consider drivers with a DUI conviction as high-risk, and their insurance premiums increase substantially.

In the United States, the average cost of car insurance with a full coverage policy is $2,542 per year for a driver with a clean driving record. For a driver with a DUI conviction, the average cost increases to $4,790 per year, which is 88% higher for the same coverage. The increase in insurance rates after a DUI can vary from state to state, with North Carolina having the highest average rate hike of 266%, and Alaska, Florida, and Missouri having the smallest average increase of 33%.

The cost of car insurance for drivers with a DUI can also depend on the company they choose. Some companies, like Progressive, American Family, and USAA, offer lower rates for drivers with a DUI. USAA, for example, has an average rate of $2,751 for a driver with a DUI, while Progressive's average rate is $2,776.

Additionally, the cost of car insurance for drivers with a DUI may be influenced by the type of coverage they choose. Full coverage insurance includes comprehensive and collision insurance, which covers damage to the driver's own car. Minimum coverage, on the other hand, only meets the state's legal requirements and tends to be cheaper. For a driver with a DUI, the average annual cost of full coverage is $3,537, while the average cost of minimum coverage is $1,134.

To find cheaper car insurance after a DUI, drivers can compare rates from multiple companies, maintain a clean driving record, bundle their policies, increase their deductible, or adjust their payment method.

Does Progressive Auto Insurance Accept American Express?

You may want to see also

How much is car insurance for drivers with a ticket?

The cost of car insurance for drivers with a ticket varies depending on the type of violation, the state in which the violation occurred, and the insurance company. The average cost of car insurance in the US is $2,278 per year for full coverage and $621 per year for minimum coverage. However, drivers with a ticket can expect to pay more.

How Tickets Impact Car Insurance

On average, a speeding ticket could increase the cost of full coverage car insurance by 21%, while a DUI is likely to raise rates even more. A DUI conviction can cause a monthly full coverage premium to be 98% higher and stay on a driving record for 10 years or more. The amount surcharged will vary by state. For example, the average cost of car insurance after a DUI for a full coverage policy is $2,184 per year in Idaho, but around $7,520 per year in Michigan.

Cheapest Car Insurance After a Speeding Ticket

After a speeding ticket, a driver's rate increase depends on several factors, including their location, driving record, and insurance company. In addition to a higher rate, most speeding tickets also come with a fine. Based on research, Erie, Auto-Owners, and USAA offer some of the cheapest average premiums for drivers after a speeding ticket.

Cheapest Car Insurance After a DUI Ticket

A DUI is one of the most serious violations a driver can receive. After getting a DUI, you can expect your car insurance premium to increase significantly. Getting a DUI also typically comes with other potential consequences, including expensive fines, jail time, and license suspension. The car insurance rate increase after getting convicted of a DUI is based on your driving record, insurance company, and state. Based on research, American National and Selective offer some of the cheapest average rates for drivers with a DUI.

Best Discounts for Drivers with Tickets

If you have received a ticket, there are several ways you can get a cheaper car insurance premium. Many car insurance companies offer discounts to help drivers save money, and you do not necessarily need a perfect driving record to qualify. Here are some common discounts:

- Automatic payments

- Defensive driving course

- Organization-based discounts

- Pay in full

- Policy bundling

- Safe driver

- Usage-based insurance

Other Ways to Save on Car Insurance After a Ticket

Besides taking advantage of discounts or switching carriers, there are other ways drivers can lower their rates after receiving a ticket:

- Improving your credit score

- Adjusting your coverage limits and deductibles

- Dropping add-ons such as roadside assistance, rental car coverage, or original equipment manufacturer (OEM) coverage

Navy Federal Auto Loan Insurance Requirements: Full Coverage or Bust?

You may want to see also

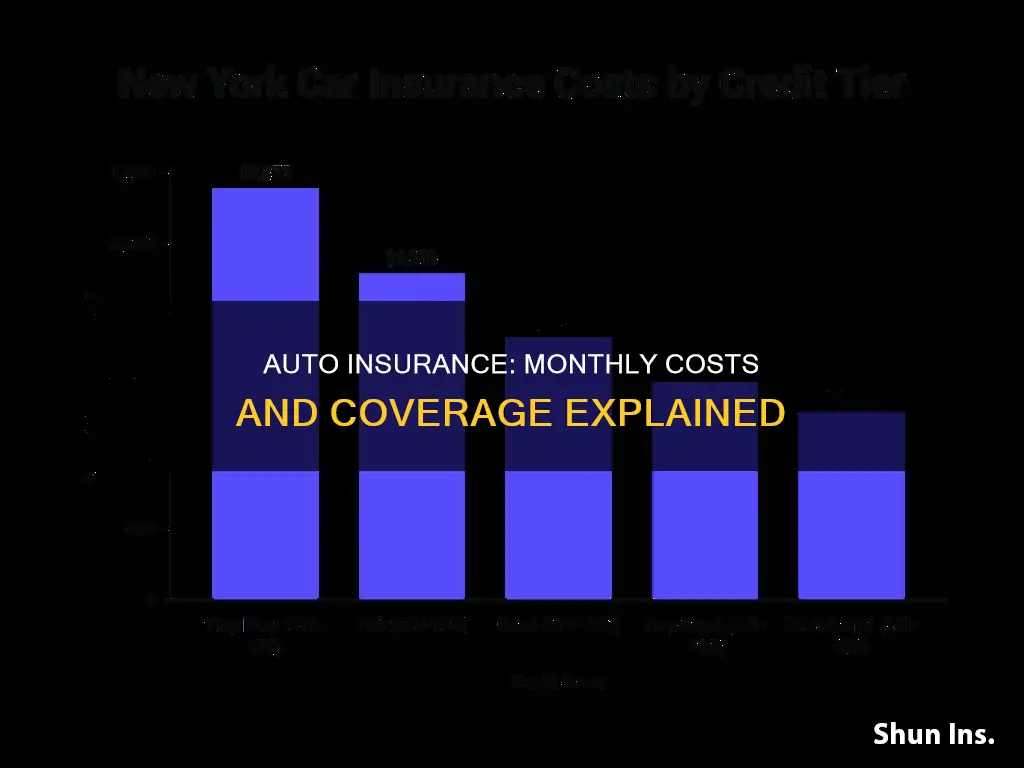

How much is car insurance for drivers with poor credit?

The cost of car insurance for drivers with poor credit varies depending on the state and the insurance company. On average, drivers with poor credit pay 114% more for full coverage car insurance than those with excellent credit. In some states, such as Nevada, drivers with poor credit may pay up to 199% more for car insurance than those with excellent credit. In other states, such as North Carolina, the difference may be smaller, with drivers with poor credit paying around 59% more.

The impact of a driver's credit score on their insurance premium also depends on the insurance company. For example, with Nationwide, a driver with an excellent credit score may pay around $873 per year, while a driver with a poor credit score could pay about $1,374 per year. On the other hand, GEICO, a driver with poor credit may pay around $1,775 per year.

It's important to note that some states, such as California, Hawaii, Massachusetts, and Michigan, prohibit or limit the use of credit scores in determining insurance rates. In these states, drivers with poor credit may not see a significant impact on their insurance premiums.

To improve their credit score, drivers can take several steps, including paying their bills on time, keeping their credit utilization low, and disputing any errors on their credit report. Improving their credit score can help drivers with poor credit obtain more affordable car insurance rates.

Canceling Auto Insurance: Early Termination

You may want to see also

How much is car insurance for drivers with good credit?

The cost of car insurance varies depending on a variety of factors, including age, gender, driving history, location, and vehicle type. On average, car insurance with full coverage in the US costs $190 per month or $2,278 per year. Minimum coverage, on the other hand, has an average annual cost of $621 and a monthly cost of $52.

Drivers with good credit tend to pay lower rates for car insurance since they are perceived as more financially responsible and less likely to file claims. The average cost of car insurance for drivers with good credit and a clean driving record is $1,718 per year for full coverage and $488 per year for minimum coverage, according to NerdWallet's analysis.

The cost of car insurance can also vary significantly by state. For example, the average cost of full coverage car insurance in California is $2,599 per year, while in North Carolina, it is $1,827 per year.

It's important to note that car insurance rates are highly personalized, and the best way to determine the cost of car insurance for drivers with good credit is to compare quotes from multiple insurance companies.

Understanding Online Shopping Auto-Insurance: BOA 3 and Beyond

You may want to see also

Frequently asked questions

The average cost of car insurance is around $50 per month for liability-only coverage and around $108 per month for full coverage.

The average cost of car insurance is around $595 per year for liability-only coverage and around $1,296 per year for full coverage.

The average cost of car insurance for a 16-year-old is around $457 per month for full coverage.

The average cost of car insurance for a 40-year-old is around $102 per month for full coverage.