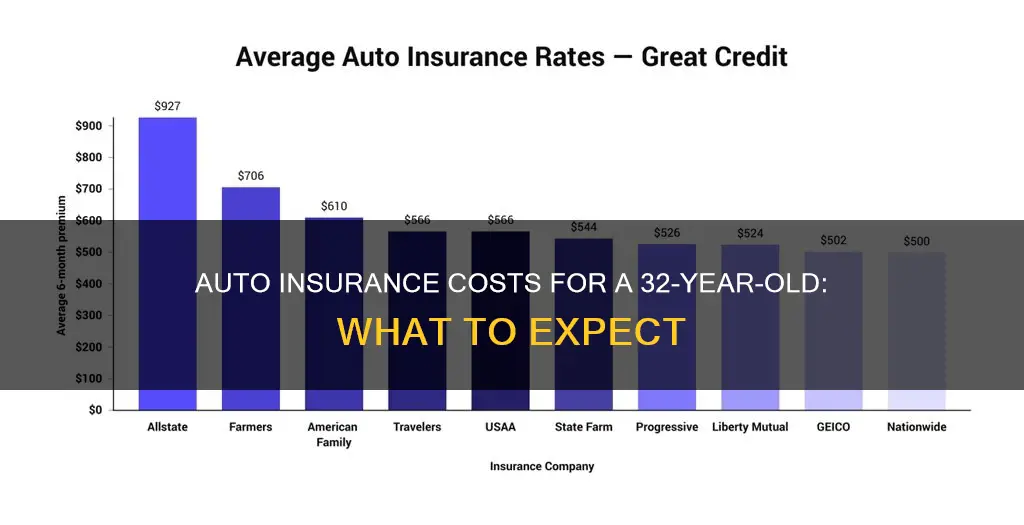

The cost of auto insurance varies depending on several factors, including age, gender, location, driving record, and credit score. While age is a significant factor, with younger and older drivers often paying more than those in their 30s to 60s, a clean driving record can also help lower insurance rates. A 32-year-old driver with a clean record can expect to pay less for car insurance than someone in the same age group with violations. The national average annual cost of car insurance for a 35-year-old with a clean driving record and good credit is $1,718 for full coverage and $488 for minimum coverage. However, rates can vary by state and insurance provider, so it's essential to compare quotes from different companies to find the best rate.

| Characteristics | Values |

|---|---|

| Average annual car insurance cost for a 32-year-old with a clean record | $1,718 for full coverage |

| Average monthly car insurance cost for a 32-year-old with a clean record | $143 for full coverage |

| Average annual car insurance cost for a 32-year-old with a clean record and poor credit | $2,741 for full coverage |

| Average monthly car insurance cost for a 32-year-old with a clean record and poor credit | $228 for full coverage |

What You'll Learn

- How much is auto insurance for a 32-year-old with a clean record compared to a 32-year-old with a DUI?

- How does gender affect auto insurance rates for 32-year-olds?

- How does a 32-year-old's auto insurance rate compare to a 25-year-old's?

- How does a 32-year-old's auto insurance rate compare to a 40-year-old's?

- How does a 32-year-old's auto insurance rate change with different coverage levels?

How much is auto insurance for a 32-year-old with a clean record compared to a 32-year-old with a DUI?

The cost of car insurance is influenced by many factors, including age, gender, location, vehicle type, credit history, and driving history. A driver's record is a significant factor in determining insurance rates, and a DUI conviction can lead to substantial increases in premiums. Let's compare the insurance costs for a 32-year-old with a clean record to one with a DUI.

For a 32-year-old driver with a clean record, the average annual cost of car insurance is around $2,000. This number can vary depending on other factors, such as the state they live in and the insurance company they choose. For example, USAA, which offers insurance to military personnel and their families, has an average annual rate of $1,335. Erie Insurance is another affordable option, with an average annual premium of $1,532.

Now, let's consider the impact of a DUI on insurance rates for a 32-year-old. A DUI is considered a severe driving incident and will likely result in significantly higher insurance premiums. On average, a driver with a DUI conviction pays about 85% to 88% more for car insurance than a driver with a clean record. This increase translates to an additional $1,468 per year for full coverage insurance. Progressive offers competitive rates for drivers with a DUI, with premiums 35% below the national average. USAA and Erie Insurance also offer rates around 28% below the national average for drivers with a DUI.

To summarize, a 32-year-old with a clean record can expect to pay around $2,000 per year for car insurance, while a 32-year-old with a DUI may pay $3,500 or more, depending on their state and insurance company. It's important to note that insurance rates are highly personalized and can vary based on multiple factors.

Temporary Auto Insurance: Month-Long Coverage

You may want to see also

How does gender affect auto insurance rates for 32-year-olds?

When it comes to auto insurance rates, age and gender are two of the most significant factors in determining the cost of coverage. While age is a more prominent factor than gender, gender still plays a notable role, especially for young drivers. Here's how gender affects auto insurance rates for 32-year-olds:

The Impact of Gender on Auto Insurance Rates for 32-Year-Olds:

- Male Drivers: Generally, males tend to pay more for auto insurance than females, especially during their teenage and young adult years. This is because male drivers are considered riskier to insure due to higher accident rates and more frequent claims. However, as males reach their 30s, the gender gap in insurance rates narrows, and they may even pay slightly less than females in some cases. By the time males are in their mid-to-late 30s, their insurance rates are typically comparable to those of females.

- Female Drivers: Females often benefit from lower auto insurance rates than males, especially in their teens and early 20s. This is because insurers consider them less risky on the road. However, as females approach their 30s, the difference in rates between the genders starts to diminish. While females may pay slightly more than males in their early 30s, the gap is usually negligible.

- State Regulations: It's important to note that not all states allow gender to be a determining factor in auto insurance rates. Currently, six states, including California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania, prohibit the use of gender as a rating factor. In these states, males and females should expect to pay roughly the same rates, provided all other factors, such as driving history and vehicle type, are identical.

- Other Factors: While gender plays a role in auto insurance rates, it is just one piece of the puzzle. Other factors, such as driving record, credit score, and vehicle type, also come into play. A female driver with a history of accidents or traffic violations may pay a higher rate than a male driver with a clean record. Similarly, a male driver with excellent credit may pay less than a female driver with poor credit. It's essential to consider the combination of factors when understanding how gender affects auto insurance rates.

Auto Insurance Rates for 32-Year-Olds:

For a 32-year-old driver with a clean record, the average annual cost of car insurance can vary depending on gender, location, and other factors. According to Bankrate's analysis, the average annual full-coverage rate for a 32-year-old male is around $1,540, while the rate for a 32-year-old female is approximately $1,513. These rates are based on specific profiles and may not be indicative of individual circumstances. Additionally, rates can fluctuate over time as insurance companies update their pricing and policies. It's always a good idea to shop around and compare quotes from multiple insurers to find the most suitable coverage for your needs.

Vehicle Teardown: Pre-Insurance Inspection Essential?

You may want to see also

How does a 32-year-old's auto insurance rate compare to a 25-year-old's?

A 32-year-old's auto insurance rate is likely to be lower than that of a 25-year-old. This is because car insurance rates are highest for teens and young adults due to their lack of experience behind the wheel. As drivers gain more experience, their premiums generally decrease. By the time a driver reaches their early 20s, they will likely notice a significant reduction in their premiums. This reduction continues throughout adulthood, provided that the driver maintains a clean driving record and has no insurance claims.

The cost of auto insurance coverage usually begins to drop by the time a driver reaches their mid-20s. A 25-year-old is likely to pay lower average rates than an 18-year-old or a younger driver. However, a 25-year-old will likely still pay higher rates than a more experienced 40-year-old driver. While a 25-year-old's rates should continue to decrease with age, they may still pay above-average premiums for several years.

The driving record is another key factor in determining auto insurance rates. Speeding tickets, at-fault accidents, and other moving violations may negate age-related premium reductions. A driver with a clean driving record and no claims is likely to pay lower insurance rates than a driver with a history of accidents or violations.

In addition to age and driving record, other factors that can affect auto insurance rates include gender, location, vehicle type, credit score, and the chosen insurance coverage. Male drivers, especially those under the age of 18, tend to pay higher premiums than female drivers due to their higher risk of engaging in risky driving behaviour. Location can also impact rates, with drivers in urban areas typically paying higher rates than those in rural or suburban areas due to higher traffic congestion and population density. The choice of vehicle can also affect rates, with certain cars being more expensive to insure due to their safety ratings, likelihood of theft, and average repair costs. In some states, credit score can also influence insurance rates, with drivers with poor credit history paying higher premiums. Finally, the chosen insurance coverage level, such as minimum or full coverage, will also impact the cost of auto insurance.

Overall, a 32-year-old with a clean driving record is likely to pay lower auto insurance rates than a 25-year-old, as they have more driving experience and are considered lower-risk. However, other factors such as gender, location, vehicle type, and credit score can also impact the insurance rates for both age groups.

Auto Insurance: Fixed or Variable?

You may want to see also

How does a 32-year-old's auto insurance rate compare to a 40-year-old's?

Auto insurance rates are calculated based on a variety of factors, including age, gender, location, driving record, credit score, type of coverage, and vehicle type. While age is not the only factor that impacts insurance rates, it is one of the biggest factors.

Younger drivers tend to pay higher insurance rates than older drivers. This is because teens and young adults are considered high-risk due to their lack of driving experience and the increased likelihood of accidents. As a result, insurance companies charge higher rates to offset the higher costs associated with claims made by these drivers. The cost of auto insurance typically decreases as drivers enter their early 20s and continue to gain driving experience.

By the time men and women reach their 30s, they generally pay comparable rates. A 32-year-old with a clean driving record will likely pay lower insurance rates than a younger driver. Their rates may continue to decrease gradually as they gain more driving experience and maintain a clean record.

On the other hand, a 40-year-old driver is likely to pay lower insurance rates than a 32-year-old. Insurance rates often continue to decrease through a person's 50s as long as they maintain a good driving record. Middle-aged drivers, particularly those aged 45-55, usually benefit from the lowest insurance rates as they are considered low-risk.

It is important to note that insurance rates may start to increase again for drivers over 70 years of age. This is because older drivers are considered higher-risk due to factors such as vision or hearing loss and slower response times, which can increase the likelihood of accidents.

Spouse Insurance: Auto Exclusion in Georgia

You may want to see also

How does a 32-year-old's auto insurance rate change with different coverage levels?

The cost of car insurance is influenced by a variety of factors, including age, gender, location, driving record, credit score, vehicle type, and coverage level. While age is a significant factor, with younger and older drivers typically paying higher premiums due to increased accident risks, other factors can also have a substantial impact on rates.

For a 32-year-old with a clean driving record, the cost of auto insurance will vary depending on the coverage level chosen. Standard car insurance policies typically include liability coverage, collision coverage, comprehensive coverage, uninsured and underinsured motorist coverage, and personal injury protection or medical payments coverage. The cost of these coverages can differ based on several factors, including the state of residence, the driver's history, and the vehicle's make and model.

Liability coverage, which is mandatory in most states, typically has coverage limits such as $100,000 per person and $300,000 per accident for bodily injury, and $50,000 for property damage. The cost of this coverage will depend on the specific limits chosen, with higher limits resulting in higher premiums.

Collision and comprehensive coverage are not required by law but are often required by lenders or lessors. Collision coverage helps pay for repairs or replacement of the insured vehicle in case of an accident, while comprehensive coverage assists with repairs or replacement due to events other than a collision, such as vandalism, theft, or natural disasters. The cost of these coverages depends on the value of the vehicle, with higher-value vehicles typically requiring higher premiums.

Uninsured and underinsured motorist coverage, which is mandatory in many states, protects the insured driver and their passengers in case of an accident caused by a driver with insufficient or no insurance. The cost of this coverage will depend on the chosen limits, similar to liability coverage.

Personal injury protection (PIP) and medical payments coverage (MedPay) help cover medical expenses for the insured driver, their family, and their passengers. PIP is mandatory in no-fault insurance states and covers medical bills, lost wages, and other related expenses, while MedPay is optional in most states and covers only medical bills. The cost of these coverages will depend on the chosen limits and the number of individuals covered.

Overall, a 32-year-old with a clean driving record can expect their auto insurance rate to increase with higher coverage levels. The specific increase will depend on the coverages selected, the limits chosen, and other factors such as location and vehicle value. It is recommended to purchase the maximum coverage that one can comfortably afford to ensure adequate protection in the event of an accident.

Auto Insurance: Automobile Expense or Extra?

You may want to see also

Frequently asked questions

The average cost of car insurance for a 32-year-old with a clean driving record will vary depending on factors such as location, gender, and the type of coverage. For example, the average cost of full coverage car insurance in the US is $1,718 per year, while the average cost of minimum coverage is $488 per year. The cost of car insurance also varies by state, with Wyoming having the cheapest full coverage rates at $972 per year, and Florida having the most expensive at $3,067 per year.

In addition to age, location, and driving record, the cost of car insurance is influenced by gender, credit score, vehicle type, and coverage level.

To get cheaper car insurance, consider comparing rates from different insurance providers and choosing a higher deductible. You may also be able to get discounts for being a good student, having a clean driving record, or bundling your car insurance with other types of insurance, such as home insurance.

The cost of car insurance per month will depend on the factors mentioned above, but on average, car insurance costs around $143 per month for full coverage and around $41 per month for minimum coverage.