How often people make auto insurance claims depends on several factors, including age, gender, driving experience, and location. According to Fox Business, motorists file insurance claims roughly once every 17.9 years. This means that by the age of 34, a person who started driving at 16 is likely to have filed at least one car insurance claim. By the time they reach 70, they will have filed an average of three claims throughout their life.

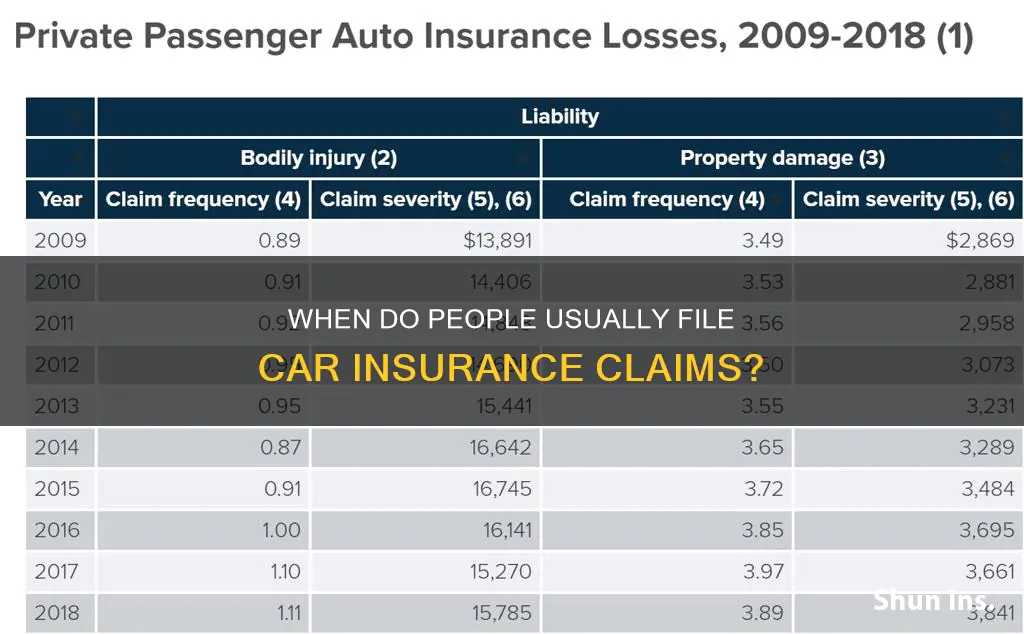

The frequency of auto insurance claims also varies by type. Collision claims are the most frequently filed, followed by property damage, comprehensive, and bodily injury claims. Collision claims have an average of 5.8 claims per 100 years of insured coverage on a vehicle, while bodily injury claims have the lowest frequency, with 0.95 claims per 100 car years.

| Characteristics | Values |

|---|---|

| How often people make auto insurance claims | Motorists file insurance claims roughly once every 17.9 years |

| Average cost of car insurance | $2,150 annually for full coverage |

| Average cost of car insurance for 16-year-old drivers | $8,765 |

| Average cost of car insurance for 17-year-old drivers | $6,829 |

| Cheapest average cost of car insurance by age | $1,915 annually for 60-year-old drivers |

| Percentage of insured drivers with a bodily injury liability claim | 0.74% |

| Percentage of insured drivers with a property damage liability claim | 2.37% |

| Percentage of collision insurance policyholders who filed a claim | 6% |

| Percentage of drivers with comprehensive coverage who filed a claim | 3.2% |

| Average auto liability claim for property damage | $5,313 |

| Average auto liability claim for bodily injury | $24,211 |

| Average collision claim | $5,992 |

| Average comprehensive claim | $2,738 |

What You'll Learn

How much do auto insurance claims cost?

The cost of auto insurance claims depends on several factors, including the type of insurance, the driver's age, gender, location, driving record, and credit score. Here is a breakdown of the average costs of auto insurance claims:

Full Coverage vs Minimum Coverage

Full coverage auto insurance includes liability, collision, and comprehensive insurance, which cover damages to your vehicle and others in an accident. The national average cost for full coverage auto insurance is $2,681 per year or $223 per month. On the other hand, minimum coverage auto insurance only includes the state-mandated minimum liability insurance, which is significantly cheaper, costing $869 per year or $72 per month on average.

Cost by State

The cost of auto insurance claims also varies by state. For example, Louisiana, New York, and Michigan are among the most expensive states for full coverage auto insurance, with average annual costs of $3,629, $4,769, and $3,643, respectively. In contrast, Idaho, Vermont, and Ohio are the cheapest states, with average annual costs of $1,021, $1,037, and $1,209, respectively.

Cost by Company

The cost of auto insurance claims also depends on the company providing the coverage. USAA, Auto-Owners, and Geico are some of the cheapest options for full coverage, with average annual rates of $1,412, $1,628, and $1,716, respectively. For minimum coverage, Erie, Mercury, and Progressive offer the lowest rates, with annual costs ranging from $241 to $341.

Cost by Age and Gender

Age and gender also impact the cost of auto insurance claims. Younger drivers, especially teens, pay higher rates due to their lack of driving experience. The average annual cost of full coverage for an 18-year-old driver is $5,669, while a 30-year-old driver pays an average of $2,150. Gender can also influence rates, with young males typically paying more than females due to riskier driving behavior. However, this difference tends to decrease as they get older.

Cost by Driving Record

Your driving record plays a significant role in determining the cost of auto insurance claims. A clean driving record can result in lower rates, while accidents, speeding tickets, and DUIs can increase your premiums. For example, the average annual cost of full coverage increases by nearly $500 after a speeding ticket and by about $1,400 after a DUI.

Cost by Credit Score

In most states, your credit score can also impact your auto insurance rates. Drivers with poor credit scores may pay significantly more than those with good credit. On average, drivers with poor credit pay about 76% more for full coverage auto insurance.

Tort Auto Insurance: Understanding Medical Injury Coverage

You may want to see also

How often do auto insurance claims occur?

The frequency of auto insurance claims varies depending on the type of claim and other factors such as age, gender, driving experience, driving record, credit history, mileage, coverage choices, deductible amount, vehicle type, and location. On average, motorists file insurance claims once every 17.9 years, according to Fox Business. This means that by the age of 34, a person who started driving at 16 is likely to have filed at least one car insurance claim. By the time they reach 70, they will have filed roughly three claims on average.

The four main categories of auto insurance claims are bodily injury, property damage, collision, and comprehensive. According to 2022 industry data from the Insurance Information Institute (III), 0.74% of insured drivers with liability insurance had a bodily injury liability claim, while 2.37% of liability insurance policyholders had a property damage liability claim. In the same year, 6% of collision insurance policyholders filed a claim, while 3.2% of drivers with comprehensive coverage filed a claim.

Collision claims are the most frequently filed, followed by property damage, comprehensive, and bodily injury claims. However, bodily injury claims are the most expensive, with an average cost of $16,260 per loss, while property damage claims cost $3,729, collision claims cost $3,278, and comprehensive claims cost $1,690 on average.

Several factors can influence the frequency of auto insurance claims, including age, gender, driving experience, driving record, credit history, mileage, coverage choices, deductible amount, vehicle type, and location. For example, teen drivers are more likely to be in fatal car accidents due to inexperience, distracted driving, and risky behaviors. Male drivers tend to engage in riskier behaviors and are involved in more accidents than female drivers.

Additionally, factors such as incorrect policy information, delays in claim reporting, and providing wrong contact details can delay the claims process.

Banks Force Gap Insurance Removal. Why?

You may want to see also

What are the different types of auto insurance claims?

Auto insurance provides property, liability, and medical coverage. While the specific types of coverage available vary depending on the insurance company and the jurisdiction, here are some of the most common types of auto insurance claims:

Liability Coverage

Liability coverage is required in most US states as a legal prerequisite to driving a car. It covers the policyholder's legal responsibility to others for bodily injury or property damage. There are two types of liability protection: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and legal fees if the policyholder causes an accident that injures others. Property damage liability, on the other hand, covers damage to property other than the policyholder's car resulting from an accident.

Collision Coverage

Collision coverage pays for repairs to the policyholder's car after an accident involving a collision with another vehicle or object. It covers the costs of repairing the car or replacing it if it is totaled. Collision coverage is not required by state laws but may be mandated by the lender or lienholder.

Comprehensive Coverage

Comprehensive coverage, also known as "other than collision coverage," pays for repairs to the policyholder's car due to scenarios other than collisions. This includes weather damage, collisions with animals, vandalism, theft, and natural disasters. Like collision coverage, comprehensive coverage is not required by state laws but may be required by lenders or lienholders.

Uninsured/Underinsured Motorist Coverage

Uninsured motorist coverage reimburses the policyholder if they are hit by an uninsured or hit-and-run driver. Underinsured motorist coverage, meanwhile, comes into play when the at-fault driver has insufficient insurance to cover the costs of the accident. This type of coverage is not required in all states, but it is an important protection to have, as state-mandated minimum coverage requirements may not be sufficient to cover all expenses.

Medical Payments Coverage

Medical payments coverage, or "MedPay," helps cover medical expenses for the policyholder and their passengers following a car accident, regardless of who is at fault. It typically includes hospital bills, doctor fees, treatment costs, medications, and ambulance fees. Medical payments coverage is optional in most places but can provide valuable financial protection in the event of an accident.

Personal Injury Protection (PIP)

Personal injury protection (PIP) is similar to medical payments coverage but is more comprehensive. It covers medical expenses, lost wages, rehabilitation costs, and funeral expenses for the policyholder and their passengers, regardless of who is at fault in the accident. PIP is not available in all states, but it is required in certain states and can provide valuable financial protection for those involved in an accident.

Gap Insurance: Worth the Cost?

You may want to see also

What factors influence auto insurance rates?

Several factors influence auto insurance rates. Here are some of the most significant ones:

Driving Record

A driver's history of accidents, traffic violations, and claims is a crucial factor in determining insurance costs. A clean driving record can result in lower premiums, while multiple infractions can lead to higher rates and even policy cancellation. The number of years of driving experience also matters, as new drivers are often considered higher-risk.

Age

Age is a significant factor, with younger and older drivers typically paying more for insurance. Teen drivers are seen as riskier clients due to their higher accident rates and reckless driving behaviour. Insurance rates tend to decrease after age 25 and then increase again after age 65, as older adults are more likely to get into accidents and suffer injuries.

Vehicle Type and Value

The make, model, and safety ratings of a vehicle can impact insurance rates. Insurers prefer insuring safer cars, as they are less likely to result in expensive claims. Additionally, the cost of the car, the likelihood of theft, repair costs, engine size, and overall safety record are considered. Vehicles with high-quality safety equipment may qualify for premium discounts.

Credit History

In most states, credit history is a significant factor in determining insurance rates. Drivers with poor credit scores tend to pay more for insurance, as data shows they file more expensive claims. Improving credit scores can help lower insurance premiums.

Location

Where a person lives and parks their car can affect insurance rates. Urban areas with higher rates of vandalism, theft, and accidents typically have higher insurance prices. The state of residence also matters, as each state has different minimum coverage requirements and categories of mandatory coverage.

Gender

Gender can influence insurance rates, particularly for younger drivers. Teenage male drivers often pay more than their female counterparts because they are seen as more likely to take risks and exhibit riskier driving behaviour. However, the gender gap tends to even out for drivers in their 30s.

Marital Status

Married drivers are considered less risky and tend to have fewer accidents, resulting in lower insurance rates. Historical data shows that married couples share driving duties and file fewer individual claims.

Mileage and Commute

The number of miles driven and the purpose of the commute impact insurance rates. Those who drive longer distances or use their vehicles for work are more likely to be involved in accidents, resulting in higher premiums. Leisure drivers who drive fewer miles typically pay less for insurance.

Coverage Amount and Deductible

The amount of coverage and the deductible chosen affect insurance rates. Higher coverage limits and lower deductibles result in more expensive premiums.

Traffic Violations and Convictions

Traffic violations, such as speeding tickets, and convictions, such as DUI, can significantly increase insurance rates. The severity of the violation and the number of infractions contribute to how much the costs increase.

Auto Shop: Insurance Check Endorsement?

You may want to see also

What happens when you make multiple auto insurance claims?

Making multiple auto insurance claims can have several implications for your insurance policy and premiums. Firstly, it's important to note that insurers typically consider all claims made within a multi-year period, usually three years, as "multiple claims". This means that whether you file two claims in six months or two claims in two years, they will be treated similarly.

When you have multiple claims, your insurance rate may increase, even if you were not at fault for the accidents. This can depend on your state and insurer, but it's a common outcome. While your insurer cannot cancel your policy mid-term if you've made multiple claims, they may choose not to renew it when it ends. This is because insurers are generally reluctant to continue covering drivers they consider high-risk. Even if you switch to a new insurer, your rate will likely increase due to your claim history.

The types of claims you make also matter. At-fault claims are particularly detrimental, and multiple at-fault claims caused by the same person within three years can often lead to non-renewal by top-tier insurance carriers. Comprehensive claims, on the other hand, usually don't affect your rate unless you file three or more in a three-year period.

To avoid multiple claim penalties, it's advisable to practice defensive driving, park your car in a secure place, and keep your vehicle well-maintained. Additionally, consider the costs of paying for minor damage out of pocket versus filing a claim, as multiple claims in a short period could lead to higher premiums.

Lithium Battery Fires: Are You Covered by Auto Insurance?

You may want to see also

Frequently asked questions

Motorists file insurance claims roughly once every 17.9 years.

The four categories of auto insurance claims are bodily injury, property damage, collision, and comprehensive.

The national average cost for car insurance is $2,150 annually for full coverage.

Some factors that affect auto insurance rates include age, gender, driving record, credit history, mileage, coverage choices, deductible amount, vehicle type, and location.

Filing multiple insurance claims may cause your insurance company to increase your rates or not renew your policy.