VA life insurance provides financial security for veterans, service members, their spouses, and dependent children. There are different programs for veterans, service members, and family members. Veterans Group Life Insurance (VGLI) is available for veterans, while Servicemembers' Group Life Insurance (SGLI) is for service members. Family members can be covered under Family Servicemembers' Group Life Insurance (FSGLI). Additionally, those with service-connected disabilities may be eligible for VALife, and short-term financial coverage is available through Traumatic Injury Protection (TSGLI) in the event of a severe injury. To apply for VA life insurance, individuals can access the VALife online application to check their eligibility and apply for coverage.

| Characteristics | Values |

|---|---|

| Who is eligible for VA life insurance? | Veterans, service members, and their spouses and dependent children |

| What does VA life insurance offer? | Financial security |

| How to apply? | Online, by mail, or by fax |

| What are the types of VA life insurance? | Veterans Group Life Insurance, Servicemembers' Group Life Insurance, Family Servicemembers' Group Life Insurance, Traumatic Injury Protection, and VALife |

| What is the maximum coverage under VALife? | $40,000 |

| Is there a minimum coverage amount? | $10,000 in increments of $10,000 |

| Is there an age limit for VALife? | Yes, the applicant must be 80 or under |

| What is the grace period for premium payments? | 31 days |

| What happens if the premium is not paid within the grace period? | The policy will lapse, and the veteran must reapply within 2 years and pay back all premiums plus interest to reinstate the policy |

| Can an incompetent Veteran apply? | Yes, an authorized power of attorney, legal guardian, or VA Fiduciary may apply on their behalf |

| Can someone else manage the account? | Yes, a power of attorney, legal guardian, or VA Fiduciary may manage or make changes to the policy on behalf of the Veteran with proper authorization |

| How can beneficiaries be updated? | By completing VA Form 29-336, Designation of Beneficiary – Government Life Insurance |

What You'll Learn

Eligibility requirements

To be eligible for VA life insurance, you must meet certain requirements as a veteran, service member, or family member. Here are the detailed eligibility requirements for each category:

Veterans:

Veterans who had Servicemembers' Group Life Insurance (SGLI) while on active duty may be eligible for Veterans' Group Life Insurance (VGLI). VGLI provides coverage for both active-duty and reserve service veterans. To apply for VGLI, veterans can enrol online or apply by mail or fax using the "Application for Veterans' Group Life Insurance" form (SGLV 8714). Additionally, veterans wanting to reinstate an expired VGLI policy need to complete the "Application for Reinstatement of VGLI Coverage" form (SGLV 180).

Service Members:

Active-duty service members automatically qualify for SGLI coverage. This includes members of the Ready Reserve and National Guard scheduled for at least 12 periods of inactive training per year, as well as members of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health Service. Cadets and midshipmen of the U.S. military academies and ROTC members are also covered. Service members can use the SGLI Online Enrollment System (SOES) to designate beneficiaries or make changes to their coverage.

Family Members:

The Family Servicemembers' Group Life Insurance (FSGLI) covers spouses and children of service members with SGLI coverage. Spouses must enrol in FSGLI through the SGLI Online Enrollment System using milConnect, while dependent children are automatically covered at no charge. Spousal coverage cannot exceed the service member's coverage amount.

Veterans' Life Insurance: Cashing in on Policies

You may want to see also

How to apply for VA life insurance online

The application process for VA life insurance depends on the type of insurance you are applying for.

Veterans Affairs Life Insurance (VALife)

VALife is a guaranteed acceptance whole life insurance program for service-connected veterans aged 80 and under. There is no time limit to apply after getting your disability rating. If you are 81 or older, you may still be eligible if you meet the following requirements:

- Before turning 81 years old, you applied for VA disability compensation for a service-connected disability.

- After turning 81, you received a rating for that same disability.

- You apply for VALife within two years of getting your disability rating.

You can check your eligibility and apply online. When applying, you will need to submit your first premium payment. The premium depends on your age when you apply and the amount of coverage you want. Your premium rate will never increase as long as you keep your VALife policy.

Veterans' Group Life Insurance (VGLI)

VGLI allows veterans to convert their Servicemembers' Group Life Insurance (SGLI) to a civilian program of lifetime renewable term coverage after separation from service. To be eligible for VGLI, you must meet at least one of the following requirements:

- You had SGLI while in the military and are within 1 year and 120 days of being released from an active-duty period of 31 or more days.

- You are within 1 year and 120 days of retiring or being released from the Ready Reserve or National Guard.

- You are within 1 year and 120 days of assignment to the Individual Ready Reserve (IRR) or Inactive National Guard (ING).

- You are within 1 year and 120 days of being put on the Temporary Disability Retirement List (TDRL).

- You had part-time SGLI as a member of the National Guard or Reserve and suffered an injury or disability while on duty that disqualified you for standard premium insurance rates.

You can apply for VGLI in one of two ways:

- Apply online through the Office of Servicemembers' Group Life Insurance (OSGLI), using the Prudential website.

- Apply by mail or fax by filling out the Application for Veterans' Group Life Insurance (SGLV 8714).

Servicemembers' Group Life Insurance (SGLI)

SGLI coverage is automatic for most active-duty servicemembers, Ready Reserve and National Guard members scheduled to perform at least 12 periods of inactive training per year, members of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health Service, cadets and midshipmen of the U.S. military academies, and ROTC members.

All servicemembers with full-time coverage should use the SGLI Online Enrollment System (SOES) to designate beneficiaries, or reduce, decline or restore SGLI coverage. Members with part-time coverage or without access to SOES should use SGLV 8286 to make changes to SGLI.

Family Servicemembers' Group Life Insurance (FSGLI)

FSGLI insures spouses and children of servicemembers with SGLI coverage. Spousal coverage may not exceed the servicemember's coverage, but dependent children are automatically covered at no charge. All servicemembers should use SOES to decline, reduce, or restore FSGLI coverage. Members who do not have access to SOES should use SGLV 8286A to make changes to FSGLI coverage.

Understanding MEC Life Insurance Death Benefits and Taxes

You may want to see also

Updating beneficiaries

Keeping your VA life insurance beneficiary information up to date is crucial to ensure your family members can file a claim and receive the benefits promptly in the event of your death. It is recommended that you review your beneficiary information at least once a year, even if there have been no significant changes, to ensure that your designated beneficiaries' addresses are current. Additionally, certain life events, such as marriage, divorce, or the birth of a child, should trigger a review of your beneficiary information.

Servicemembers' Group Life Insurance (SGLI)

If you are in any uniformed service, except for the Public Health Service, and have full-time SGLI coverage, you can now use the SGLI Online Enrollment System (SOES) to manage your coverage and beneficiary information. To access SOES, sign in to www.dmdc.osd.mil/milconnect and go to the Benefits Tab, Life Insurance SOES- SGLI Online Enrollment System.

If you are in the Public Health Service or have part-time SGLI coverage in any uniformed service, use the SGLV 8286 form to make SGLI coverage and beneficiary changes. Submit the completed form to your branch of service personnel office.

Veterans' Group Life Insurance (VGLI)

The quickest way to update your VGLI beneficiary is to access your VGLI Policy online. Download and complete the SGLV 8721, VGLI Beneficiary Designation/Change Form. You can fax the completed form to 1-800-236-6142 or mail it to OSGLI at P.O. BOX 41618 Philadelphia, PA 19176-9913.

Other VA Life Insurance Policies (policies beginning with V, RH, J, RS, K, or W)

The fastest and easiest way to update your beneficiary for these policies is through the Online Policy Access website. After creating an online account and logging in, you can update your beneficiary information, which will be immediately sent to the office to be included in your records.

Alternatively, you can download the 29-336, Designation of Beneficiary and Optional Settlement form. Complete the form and mail it to: VARO&IC (B&O) P.O. BOX 8638 PHILADELPHIA, PA 19101.

Life Insurance: When to Keep or Ditch Term Coverage

You may want to see also

Changing or cancelling your policy

If you have a Servicemembers' Group Life Insurance (SGLI) policy and want to make changes to your coverage, you can do so through the SGLI Online Enrollment System (SOES). This system allows you to designate beneficiaries, reduce, decline, or restore your SGLI coverage. To access SOES, visit the milConnect website. If you have part-time coverage or do not have access to SOES, you can use the SGLV 8286 form to make changes to your SGLI policy.

For those with Family Servicemembers' Group Life Insurance (FSGLI), use SOES to decline, reduce, or restore coverage. The website to access SOES is the same as above. If you don't have access to SOES, use the SGLV 8286A form to make changes to your FSGLI coverage.

If you want to cancel your VALife policy, there are a few things to keep in mind. First, if you cancel within 31 days of enrollment, you will receive a full refund of premiums paid. After this 31-day period, if you cancel your policy more than two years after enrollment, you can receive the cash value of your policy or use it for extended term insurance. The cash value will be less than the amount of premiums paid. However, if you cancel within the two-year waiting period, there will be no return of funds unless it is within the 31-day window, as the policy has not yet accumulated cash value. To reinstate a lapsed policy, you must reapply within two years from the lapse and pay back all premiums plus interest, if applicable. It is important to note that veterans aged 81 or older cannot reinstate a lapsed VALife policy.

Life Insurance Payouts After Suicide: What's the Verdict?

You may want to see also

Monthly premium rates

Servicemembers' Group Life Insurance (SGLI):

SGLI is a low-cost group term life insurance program provided to Servicemembers. It is automatically included for most active-duty Servicemembers, including those in the Ready Reserve and National Guard who are scheduled for at least 12 periods of inactive training annually. Members of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health Service, as well as cadets and midshipmen of the U.S. military academies and ROTC members, are also covered. The monthly premium rates for SGLI are based on the insured's age and the chosen coverage amount. The premiums are typically deducted from the Servicemember's pay, and they do not increase with age.

Veterans' Group Life Insurance (VGLI):

VGLI is available to veterans who had SGLI coverage during their active duty. It allows them to convert their SGLI coverage to a civilian program of renewable term coverage after separation from service. The monthly premium rates for VGLI depend on the veteran's age at the time of enrollment and the selected coverage amount. Similar to SGLI, VGLI premiums do not increase with age.

Family Servicemembers' Group Life Insurance (FSGLI):

FSGLI provides coverage for spouses and dependent children of Servicemembers enrolled in SGLI. Spousal coverage cannot exceed the Servicemember's coverage limit. Dependent children are automatically covered at no additional cost. The monthly premium rates for FSGLI are determined based on the Servicemember's age and chosen coverage amount.

Traumatic Injury Protection (TSGLI):

TSGLI is an automatic feature included in SGLI. It provides additional payments to Servicemembers who suffer traumatic injuries, such as amputations, blindness, or paraplegia, during their service. The monthly premium rates for TSGLI are incorporated into the SGLI premiums, and there are no separate charges.

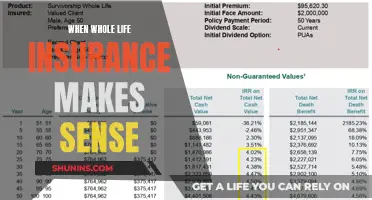

Veterans Affairs Life Insurance (VALife):

VALife is a guaranteed acceptance whole life insurance program for service-connected veterans aged 80 and under. It offers coverage of up to $40,000, with lesser amounts available in $10,000 increments. The monthly premium rates for VALife are locked in at the rate you pay when you enroll and do not increase over time. The premiums are based on the insured's "insurance age," which is calculated based on their birthday in relation to the application date.

It is important to note that VA life insurance plans have different eligibility requirements and application processes. Be sure to review the specific guidelines for each plan to understand the monthly premium rates and other relevant details.

AD&D Insurance: Term Life's Twin or Distant Cousin?

You may want to see also

Frequently asked questions

You can apply for VA life insurance online, by mail, or by fax. If you are a current service member, you will be enrolled in Servicemembers' Group Life Insurance (SGLI) automatically through your service branch. Civilian spouses of active-duty members are automatically enrolled in Family Servicemembers' Group Life Insurance (FSGLI); military spouses need to enroll in FSGLI through the SGLI Online Enrollment System using milConnect.

The maximum coverage under VALife is $40,000. You can get lesser coverage in increments of $10,000.

Your premiums are based on your "insurance age." If you are less than six months from your last birthday when you applied, your premium is based on your current age. If you are less than six months from your next birthday, your premium rate is based on your age on your next birthday.

Yes, you can have other commercial policies or VA life insurance policies like Veterans' Group Life Insurance or Veterans' Mortgage Life Insurance.

No, VALife does not offer premium waivers.