Auto insurance renewal is a topic that many drivers need to be aware of, as it can impact their coverage and finances. Most auto insurance policies have a term of six or twelve months, and it is important to know when your policy is up for renewal to avoid a lapse in coverage. While some insurers may offer a grace period, it is not a given, and it is best to stay on top of payments to maintain active insurance. In most cases, insurance providers will send a renewal or cancellation notice before the end of the policy term. This notice is typically sent out 30 to 60 days in advance, giving you time to review the new terms and compare rates with other providers. By comparing quotes and shopping around, you can often find more budget-friendly options and save money on your premium. Additionally, there is no obligation to stay with your current insurer, and you are free to cancel your policy and switch to another provider at any time. However, cancelling after the renewal may incur cancellation or administration fees, so it is best to plan ahead. Staying informed about auto insurance renewal can help drivers make informed decisions and ensure they have the coverage they need.

| Characteristics | Values |

|---|---|

| Renewal notice period | 30-45 days before the policy expires |

| Renewal notice method | Mail or email |

| Renewal frequency | Every 6 or 12 months |

| Auto-renewal | Common but not mandatory |

| Auto-renewal notice period | 3-4 weeks before the renewal date |

What You'll Learn

Auto-renewal: the pros and cons

Auto-renewal is a common feature of insurance policies, and it can be a convenient way to ensure that you always have the necessary coverage. However, there are also some potential drawbacks to be aware of. Here are some pros and cons of auto-renewal to help you decide if it's the right choice for you.

The pros of auto-renewal

- Hassle-free and stress-free: Auto-renewal means you don't have to worry about finding a new insurance deal or checking out other providers. Your current provider will handle everything for you, giving you one less thing to think about.

- Peace of mind: With auto-renewal, you won't have to worry about losing your cover when your current insurance contract ends. This is especially important for car insurance, as it is illegal to operate a vehicle without insurance in some places.

The cons of auto-renewal

- Potential for higher costs: Even if your coverage doesn't change, the cost of your policy may increase with auto-renewal. You might discover that your insurance costs have gone up, even though there are more cost-effective options available on the market.

- Limited flexibility: Auto-renewal starts a new contract period, which can make it difficult to change your policy until the end of that period, which is often 12 months later. While some insurance providers offer a cooling-off period, you'll typically have to pay for any coverage you received after the renewal, as well as cancellation fees or other charges.

- Missed savings opportunities: If you choose to renew your insurance with two to four weeks left on your contract, your insurance provider may offer you a better rate. With auto-renewal, you might miss out on this opportunity to save money.

Most insurance companies will send out renewal notices 30 to 45 days before your current policy expires. This gives you time to review the terms of your new plan and decide if you want to make any changes. If you don't receive a renewal notice, be sure to contact your insurance provider to confirm that your policy will be renewed.

Safe Auto: Commercial Insurance Coverage and Options

You may want to see also

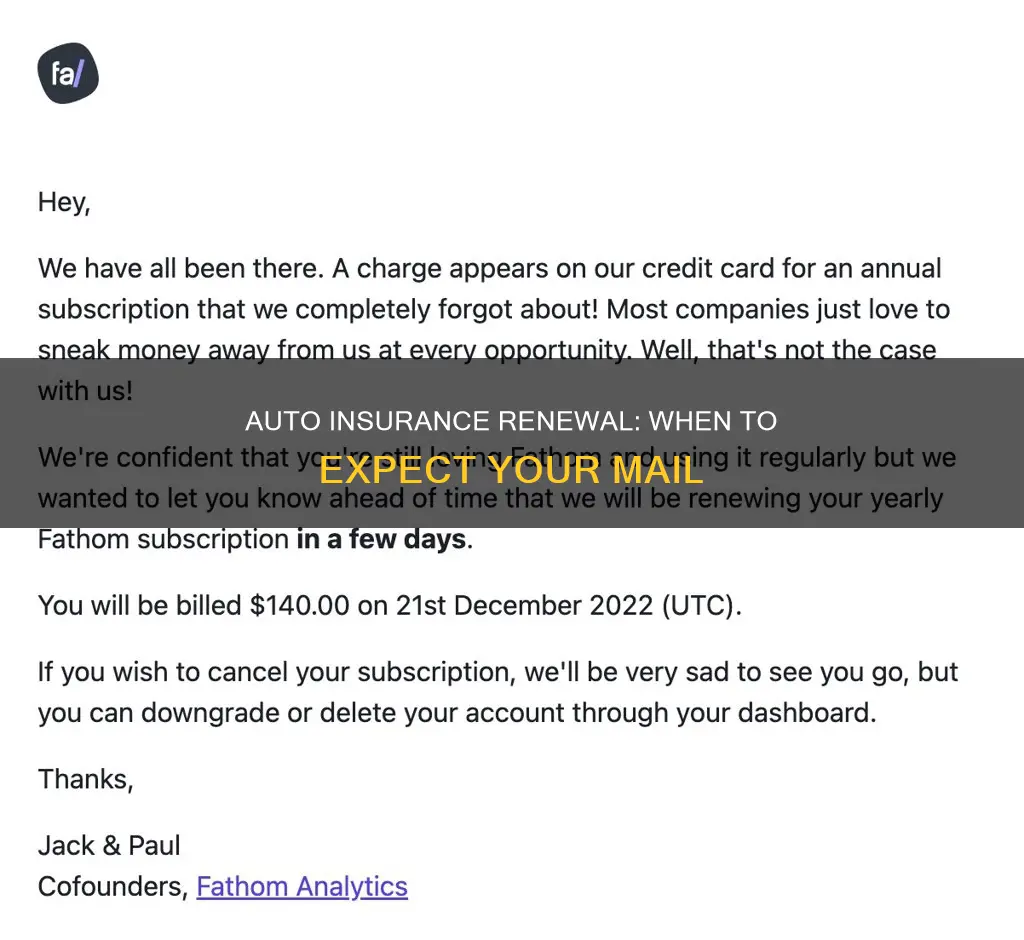

When to expect a renewal notice

Most auto insurance policies last for six or 12 months, after which they are up for renewal. Renewal notices are typically sent out by insurance providers between 21 and 45 days before the policy expires. Some providers may send out renewal notices as early as six weeks before the renewal date, while others may provide a notice period of up to 60 days. It is important to review the renewal notice carefully and compare it with your current policy to assess any changes in coverage, premiums, or terms and conditions.

The renewal notice will be sent to you via mail or email, and it will include information about your new insurance policy for the upcoming term, including any changes to your premium. In some cases, you may also receive a phone call, push notification, or text message reminding you of the upcoming renewal. It is your responsibility to ensure that you have received the renewal notice and to review it thoroughly. If you are unsure about your renewal date or have not received a renewal notice, contact your insurance provider directly.

Upon receiving the renewal notice, you have the option to either continue with the renewal by making the payment before the due date or switch to another insurance provider if you find a better deal. It is recommended to start comparing quotes and reviewing your coverage needs a few weeks before the renewal date to allow ample time to make an informed decision.

If you are enrolled in automatic payments or have set up auto-renewal with your current insurance provider, your policy will likely renew automatically. However, it is still important to review the renewal terms and confirm that your coverage is still adequate for your needs. Additionally, be mindful of any changes in your circumstances that may impact your insurance needs, such as a change in your daily commute, vehicle modifications, or the addition of new drivers to your household.

Lower Auto Insurance Premiums: What Works?

You may want to see also

What to do if you don't want auto-renewal

If you don't want your car insurance to auto-renew, you are under no obligation to stay with your current insurer. You can cancel your policy at any time, and you are free to switch insurers.

To avoid auto-renewal, call your insurer and ask them not to renew your policy automatically. Your policy will then lapse or stop once the current one ends. It's best to do this sooner rather than later, as if you let your current policy auto-renew and then decide to switch, you might have to pay a cancellation fee.

It's also worth noting that if your policy lapses before you've bought a new one, you risk driving without insurance. Therefore, it's important to ensure that your new policy starts before your old one ends.

Splitting Vehicle Insurance for Taxes

You may want to see also

What to do if you want to switch insurers

If you want to switch insurers, the first step is to shop around for a better rate. You can do this by getting free online quotes from multiple providers. Take your time to find the best car insurance company that offers a good mix of cheap rates, useful coverage options, and dependable customer service.

Once you've found a few potential insurers, contact your current company to see if they can match the quotes you received and ask about their cancellation process. You may need to give your insurance company advance notice if you want to cancel your policy, and there may be a penalty for switching in the middle of your coverage period. So, if possible, it's best to switch at the end of your policy term. If you paid for your policy in full, you should receive a refund for the portion you haven't used.

After deciding on a new insurer, purchase your new policy and confirm it's active. Then, cancel your old insurance policy. Some companies charge a cancellation fee, so be sure to check with your current provider.

Make sure your new policy starts the same day your old policy expires to avoid fees or legal trouble for having a lapse in coverage. Even a brief gap in coverage can lead to fines and higher insurance rates, and you could be driving illegally without insurance.

Finally, if you have a lease or loan on your car, notify your lender or lease provider of the change. Most car leases and loans require you to have car insurance, and your lender needs to know the details of your new policy.

Filing Claims: USAA Auto Insurance

You may want to see also

How to save money on your premium

Auto insurance renewals are a great opportunity to save money and reassess your needs. However, it's important to be proactive as many policies auto-renew as the default option.

- Shop around for insurance: Prices differ from company to company, so it's worth getting at least three quotes from different insurance providers and types of providers. Compare the quotes based on your specific situation, considering the company's reputation and customer satisfaction ratings, as well as the price.

- Compare insurance costs before buying a car: Insurance premiums are based on the car's price, repair costs, safety record, and theft likelihood. Insurers often offer discounts for features that reduce theft or injury risk, or for cars known to be safe.

- Raise your deductible: Opting for a higher deductible on your insurance can lower your premium costs. Just ensure you have enough money set aside to pay the higher deductible if you need to make a claim.

- Reduce optional insurance on older cars: If your car is worth less than 10 times the insurance premium, collision and comprehensive coverage may not be cost-effective. Check your car's value on websites like Kelley Blue Book, National Association of Auto Dealers (NADA), or TrueCar.

- Bundle your insurance or stick with the same company: Many insurers offer discounts if you purchase multiple types of insurance from them, such as homeowners and auto insurance, or insure more than one vehicle. Some companies also offer loyalty discounts to longtime customers.

- Maintain a good credit history: Establishing solid credit history can lead to lower insurance costs, as insurers often use credit information to price policies. Check your credit record regularly to ensure all information is accurate.

- Take advantage of low-mileage discounts: Some companies offer discounts for motorists who drive less than the average number of miles per year, including those who carpool to work.

- Ask about group insurance: Certain companies offer reduced rates for drivers who get insurance through a group plan from their employers or other associations.

- Seek out other discounts: There are various other discounts that your insurer may offer. For example, some companies provide discounts for drivers with a clean driving record, those who've taken a defensive driving course, or if there's a young driver on your policy who's a good student.

Remember, while saving money is important, it's also crucial to ensure your insurance coverage meets your needs.

Gap Insurance: Writing a Loss Claim

You may want to see also

Frequently asked questions

You will typically receive your auto insurance renewal notice 30 to 60 days before your current policy expires.

Review the renewal notice carefully to check for any changes in coverage, policy terms, or premiums. Compare the new terms with your current policy and contact your insurance provider to discuss any concerns or desired changes.

Yes, you have the option to switch providers at the time of renewal. Review your current coverage and premiums and compare them with offerings from other insurance companies. If you find a better option, initiate the switch by contacting the new insurer and completing the necessary paperwork. Remember to cancel your existing policy to avoid paying for two policies.

Yes, your auto insurance premiums can change during the renewal process. Insurance companies consider various factors when determining premiums, such as your driving history, claims history, vehicle type, location, and other personal details. Changes in these factors, as well as market conditions and underwriting guidelines, can lead to adjustments in your premiums.