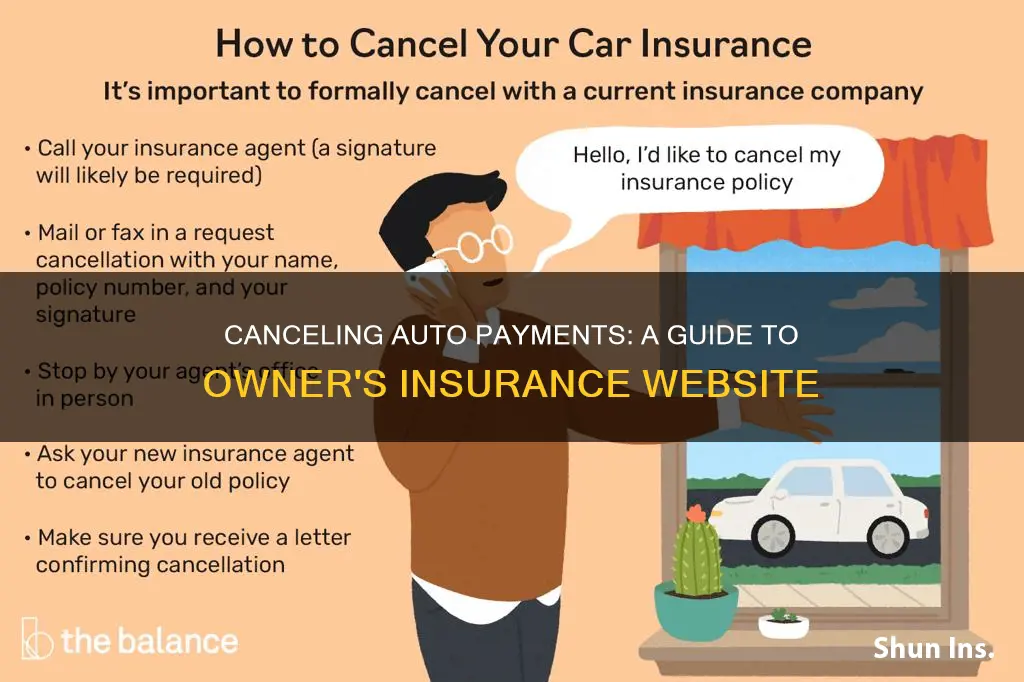

If you need to cancel a payment on your Auto-Owners Insurance policy, you can do so by contacting your local independent agent or the Auto-Owners Insurance office. You will need to sign a cancellation request form and submit it to the office. You can also download the form from the Auto-Owners Insurance website, print and complete it, and then return it to the office to cancel your policy. It is important to note that cancelling your car insurance policy may result in a cancellation fee and other consequences, such as increased rates when purchasing a new policy.

| Characteristics | Values |

|---|---|

| Website | Auto-Owners Insurance website |

| Cancellation Process | Contact the insurance company, sign and send a cancellation letter (if required), and get a notice of policy cancellation |

| Cancellation Fee | Some companies charge a fee of $50, or a "short rate" fee of 10% of the remaining premium |

| Cancellation Letter | Required by some companies, ask your carrier for the format and address or fax number |

| Notice Period | Some companies require 30 days' notice |

| Refund | Pre-paid premiums will be refunded, excluding any required fees |

| Payment Methods | Pay online, by phone, by mail, or in person |

What You'll Learn

- Cancelling a policy via non-payment is not recommended as your insurance company won't know your intention to cancel

- You may be charged a cancellation fee, or a short-rate fee of 10% of the remaining premium

- Contact your insurer to see if they require a cancellation letter or a notice period

- If you cancel your car insurance, you'll get a refund for any remaining unused premiums

- Cancelling your car insurance won't hurt your credit score

Cancelling a policy via non-payment is not recommended as your insurance company won't know your intention to cancel

Cancelling an insurance policy via non-payment is not recommended as your insurance company won't know your intention to cancel. If you miss a payment, your insurance company may assume that it was due to forgetfulness or financial difficulty. In this case, they may allow the missed payment to slide, especially if it is your first missed payment. However, if you continue to miss payments without contacting your insurance company, your policy will likely be cancelled for non-payment. This can result in a range of negative consequences, including:

- Policy cancellation: Your auto insurer will eventually cancel your policy if you miss a certain number of payments or fall too far behind.

- Failure to renew your policy: Not only will your current insurance company cancel your policy, but they may also refuse to offer you another policy in the future.

- Increased rates: If you purchase a new policy after your previous policy was cancelled for non-payment, your rates will likely be much higher.

- Fines from the Department of Motor Vehicles (DMV): Driving without insurance is illegal in almost every state, and you may be subject to fines from the DMV if you are caught.

- License/registration suspension: If you are caught driving without insurance, your driver's license and registration may be suspended until you can provide updated proof of insurance.

- Fines from your lienholder: If your vehicle is financed and your insurance lapses, your lienholder may charge you penalties or even repossess your vehicle.

- Impacted credit score: Unpaid bills can negatively affect your credit score, making it more difficult to secure loans or credit cards in the future.

To avoid these negative consequences, it is important to contact your insurance company as soon as you know you will miss a payment. They may be able to offer alternative options, such as a different payment deadline or a deferral of the month's payment. Additionally, it is important to remember that insurance companies are required to notify you in writing before cancelling your policy, so you will likely have some time to resolve the issue before your coverage is cancelled. Overall, while it may be tempting to cancel your policy via non-payment, it is always best to communicate directly with your insurance company to avoid unnecessary complications and negative consequences.

Retirement Planners: Auto Insurance Allies?

You may want to see also

You may be charged a cancellation fee, or a short-rate fee of 10% of the remaining premium

When cancelling your car insurance policy, you may be charged a cancellation fee. This fee is outlined in the insurance policy's Terms and Conditions section, which details the approach to cancellation fees and in which situation they apply.

Cancellation fees can be a flat fee or a short-rate fee. Short-rate cancellations act as a disincentive for the policyholder to cancel the policy before its normal expiration date. With short-rate cancellations, the insurer will charge the policyholder a percentage of the unearned premium—usually 10%. This amount will be taken from the remaining refund, or the policyholder will receive a bill if there is no refund owed.

Short-rate cancellation calculations are based on the remaining premium owed to the company. This means that more of the premium is owed at the beginning of the policy term and is not divided evenly among the days of coverage. This method helps the insurance company offset some of the costs associated with setting up the policy.

To cancel your Auto-Owners Insurance policy, you will need to contact your local agent or the Auto-Owners Insurance office to submit a cancellation request form. You can download this form from the Auto-Owners Insurance website, print and complete it, and then return it to the office.

Gap Insurance: Post-Accident Steps

You may want to see also

Contact your insurer to see if they require a cancellation letter or a notice period

To cancel your Auto-Owners Insurance policy, you'll need to contact your insurer to see if they require a cancellation letter or if there is a notice period. While cancellation requirements vary by insurer, many companies require a written cancellation letter. This is to ensure that there is no miscommunication between you and your insurer and to provide a record of your intention to cancel your insurance.

Before drafting your letter, check your policy to see if your insurer has any specific cancellation requirements. For example, your insurer may need your letter to go to a specific department, or they may require a certain number of days' notice before they can deactivate your coverage. The required cancellation notice period is typically 30 days, but it can be as long as 60 days.

Your cancellation letter should include the following:

- Your name (you must be a policyholder to cancel)

- Policy number

- Your address and contact information

- The insurance company's name

- The current date

- The desired cancellation date

- Reasons for cancellation

- A request to stop payment or for a refund

Keep your letter concise and firm but polite. Be sure to proofread your letter before sending it to the appropriate address.

Auto Insurance: Couples and Marriage

You may want to see also

If you cancel your car insurance, you'll get a refund for any remaining unused premiums

If you cancel your car insurance, you may get a refund for any remaining unused premiums, but this depends on a few factors. Firstly, you are more likely to get a refund if you paid your premium in advance, either for the full policy term or for the current month. If you pay monthly, you may only get a refund if you cancel in the middle of the billing cycle. Secondly, the reason for cancellation may impact your refund. For example, if you cancel because you sold your car or moved to another state, you may be more likely to get a refund. However, if you cancel because you found a better rate elsewhere, you may have to pay a cancellation fee, which could offset your refund.

The amount of your refund will depend on how much time is left on your policy and your insurance company's rules about refunds. Some companies may charge a flat cancellation fee, while others may charge a percentage of the unearned premium, known as a short-rate fee. This will be deducted from your refund. It's important to review your insurance company's rules regarding cancellations before cancelling your policy.

If you are entitled to a refund, you can typically receive it by check, direct deposit, or the original payment method. The time it takes to receive your refund may vary depending on the method chosen. It's important to note that insurance companies are not always obligated to refund your money within a specific time frame, so it's best to notify your insurer of your cancellation plans when it's close to the renewal date.

Grandchildren on Auto Insurance Policies

You may want to see also

Cancelling your car insurance won't hurt your credit score

Understanding the Process

To cancel your car insurance, you'll need to contact your insurance company. This usually involves a quick phone call, but some companies may also allow you to submit a cancellation request through their website or mobile app. It's a good idea to check with your insurer to see if they require any fees, a cancellation letter, or a notice period before processing your request.

Potential Consequences

While cancelling your car insurance won't directly affect your credit score, there are some indirect ways it could impact you financially:

- Unpaid Premiums: If you have any outstanding premiums when you cancel, your insurer might send the unpaid amount to collections, which could negatively affect your credit score.

- Coverage Gaps: Cancelling without a new policy in place could leave you uninsured. If you get into an accident during this period, you'll be responsible for any financial costs, which could indirectly affect your credit score.

- Credit-Based Insurance Scores: In certain regions, insurers use credit-based insurance scores to determine premiums. Frequent policy changes or cancellations could be perceived as instability, potentially impacting future insurance rates.

Best Practices for Cancelling

To avoid any negative consequences, consider the following:

- Pay Premiums on Time: Ensure you pay any outstanding premiums on time to avoid issues with collections and maintain a good credit score.

- Plan Ahead: If you're considering cancelling, have a new policy in place to avoid coverage gaps and financial risks.

- Shop Wisely: Obtain quotes from alternative insurers without affecting your credit score by using soft inquiries.

While cancelling your car insurance policy won't directly impact your credit score, it's important to be mindful of potential indirect effects, such as unpaid premiums and coverage gaps. Remember to pay your premiums on time, plan ahead, and choose your insurance options wisely to maintain a healthy financial standing.

Speeding Tickets and Auto Insurance: The LexisNexis Factor

You may want to see also

Frequently asked questions

You need to contact your local independent agent or Auto-Owners Insurance directly to request a cancellation of your policy. You will need to sign a cancellation request form.

If you paid your premium in advance and cancel your policy before the end of the term, the insurance company might refund the remaining balance. Most auto insurers will prorate your refund based on the number of days your current policy was in effect.

Ensure that you have new coverage lined up that starts on or before your end-of-coverage date. You should set it so your old policy terminates on the same day that your new policy begins.