Receiving a ticket for a traffic violation can be a stressful experience, especially when it involves a Lapsed Insurance violation. This type of ticket typically indicates that your vehicle's insurance coverage was not active at the time of the incident. It's important to understand the implications and take appropriate action to resolve the issue. In this paragraph, we will guide you through the steps to address a Lapsed Insurance ticket, ensuring you know your rights and how to proceed to avoid further complications.

| Characteristics | Values |

|---|---|

| Understand the Ticket | Read the ticket carefully to understand the violation and the charges. |

| Check for Accuracy | Verify the details, including the date, location, and nature of the violation. |

| Response Time | Respond promptly to the ticket within the specified timeframe to avoid penalties. |

| Gather Evidence | Collect any relevant evidence, such as photos or witness statements, to support your case. |

| Contact the Authority | Reach out to the local law enforcement agency or the relevant authority to discuss the ticket. |

| Consider Legal Advice | Consult a legal professional or a traffic attorney to understand your rights and options. |

| Pay Attention to Deadlines | Be aware of any deadlines for responding or paying the ticket to avoid additional fees. |

| Explore Plea Options | Decide whether to plead guilty, not guilty, or request a hearing based on the circumstances. |

| Understand Penalties | Research the potential consequences, including fines, license points, and possible vehicle impoundment. |

| Learn from the Experience | Use the incident as a learning opportunity to improve driving habits and avoid similar violations in the future. |

What You'll Learn

- Understand the Ticket: Review the details, including the violation and potential penalties

- Check for Errors: Verify accuracy and ensure no mistakes were made

- Consult an Attorney: Consider legal advice for complex cases or potential defenses

- Pay or Contest: Decide whether to pay or challenge the ticket in court

- Learn from Experience: Reflect on the incident to prevent future violations

Understand the Ticket: Review the details, including the violation and potential penalties

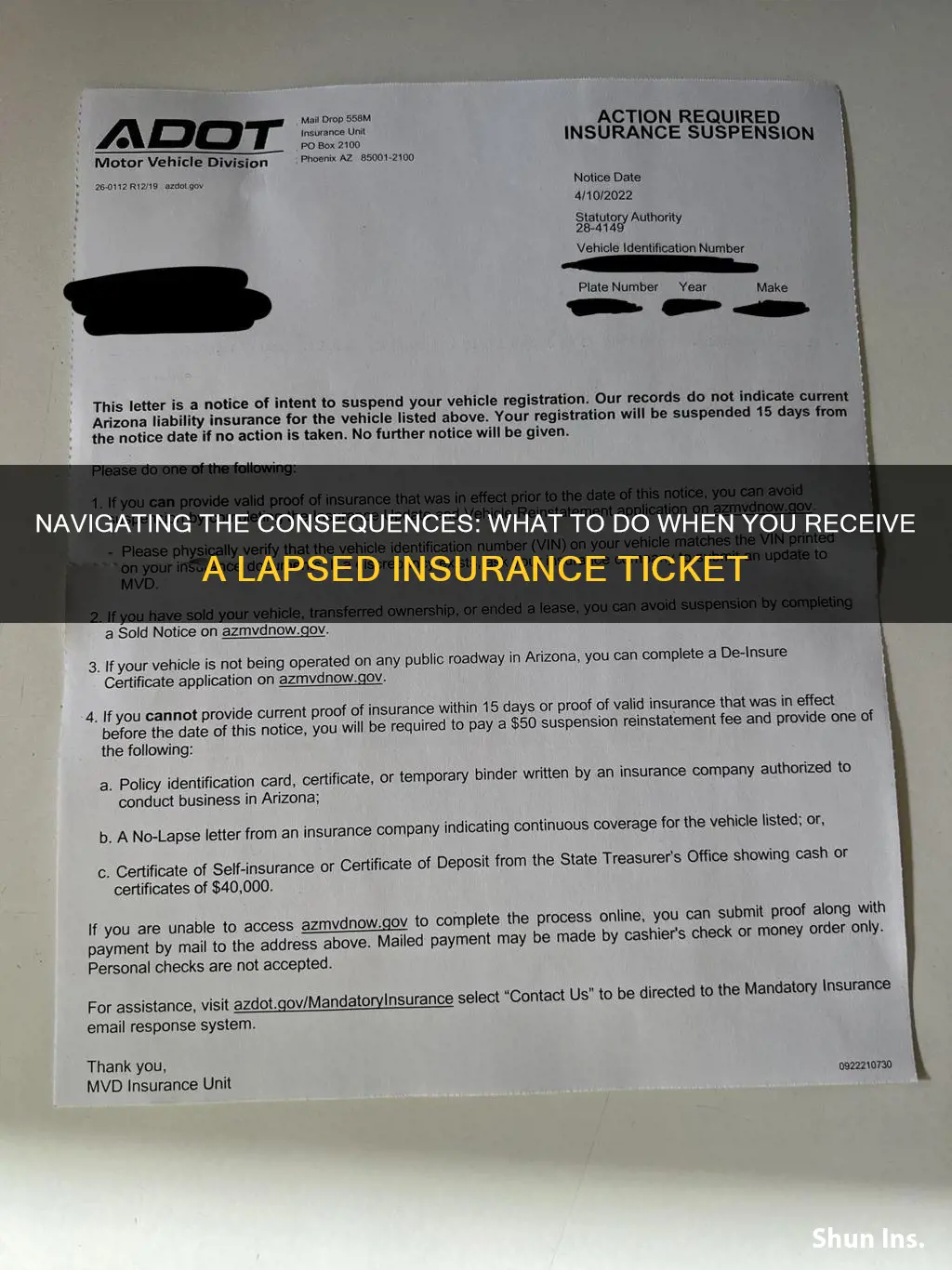

When you receive a ticket for a violation related to your insurance, it's crucial to approach it with a clear understanding of the details. Start by carefully reviewing the ticket, as it will outline the specific violation that occurred. For instance, it might state that you were driving without the required insurance coverage, which is a common issue for those who have recently switched policies or made a mistake in their coverage. The ticket will also provide information about the date, time, and location of the incident, which are essential details to remember.

The violation section of the ticket is critical as it describes the exact action that led to the ticket. For example, it might say you were driving without insurance at 3:45 PM on Main Street. Understanding this violation is key to knowing what you need to address.

Potential penalties are another critical aspect to consider. These can vary widely depending on the jurisdiction and the specific violation. Common penalties include fines, license points, and even the possibility of a suspended or revoked license. For instance, driving without insurance can result in a fine of $200 to $500, plus the potential for 3 to 6 license points. These points can have long-term consequences, affecting your insurance rates and driving privileges.

Additionally, the ticket may include information about the grace period or the time you have to respond. This is a crucial detail as it determines how quickly you need to take action. If you fail to respond within this period, the ticket may be considered unpaid, leading to further complications.

Lastly, it's important to note that the details on the ticket are just the beginning. You should also consider the impact on your insurance and driving record. The violation could affect your insurance rates, and it's essential to inform your insurance provider as soon as possible to discuss any necessary adjustments to your policy. Understanding these details will help you make informed decisions about how to proceed.

Auto Insurance Rates: Monthly Cost Analysis

You may want to see also

Check for Errors: Verify accuracy and ensure no mistakes were made

When you receive a ticket for a violation related to your insurance coverage, it's crucial to approach the situation with a critical eye and a methodical mindset. One of the initial steps you should take is to carefully review the details of the ticket. Check for any errors or discrepancies that might have been made during the ticketing process. This includes verifying the accuracy of the following:

- Personal Information: Ensure that your name, address, and contact details are correct. Mistakes in personal information can lead to further complications and delays in resolving the issue. Double-check the ticket to make sure it reflects your accurate details.

- Date and Time: Confirm the date and time of the alleged violation. Sometimes, tickets may contain incorrect or outdated information, especially if the event occurred a while ago. Accuracy in this regard is essential to build a strong case.

- Violation Description: Read the description of the violation carefully. Make sure it accurately represents the incident. If the description is vague or misleading, it might be a sign of an error or an attempt to misrepresent the situation. Look for any discrepancies between the ticket's description and the actual events.

- Evidence and Supporting Documents: Examine any evidence or supporting documents provided with the ticket. Ensure they are relevant and correctly represent the situation. For instance, if there are photos or witness statements, verify their authenticity and ensure they align with your understanding of the event.

- Officer's Signature and Contact Information: Check for the officer's signature and their contact details. If there are any discrepancies or if you believe there might have been a mistake in the ticketing process, you may need to reach out to the officer or the relevant authorities to clarify or dispute the ticket.

By thoroughly checking for errors and verifying the accuracy of the ticket's contents, you can ensure that you have a solid foundation to address the issue. This initial step is crucial as it helps you identify potential mistakes, gather evidence, and make informed decisions about the next course of action. Remember, a careful review can make a significant difference in how your case is handled and the outcome you achieve.

Total Loss Vehicle: Insurance Release Timing

You may want to see also

Consult an Attorney: Consider legal advice for complex cases or potential defenses

If you've received a ticket for a violation related to lasped insurance, it's important to understand the specific laws and regulations in your jurisdiction. Lasped insurance, often referring to lapsed or expired insurance coverage, is a serious matter and can result in various legal consequences. Consulting an attorney is a crucial step to ensure you navigate this process effectively and protect your rights.

The complexity of insurance-related laws can vary significantly from one region to another. An attorney specializing in insurance law or traffic violations can provide invaluable guidance tailored to your local regulations. They will assess the details of your case, including the specific violation charged, and advise on the potential legal implications. For instance, they might help you understand the difference between a minor infraction and a more serious offense that could impact your driving record and insurance premiums.

In many cases, the consequences of a lasped insurance ticket can be severe. These may include fines, license suspension, or even mandatory court appearances. An attorney can help you build a strong defense strategy, which might involve negotiating with the prosecution or presenting evidence to support your case. They can also ensure that your rights are respected throughout the legal process, which is essential for a fair outcome.

Furthermore, an attorney can provide practical advice on how to handle the immediate aftermath of receiving the ticket. This may include steps to take to avoid further legal issues, such as ensuring your insurance is up to date or making necessary adjustments to your vehicle's documentation. They can also guide you through the administrative processes, such as paying fines or attending required court hearings.

In complex cases, where the violation is part of a larger legal matter or involves unique circumstances, an attorney's expertise becomes even more critical. They can help you understand the potential long-term implications and develop a comprehensive plan to address the situation. Consulting an attorney is a proactive step that can significantly improve your chances of a favorable resolution and help you avoid unnecessary legal complications.

Progressive Auto Insurance: Understanding Coverage for Other Drivers

You may want to see also

Pay or Contest: Decide whether to pay or challenge the ticket in court

When you receive a ticket for a traffic violation related to your insurance coverage, such as a lapsed insurance ticket, you have two main options: pay the fine or contest the ticket in court. This decision can significantly impact your driving record and insurance rates, so it's crucial to consider your circumstances carefully.

Paying the fine is often the quicker and easier option. It resolves the issue immediately and avoids the potential complications of a court appearance. However, it's essential to understand the implications. Paying the fine may not address the underlying issue of your insurance status. If your insurance was indeed lapsed, you'll need to ensure you have valid coverage to avoid further penalties. Additionally, paying the fine could result in points on your driving record, which can increase your insurance premiums.

On the other hand, contesting the ticket in court can be a more complex process but may offer a better long-term solution. If you believe the ticket was issued in error or due to a misunderstanding, challenging it could lead to the dismissal of the charges. For instance, if your insurance was temporarily suspended but you had just renewed your policy, providing proof to the court could result in the ticket being dismissed. Contesting the ticket also gives you an opportunity to address the issue of your insurance status directly with the court.

When deciding whether to pay or contest, consider the following:

- Understanding the Law: Familiarize yourself with the specific laws and regulations regarding insurance coverage and traffic violations in your jurisdiction.

- Evidence: Gather any relevant evidence that supports your case. This could include proof of insurance renewal, medical documentation, or any other information that clarifies your situation.

- Court Appearance: If you choose to contest, be prepared for a court appearance. This may involve presenting your case to a judge or magistrate, so ensure you have a clear and organized argument.

- Potential Outcomes: Understand the possible outcomes of both paying the fine and contesting the ticket. This will help you make an informed decision.

In summary, the decision to pay or contest a lapsed insurance ticket depends on your specific circumstances and the potential consequences. While paying the fine is a quick fix, contesting the ticket may provide a more permanent solution and an opportunity to address the underlying issue. It's essential to weigh your options carefully and consider seeking legal advice if needed.

Reporting Auto Body Insurance Fraud: What You Need to Know

You may want to see also

Learn from Experience: Reflect on the incident to prevent future violations

When you receive a ticket for a lapse in insurance coverage, it's a crucial moment to reflect on the incident and take proactive steps to prevent future violations. This reflection is a powerful tool for personal and professional growth, ensuring that you learn from your mistakes and make informed decisions moving forward. Here's a detailed guide on how to approach this process:

Understand the Incident: Begin by thoroughly reviewing the details of the ticket. Understand the specific reasons why your insurance coverage lapsed. Was it due to missed payments, administrative errors, or a change in your circumstances? Identifying the root cause is essential as it provides a clear understanding of the situation and helps you avoid similar pitfalls in the future. For instance, if the lapse was due to a missed payment, you can learn to set up automatic payments or reminders to ensure timely payments moving forward.

Analyze Your Actions: Reflect on the actions or inactions that led to the insurance lapse. Consider your decision-making process and any potential mistakes or oversights. For example, if you forgot to update your insurance provider about a change in address, you can learn to implement a system for regular reviews of your insurance details, ensuring all information is up-to-date. This self-analysis is a critical step in personal development, allowing you to identify areas for improvement and make necessary adjustments.

Create a Preventive Plan: Based on your analysis, develop a comprehensive plan to prevent similar incidents in the future. This plan should be tailored to your specific situation and may include setting up reminders, automating payments, or regularly reviewing your insurance coverage. For instance, you could set up monthly reminders to check your insurance status and ensure all payments are made on time. Additionally, consider implementing a system to notify you of any changes in your insurance policy, such as upcoming renewals or policy updates.

Learn from Industry Best Practices: Research and learn from industry best practices to avoid common pitfalls. Insurance professionals often have valuable insights and recommendations to share. They can provide guidance on how to manage insurance effectively, including tips on staying organized, setting reminders, and maintaining open communication with insurance providers. By adopting these best practices, you can significantly reduce the chances of future lapses.

Seek Professional Guidance: If the lapse was due to complex circumstances or if you're unsure about the best course of action, consider seeking professional advice. Insurance brokers or agents can offer specialized guidance and help you navigate the process of ensuring continuous coverage. They can also provide valuable insights into the local insurance market and help you make informed decisions regarding your coverage options.

By following these steps, you can turn a potentially negative experience into a valuable learning opportunity. Reflecting on the incident, understanding the causes, and implementing preventive measures will not only help you avoid future violations but also demonstrate your commitment to personal and professional growth. This approach ensures that you stay informed, organized, and compliant with insurance requirements, ultimately leading to a more secure and reliable insurance experience.

Auto Insurance: Covering My Husband?

You may want to see also

Frequently asked questions

If you receive a ticket or notice regarding a lapsed insurance policy, it is important to act promptly. First, review the details of the ticket to understand the specific issue. Contact your insurance provider as soon as possible to discuss the situation. They may offer options to reinstate the policy, such as paying any outstanding premiums or fees. It's crucial to address the issue to avoid further consequences and ensure your insurance coverage remains valid.

If you no longer have the original insurance policy and receive a ticket, it's essential to gather any relevant documentation you might have. Contact the insurance company to inform them of the situation and request a copy of your policy records. They can help you understand the details of the lapsed policy and guide you through the process of resolving the ticket. You may also need to provide proof of insurance coverage for a specific period.

Ignoring a lapsed insurance ticket can have several negative consequences. Insurance companies may impose penalties, including late fees or policy cancellation. If the policy is canceled, you might face challenges in obtaining coverage in the future, as insurers often consider the history of policy lapses. It's advisable to take immediate action to resolve the issue and prevent further complications, such as increased premiums or difficulty in finding new insurance coverage.