How often you pay your home insurance depends on whether you pay your insurance provider directly or through an escrow account with your mortgage lender. If you pay directly to your insurance company, you can typically choose to pay monthly, quarterly, semi-annually, or yearly. If you pay through an escrow account, your insurance will be paid yearly.

| Characteristics | Values |

|---|---|

| Frequency of House Insurance Payment | Monthly, quarterly, semi-annually, yearly |

| Factors Affecting Payment Frequency | Whether paid through an escrow account or directly to the insurance company, mortgage status, lender requirements |

| Benefits of Yearly Payments | Lower rate compared to monthly payments, significant savings |

| Benefits of Monthly Payments | Added flexibility, smaller payments |

What You'll Learn

Paying house insurance monthly

When you pay your house insurance monthly, you're contributing towards the annual payment. This means that, while you make smaller, more manageable payments, you will still benefit from the discount offered by insurance companies for making a single annual payment.

Monthly payments are usually facilitated through an escrow account. This is a type of savings account managed by your lender, which sets aside money for home insurance and property tax payments. Your lender will then pay your insurance company annually from this account.

If you don't have an escrow account, you can typically pay your insurance company directly in monthly instalments. However, some insurance companies may add an instalment or convenience fee for this option, so it's important to check their terms and conditions.

It's worth noting that paying your house insurance annually in one lump sum may result in a lower rate than if you pay monthly. Many insurance companies offer discounts for annual payments, so paying monthly could cost you more overall.

Therefore, when deciding whether to pay your house insurance monthly, it's important to consider your financial situation and what works best for you.

Farmers Insurance and the Power of Referrals: Building a Network of Trust

You may want to see also

Paying annually

Paying for house insurance annually can be a great option for those who want to get their bills out of the way in one go. By paying upfront for your home insurance, you won't have to worry about additional costs until it's time to renew or switch. This option also tends to provide greater choice, as most insurers offer this as the standard option.

Additionally, paying your home insurance premium annually can be beneficial if you're looking to purchase both home contents insurance and building insurance. By paying annually, you can avoid the hassle of managing multiple monthly payments and may be able to take advantage of discounts offered by insurance companies for annual payments.

It's worth noting that the availability of annual payment options may vary depending on your lender and insurance provider. Consult with your lender and review the terms and conditions to understand your specific options. Additionally, consider using a price comparison website to explore different insurance providers and their payment options.

Farmers Insurance's Political Leanings: Unraveling the Ties with the Republican Party

You may want to see also

Using an escrow account

An escrow account is a type of savings account managed by your lender that sets aside money for home insurance and property tax payments. With an escrow account, your homeowners insurance will typically be paid yearly. The account is set up and managed by mortgage lenders and servicers, usually during the homebuying process. This separate account is used to pay additional non-mortgage expenses like property taxes and homeowners insurance premiums. Instead of making these payments yourself, the amount is added to your monthly mortgage payment and then directed to your escrow account. From there, the mortgage servicer pays these bills on your behalf.

An escrow account can automate your payments and make life a little easier. It is especially useful if you are someone who likes the idea of having your mortgage servicer take care of your homeowners insurance premiums and property taxes. It is also beneficial if you think it might be challenging to set that money aside each month. The convenience of an escrow account may appeal to you if you prefer a "set-it-and-forget-it" approach to managing your finances.

Additionally, your mortgage servicer may incentivize the use of escrow accounts by offering breaks on closing costs or lower mortgage rates. This can result in significant savings over the life of your loan. However, it's important to note that using an escrow account will likely result in higher closing costs since the mortgage lender needs to fund the account.

It's worth mentioning that escrow accounts are typically required for borrowers whose down payment is less than 20 percent. Similarly, if you're refinancing your mortgage, you'll likely need to have at least 20 percent equity in the home for the lender to waive the escrow requirement.

Securing Your Policy: A Guide to Changing Your Farmers Insurance Password

You may want to see also

Paying without an escrow account

If you don't have an escrow account, you can typically choose to pay for your home insurance monthly, quarterly, semi-annually, or yearly. Without an escrow account, you will need to pay your insurance company directly.

The benefit of not having an escrow account is that you can shop around for a better deal on your insurance, and you may be able to save money by switching insurance companies. Additionally, you can invest any excess money that would have otherwise gone into an escrow account. However, you will need to keep track of due dates and set aside money each month to ensure you have enough to pay your insurance premiums when they are due.

If you are a first-time homebuyer or have a down payment of less than 20%, your lender will likely require you to pay your homeowners insurance through an escrow account. This ensures that your insurance premium will be paid on time every month and protects the lender's investment in your home. An escrow account can also be advantageous as it is convenient to write one check a month to your lender and let them disburse it to the taxing authority and insurance company instead of writing multiple checks each month.

When you close on your home, the lender will often require you to pay the first term of your homeowners insurance or roughly 10% to 20% of your annual premium, which is deposited into your escrow account. The mortgage servicer will then draw from this account to pay your insurance bills on your behalf. At the end of the year, if you have paid too much towards any amount owed, your bank or lender will refund your money.

The Link Between Farmers Insurance and Carfax: What You Need to Know

You may want to see also

Discounts for paying annually

Home insurance can be paid in several ways, including monthly, quarterly, semi-annually, or annually. If you pay through an escrow account, your insurance will be paid yearly. If you don't have an escrow account, you can typically choose your payment frequency.

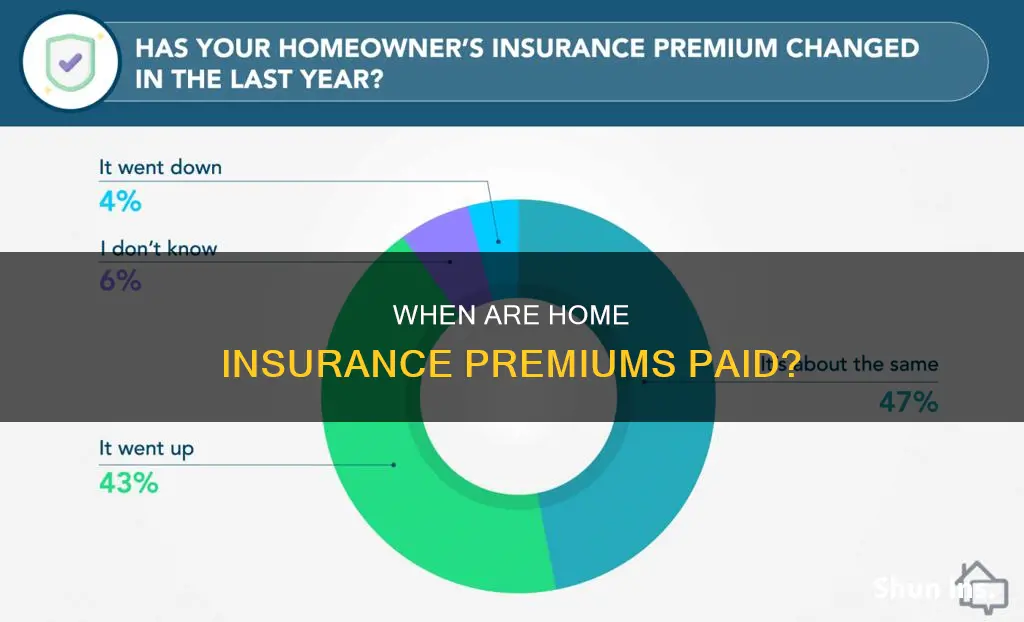

If you pay your premium annually, you will typically get a lower rate than if you paid monthly. This is because insurance companies often offer discounts for paying in one lump sum. Many insurance groups also offer other discounts to their customers, such as going paperless or bundling home insurance with an auto policy.

Some insurance companies offer a discount for setting up automatic payments. This is another way to save time and money, in addition to the discount you would receive for paying annually.

If you are buying a new home and financing it through a lender, you may have the option to pay your insurance monthly or annually. However, paying the entire annual premium in one lump sum can result in significant savings.

Farmers Insurance: Navigating the Highs and Lows of Coverage Costs

You may want to see also

Frequently asked questions

House insurance is typically paid annually or in monthly instalments.

You can pay your house insurance premium directly to the insurance company or through an escrow account with your mortgage lender.

An escrow account is a savings account managed by your lender that sets aside money for expenses like home insurance and property tax payments.