New York Life offers a range of life insurance policies, including term life insurance, whole life insurance, and universal life insurance. While the company doesn't provide quotes online, its policies are known for their excellent financial strength. New York Life allows customers to manage their policies online or through its mobile app, where they can view and update account details, verify and update beneficiaries, and make secure payments. This paragraph introduces the topic of suspending life insurance with New York Life and provides an overview of the company's life insurance offerings and customer support.

What You'll Learn

Cancelling your New York Life insurance policy

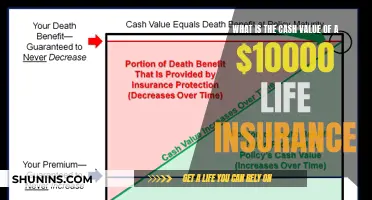

To cancel your New York Life insurance policy, you will need to surrender your policy. This means that your life insurance coverage will end. You will generally receive most or all of the cash value that has accumulated in your life insurance policy, but it may be subject to surrender fees and federal income taxes. Any unpaid premiums will also be collected.

To initiate the cancellation of your policy, you can contact New York Life by phone at 1-800-225-5695 on weekdays from 8 a.m. to 7 p.m. ET. You can also reach out to your local financial professional or New York Life agent for assistance.

It is important to carefully consider the implications of cancelling your life insurance policy. Surrendering your policy will result in the loss of your life insurance coverage. Additionally, there may be financial consequences, such as surrender fees and taxes, associated with cancelling your policy.

Before making a decision, it is recommended to explore alternative options for accessing cash or reducing expenses. For example, you may be able to borrow against the cash value of your life insurance policy or adjust your payment schedule. You could also investigate other sources of immediate cash, such as home equity loans, personal loans, or borrowing against a 401(k).

If you decide to proceed with cancelling your New York Life insurance policy, be sure to review the terms and conditions of your policy, understand any financial implications, and seek guidance from a trusted financial professional.

Sun Life Insurance: Acupuncture Coverage and Benefits Explained

You may want to see also

Borrowing against your policy

It's important to note that you will be charged interest on the loan, usually at a more favourable rate than you would get on the open market. If the loan isn't paid back before your death, it will be deducted from the death benefit, resulting in your beneficiaries receiving a reduced payment.

Additionally, if you surrender your policy while the loan is still outstanding, you may be liable for federal or state income taxes. This occurs when the value of the outstanding loan plus your cash surrender value is more than the total amount of premiums you have paid into your policy (excluding certain non-taxable distributions).

Before taking out a loan against your life insurance policy, carefully consider the trade-off between your current financial needs and the reduced benefit your beneficiaries will receive in the future.

Life Insurance Payouts During a Pandemic: What You Need to Know

You may want to see also

Surrendering your policy

Surrendering your life insurance policy means functionally cancelling it. If you do this, your life insurance coverage will end, and you will no longer be insured. However, you will generally receive most or all of the cash value that has accumulated in your life insurance policy. This amount may be subject to surrender fees and federal income taxes, and any unpaid premiums will also be collected.

Before you surrender your policy, it is important to consider the consequences. Surrendering your policy means that you will no longer have life insurance coverage, which could leave your family financially vulnerable in the event of your death. Additionally, if you have an outstanding policy loan, you may be liable for federal or state income taxes if the value of the outstanding loan plus your cash surrender value is more than the total amount of premiums you have paid into your policy (less certain non-taxable distributions).

If you are considering surrendering your life insurance policy, it is important to weigh the immediate financial benefits against the potential long-term risks. It may be wise to investigate other options for procuring immediate cash, such as home equity loans, personal loans, borrowing against a 401(k), or even a 0% APR credit card, depending on your present and future financial needs.

Another option to access cash from your policy without surrendering it entirely is to borrow against the policy. This means taking out a loan with the cash value of your life insurance policy as collateral. While you will be charged interest on the loan, the rate is usually more favourable than you would get on the open market. However, if the loan isn't paid back before you pass away, it will be deducted from the death benefit, resulting in a reduced payout for your beneficiaries.

If you are struggling to keep up with premiums but want to keep your life insurance policy, there are ways to apply the cash value to help pay them. For example, in some cases, you can use the dividends you receive to help pay your premiums. Alternatively, with universal life insurance, the cost of your premiums comes directly out of the cash value.

In difficult financial times, it is important to do what is right for you and your family. If you are considering cashing in your life insurance policy, it is recommended that you speak to a trusted financial professional to go over all your options and find the best path forward.

Global Life Insurance: A Good Investment?

You may want to see also

Selling your policy to a third party

Selling your life insurance policy to a third party is known as a life settlement. This is when the owner of the life insurance policy sells the policy to a life settlement provider and receives an immediate payment in return. The life settlement provider then becomes the new owner of the life insurance policy, paying any future premiums and receiving the death benefit when the person whose life is insured under the policy (the insured) dies.

The New York State Department of Financial Services recommends that you consult your own professional financial advisor, attorney, or accountant to help you decide if this is the most suitable arrangement for you. They also recommend that you consider your options before selling your policy. For example, if you need funds to pay expenses, there may be other options available under your policy that will allow you to keep your policy in force for your beneficiaries.

You should ask your insurance agent or insurance company if your life insurance policy has any cash value. Generally, life insurance policies allow you to take a policy loan up to the amount of the cash value. You may also be able to take out some of the cash value to meet your immediate needs. You should seek the advice of your insurance agent or other professional before using the cash value of your policy.

You should also find out if your policy allows you to reduce the amount of the death benefit in order to lower the amount of premium you are required to pay. If you are planning to sell your policy because the premiums have gotten too high, this may provide a way to maintain some of the death benefit.

It is also important to comparison shop. Get quotes from several life settlement providers to make sure you have a competitive offer. If you use a life settlement broker, they represent exclusively you and have the duty to act in your best interests and according to your instructions. The broker is also required to disclose the amount of compensation to be paid to them by no later than the date the life settlement contract is signed.

You should also find out the tax implications, as not all proceeds received from the sale of your life insurance policy are tax-free. The proceeds you receive from a life settlement may also be accessible by your creditors. Find out if you may lose any public assistance benefits, such as supplementary social security benefits, food stamps, or Medicaid, or other governmental benefits or entitlements if you receive proceeds from a life settlement transaction.

You have the right to change your mind about the life settlement transaction after you receive the proceeds of the life settlement. You have the right to rescind (cancel) the life settlement contract from the time the contract is signed until fifteen days after you receive the proceeds.

Life Insurance Double Indemnity: Still a Viable Option?

You may want to see also

Contacting New York Life

There are several ways to get in touch with New York Life, depending on your query.

If you have a question about your application, you can contact New York Life at (800) 288-9858, or check the frequently asked questions.

For general queries, the Customer Experience Team can be reached at (800) 850-2658. Their business hours are Monday to Friday, 8 am to 8 pm Eastern Time.

If you have specific questions about your policy, claim, or application, New York Life's customer service experts are available to help. The number to call is 1 (800)-225-5695, or 1 (212)-576-6600 as a toll number alternative. These lines are open Monday through Friday, 8 am to 7 pm Eastern Time.

If New York Life provides benefits through your employer, and you need assistance with your disability, life, or accidental death and dismemberment claim, you can contact New York Life at [email protected].

If you suspect fraudulent activity, you can call the fraud hotline at 1-877-279-0325.

To get support from a trusted agent, you can use the locator tool to find an agent near you, or provide some information about yourself to be paired with an agent that meets your needs and goals.

For NYLIFE Securities, you can contact your NYLIFE Securities Financial Services Professional, or:

NYLIFE Securities LLC

P.O. Box 796

New York, NY 10159-0796

NYLIFE Securities LLC

51 Madison Avenue Floor B3 Room 0304

New York, NY 10010-1603

800) 695-4785

Monday-Friday, 9 a.m. - 5 p.m. Eastern Time

For the AARP Life Insurance Program from New York Life, you can reach a claims specialist at (800) 695-5165, Monday to Friday, 8 am to 5 pm Eastern Time.

The quickest way to report a life insurance claim is to complete the online claims form.

HSA and Group Term Life Insurance: What's the Difference?

You may want to see also

Frequently asked questions

To suspend your New York Life insurance policy, you must meet certain criteria. You must be covered by the MyIncome Protector policy and be receiving federal or state unemployment benefits for a minimum of 4 consecutive weeks. During the suspension, your policy remains in force, but no premiums are due and no policy benefits are payable.

You can suspend your policy for up to one year. Once the suspension period has ended, you cannot suspend your policy again until 2 years have passed since the previous suspension.

No, you can only suspend your policy during a period of unemployment.

After the suspension period has ended, you will be required to resume paying your premiums.