AAA, or the American Automobile Association, offers auto insurance to its members. The cost of auto insurance through AAA varies by location and age group, with 18-year-olds paying the most each month. Teen drivers are considered high-risk due to their inexperience and are more likely to be in a crash, resulting in higher insurance rates. In most states, teens can obtain their own auto insurance policy when they reach the age of majority, which is 18. However, minors (16-17 years old) need a parent or guardian's signature to get insurance. AAA offers various discounts and coverage options to its members, including liability coverage, collision coverage, and comprehensive coverage.

| Characteristics | Values |

|---|---|

| Who can apply? | Teens can be added to an existing policy or purchase their own standalone policy if permissible in the state. |

| Age requirement | Teens can get their own auto insurance policy when they reach the age of majority, which is 18 in nearly all states (except in Alabama, where teens are considered minors until age 19). |

| Parental/guardian signature | Minors (or drivers 16-17 years old) need a parent or guardian's signature to get insurance. |

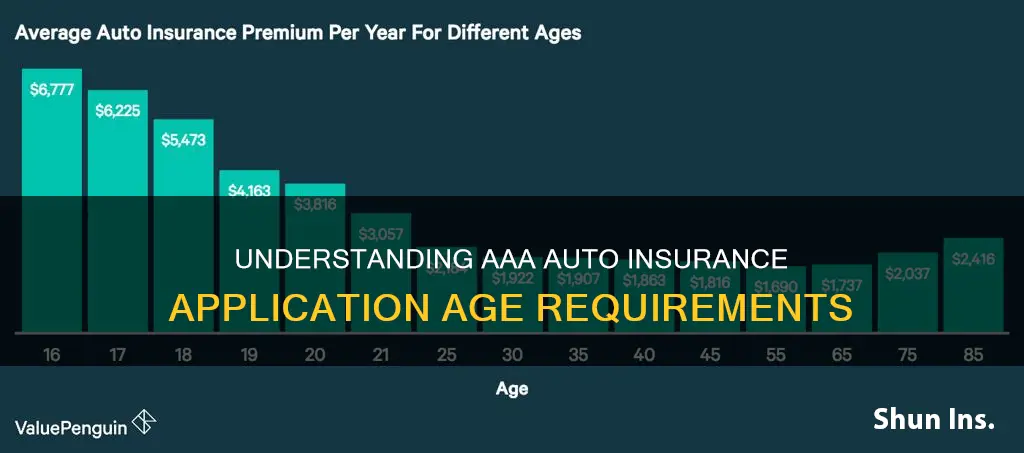

| Cost | The cost of auto insurance through AAA varies by location. AAA offers cheap rates for all age groups, with 55-year-olds seeing the lowest monthly premiums and 18-year-olds paying the most each month. |

| Discounts | AAA offers a variety of discounts for young drivers, including through the teenSMART driving program, good student discount, and distant student discount. |

What You'll Learn

Teen drivers and insurance

How to insure a teen driver

There are two ways to insure a teen driver. A parent or guardian can add their teen driver to their existing policy, or a young driver can purchase their own standalone policy if permissible in their state. Typically, parents opt to add teen drivers to their own policies because standalone policies for teens are very expensive. By adding a teen driver to an existing auto policy, parents can get them the same coverage for a lot less money.

When to insure a teen driver

Laws regarding teen drivers and auto insurance vary by state. In some states, teen drivers don't need to be named on an insurance policy until they have a driver's license. In other states, insurance coverage is required even for teen drivers who have a learner's permit. In California, for example, teen drivers are automatically covered under their parent or guardian's insurance once they obtain a learner's permit.

If your teen has their own car, you'll need to make sure it's added to your existing insurance policy. You can do this by contacting your insurance agent and providing the unique vehicle identification number (VIN) and other details about the new vehicle.

Car insurance for teens can be expensive because they have a greater tendency to drive distracted, speed, tailgate, and not wear a seatbelt. The average cost of teen car insurance depends on the exact age of the driver, their ZIP code, driving history, and vehicle type. A separate policy for a 16-year-old driver who has just received their license will likely be more costly than a policy for an 18-year-old with more driving experience.

How to save on teen car insurance

You can lower the cost of teen car insurance with discounts for students and teen drivers. Many insurance companies offer a "good student" discount for students who maintain a certain GPA while enrolled in school part- or full-time. Some companies also offer discounts for teen drivers who complete an approved driving school or driving course.

Another way to save on teen car insurance is to add them to your existing policy. It's generally cheaper to add a teen driver to an existing insurance policy rather than buy a separate policy for them. That's because a teen driver on their own policy doesn't benefit from the lower rate earned by a more experienced driver.

Auto Insurance and Broken Frames: What's Covered?

You may want to see also

Discounts for teens

While auto insurance for teens can be expensive, there are several discounts available from AAA to help bring down the cost. Here are some of the ways teens can save on their auto insurance:

Good Student Discount

AAA offers a Good Student discount for high schoolers and college students who achieve good grades. Students with a verifiable GPA of 3.0 or higher can get savings of up to 14.5% (7.1% in California) on their insurance. This discount is available to full-time and part-time students and may require proof of grades with transcripts or report cards.

Safe Driver Discount

Teens can get a safe driver discount of up to 24% by completing the AAA teenSMART program, which is available in Arizona, California, Montana, Nevada, Utah, and Wyoming. This online course costs about $59 and takes around eight hours to complete. The program educates teens on safe driving practices and has been proven to help reduce accidents.

Distant Student Discount

Students living away from home, such as college students, can take advantage of AAA's distant student discount. This discount can save students up to 30% on auto coverage in Arizona, Montana, Nevada, Utah, and Wyoming. To qualify, students must attend and live at a school more than 100 miles from their permanent residence and not have a car at school.

Safe Driving Course Discount

Some insurance carriers offer discounts for teen drivers who complete an approved driving school or driving course. AAA recommends both parents and teens sign a contract agreeing not to drink and drive, use drugs, or text and drive, among other safe driving practices.

Choosing a Car

The type of car a teen drives can also impact insurance costs. Driving an inexpensive car with good safety features can help lower insurance premiums. Additionally, assigning a teen driver to a specific car within a family's policy can prevent the carrier from associating the teen with the most expensive car, potentially saving costs.

Increasing the Deductible

Increasing the deductible on a policy can lower the monthly insurance premium. The deductible is the amount paid out of pocket before the insurance company covers the remainder of a claim.

Other Discounts

AAA also offers the SMARTtrek app, which monitors driving behaviour and can provide a 10% discount on auto insurance, potentially increasing to 30% at renewal.

While these discounts can provide significant savings, it's important to note that the total insurance discount a driver qualifies for may be capped. Additionally, insurance rates and requirements can vary by state, so it's always a good idea to speak with an insurance agent to understand the specific options and discounts available.

U.S. DOT Numbers: Unraveling the Auto Insurance Mystery

You may want to see also

State-specific requirements

If you are a parent or guardian, it is important to check that any non-driving teenagers in your household are not excluded from your insurance policy before they start driving. In general, a teen driver is covered to drive their parent or guardian's car as long as they are listed on the same policy as that vehicle.

If your teen has their own car, you will need to make sure it is added to your existing insurance policy. This can be done by contacting your insurance agent and providing the unique vehicle identification number (VIN) and other details about the vehicle.

In most cases, you should be able to get your teen's new car added to your policy in a matter of minutes. However, it is important to consider what types of coverage you have and how much of each will be needed. Liability coverages are typically set at the policy level, while collision and comprehensive coverages can be set by vehicle.

It is worth noting that if your teen has their own car and no longer lives with you, they may need to obtain their own auto insurance policy. This is because car insurance typically covers drivers who live at the same address. However, there is an exception for students away at college; most insurance carriers will allow parents to keep their children on their policy until after graduation, although exact requirements may vary.

State Farm's Annual Auto Insurance: What You Need to Know

You may want to see also

Adding teens to existing policies

In the US, young drivers are considered to be those aged 16 to 18. Teenagers in this age bracket are statistically more likely to be involved in road accidents than older, more experienced drivers. As a result, insurance premiums for teens are significantly higher than for those in their thirties or fifties.

If you are the parent or guardian of a teen driver, you have two options for insuring them: you can either add them to an existing policy or they can purchase their own standalone policy. The latter is usually much more expensive, so most parents opt to add their teens to their own policies. This is only possible, however, if the teen drives a family car and lives at home. If your teen owns their own car, they will need to take out their own insurance policy.

The cost of insuring a teen driver varies depending on the state you live in and the insurance provider you choose. On average, a 16-year-old can expect to pay around $6,700 per year for car insurance, while a 17-year-old will pay around $6,200, and an 18-year-old will pay approximately $5,500. These rates decrease with each birthday as teens gain more driving experience and are seen as less of a risk by insurance companies.

There are a few ways to keep costs down when insuring a teen driver. Firstly, choosing a cheaper car will result in lower premiums. Additionally, increasing the deductible on the policy (the amount you pay out of pocket before the insurance company covers the rest) will reduce the monthly premium. Taking a safe driving course can also lead to discounts of up to 20%. Good grades can also lead to lower rates, with many insurance companies offering "good student" discounts.

It's important to note that the minimum coverage required for teen drivers is liability insurance, which covers the other driver's auto repairs and injuries in the event of an accident. However, there are optional coverages that can be added for extra protection, such as personal injury protection and uninsured property damage coverage.

When adding a teen driver to an existing policy, it's essential to ensure that they are covered to drive all the vehicles listed on the policy. This is usually the case, but it's always best to check with your insurance provider to be sure.

In summary, while insuring a teen driver can be costly, there are ways to mitigate these costs by taking advantage of discounts and choosing the right type of coverage. It's also worth considering the benefits of adding a teen to an existing policy versus taking out a separate policy.

Comp Insurance: Vehicle Protection

You may want to see also

Teen driver safety tips

While getting auto insurance for your teen driver is important, there are several other safety tips to keep in mind to ensure your teen stays safe on the road. Here are some detailed and instructive tips for teen driver safety:

Understand State Laws and Restrictions:

Familiarize yourself with the specific laws and restrictions in your state regarding teen drivers. This includes learning about the Graduated Driver Licensing (GDL) laws, which are designed to limit high-risk driving situations for new drivers. These laws can vary from state to state, so it's important to know the exact restrictions and provisions that apply to your teen's license.

Set Clear Rules and Consequences:

Establish a set of driving rules and guidelines for your teen to follow. This can include restrictions on night driving, passenger limits, a strict no-phone policy while driving, and a requirement to always wear a seat belt. Clearly communicate the consequences for breaking these rules, such as suspending driving privileges or limiting driving hours and locations.

Be a Good Role Model:

Remember that your teen learns from your driving behavior. Practice safe driving habits yourself, such as always wearing a seat belt, avoiding distractions like cell phones, and obeying speed limits. Set a positive example that your teen can emulate.

Emphasize the Dangers of Impaired Driving:

Talk openly and frequently with your teen about the dangers of driving under the influence of alcohol or drugs. Remind them that it is illegal to drink under the age of 21, and that driving while impaired can lead to deadly consequences. Make sure they understand that their blood alcohol concentration (BAC) should always be at .00, not just below the legal limit of .08 for drivers over 21.

Prioritize Safe Driving Practices:

Encourage your teen to prioritize safe driving practices. This includes eliminating distractions like texting, talking on the phone, eating, or applying makeup while driving. Emphasize the importance of keeping their eyes on the road and hands on the wheel at all times. Additionally, discuss the risks of drowsy driving and the importance of getting sufficient sleep.

Choose a Suitable Vehicle:

When selecting a vehicle for your teen, opt for larger, newer cars rather than high-performance vehicles. Inexpensive and safe vehicles with advanced safety features can also help lower insurance costs.

Encourage Safe Driving Courses:

Enroll your teen in a safe driving course or workshop. These programs can provide valuable skills and education to help them become safer and more responsible drivers. Additionally, completing an approved driving course may qualify them for insurance discounts.

Monitor and Supervise:

Closely monitor your teen's driving habits, especially during the first six to twelve months of driving. Supervise their driving practice and gradually introduce them to more complex driving situations. New teen drivers are at the highest risk of crashing during the first six months of unsupervised driving, so your oversight and guidance are crucial during this period.

Set a Good Example:

As a parent or guardian, your influence on your teen's driving habits is significant. Be a positive role model by practicing safe and responsible driving yourself. Listen to your teen's concerns and warnings about your driving habits, and make changes if necessary. Set the standard for the type of driving behavior you want your teen to emulate.

Encourage Open Communication:

Have frequent and open conversations with your teen about safe driving. Discuss the rules of the road, share stories and statistics related to teen driving, and remind them of the responsibilities and consequences of being behind the wheel.

By following these tips and staying involved in your teen's driving education, you can help them develop safe driving habits that will keep them secure on the road.

Southern vs Auto Owners: Insurance Differences

You may want to see also

Frequently asked questions

There are two ways to insure a teen driver: a parent or guardian may add their teen driver to an existing policy, or a young driver may purchase their own standalone policy if permissible in your state.

Laws regarding teen drivers and auto insurance vary by state. In some states, teen drivers aren't required to be named on an insurance policy until they have a driver's license. In others, insurance coverage is required even for teen drivers who have a learner's permit.

In general, a teen driver is covered to drive a parent or guardian's car as long as they're listed on the same policy as that vehicle.

If your teen has their own car, they'll need their own policy. However, if they live with you, you can add their car to your existing insurance policy.

Your child can be listed on your auto insurance policy as long as they are living with you. Once your teen driver moves out, they'll need to get their own insurance.