Life insurance is an important financial product that provides financial security for loved ones after the policyholder's death. The face value of a life insurance policy refers to the amount paid out to beneficiaries, which is chosen by the policyholder when they sign up for coverage. This amount can increase or decrease over time, depending on how the policy is managed. To calculate the present value of life insurance, one must consider future income, investments, savings, debts, and expenses. Various online calculators and formulas can aid in determining the appropriate coverage amount, but consulting a financial expert is advisable for a comprehensive understanding.

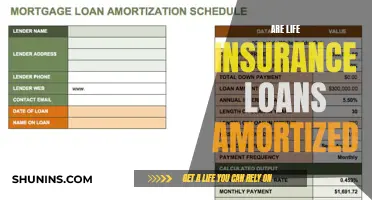

| Characteristics | Values |

|---|---|

| Purpose | To determine the amount of money that will be paid out to beneficiaries after the policyholder's death |

| Factors | Estimated burial expenses, income-earning years, net income of survivors, current investments and savings, number of children, one-time expenses (e.g. college fees) |

| Policy Type | Term life insurance, whole life insurance, universal life insurance, variable life insurance |

| Face Value | The amount paid to beneficiaries upon the policyholder's death; can increase or decrease depending on cash withdrawals |

| Cash Value | Money that can be withdrawn from the policy while the policyholder is alive; reduces the face value |

What You'll Learn

- Calculating the present value of an annuity

- How to decide on the right amount of life insurance coverage?

- The importance of understanding different types of life insurance policies

- The role of a licensed agent or financial planner in determining coverage level

- Factors influencing the cost of life insurance

Calculating the present value of an annuity

To calculate the present value of an annuity, you need to determine how much money would be needed today to fund a series of future annuity payments. This is important because it allows individuals to compare the value of receiving a series of payments in the future to the value of receiving a lump-sum payment today.

The formula for the present value of an ordinary annuity is:

Present value of an annuity stream = Dollar amount of each annuity payment x [1 - (1 + r)^(-n)] / r

Where:

- P = Present value of an annuity stream

- PMT = Dollar amount of each annuity payment

- R = Interest rate (also known as the discount rate)

- N = Number of periods in which payments will be made

For example, assume someone has the opportunity to receive an ordinary annuity that pays $50,000 per year for the next 25 years, with a 6% discount rate, or take a $650,000 lump-sum payment. Using the formula, the present value of the annuity is $639,168. This means the annuity is worth $10,832 less on a time-adjusted basis, so the person would be better off choosing the lump-sum payment.

It's important to note that the discount rate used in the present value calculation is not the same as the interest rate that may be applied to the annuity payments. The discount rate reflects the time value of money, which means that a dollar today is worth more than a dollar in the future because it can be invested and potentially earn a return. The higher the discount rate, the lower the present value of the annuity.

Additionally, there is a slight variation in the formula for calculating the present value of an annuity due, which is an annuity where payments are made at the beginning of each period. The formula for an annuity due is:

Present value of an annuity stream = Dollar amount of each annuity payment x [1 - (1 + r)^(-n)] / r x (1 + r)

Where the values of each variable are the same as in the formula for an ordinary annuity.

Gerber Life Insurance: Application Process Simplified

You may want to see also

How to decide on the right amount of life insurance coverage

The right amount of life insurance coverage depends on several factors, and there are multiple methods for calculating it. Here are some guidelines to help you decide on the appropriate coverage amount:

- Financial and family situation: The primary purpose of life insurance is to provide financial protection for your loved ones in the event of your death. If you have financial dependents, such as a spouse or children, you should consider a coverage amount that will replace your income and maintain their standard of living. The younger and healthier you are, the lower your premiums will be. Older individuals can still obtain life insurance, but it may be more expensive.

- Debts and liabilities: Life insurance can help cover outstanding debts, including mortgages, car loans, student loans, credit card debt, and personal loans. Ensure your coverage amount is sufficient to pay off these debts, including any interest or additional charges.

- Future expenses: Consider any future expenses your dependents may incur, such as college tuition for children or retirement planning for your spouse. Choose a coverage amount that will help them meet these expenses.

- Final expenses: Account for burial costs, funeral expenses, and other end-of-life expenses. The average cost for these expenses can range from $7,000 to $10,000.

- Income replacement: Financial experts often recommend purchasing coverage equivalent to at least 10 times your annual income. This ensures that your dependents will have sufficient financial support for several years.

- DIME Formula: This formula takes into account Debt and final expenses, Income, Mortgage, and Education (DIME). It helps you calculate a coverage amount that considers your debts, income replacement needs, mortgage, and children's education expenses.

- Shortfall calculation: This approach calculates the annual income you want to leave for your dependents and subtracts other sources of income, such as retirement accounts, pensions, savings, and Social Security. The resulting shortfall is the amount you should aim to replace with life insurance.

- Online calculators: Utilize online life insurance calculators to get a general idea of the coverage amount you may need. These calculators consider factors such as your age, income, debts, and financial goals.

- Consult professionals: Speak with a certified financial planner or a licensed insurance agent to assess your financial situation and provide personalized recommendations for coverage amounts.

How to Remove Your Spouse from Life Insurance Policies

You may want to see also

The importance of understanding different types of life insurance policies

Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies. There are many different types of life insurance policies available to meet all sorts of consumer needs and preferences. Understanding the different types of life insurance is important as it can help you choose the best coverage for you and your family.

There are two main categories of life insurance: term and permanent. Term life insurance is designed to last a certain number of years, then end. Common terms are 10, 20, or 30 years. It is often the cheapest life insurance option and is sufficient for most people. However, if you outlive your policy, your beneficiaries won't receive a payout. Permanent life insurance, on the other hand, stays in force throughout the insured person's entire life unless the policyholder stops paying premiums or surrenders the policy. It is more expensive than term life insurance but offers lifelong coverage.

Within these two main categories, there are several types of life insurance policies. Here are some of the most common ones:

- Whole life insurance: This is the simplest form of permanent life insurance, providing coverage for your entire life. It includes a cash value component that grows over time, tax-deferred. Whole life insurance policies have level premiums, guaranteed death benefits, and guaranteed cash values that grow at a guaranteed rate.

- Universal life insurance: This is another form of permanent insurance that offers flexible premiums and a cash value component that grows based on market interest rates. Universal life insurance can adjust to your life circumstances while providing cash value growth.

- Variable life insurance: This type of cash value life insurance is tied to investment accounts such as bonds and mutual funds. It offers the potential for considerable gains if your investments perform well, but it requires hands-on management as the cash value can change daily based on the market.

- Final expense insurance: Also known as burial insurance, this type of life insurance is intended to cover end-of-life expenses such as funeral and burial costs. It is a small whole life insurance policy with a limited death benefit, typically ranging from $5,000 to $25,000.

- Simplified issue and guaranteed issue life insurance: These policies don't require a medical exam, making them accessible to older applicants or those with serious health problems. They typically offer lower coverage levels and higher premiums due to the higher risk involved.

- Group life insurance: This type of life insurance is usually offered by employers as part of an employee benefits package. It is often term life insurance, but some companies also offer permanent coverage as a voluntary benefit. Group life insurance offers affordable premiums as the company is effectively "buying in bulk."

When choosing a life insurance policy, it's important to consider your age, financial situation, family status, and other factors. Working with a financial professional or agent can help you determine which type of policy is right for you and tailor it to your specific needs.

Fibromyalgia's Impact: Life Insurance Considerations and Challenges

You may want to see also

The role of a licensed agent or financial planner in determining coverage level

A licensed agent or financial planner plays a crucial role in determining the appropriate level of life insurance coverage for an individual. Here are some key aspects of their role:

Expert Guidance

Life insurance agents are licensed professionals who possess in-depth knowledge about various life insurance products. They guide individuals through the complex process of choosing and purchasing a policy that meets their unique needs. This includes explaining the differences and potential advantages of different types of policies, such as term life, whole life, and universal life insurance.

Personalized Needs Assessment

One of the primary roles of a licensed agent or financial planner is to conduct a comprehensive needs assessment. They consider factors such as the client's financial situation, health status, family obligations, future goals, and budget to tailor recommendations that provide adequate coverage without overpaying. This personalized approach ensures that the client is neither underinsured nor paying for unnecessary coverage.

Assistance with Application and Paperwork

Agents assist clients in managing the application process, which can be cumbersome and time-consuming. They help schedule medical exams, ensure that all necessary paperwork is completed accurately, and facilitate the coordination of health assessments required by the insurance provider. This assistance helps avoid delays or coverage denials.

Ongoing Support and Policy Management

Life insurance needs can evolve over time due to changes in income, marital status, family dynamics, and other factors. Licensed agents and financial planners provide ongoing support by periodically reviewing and adjusting policies to ensure they remain aligned with the client's circumstances. They assist with policy management tasks, such as beneficiary changes, conversions, and renewals.

Advocacy and Claim Assistance

Having a licensed agent or financial planner can be invaluable when filing a claim. They act as advocates for their clients, helping to ensure that claims are processed efficiently and fairly. They provide assistance with submitting paperwork and resolving any issues that may arise during the claims process.

Ethical and Trustworthy Advice

Professional life insurance agents adhere to high ethical standards, prioritizing their clients' interests above their own. They provide accurate and honest information, offering advice that is in the client's best interest. Building a relationship with a trusted agent ensures that the client's financial future and that of their family are protected.

In summary, a licensed agent or financial planner plays a vital role in determining the appropriate level of life insurance coverage. They provide expert guidance, personalized recommendations, administrative support, and ongoing assistance to ensure that the client's coverage meets their needs and budget.

Listing Yourself as a Beneficiary: Is it Possible?

You may want to see also

Factors influencing the cost of life insurance

When calculating the present value of life insurance, several factors come into play that influence the cost. Understanding these factors can help individuals make informed decisions about their coverage needs and manage their finances effectively. Here are the key factors that impact the cost of life insurance:

- Death Benefit Amount: The death benefit is the primary benefit of a life insurance policy, and it directly affects the premium cost. The higher the coverage amount, the higher the premium, as it provides more financial protection to the beneficiaries.

- Type of Policy: The type of life insurance policy chosen, such as term life insurance or permanent life insurance, impacts the cost. Term life insurance covers an individual for a specific period and is typically less expensive, while permanent life insurance offers lifelong coverage and may include a savings component, resulting in higher premiums.

- Riders: Riders are additional benefits that can be added to a life insurance policy, such as critical illness coverage or accidental death benefit. While riders enhance the policy's protection, they also increase the premium.

- Age: Age is a significant factor, as younger individuals generally pay lower premiums due to their lower risk of mortality. The likelihood of passing away during the policy period increases with age, leading to higher premiums for older individuals.

- Gender: Gender can also influence premiums, with women often paying less than men due to their longer life expectancy.

- Health: An individual's health status, including pre-existing conditions, plays a crucial role in determining premiums. Healthier individuals with good habits tend to pay lower premiums, while those with chronic health issues may need to pay more or opt for policies without a medical exam, which tend to be more expensive.

- Tobacco Use: Smoking or tobacco use significantly increases life insurance costs due to the associated health risks. Life insurance companies often classify individuals as smokers even if they only occasionally use tobacco products.

- Family History: A family history of hereditary or serious medical conditions can affect the premium. Insurers consider the likelihood of an individual developing similar health issues, which may increase their risk profile.

- Lifestyle and Occupation: High-risk jobs, such as law enforcement or firefighting, can lead to higher insurance costs. Additionally, dangerous hobbies or activities, like skydiving or racing, can result in increased premiums or even denial of coverage.

- Annual Salary: When using life insurance to replace lost income for a beneficiary, the insured's annual salary can be a factor in determining the coverage amount and, consequently, the premium cost.

- Debts: If the purpose of the life insurance is to pay off debts, the coverage amount and cost may be influenced by the principal amount of those debts.

- Financial Gifts: Individuals may choose to use life insurance to leave financial gifts for their beneficiaries, such as charitable donations or education funds. The amount intended for these gifts can impact the coverage amount and, thus, the cost of insurance.

Becoming a Life Insurance Agent in Alabama: A Guide

You may want to see also

Frequently asked questions

The present value of life insurance is the amount that your beneficiaries will receive after your death. This is also known as the face value of the policy.

To calculate the present value, you need to consider your current financial situation, future financial goals, and the desired annuity payouts after retirement. You can use the following formula:

> Present Value of Annuity = Current Worth of Future Income Generated by Investment

When calculating the present value, it is essential to consider your annual salary, the number of income-earning years you want to replace, your net income, investments, savings, debts, future needs (such as college fees), and funeral costs. Additionally, if you are a stay-at-home parent, you should include the cost of replacing services like childcare.