If you've been in a car accident, you might be wondering how soon your insurance company will respond to your claim. The answer depends on several factors, including the severity of the accident, the number of people involved, and whether there are any injuries. In general, insurance companies strive to resolve claims within 30 days, but this can vary depending on the state and the specific circumstances of the claim. Some states have laws that require insurance companies to settle claims within a certain timeframe, which can range from 15 to 45 days. If you don't hear back from your insurance company within a reasonable amount of time, you may need to follow up or seek legal assistance.

| Characteristics | Values |

|---|---|

| Average time for insurance claim to be approved | 30 days |

| Time for insurance company to respond to demand letter | A few weeks to months |

| Time for insurance company to respond to claim | Up to 15 days |

| Time for insurance company to investigate claim | 15 business days |

| Time for insurance company to notify of acceptance or denial of liability | 15 days |

| Time for insurance company to issue payout | 5-30 days |

What You'll Learn

Insurance companies must acknowledge your claim within a certain timeframe

Insurance companies are required to acknowledge your claim within a certain timeframe. This timeframe varies depending on the state and the type of claim.

In California, for instance, insurers have 40 days to accept or reject a claim and then 30 days to issue payment once a settlement is agreed upon. On the other hand, North Carolina insurers have 30 days to acknowledge a claim and then 10 days after settlement to pay the claim. Texas insurers have a similar timeframe, with 30 days to accept or reject a claim and 5 days to issue payment.

While these timelines provide a general guideline, it's important to note that the complexity of the claim can also impact the response time. Factors such as the severity of the accident, the number of people involved, and the clarity of responsibility can influence how long it takes for an insurance company to respond.

Additionally, insurance companies typically have the right to request additional time if needed. They can make a formal request and, in some cases, may be granted up to 60 additional days to make a decision.

To ensure a timely response, it is advisable to provide as much information as possible when filing a claim, including photographs, witness statements, and medical records. Staying proactive and maintaining open communication with the insurance company can also help expedite the process.

Gap Insurance: What's the Deal?

You may want to see also

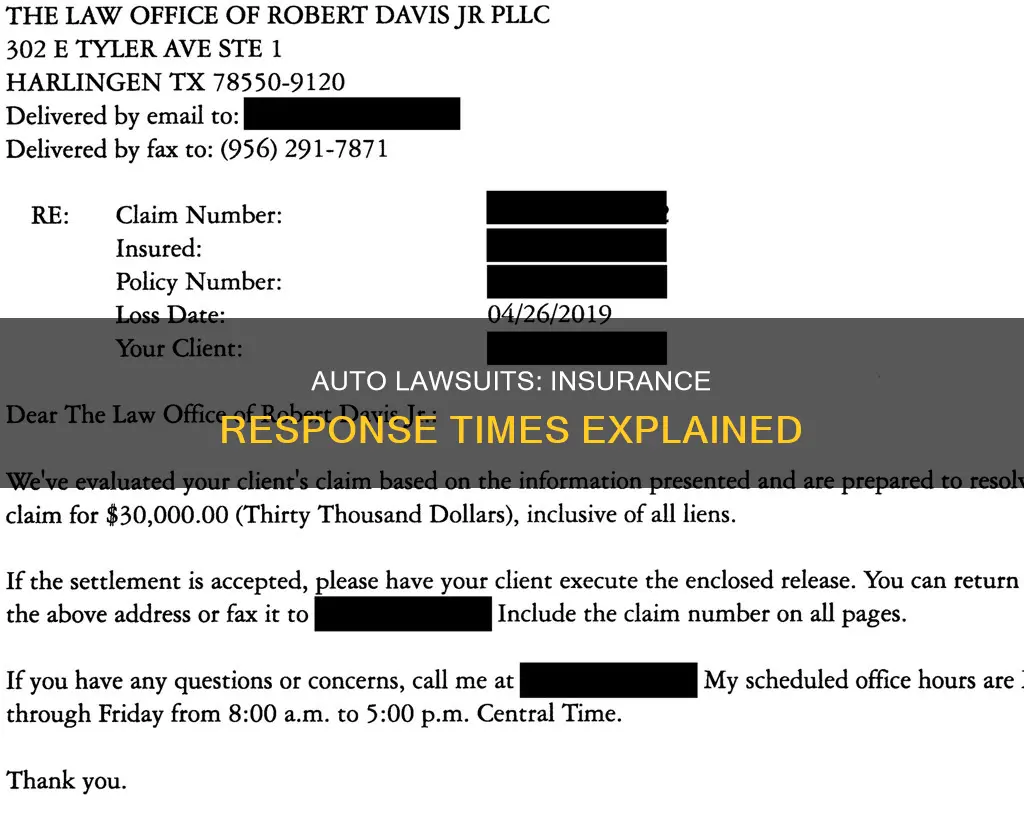

There are no guarantees of a response to your demand letter

A demand letter is a crucial step towards settling a car accident claim. It is a formal demand for compensation for your losses (damages). It is your attempt to settle your car accident claim before you file a civil lawsuit.

However, there are no guarantees that you will receive a response to your demand letter. When you make a claim against someone else's insurance policy, known as a third-party claim, you have no contract with the insurance company. Therefore, you might receive a delayed response or no response at all.

If you don't hear back from the insurance company, you can call the claims department to ask when you can expect a response. You can also include a deadline in your demand letter, such as "I look forward to receiving your reply no later than 15 days from the date of this letter." While this deadline is not binding, it may motivate a more timely response.

If you still don't receive a response, you can ask to speak to the adjuster's supervisor or the claims manager. However, this may make it seem like you are overeager to settle your claim, and the insurer might make you a lowball settlement offer.

If all else fails, you can file a lawsuit or threaten to do so to kickstart negotiations with the insurance company. Going to court is expensive, time-consuming, and unpredictable, so insurance adjusters and executives generally want to avoid it. However, if the insurance company doubts that you can prove your claim or thinks your settlement demand is unreasonable, you could be in for a long fight.

Therefore, while there are no guarantees of a response to your demand letter, there are several steps you can take to try to get one or to pursue other options if you don't receive a reply.

Auto Insurance in Georgia: Costs Explained

You may want to see also

The time it takes to settle a claim depends on the state

The time it takes to settle an insurance claim depends on a variety of factors, including the state in which the claim is being made. While some states have specific time limits for insurance companies to settle claims, others do not. On average, insurance claims are paid out within 30 days. However, this can vary depending on the complexity of the claim, the severity of the damage, the number of people involved, and the clarity of responsibility.

In California, insurance companies have 40 days to accept or reject a claim and 30 days to issue payment once a settlement is agreed upon. In North Carolina, insurers have 30 days to acknowledge a claim and 10 days to pay out after a settlement. Texas insurers have a similar timeframe, with 30 days to accept or reject a claim and 5 days to issue payment.

The time it takes to settle a claim can also depend on the type of claim being made. For example, claims for property damage or roadside assistance typically take less time than injury claims involving multiple drivers. Claims involving serious injuries, long hospital stays, or significant property damage can also take longer to settle.

To speed up the claims process, it is important to provide the insurance company with all the necessary information, such as police reports, photos of the damage, and insurance information for all parties involved. Responding promptly to requests and staying in communication with the insurance adjuster can also help to avoid delays.

Utah's Vehicle Insurance Laws: Owner Security

You may want to see also

The severity of the accident can cause delays

In addition, the severity of the accident will determine the level of damage, cost, injuries, and repairs, which will impact the time it takes to process a claim. If the accident involves multiple vehicles and drivers, this will also cause delays as there will be more witnesses to interview, and vehicle damage to assess.

If the accident is severe, there may be significant property damage to assess, and this will take time. The time it takes to settle a claim also depends on the type of claim. For example, claims for property damage or roadside assistance usually take less time than injury claims involving multiple drivers.

The severity of the accident can also impact the time it takes to determine fault. If fault is not clear, this will cause delays in the insurance payout.

Replacement Value: The Auto Insurance Offering You Need to Know About

You may want to see also

Incorrect policy information can cause delays

It is important for policyholders to carefully review their insurance policy and submit all the required documentation to avoid delays in the claims process. This includes providing accurate and complete information on claim forms, as well as submitting any necessary supporting documents. Policyholders should also be mindful of any time limits for filing claims, as submitting a claim after the deadline can also result in delays.

In some cases, insurance companies may be found to intentionally delay the claims process. This is known as acting in "bad faith" and can give rise to legal action against the insurance company. Policyholders who believe their insurance company is causing undue delays can seek legal counsel to review their case and determine if there are valid reasons for the hold-up. An attorney can also assist in communicating with the insurance company and ensuring that the policyholder's rights are protected.

Parking Lot Perils: Unraveling the Complex World of Auto Insurance Claims

You may want to see also

Frequently asked questions

You will likely get a response within a few weeks or months. However, there is no guarantee that you will receive a response to your demand letter.

In New York, insurance adjusters must acknowledge the receipt of your claim within 15 business days. They then have 15 business days to investigate and 15 days to notify you of whether they are accepting or denying liability.

Here are some tips:

- File your claim right away.

- Respond to your insurance adjuster promptly.

- Take care of your vehicle repairs and medical needs.

- Follow up if you don't hear from your insurance adjuster.

- Get help from an attorney.