Auto insurance companies use several factors to determine insurance rates, including an applicant's credit score and credit history. While a credit score can influence insurance rates, it is not the only factor, and insurance companies also consider driving history, claims history, and other criteria. In some states, including California, Hawaii, and Massachusetts, insurers are prohibited from using credit history to set insurance rates. It's important to note that insurance quotes do not affect credit scores, as insurance companies perform a soft pull that does not show up to lenders.

| Characteristics | Values |

|---|---|

| Credit-based insurance scores used by auto insurance companies | Different from the typical credit scores such as FICO scores |

| Factors considered by auto insurance companies | Driving history, type of car, other drivers in the household, insurance claims history, coverage selections, deductible amount |

| Impact of credit-based insurance scores on insurance rates | Drivers with lower credit scores may pay higher premiums |

| States that ban the use of credit-based insurance scores | California, Hawaii, Massachusetts, Michigan |

| Ways to improve credit scores | Make timely payments, pay down debts, maintain low credit card balances, apply for new credit sparingly |

What You'll Learn

- Lenders will be notified if you don't have auto insurance

- Lenders can place their own insurance on your vehicle

- Lenders can repossess your vehicle if you don't have insurance

- You can get storage only coverage for a car that you're not currently driving

- Credit insurance is optional insurance that covers your loan payments in certain circumstances

Lenders will be notified if you don't have auto insurance

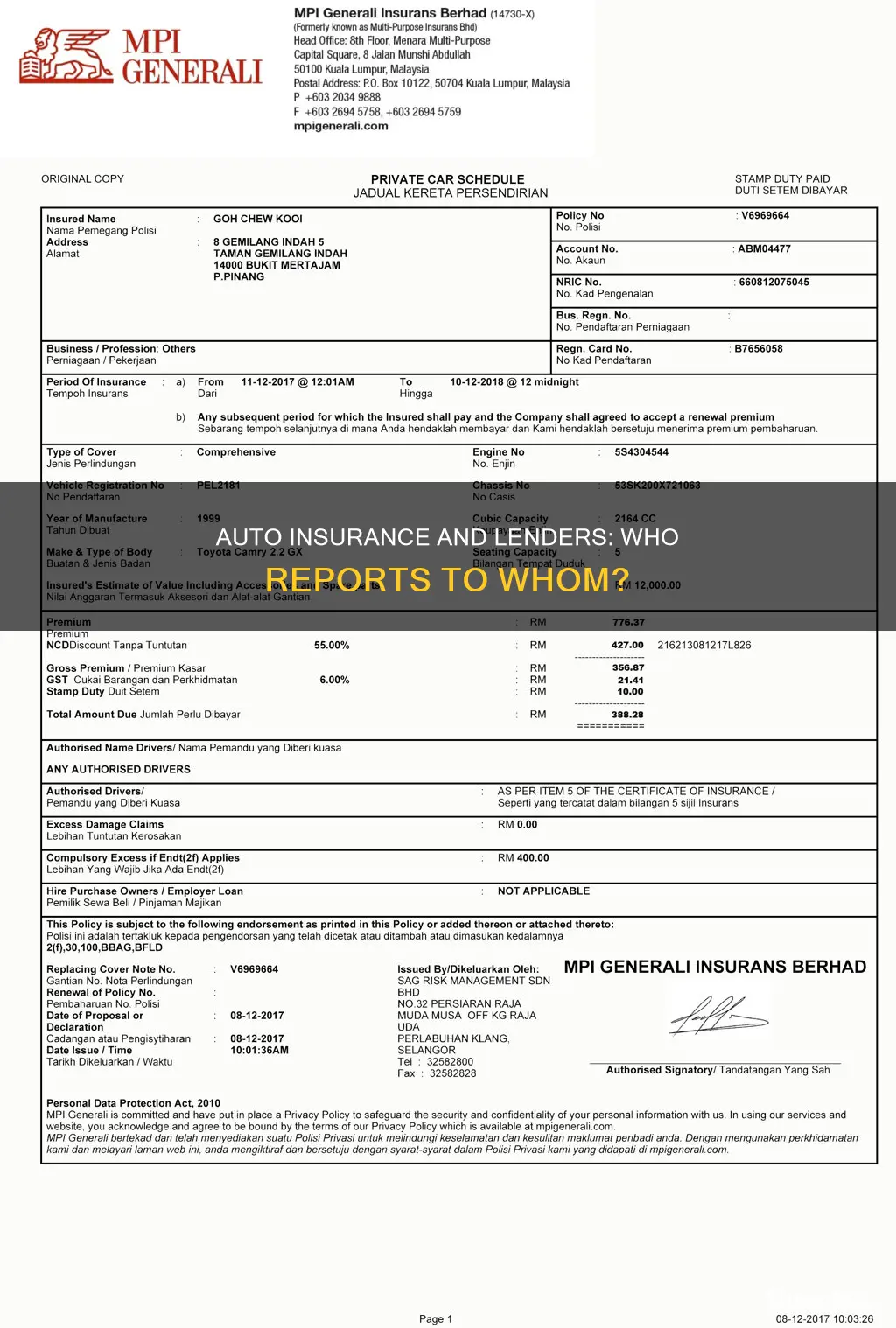

Lenders will almost certainly be notified if you don't have auto insurance. This is because, when a policy is non-renewed or cancelled, a letter is typically sent to the lienholder, informing them that you no longer have coverage.

If the lender is the lienholder, they will request proof of insurance from your insurance company. If they don't receive it, they will require you to obtain other coverage. If they don't receive proof of insurance, they may place a lender-placed policy, which you will be required to pay at a much higher price than standard market insurance.

Lenders usually stipulate in the contract that some form of full coverage is to be maintained for the life of the loan. They impose this requirement because they want the vehicles they finance—which are technically still their assets—to be protected in case of an accident or theft of the car.

If you don't keep full coverage on a financed vehicle, you're likely in breach of your contract. Your insurance company or the DMV may then contact the lienholder to alert them of the change, at which point the lender can legally cancel your contract, request full payment of the loan, or even repossess the vehicle.

In some states, the government will also be notified and will fine you for not having insurance. They may also suspend your license.

Strategies to Reduce Auto Insurance Premiems Post-DUI

You may want to see also

Lenders can place their own insurance on your vehicle

Lender-placed auto insurance, also known as force-placed insurance, is a policy that your lender can force upon you if your mandatory full-coverage car insurance lapses or does not cover the entire value of your vehicle. This typically occurs when you are financing your vehicle, as lenders want to protect their asset until you make the final payment and they remove their name from the title.

When you finance a car, your loan contract will usually require you to purchase enough insurance to cover the vehicle. This is because you do not technically own the car until you have paid off the loan in full. As such, lenders may require you to obtain collision coverage or both collision and comprehensive coverage. This ensures that your auto loan can be repaid if the vehicle is damaged, totaled, or stolen.

If you fail to carry the proper insurance or opt not to get any insurance at all, your lender can get force-placed insurance to cover the vehicle. This insurance is designed to protect the lender, not you, and the lender will charge you for the policy. Force-placed insurance can be costly and may still leave you lacking in coverage. The premiums for this type of insurance are usually higher since you are considered a higher risk without your own car insurance. Additionally, force-placed insurance may not include liability insurance, which is required in most states.

To avoid force-placed insurance, make sure you fulfill all your auto loan obligations regarding car insurance. Choose a policy that includes enough coverage for the value of your vehicle and do not let your policy lapse. Remember that a lapse in coverage, even for just one month, can result in force-placed insurance.

Florida Auto Insurance: Understanding No-Fault State Regulations

You may want to see also

Lenders can repossess your vehicle if you don't have insurance

Lenders typically require borrowers to provide proof of insurance at the beginning of the loan and to maintain coverage throughout the loan term. They may request regular updates or copies of insurance documents to ensure compliance. Some lenders also use electronic monitoring systems to track insurance status and will be notified if coverage lapses.

If you are unable to maintain insurance coverage due to financial hardship, it is important to communicate with your lender. Discuss your situation and explore possible options, such as finding more affordable insurance coverage or making alternative payment arrangements.

It's worth noting that lenders may also add force-placed insurance to your account if you don't have insurance. This means they will purchase the required amount of insurance on your behalf and increase your monthly payments. However, force-placed insurance is expensive and only protects the lender's property, not you.

To avoid repossession, it is crucial to maintain continuous insurance coverage on your financed vehicle and stay current on your loan payments.

Umbrella Insurance: Auto Accident Coverage

You may want to see also

You can get storage only coverage for a car that you're not currently driving

If you're not driving your car and plan to keep it in storage, you may be wondering if you need to maintain your auto insurance policy. While it's not a legal requirement to have car insurance if your vehicle is parked or in storage, it's highly recommended that you keep your car insured to protect yourself financially in the event of any damage.

Car Storage Insurance

Car storage insurance, also known as parked-car insurance or comprehensive-only coverage, is designed specifically for vehicles that are not being driven. This type of insurance covers anything that can happen to your car while it's stored or parked, including theft, fire, hail, or other mishaps. By purchasing car storage insurance, you can reduce your auto insurance costs since you won't need to maintain as much coverage.

Benefits of Car Storage Insurance

There are several benefits to maintaining car storage insurance for a vehicle that's not in use:

- Avoid coverage gaps: If you cancel your car insurance policy, you may face higher premiums when you reinstate it in the future due to a gap in your auto insurance history.

- Protect against accidents: Without insurance, you'll be fully responsible for any damage that occurs to your vehicle while in storage.

- Comply with lender requirements: If your vehicle is financed, your lender may require you to maintain insurance as a condition of your car loan, even if it's in storage.

- Prevent a lapse in coverage: Keeping at least comprehensive coverage will help you avoid a lapse in coverage that can lead to higher rates in the future.

- Peace of mind: Unfortunate events can occur even if your vehicle is not being driven. Comprehensive coverage gives you peace of mind that you're protected against theft, vandalism, fire, and other covered perils.

Drawbacks of Dropping Liability Coverage

If you decide to drop liability coverage while your car is in storage, it's important to be aware of the following drawbacks:

- Storage location limitations: You won't be able to park your car on a public road and will need to store it in a garage, driveway, or private storage unit.

- Driving restrictions: You won't be able to legally drive your car, even to move it to a different storage location, as you won't meet the minimum insurance requirements for operating a vehicle.

Cost of Car Storage Insurance

The cost of car storage insurance, or comprehensive-only coverage, varies depending on several factors, including the make and model of your vehicle, your driving record, insurance history, and location. It's important to contact your insurance provider to discuss your specific options and costs.

In summary, while it may be tempting to cancel your auto insurance policy for a car that's not in use, maintaining at least comprehensive coverage is highly recommended to protect your vehicle and avoid potential financial penalties in the future.

Auto Insurance: Seattle vs Portland, Who's Cheaper?

You may want to see also

Credit insurance is optional insurance that covers your loan payments in certain circumstances

Credit insurance is a type of insurance policy that covers your loan payments in the event of death, disability, or unemployment. It is marketed as a credit card feature, with the monthly cost charged as a low percentage of the card's unpaid balance. Credit insurance is optional and you do not have to purchase it.

There are three types of credit insurance:

- Credit Life Insurance: This type of insurance pays off all outstanding loans and debts if you die.

- Credit Disability Insurance: Also called accident and health insurance, this type of insurance pays a monthly benefit directly to a lender equal to the loan's minimum monthly payment if you become disabled.

- Credit Unemployment Insurance: If you become involuntarily unemployed, this insurance pays a monthly benefit directly to the lender equal to the loan's minimum monthly payment.

Credit insurance can provide peace of mind and act as a safety net during tough economic times. However, it is important to carefully consider whether you need it. The cost of credit insurance can be high relative to its benefits, and there may be fine print that makes it difficult to collect on the policy. Additionally, if you already have life or disability insurance, you may already be covered.

Before purchasing credit insurance, it is advisable to ask yourself the following questions:

- Do you have other insurance or assets that would cover your debt obligations in the event of death, disability, or unemployment?

- Would it be more cost-effective to buy a separate life or disability insurance policy?

- Will the credit insurance cover the full term of the loan and the entire balance?

- How long is the waiting period before the monthly benefit is paid?

- What isn't covered by the policy?

- Can the insurance company or lender cancel the insurance or change the terms and premiums without your consent?

By carefully considering these questions and comparing the cost and benefits of credit insurance to other options, you can make an informed decision about whether credit insurance is right for your needs.

Auto Owners Insurance: Unraveling the Rating System

You may want to see also

Frequently asked questions

No, getting a quote from an auto insurance company will not affect your credit score. This is because the insurance company is not looking at your actual score; it is just using your credit report information.

Yes, in states where it is allowed, auto insurance companies might consider a credit-based insurance score when reviewing your application or setting your premiums. However, these scores are different from the ones that creditors use, and insurance companies consider many factors in addition to a score.

A credit-based insurance score is used to determine how likely you are to file a claim. It gives insurers an idea of how big a risk you are and helps them decide how much to charge you for coverage.