Knowing how to check your auto insurance statement is crucial to ensure you are not driving without valid insurance. Driving without insurance can lead to hefty fines or even suspension of your license. There are several ways to verify your auto insurance coverage, from checking your glove compartment for physical documents to logging into your online insurance account. If you are in the US, your local Department of Motor Vehicles (DMV) can also inform you about the availability of insurance information. Alternatively, you can contact your insurance company directly, either by calling their customer service or emailing them.

| Characteristics | Values |

|---|---|

| How to check another driver's insurance | Ask the other driver, file a police report, check with the DMV, or contact your insurance company |

| Information needed to check another driver's insurance | Driver's basic contact information, driver's license number, insurance company, license plate number, vehicle identification number (VIN) |

| How to check your own insurance | Call your insurance company, log into your online account, check physical documents, access your online insurance account, review financial records, contact your insurance provider directly, use government resources, use third-party services |

| Information needed to check your own insurance | Policy number, basic information |

What You'll Learn

Contacting the police

If you need to check someone's auto insurance statement, you can contact the police. Here's a step-by-step guide on how to do this:

- Gather Information: Before reaching out to the police, ensure you have the necessary information. The key details required are the license plate number of the vehicle in question, and, if possible, the vehicle identification number (VIN), owner's driver's license number, and contact information.

- File a Police Report: If you have been involved in a collision or need to report an accident with an uninsured driver, your first step should be to file a police report. The police will respond to the scene, collect information, and file an official accident report. This report will include insurance information from all drivers involved.

- Obtain a Copy of the Police Report: After filing the report, you can request a copy from the police department. This report will contain crucial details, including insurance information, which you can use to check the other driver's auto insurance status.

- Provide Legitimate Reasons: When requesting information from the police about another person's auto insurance, you will need to demonstrate a valid reason for your inquiry. Being involved in a collision or accident with the other driver is typically a sufficient reason for the police to share their insurance details with you.

- Include Supporting Documentation: Along with the license plate number, it is helpful to provide the police with additional documentation, such as an incident report. This supports your request and helps the police identify the vehicle and its owner.

- Request Insurance Information: When speaking with the police, clearly state that you are seeking information about the other person's auto insurance coverage. They will guide you through the process of obtaining this information, which may vary depending on your location and the specific circumstances.

- Follow-up as Needed: In some cases, you may need to follow up with the police, especially if the insurance information is not readily available or if there are complexities in obtaining it. Be prepared to provide any additional information or documentation that the police may require.

Remember, insurance information is not public record, and you will need to demonstrate a valid reason for requesting it. The police can assist you in obtaining this information, especially if you have been involved in a collision or accident, helping to ensure a fair resolution for all parties involved.

Should You Disclose Your Insurance Check Amount to an Auto Shop?

You may want to see also

Contacting the insurance company

Firstly, you will need to gather the relevant driver and vehicle information. This includes the basic contact information of the driver, their driver's license number, insurance company (if known), license plate number, and Vehicle Identification Number (VIN). Having this information ready will make the process smoother and ensure you don't need to scramble for details during your call or email.

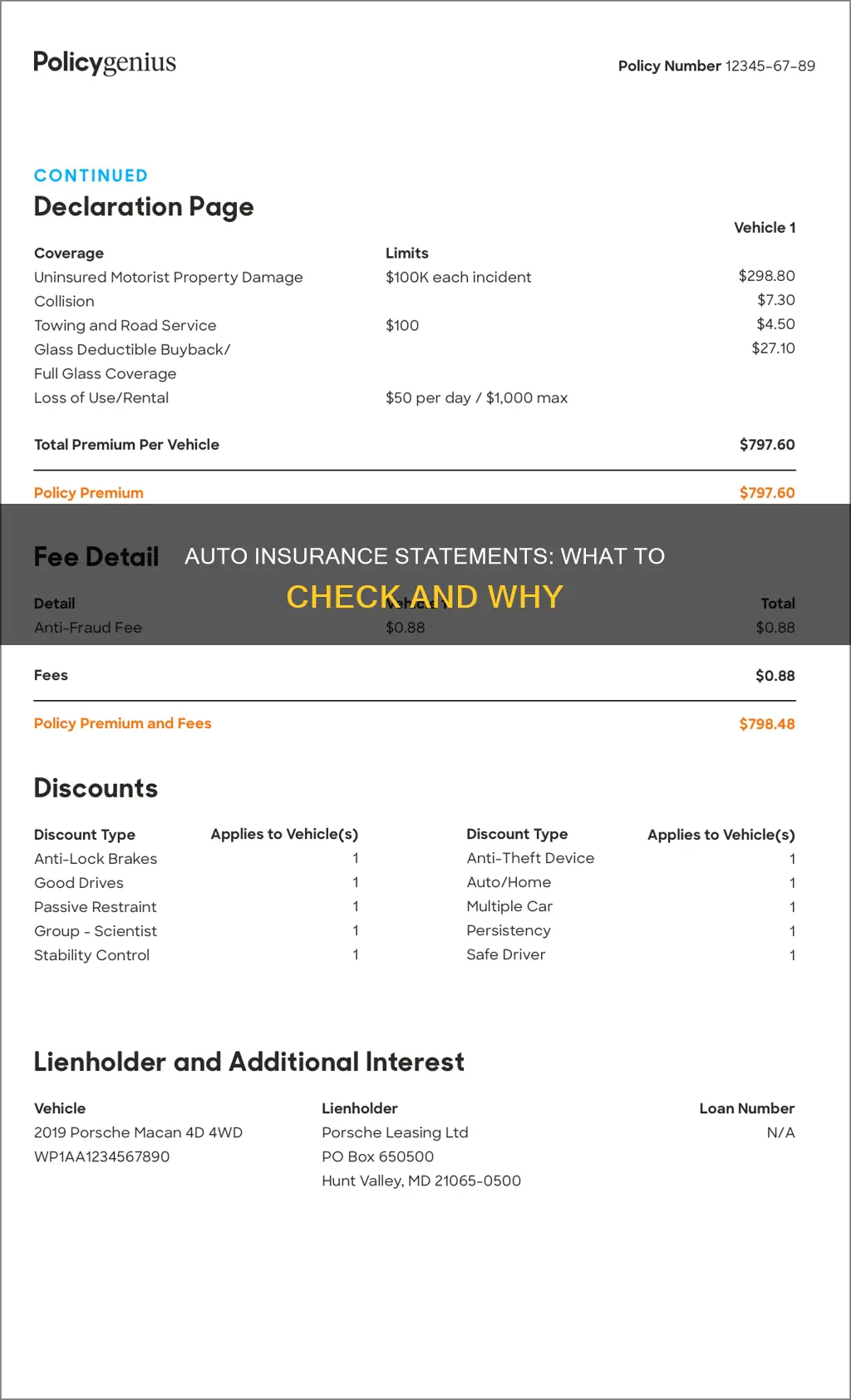

Once you have the necessary information, you can proceed to contact the insurance company. You can either call their customer service department or send them an email. It is recommended to have your basic information and policy number ready before initiating contact. This will help the process become more efficient and ensure you receive accurate information. During the call or in your email, confirm essential details such as the policy and group numbers, the policyholder's name, and the policy's active status and end date. This not only verifies your coverage but also provides a clear understanding of when your policy will need to be renewed.

If you prefer written confirmation or are not in a hurry, sending an email to your insurance provider can be a good option. This method allows you to request a copy of your insurance policy or confirm the details of your coverage. Once you send the email, keep an eye on your inbox for their response, which may include information about policy documents, renewal notices, and updates to your coverage. You can also request insurance policy documents via email, which serves as confirmation of active coverage.

Online Platforms and Mobile Apps

Most insurance companies nowadays provide online platforms or mobile apps that allow customers to register and log in to access their insurance information. By creating an online account with your insurance provider, you can conveniently verify your car insurance coverage, access policy documents, proof of coverage, and payment history. This enables you to not only confirm your insurance status but also stay updated with any changes in your premium or automatic renewals.

Government Resources

In the United States, the Department of Motor Vehicles (DMV) is a valuable resource for checking your car insurance status. By providing your vehicle's license plate number or VIN, the DMV can inform you about the availability of insurance information. However, it's important to note that the availability of this information may vary from state to state. Additionally, the DMV may send out Vehicle Insurance Advisory Notices to inform you about potential insurance issues.

For those residing in the UK, the Motor Insurance Database (MID) offers a free service called askMID to help confirm your vehicle's insurance status. By entering your vehicle registration number on their official website, you can easily check if your vehicle is insured. Keeping your insurance details up to date on this database is crucial to avoid potential fines.

Third-Party Services

There are also third-party services that can assist in verifying your car insurance status. These services utilize insurance databases to track coverage on registered vehicles. Online platforms, such as CLUE Auto by LexisNexis Risk Solutions, allow you to enter your vehicle's details, including the Vehicle Identification Number (VIN), to check for valid insurance coverage. CLUE Auto provides comprehensive data, including policy details associated with a particular VIN, and is a widely used source for claims history.

Obtaining Auto Insurance Repair Jobs: A Comprehensive Guide

You may want to see also

Checking the Department of Motor Vehicles (DMV)

The DMV can be a good place to start when checking on your auto insurance statement. Here are the steps you can take:

- Visit the DMV website for your state or region. Some DMV websites provide online services that allow you to check your insurance and registration status. For example, in Nevada, you can log in to MyDMV to check your insurance and registration status, update your policy information, and change your address. Similarly, California's DMV website provides an online inquiry form for checking suspended registration reinstatement.

- If online services are not available or you prefer in-person communication, you can visit your local DMV office. It is recommended that you avoid visiting the DMV office unless instructed to do so, as many insurance-related issues can be resolved without a visit.

- When visiting the DMV office, bring the necessary documentation, such as your license plate number, Vehicle Identification Number (VIN), insurance card, and registration certificate. Having this information will help streamline the process and ensure you can provide verification of your insurance coverage.

- At the DMV office, you can speak with a representative to address any concerns or questions you have about your auto insurance statement. They can assist you in verifying your insurance coverage, updating your policy information, or providing guidance on any necessary steps to take.

- If you have received any correspondence from the DMV regarding your insurance, such as a verification request or a certified letter, be sure to bring it with you. This will help expedite the process and allow the DMV to better understand your situation.

- In some cases, you may need to submit a request or fill out a form to obtain specific information about your auto insurance statement. Follow the instructions provided by the DMV and provide any required documentation to facilitate the process.

- Keep in mind that the DMV may have specific requirements or procedures for handling insurance-related inquiries, so it is always best to check their website or contact them directly for the most up-to-date information.

Can Do Auto Insurance: Easy, Fast, Affordable

You may want to see also

Reviewing financial records

Balance Sheet:

The balance sheet offers a snapshot of the business's financial condition at a specific point in time. It is based on the equation: Assets = Liabilities + Equity.

- Assets: These are items of value owned by the business, such as cash, receivables, investments, inventory, fixed assets, and property.

- Liabilities: Liabilities represent the business's outstanding debts and obligations, including loans, payables, bills, and notes payable.

- Equity: Equity refers to the capital of the business, including common and preferred stocks. A positive equity balance indicates the business's ability to sustain and grow, while a negative balance may suggest financial troubles.

Income Statement:

The income statement, or profit and loss (P&L) statement, provides insights into the business's performance and profitability over a specific period.

- Revenue: This reflects the total sales or service fees generated by the business.

- Expenses: Expenses represent the costs incurred to produce and sell goods or services, including material costs, service costs, interest, depreciation, and bad debts.

- Profit or Loss: This is calculated by subtracting expenses from revenue. A positive result indicates profit, while a negative result indicates a loss.

- Income Tax: This is the amount of tax owed by the business, calculated based on the applicable tax rate in the country of operation.

- Profit or Loss After Tax: This is the final profit or loss figure after deducting income tax.

Cash Flow Statement:

The cash flow statement details the movement of cash within the business over a specific period. It can be presented using the direct or indirect method.

- Direct Method: This method presents a condensed statement of cash receipts and disbursements.

- Indirect Method: This method adjusts net income by items that impact reported net income but do not affect cash.

Statement of Stockholder's Equity:

This statement provides details on the movement of the equity account, including information on common stock, preferred stock, additional paid-in capital, and retained earnings.

Notes to the Financial Statement:

These provide a narrative explanation of the financial statement, including the standards used for measurement and the business's future plans and operations.

Regular Review and Red Flags:

It is important to keep up with financial statements regularly, preferably on a monthly basis. Familiarity with the statements helps to identify red flags, such as misapplied payments, increasing debt-to-credit ratios, or an imbalanced balance sheet.

Reviewing financial statements allows business owners and stakeholders to make informed decisions, track revenue, plan expenses, and ensure the accuracy and reliability of their financial data.

Insurance Rates: A Sneaky Peek

You may want to see also

Contacting the driver

- Understanding your obligations: In most states, you are legally required to speak only with a representative of your own insurance company. Your obligations to communicate with others are usually dictated by state laws and your insurance policy terms. You must also notify your insurance company about the incident within a reasonable timeframe and cooperate with their investigation.

- Exchanging information at the scene: After an accident, it is essential to stay calm and exchange information with the other driver. Get their name, contact information, insurance company name, and policy number. Provide your information as well, but avoid sharing personal addresses. Remember to also exchange driver's license numbers, vehicle license plate numbers, vehicle identification numbers (VIN), and other relevant details.

- Proceeding with caution: When speaking with the other driver's insurance company, understand that their primary goal is to minimise their financial payout. They may try to get you to admit fault or make statements that could reduce their liability. Be cautious about what you say, and avoid discussing the specifics of the accident, how it happened, or who is to blame.

- Protecting your rights: You are not obligated to provide a written or recorded statement to the other driver's insurance company. They may pressure you for such a statement, but it is within your rights to decline. Remember that any information you provide can potentially be used against you, and giving inconsistent statements may harm your case.

- Providing limited information: When speaking with the other driver's insurance company, stick to providing only the necessary information. Share your name, address, and phone number if needed. Do not volunteer details about the accident, your injuries, your insurance claims, or any discussions with a lawyer. Take notes during the conversation to keep track of the topics discussed.

- Redirecting them: If the other driver's insurance company continues to contact you, politely redirect them to your insurance company or your lawyer. You can inform them that you are working with your insurance company or an attorney to figure out your options and that they can contact your insurer for more information about the accident.

- Avoiding quick settlements: The other driver's insurance company may try to pressure you into accepting a quick settlement before you fully understand the extent of your injuries or the cost of repairs. It is generally not a good idea to accept a settlement over the phone or sign anything without seeking legal advice or consulting your insurance company first.

- Knowing when to talk: In minor accidents, such as a fender bender or slight dent, where injuries and damages are negligible, it may be appropriate to speak with the other driver's insurance company directly. However, if there is any doubt about the extent of injuries or damages, it is advisable to follow the suggestions above and involve your insurance company or legal representation.

- Documenting the process: Keep a record of all interactions with the other driver's insurance company. Take notes during conversations, save emails or voicemails, and make copies of any documents or forms you receive or send. This documentation can be crucial if there are disputes or discrepancies in the future.

Remember, when contacting the other driver's insurance company, always be cautious about what you say, protect your rights, and seek guidance from your insurance company or a legal professional if needed.

Uploading Insurance: Uber's Vehicle Prep

You may want to see also

Frequently asked questions

Most insurance companies offer an online portal or mobile app where you can log in and access your insurance information.

You will need basic information such as your name, contact details, policy number, and vehicle details (e.g., license plate number, Vehicle Identification Number or VIN).

Yes, you can call your insurance company's customer service line to verify your insurance coverage. Make sure to have your basic information and policy number ready for a smoother process.

Yes, you can send an email to your insurance provider to request a copy of your insurance policy or confirmation of coverage details.

Yes, in the United States, you can check with the Department of Motor Vehicles (DMV) by providing your vehicle's license plate number or VIN. In the UK, you can use the Motor Insurance Database (MID) or askMID service.