Car insurance for 21-year-olds is generally expensive, with the average cost of car insurance for a 21-year-old driver on their own policy being $4,186 per year for full coverage and $1,441 per year for minimum coverage. However, USAA, Erie, and Farm Bureau offer the cheapest insurance rates for 21-year-old drivers, with monthly rates starting at $62, $167, and $179, respectively. Factors such as location, vehicle type, and insurance company also influence insurance rates for 21-year-olds.

| Characteristics | Values |

|---|---|

| Average cost of car insurance for a 21-year-old | $120 per month for minimum-coverage |

| $349 per month for full coverage | |

| Cheapest car insurance for 21-year-olds | USAA |

| Country Financial | |

| Erie | |

| Farm Bureau | |

| Travelers | |

| Geico | |

| Average cost of car insurance for a 21-year-old male | $285 per month for full coverage |

| Average cost of car insurance for a 21-year-old female | $263 per month for full coverage |

What You'll Learn

Car insurance for 21-year-olds: what's the average cost?

The average cost of car insurance for a 21-year-old varies depending on several factors, including the driver's gender, location, vehicle type, insurance company, and whether they are insured on their parents' policy.

Average Cost of Car Insurance for 21-Year-Olds

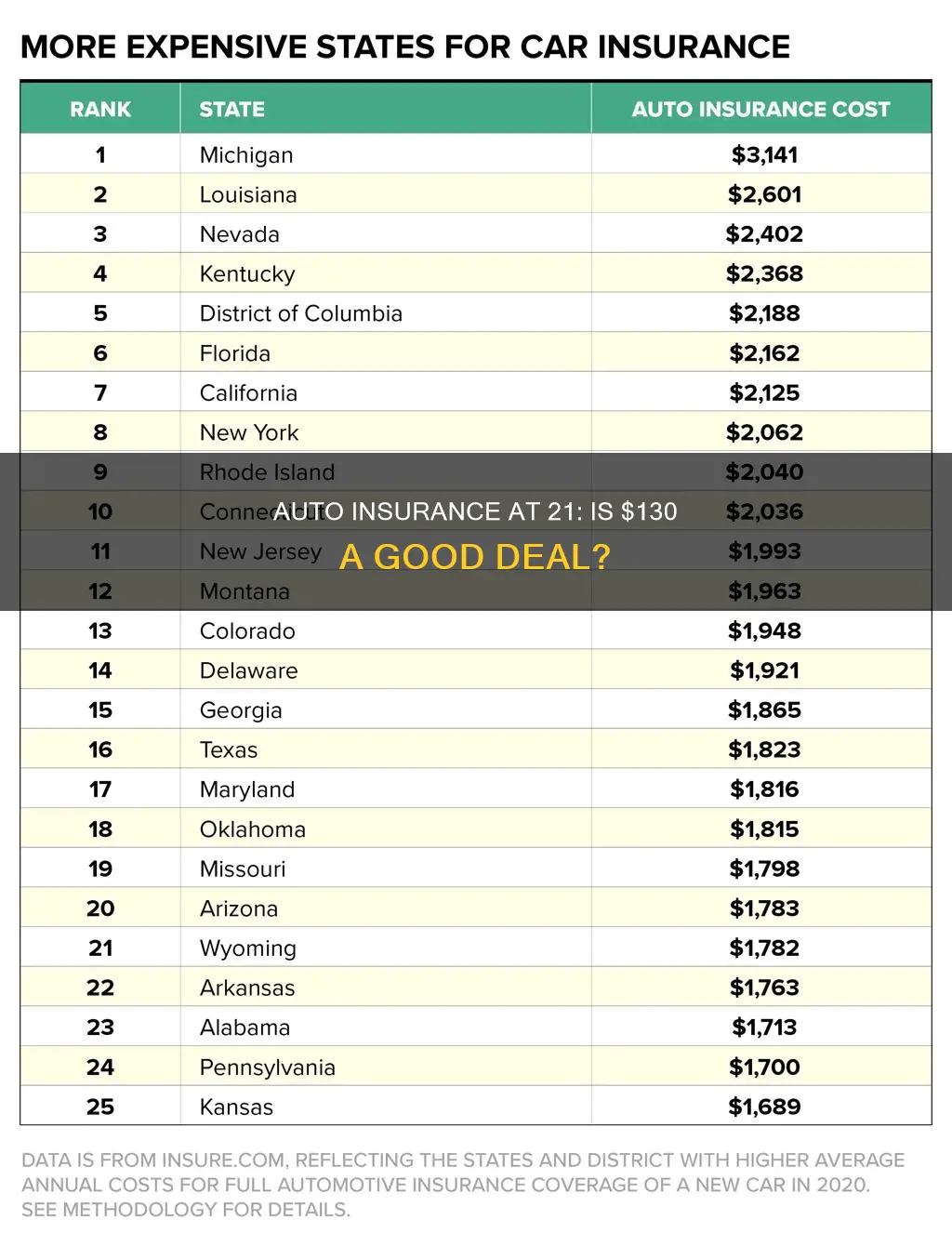

According to various sources, the average cost of car insurance for a 21-year-old driver in the United States is between $248.33 and $4333 per year for full coverage and between $1044 and $1250 per year for minimum coverage. The cost of car insurance for 21-year-olds also varies by state, with Florida having the highest rates and Hawaii having the lowest.

Factors Affecting the Cost of Car Insurance for 21-Year-Olds

The cost of car insurance for 21-year-olds can be affected by various factors. One factor is gender, with male drivers typically paying higher premiums than female drivers due to a higher risk of accidents. The type of vehicle being insured also plays a role, with certain makes and models considered riskier and more expensive to insure. Additionally, the insurance company itself can impact the cost, with some companies offering lower rates for young drivers.

Ways to Save on Car Insurance for 21-Year-Olds

There are several ways for 21-year-olds to save on car insurance:

- Compare quotes from multiple insurance companies

- Take advantage of discounts, such as good student discounts or distant student discounts

- Improve driving skills and maintain a clean driving record

- Choose a higher deductible

- Bundle insurance policies, such as homeowners or renters insurance

- Improve credit score

The Long Shadow of Violation: Understanding Auto Insurance Penalties

You may want to see also

How can 21-year-olds save on car insurance?

Car insurance for 21-year-olds can be quite expensive, as young drivers are considered to be high-risk due to their relative lack of experience. However, there are several ways that 21-year-olds can save money on their car insurance:

Shop Around for Quotes

By far the most effective way to save money on car insurance is to shop around and compare quotes from multiple insurance companies. Different companies use different algorithms to calculate their premiums, so you may find that you are offered a much better rate by one company than another, even for the exact same coverage. This is especially true for young drivers, as the cheapest companies for teens are often not the cheapest for drivers in their early 20s.

Stay on Your Parents' Policy

If you are a 21-year-old who still lives at home, it is likely to be much cheaper for you to stay on your parents' insurance policy than to buy your own. Even if you have to pay a little extra, it will still be much cheaper than paying for two individual policies. However, keep in mind that any driving infractions will impact your parents' premiums as well as your own.

Take Advantage of Discounts

Many insurance companies offer discounts for young drivers. For example, if you are a full-time student, you may be eligible for a "good student discount", which usually requires you to maintain a B average or a 3.0 GPA or higher. You may also be able to get a discount for taking a driver training course, or for simply being a safe driver. Ask your insurance agent about what discounts are available to you, as they may not be offered automatically.

Choose a Cheaper Car

The type of car you drive has a big impact on your insurance premiums. Sports cars, luxury vehicles, and cars that are expensive to repair or replace will generally result in higher premiums. Instead, opt for a cheaper, more modest vehicle, such as a Honda CR-V, Hyundai Tucson, or Ford F-150.

Raise Your Deductible

You can also lower your insurance payments by increasing your deductible (the amount you pay out of pocket if you file a claim). Just be sure that you can afford the deductible in the event that you do need to make a claim.

Auto Insurance Refunds: What You Need to Know

You may want to see also

What are the cheapest car insurance companies for 21-year-olds?

The cost of car insurance for a 21-year-old varies depending on several factors, including gender, location, driving history, and credit score. However, some of the cheapest car insurance companies for 21-year-olds include:

- USAA: Offers the cheapest rates for military members, veterans, and their families, with an average annual full coverage premium of $2,708 for 21-year-old drivers.

- Erie: Offers rates starting at $167 per month and is highly recommended for 21-year-old drivers.

- Farm Bureau: Along with Erie, Farm Bureau offers the cheapest rates for 21-year-olds, with premiums around $179 per month.

- GEICO: Provides the best rates overall, with full coverage policies at just $152 per month or $1,824 per year.

- State Farm: Offers good student discounts of up to 25% and has affordable rates for 21-year-olds, with an average annual cost of $1,986.

- Auto-Owners: Provides the second-cheapest average rates for 21-year-olds looking to buy their own policy, at $2,871 per year.

- Travelers: Offers affordable rates for 21-year-olds, with a full coverage policy costing $219 per month.

- Country Financial: Available in 19 states, Country Financial offers rates starting at $79 per month for 21-year-olds.

Allstate Auto Insurance: What's the Deal with Rental Trucks?

You may want to see also

How does age affect car insurance rates?

Age is one of the most important factors that insurance companies consider when determining car insurance quotes. Young people have less driving experience, so drivers under the age of 25 tend to pay the highest car insurance rates. Rates start to decrease in a driver's 20s and can continue to go down into their 50s. The downward trend of insurance premiums typically comes to an end as drivers reach their 70s.

The cost of car insurance is high for 21-year-old drivers because they are considered riskier drivers. They have less driving experience than older drivers and are more likely to be involved in accidents. According to the AAA Foundation for Traffic Safety, drivers between the ages of 20 and 24 were 74% more likely to get into an accident than drivers in their 30s in 2015.

The average cost of car insurance for a 21-year-old driver is about $4,186 per year for full coverage and about $1,441 per year for minimum coverage. The cheapest car insurance for 21-year-olds is offered by USAA, which is only available to military members, veterans and their immediate families. Country Financial has the cheapest rates available to all 21-year-olds.

There are several ways for 21-year-old drivers to save money on car insurance. One way is to share a car insurance policy with their parents. Another way is to compare quotes from multiple companies and take advantage of discounts.

Kemper Auto Insurance: Contacting the Provider

You may want to see also

How does gender affect car insurance rates?

Several factors determine car insurance rates for 21-year-olds, including driving history, location, gender, marital status, and credit score. While gender-based pricing varies across insurers, young male drivers tend to pay more for car insurance than females.

Gender-Based Pricing

In most states, car insurance companies are allowed to consider gender when setting rates. However, the difference in pricing between genders is often slight, especially for adult drivers. Younger men and women typically see the most significant gender-based pricing differences, with teenage boys paying the most for car insurance.

Reasons for Gender-Based Pricing Differences

Insurers charge higher rates for individuals who are statistically more likely to be involved in accidents or make claims. Young men are considered riskier to insure due to their higher likelihood of engaging in risky driving behaviors, such as speeding or driving under the influence of alcohol. They may also be more likely to purchase sports cars or take risks behind the wheel.

States with Gender-Neutral Insurance Rates

It's important to note that some states, including California, Hawaii, Massachusetts, Montana, North Carolina, and Pennsylvania, explicitly prohibit insurance companies from considering gender when determining rates. In these states, men and women should pay the same price for auto insurance coverage, assuming all other factors are equal.

Ways to Save on Insurance

Regardless of gender, there are several strategies to reduce car insurance costs:

- Shop around: Compare rates from multiple insurance companies, as pricing algorithms vary, and you may find more favorable rates with a different insurer.

- Maximize discounts: Different insurers offer various discounts, so explore all available options, such as good student discounts, safe driver programs, or discounts for teachers.

- Consider pay-per-mile insurance or telematics programs: These programs use a plug-in device or a smartphone app to track your driving habits and can offer significant savings for safe and low-mileage drivers.

- Adjust your coverage: If your vehicle is older or worth less, consider dropping comprehensive and collision coverage. You can also raise your deductible to lower your premium, but ensure the deductible amount is affordable if needed.

Rider Insurance: Vehicle Add-Ons Covered

You may want to see also

Frequently asked questions

I cannot say whether 130 auto insurance is good for a 21-year-old without more information. However, I can tell you that the average cost of car insurance for a 21-year-old is $120 per month for minimum coverage and $349 per month for full coverage.

Car insurance costs for 21-year-olds are determined by factors such as driving history, location, gender, marital status, and credit score.

Car insurance is typically high for 21-year-olds because they are considered high-risk drivers due to their lack of driving experience and higher likelihood of being involved in accidents.

21-year-olds can save on car insurance by comparing quotes from multiple providers, taking advantage of discounts, choosing a higher deductible, and bundling insurance policies.