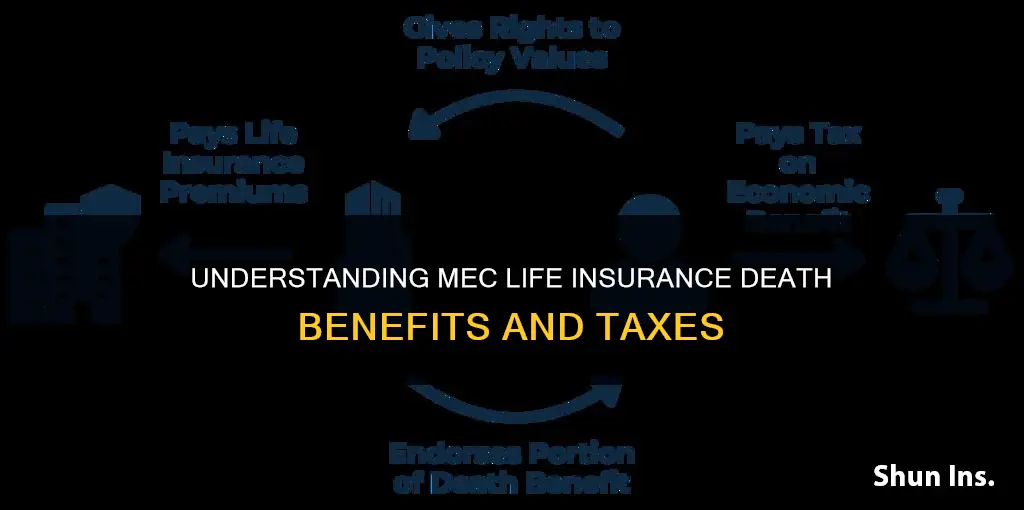

Life insurance is a crucial financial tool to protect your loved ones after you're gone. However, understanding the tax implications of life insurance proceeds, also known as death benefits, is essential for effective financial planning. While death benefits are typically tax-free, certain scenarios can trigger tax liability. One such scenario involves Modified Endowment Contracts (MECs), which are life insurance policies that lose their tax benefits due to excessive cash value. When a life insurance policy becomes an MEC, the tax rules for accessing the cash value become more stringent. This article will explore the topic of whether the death benefit of an MEC life insurance policy is taxable, providing valuable insights for policyholders and their beneficiaries.

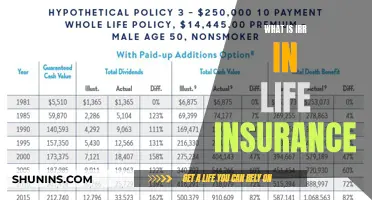

| Characteristics | Values |

|---|---|

| Tax on death benefit | Generally tax-free |

| Exceptions to tax-free death benefit | Transfers-for-value, employer-owned life insurance, beneficiary is an estate |

| Tax on interest | Yes |

| Tax on cash value withdrawals | Yes |

| Tax on cash value withdrawals if under 59.5 years old | Yes, plus 10% penalty |

| Tax on cash value loans | Yes |

What You'll Learn

What is a Modified Endowment Contract (MEC)?

A Modified Endowment Contract (MEC) is a life insurance policy that has exceeded premium payment limits as defined by the IRS. When a policy is deemed a MEC, the IRS removes its tax breaks and other benefits.

MECs came about in the 1980s after many policyholders took advantage of the fact that the cash value portion of their policies could grow tax-free. Insurers added features to emphasise this perk and sell more insurance. As a result, permanent life insurance became a popular tax shelter. However, when the IRS caught on to this trend, they introduced the MEC to curb it.

Today, for a life insurance policy to become a MEC, it must meet three criteria:

- You purchased the policy on or after 20/21 June 1988.

- Your policy meets the definition of a life insurance policy.

- The policy fails the "seven-pay" test.

The "seven-pay" test determines whether a life insurance policy will become a MEC. If you put too much money into your policy in the first seven years, it becomes a MEC. The limit varies depending on the policy. For example, if you have a $200,000 policy and your insurer sets your seven-pay or MEC limit at $4,500 a year for the first seven years of the contract, your policy becomes a MEC if you pay more than that amount, even once.

Once a policy becomes a MEC, it cannot be reversed. However, your insurance company will warn you if that's about to happen.

Life Insurance and Divorce: Who Gets What?

You may want to see also

How does a life insurance policy become a MEC?

A life insurance policy becomes a Modified Endowment Contract (MEC) when it loses its tax benefits due to containing too much cash. This happens when the total amount of premium paid into the policy exceeds a certain limit. The limit is based on the age of the policy owner, the face amount of the policy, and other factors. The purpose of this limit is to prevent people from using life insurance cash value as a tax shelter instead of for insurance protection.

The Technical and Miscellaneous Revenue Act of 1988 (TAMRA) created the MEC by placing limits on the amount of premium that a policy owner could pay into a policy and still receive favorable tax treatment. Any policy that receives premiums beyond these limits automatically becomes a MEC.

The specific rule regarding life insurance and MECs is called the "7-pay test". This rule calculates the annual premium a life insurance policy would need to be paid up after seven level annual premiums. The 7-pay test determines whether the total amount of premiums paid into a life insurance policy within the first seven years is more than what would be needed to pay it up in full for those seven years. Policies become MECs when the premiums paid exceed what is needed to be paid within the seven-year time frame.

Once a policy has been classified as an MEC, it cannot regain its former tax advantages. The MEC classification is permanent and cannot be reversed. The tax consequences of a policy becoming an MEC include the loss of the tax benefits for withdrawing or borrowing cash value, and the possibility of penalties for early withdrawals.

Life Insurance Payouts: Are They Taxed in Minnesota?

You may want to see also

What are the tax consequences of a MEC?

A Modified Endowment Contract (MEC) is a life insurance policy that has lost its tax benefits because it contains too much cash. The MEC limits for a policy depend on its terms and death benefit amount. If a policy is close to becoming an MEC, the insurance company will typically notify the policyholder. Once the Internal Revenue Service (IRS) relabels a life insurance policy as an MEC, it loses the tax breaks for withdrawals and loans that are made from the policy. This permanent change can happen when excess premiums are paid in too short a period.

The IRS taxes withdrawals under a modified endowment contract similarly to non-qualified annuity withdrawals. Any withdrawals from an MEC are taxed on a last-in-first-out basis (LIFO) instead of a first-in-first-out (FIFO) basis. This means that you must take out your gains first and pay taxes before withdrawing your premium payments without tax. Furthermore, if the policyholder is under the age of 59.5, they must pay a 10% penalty for early withdrawal of their gains. The same taxes apply to cash value loans as policyholders can no longer borrow their gains tax-free from an MEC.

Despite the reduced tax benefits and other limitations of MECs, they are often marketed as an estate planning tool. They are usually touted as an alternative to annuities, which immediately become taxable upon the death of the owner. In contrast, MECs still resemble life insurance policies in that they pass their assets tax-free to heirs.

MECs are appealing for some people with particular estate planning goals. MECs still offer a tax-free death benefit and tax-deferred cash accumulation. So, they can be useful to individuals with the immediate means to support themselves throughout retirement and who want to pass on wealth.

Life Insurance Payouts for Suicide Claims: What You Need to Know

You may want to see also

Are there any pros to a MEC?

Modified Endowment Contracts (MECs) are often marketed as an estate planning tool. They are usually touted as an alternative to annuities, which immediately become taxable upon the death of the owner. In contrast, MECs still resemble life insurance policies in that they pass their assets tax-free to heirs.

MECs can be appropriate if you are looking for a way to leave a tax-free inheritance to family members. For example, you might find it simpler to pay off a policy all at once with a single premium, even if it turns the life insurance into an MEC. However, you should not purchase an MEC with the intention of accessing the cash value tax-free while alive. That being said, you could still take out the cash value as needed so long as you pay the appropriate taxes.

MECs still offer a tax-free death benefit and tax-deferred cash accumulation. So, they can be useful to individuals with the immediate wherewithal to support themselves throughout retirement and who want to pass on wealth.

MECs can be used for estate planning, but it is important to understand the cons as well. If your policy becomes an MEC, this advantage goes away and the policy is treated like a typical retirement vehicle, such as a non-qualified annuity. Withdrawals will be Last In-First Out (LIFO), which means that distributions will come from the interest on your cash value first and will therefore be taxed as regular income.

Life Insurance and Debt Collection in New York

You may want to see also

How can I avoid a MEC?

To avoid your life insurance policy being classified as a Modified Endowment Contract (MEC), it must meet the "7-pay" test. This test calculates the annual premium a life insurance policy would need to be paid up after seven level annual premiums. This is called the 7-pay limit or MEC limit, and is based on rules established by the Internal Revenue Code, setting the maximum amount of premium that can be paid into the contract during the first seven years from the date of issue in order to avoid MEC status.

Each policy now issued will have its own MEC premium limit that is based on several factors, including the age of the policy owner and the face amount of the policy. Any premium paid into the policy in excess of this limit will result in reclassification of the policy as an MEC. However, the unused cap space within this limit is cumulative. For example, if the MEC limit for a policy is $5,784 the first year and $4,000 of the premium is paid into the policy, then the excess $1,784 of the unpaid premium is carried over to the premium limit for the second year.

This limitation expires after seven years as long as no material changes occur, such as an increase in the death benefit. Any material change will effectively restart the seven-year test. A decrease in the death benefit will not restart the test, but it may result in the policy being immediately classified as an MEC in some cases.

To avoid your life insurance policy becoming an MEC, you should ask your insurance agent or carrier to see what their policy is for handling excess premiums that could create problems. Insurance carriers keep track of this matter and will notify their policy owners if either the seven-pay test or the IRS guideline premiums are exceeded. For more information on MECs and their proper use, consult your insurance agent or financial advisor.

Life Insurance for SSI Recipients: Is It Possible?

You may want to see also