The cost of monthly auto insurance varies depending on factors such as location, age, gender, driving history, and vehicle type. In the US, the average monthly cost of a full-coverage car insurance policy is $158, while a state minimum policy costs around $42 per month. However, rates can differ significantly by state, with Louisiana being the most expensive at $240 per month, and South Dakota the cheapest at $29 per month for minimum coverage.

Age is a significant factor, with younger drivers typically paying more. An 18-year-old male, for example, pays on average $461 per month, while a 20-year-old female pays $294. As drivers get older, rates tend to decrease, with drivers above 60 often benefiting from the most affordable rates.

Other factors that influence monthly auto insurance rates include driving history, with those who have a clean driving record usually paying less. Additionally, vehicle type plays a role, with luxury and sports cars generally being more expensive to insure due to higher replacement and repair costs.

| Characteristics | Values |

|---|---|

| Average monthly cost of car insurance in the US | $158 |

| Average monthly cost of car insurance in the US (full coverage) | $194 |

| Average monthly cost of car insurance in the US (minimum coverage) | $53 |

| Average annual cost of car insurance in the US | $1,718 |

| Average annual cost of car insurance in the US (full coverage) | $2,329 |

| Average annual cost of car insurance in the US (minimum coverage) | $633 |

| Average monthly cost of car insurance in the US (for a preferred driver) | $158 |

| Average monthly cost of car insurance in the US (state minimum policy) | $42 |

| Average cost of car insurance in the US (for a 40-year-old male) | $1,483 per year |

| Average cost of car insurance in the US (for a 40-year-old male) | $124 per month |

| Average cost of car insurance in the US (for a 30-year-old man) | $64 per month |

| Average cost of car insurance in the US (for a 30-year-old man) | $767 per year |

What You'll Learn

The average cost of car insurance in the US

The cost of car insurance in the US varies depending on several factors, including age, driving history, location, and the insurance company. According to a June 2024 analysis by NerdWallet, the national average annual cost of car insurance is $1,718 for full coverage and $488 for minimum coverage. On a monthly basis, full coverage averages $143, while minimum coverage averages $41 per month.

The cost of car insurance also differs across states. Wyoming, Vermont, and New Hampshire are among the cheapest states for full coverage, while Florida, Louisiana, and Texas are the most expensive. The average annual cost of full coverage in Wyoming is $972, while in Florida, it is $3,067.

In addition to geographical variations, car insurance rates can differ based on personal characteristics. Young drivers, those with a recent DUI, and individuals with poor credit tend to pay higher car insurance rates. The average annual cost of full coverage for a 20-year-old driver is $3,576, compared to $1,718 for the national average.

When considering the cost of car insurance, it is important to remember that the rates are dynamic and can change over time. Comparing quotes from different insurance companies and reviewing your coverage options can help you find the most suitable policy for your needs and budget.

Insurify: Trustworthy Auto Insurance Comparison?

You may want to see also

The cost of car insurance by state

The cost of car insurance varies significantly from state to state in the US. The national average annual cost for a full-coverage policy is $1,895, but this can range from $1,307 in New Hampshire to $8,232 in New York.

Some of the factors that contribute to these differences include state insurance laws, population density, the frequency of insurance claims, the number of uninsured drivers, weather conditions, and local crime rates. For example, states with more stringent car insurance requirements, such as Michigan, tend to have higher insurance premiums. On the other hand, states with milder weather and fewer claims, such as Vermont and Maine, have cheaper insurance rates.

States with the Highest Full-Coverage Car Insurance Rates:

- Louisiana: $4,357

- New York: $4,112

- Michigan: $4,067

- Pennsylvania: $3,909

- Nevada: $3,870

States with the Lowest Full-Coverage Car Insurance Rates:

- Maine: $1,460

- Vermont: $1,539

- Hawaii: $1,581

- Idaho: $1,588

- Ohio: $1,660

It is worth noting that these rates are averages and that individual insurance premiums can vary based on personal factors such as age, gender, driving record, and credit history.

Gap Insurance: Job Loss Protection

You may want to see also

The cheapest car insurance companies

The cheapest car insurance company for you will depend on your age, location, driving history, credit score, and other factors. Here are some of the cheapest car insurance companies in the US:

- USAA: USAA is consistently ranked as one of the cheapest car insurance companies, but it is only available to military members, veterans, and their families.

- Travelers: Travelers offers the cheapest rates for full coverage in Pennsylvania and Florida, and for drivers with poor credit in Florida. It is also the cheapest option for sports car drivers in Florida.

- Nationwide: Nationwide is the cheapest insurance company in Pennsylvania for drivers with bad credit. It also offers the lowest rates for minimum coverage in Florida.

- State Farm: State Farm provides the cheapest rates for full coverage in Florida. It is also the most affordable option for drivers with an at-fault accident, a DUI, or a speeding ticket on their record in Florida.

- GEICO: GEICO has the cheapest minimum coverage in Florida. It is also the cheapest option for young adult drivers in their 20s.

- Erie: Erie is ranked as one of the best car insurance companies in Pennsylvania. It is the third cheapest option for full coverage in the state.

- Auto-Owners: Auto-Owners Insurance is one of the cheapest options for full coverage in Pennsylvania.

- NJM: NJM Insurance is a regional insurance company that offers affordable rates in Pennsylvania.

Auto Insurance: What's Essential?

You may want to see also

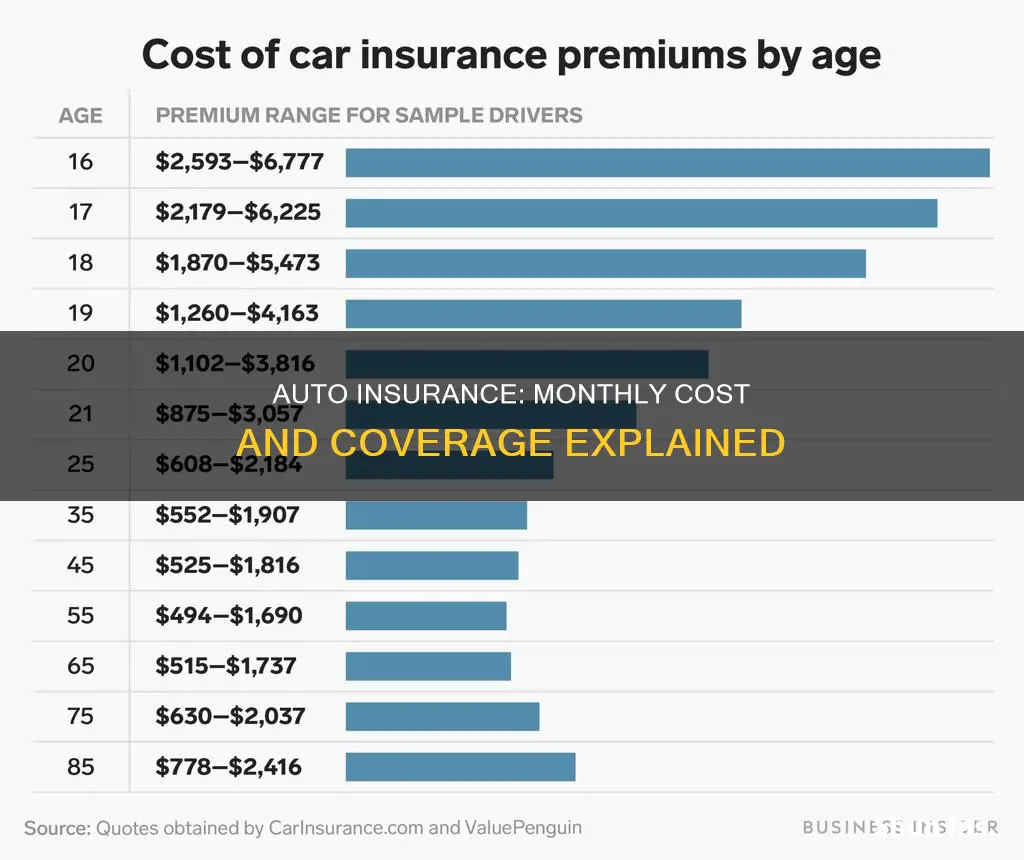

The cost of car insurance by age

The cost of car insurance varies depending on the age of the driver. In general, younger and older drivers pay more for car insurance than those in their 20s to 60s. This is because younger and older drivers are considered higher-risk due to their lack of experience or age-related factors such as decreased reaction time.

Teens and Young Adults

Teens and young adults typically pay the highest rates for car insurance due to their lack of driving experience. The average cost of car insurance for a 16-year-old is around $3,192 per year for minimum coverage and $8,765 per year for their own full coverage policy. For a 20-year-old, the average cost is $1,023 for minimum coverage and $3,576 for full coverage.

Adults

As drivers move into their mid-to-late 20s, their car insurance rates start to decrease. By age 30, the average cost of car insurance is $1,508 for minimum coverage and $2,103 for full coverage. This downward trend continues into the 40s and 50s, with rates levelling off in the early 60s.

Seniors

Around age 70, car insurance rates start to increase again due to factors such as decreased reaction time and vision problems. However, senior drivers are still likely to pay less than teen drivers, assuming they have a clean driving record.

Gap Insurance: Payout or Pitfall?

You may want to see also

The cost of car insurance by gender

The cost of car insurance varies depending on a number of factors, including age, location, insurance provider, and driving record. However, gender can also play a role in determining insurance rates, with men generally paying more than women. Here is an overview of how the cost of car insurance differs between genders.

The Impact of Gender on Car Insurance Rates

On average, men pay slightly more for car insurance than women. This is because men are considered higher-risk drivers due to a higher likelihood of accidents, speeding, and DUI convictions. As a result, insurance companies view them as more likely to file claims. According to Insure.com, women between the ages of 16 and 24 pay around $500 less per year for car insurance than men, with men in this age group paying about 11% more than women. However, the difference in rates between genders tends to decrease with age, and by age 40, the national average cost of car insurance for men is only about 4% higher than for women.

States That Prohibit Gender-Based Rates

It is worth noting that not all states allow insurance companies to use gender as a factor in determining rates. As of 2021, seven states have banned the use of gender in setting car insurance rates:

- California

- Hawaii

- Massachusetts

- Michigan

- Montana

- North Carolina

- Pennsylvania

In these states, gender will not affect how much you pay for car insurance.

Car Insurance Rates by Gender and Company

The impact of gender on car insurance rates can also vary depending on the insurance company. Here is a comparison of average annual full-coverage rates for men and women from some popular insurance companies:

- American Family Insurance: $1,532 for women, $1,563 for men

- Farmers Insurance: $1,646 for women, $1,673 for men

- Geico: $1,302 for women, $1,296 for men

- Progressive: $1,342 for women, $1,345 for men

- State Farm: $1,356 for both men and women

As you can see, the difference in rates between genders varies across companies, with some companies charging women slightly more and others charging men more.

Ways to Save on Car Insurance

Regardless of gender, there are several ways to save on car insurance:

- Shop around and compare rates from multiple insurance companies.

- Ask about discounts, such as good student discounts or discounts for bundling policies.

- Consider a higher deductible, which can lower your monthly premium.

- Look into telematics insurance, which can reduce your rate if you have safe driving habits.

Auto Insurance: Is It Really Necessary?

You may want to see also

Frequently asked questions

The average cost of car insurance per month depends on the type of coverage. For a minimum-coverage policy, the average cost is $64 per month, while for a full-coverage policy, the average cost is $164 per month.

Car insurance for a 20-year-old male costs $328 per month or $3,935 per year. Car insurance for a 20-year-old female costs $294 per month or $3,527 per year.

If you obtain a policy with 100/300 in personal liability coverage, then $100 a month in car insurance is a fantastic rate. However, your driving record and the age of your vehicle will also affect your monthly car insurance cost, so this rate may not be achievable for everyone.