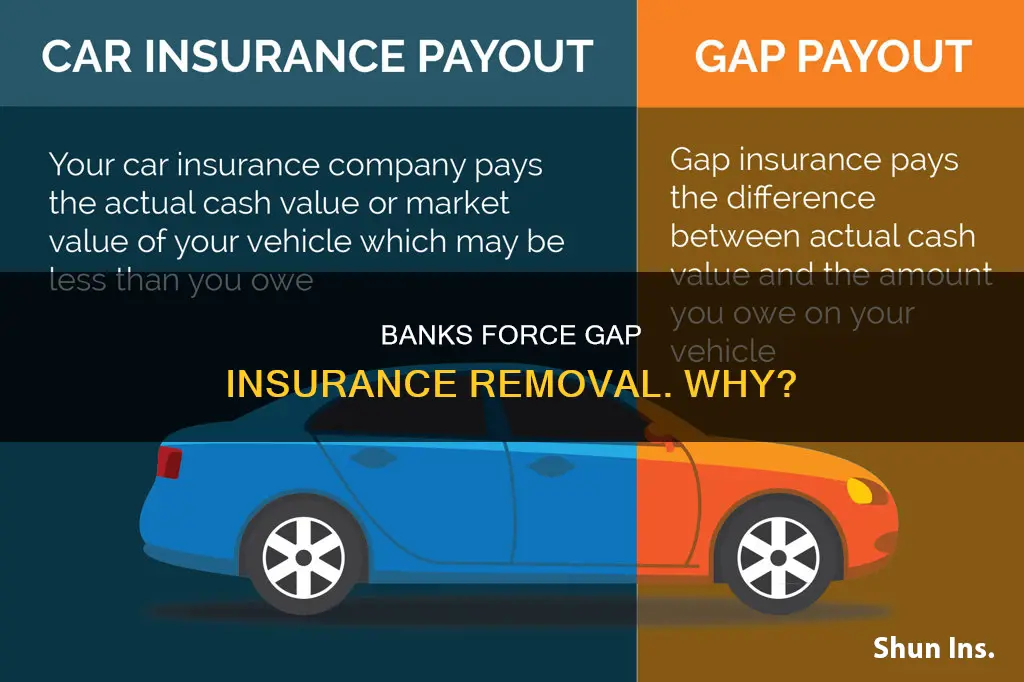

Gap insurance is an optional form of car insurance that covers the difference between the amount owed on a car loan or lease and the depreciated value of the car if it is stolen or written off. This type of insurance is designed to protect drivers from being left with outstanding debt on a vehicle they can no longer use. Gap insurance is typically purchased from car insurance companies or dealerships, and can cost anywhere from $20 to $700 depending on the provider. While it is not required by law, lenders or leasing companies may require drivers to purchase gap insurance as additional protection.

| Characteristics | Values |

|---|---|

| When to get gap insurance | When you have a car loan or lease and the amount you owe is more than the car's value |

| When to drop gap insurance | When the loan balance is lower than the car's value or you sell your car |

| Who offers gap insurance | Car insurance companies, banks, credit unions, and dealerships |

| Cost of gap insurance | $3-$700 per year |

| Pros of gap insurance | Covers the gap when you owe more than your vehicle is worth |

| Cons of gap insurance | If added to a car loan through a dealer, you could pay loan interest on the cost |

What You'll Learn

- Gap insurance is optional and covers the difference between the amount owed on a car loan and the car's depreciated value

- It is called 'guaranteed asset protection' and can be purchased from car insurance companies or banks

- It is worth considering if you have a long-term loan, made a small down payment, or have a car that depreciates quickly

- It does not cover engine failure, transmission failure, death, or your deductible

- It can be cancelled and you can get a refund for unused coverage

Gap insurance is optional and covers the difference between the amount owed on a car loan and the car's depreciated value

Gap insurance is an optional type of car insurance that covers the difference between the amount owed on a car loan and the car's depreciated value. It is designed to protect drivers from financial loss in the event of a total loss or theft of their vehicle. When a car is stolen or deemed a total loss, standard insurance policies will only cover the car's depreciated value, which is often less than the outstanding loan amount. Gap insurance bridges this gap by paying the difference, ensuring that drivers are not left with a large bill for a vehicle they can no longer use.

Gap insurance is particularly useful for drivers who have made a small down payment on their vehicle, have a long-term loan, or own a car that depreciates quickly. It can be purchased from car insurance companies, loan providers, or dealerships, with costs varying depending on the provider and the driver's circumstances. While it is not required by state law, some lenders or leasing companies may require gap insurance to protect themselves from financial loss if the car is stolen or totalled.

For example, let's say you buy a car for $50,000 and make a down payment of $10,000. Three years later, your car is involved in an accident and is deemed a total loss. By this time, your car's value has depreciated to $20,000, but you still owe $24,000 on the loan. Without gap insurance, your insurance company will pay you $20,000 (minus your deductible), leaving you with a $4,000 gap that you have to pay off. With gap insurance, this $4,000 gap would be covered, and you would not owe anything on the loan.

It's important to note that gap insurance does not cover every expense related to a car loan or lease. It also does not cover engine or transmission failure, overdue payments, late fees, extended warranties, or lease penalties. Additionally, gap insurance is not necessary if you have already paid off most of your loan or made a significant down payment, as the gap between the car's value and the loan amount is smaller. In such cases, it may be more cost-effective to absorb the difference if your car is totalled.

Drivetime: Gap Insurance Options

You may want to see also

It is called 'guaranteed asset protection' and can be purchased from car insurance companies or banks

Guaranteed asset protection, or GAP insurance, is an optional form of coverage that pays the difference between what your vehicle is worth and how much you owe on your car loan at the time it is stolen or totaled. This type of insurance bridges the gap between what a standard auto insurance policy covers and the amount you still owe on your car loan.

When you buy a new car, it starts to depreciate in value as soon as it leaves the car lot. Most cars lose 20% of their value within a year. A standard auto insurance policy will cover the depreciated value of a car, which is the current market value of the vehicle at the time of a claim. However, if you've only made a small down payment, it's possible that in the early years of owning the vehicle, the amount of the loan will exceed the market value of the car. In the event of an accident where your car is badly damaged or totaled, GAP insurance covers the difference between what the vehicle is currently worth (covered by your standard insurance) and the amount you actually owe on the loan.

GAP insurance is intended to cover the loss you would suffer if your loan balance is higher than the value of the vehicle. It is one of several optional add-on products, such as extended warranties or credit insurance, that a dealer will likely offer when purchasing or leasing a car. The cost of GAP insurance can vary greatly and is typically rolled into the loan amount, increasing the total amount you'll pay in interest over time. You can purchase GAP insurance from car insurance companies or banks, and it usually costs between $20 and $40 per year when added to a car insurance policy. Dealerships and banks charge a lump sum of up to $700 for GAP insurance, making them a more expensive option.

You should consider buying GAP insurance for your new car if you made less than a 20% down payment, financed for 60 months or longer, leased the vehicle, purchased a vehicle that depreciates faster than average, or rolled over negative equity from an old car loan into the new loan. GAP insurance can provide financial protection and peace of mind in case of an accident or theft, ensuring you don't owe money on a totaled car.

Vehicle Totaled: What to Tell Your Insurer

You may want to see also

It is worth considering if you have a long-term loan, made a small down payment, or have a car that depreciates quickly

Gap insurance is an optional type of car insurance that covers the difference between what a car is worth and what the driver owes on their loan or lease if the car is stolen or totaled. It is worth considering if you have a long-term loan, made a small down payment, or have a car that depreciates quickly.

If you have a long-term loan, gap insurance can protect you from owing more on your car than it is worth. Long-term loans almost guarantee that the car buyer will have negative equity for some time. The longer it takes to pay off a loan, the longer it takes for loan payments to catch up with the car's depreciating value.

Making a small down payment can also result in a bigger gap between what you owe and the car's depreciated value. A small down payment on a large loan can leave you vulnerable to owing more on your car than it is worth.

Certain types of cars depreciate much faster than others. Electric vehicles, for example, depreciate faster than other vehicle types, losing about half their value in five years. If you have a car that depreciates quickly, gap insurance can help protect you from being upside down on your loan.

In summary, gap insurance is worth considering if you have a long-term loan, made a small down payment, or have a car that depreciates quickly. It can help protect you from owing more on your car loan or lease than your car is worth.

Gap Insurance: What's the Deal?

You may want to see also

It does not cover engine failure, transmission failure, death, or your deductible

Gap insurance covers the difference between the amount owed on a car loan and the amount paid out in a total loss settlement from an auto insurer. However, it is important to note that gap insurance does not cover certain expenses. Here are some key points to consider:

Engine Failure and Transmission Failure

Gap insurance does not cover engine or transmission failure. It is designed to protect against financial loss in the event of a total loss, such as an accident or theft of the vehicle. Mechanical issues, including engine and transmission problems, are not covered under gap insurance or standard car insurance policies. If you experience engine or transmission failure, you will need to rely on other forms of protection, such as an extended warranty or mechanical breakdown insurance, if available.

Death

Gap insurance also does not cover death or funeral costs. It is strictly limited to covering the financial gap in the event of a total loss to your vehicle. In the unfortunate event of a death, the liability portion of your car insurance policy may provide some coverage for accidental death to others, and personal injury protection or medical payments coverage can help cover funeral fees for you and your passengers. However, for comprehensive death-related expenses, you may need to consider additional insurance options or other financial planning measures.

Deductible

Additionally, gap insurance typically does not cover your deductible. Your deductible is the amount you are responsible for paying before your insurance company steps in to cover the remaining costs. In the event of a claim, if you have a gap in your collision or comprehensive insurance, gap insurance will cover that gap minus your deductible. For example, if you have a $3,000 gap and a $500 collision deductible, gap insurance will pay $2,500, and you will be responsible for the remaining $500 deductible. However, some gap insurance policies offered by dealerships may include deductible coverage, but these policies tend to be more expensive.

Understanding the Limitations of Gap Insurance

While gap insurance can provide valuable protection in certain situations, it is essential to understand its limitations. Gap insurance is intended to cover a specific type of financial risk associated with car loans and total loss scenarios. By understanding what is not covered by gap insurance, you can make informed decisions about your insurance choices and explore alternative options to ensure comprehensive protection.

Gap Insurance: Honda's Secret Weapon

You may want to see also

It can be cancelled and you can get a refund for unused coverage

Gap insurance is an optional type of car insurance that covers the difference between what a car is worth and what the driver owes on their auto loan or lease if the car is stolen or declared a total loss. Gap insurance is not required by state law, but it may be required by lenders and lessors.

You can cancel your gap insurance policy early and get a refund for unused coverage if you have paid for the coverage upfront. The refund will be a prorated amount based on what you paid upfront and how much time is left on the policy. You will not get a refund if you have filed a claim against the policy.

To get a refund, you will need to contact your insurance company and let them know that you want to cancel your policy. They will provide you with the necessary paperwork and let you know what other information is required. Most insurance companies will need to see an odometer disclosure statement verifying the car's current mileage. You can obtain this free form from your state's DMV website.

If you cancel your gap insurance policy because your auto loan has been paid off, your insurance company might also request a letter from your lender verifying that the car loan was closed.

Once you've submitted all the necessary paperwork and documentation, you should receive your refund. Most insurance companies will allow you to choose between a physical check or a direct deposit to your bank account.

Keep in mind that gap insurance refunds are most commonly issued after a loan is paid off early or the car is sold or traded in. You can also get a refund if you switch to a different gap insurance company or if you no longer need gap insurance because your loan balance is lower than the vehicle's actual cash value.

RV Gap Insurance: Necessary Protection?

You may want to see also

Frequently asked questions

Gap insurance, or guaranteed asset protection, is an optional form of insurance that covers the difference between the amount owed on a car loan or lease and the car's market value in the event of theft or total loss.

Gap insurance is not required by law, and once the loan balance is lower than the car's value, there is no need for it. The bank may also require you to remove it to lower their own risk.

You can remove gap insurance when your loan balance is lower than or equal to your car's value. You can use online pricing guides to determine your car's market value.

Contact your gap insurance provider and request that they cancel your policy. You may be entitled to a refund for any unused portion of the policy.