Comparing a contractor's bill to an insurance payment can be a complex process, especially when dealing with home repairs. It is important to understand the dynamics between homeowners, contractors, and insurance companies to ensure fair payment and avoid disputes. Homeowners should be cautious when signing documents such as direction to pay forms, which authorise insurance companies to pay contractors directly, and be aware of their rights and responsibilities. Insurance companies may take a hands-off approach to claims or rigorously scrutinise them, and it is important to understand their requirements for estimates and proof of work. Homeowners should also be aware of the potential for delays in insurance payments and be prepared to advocate for their rights.

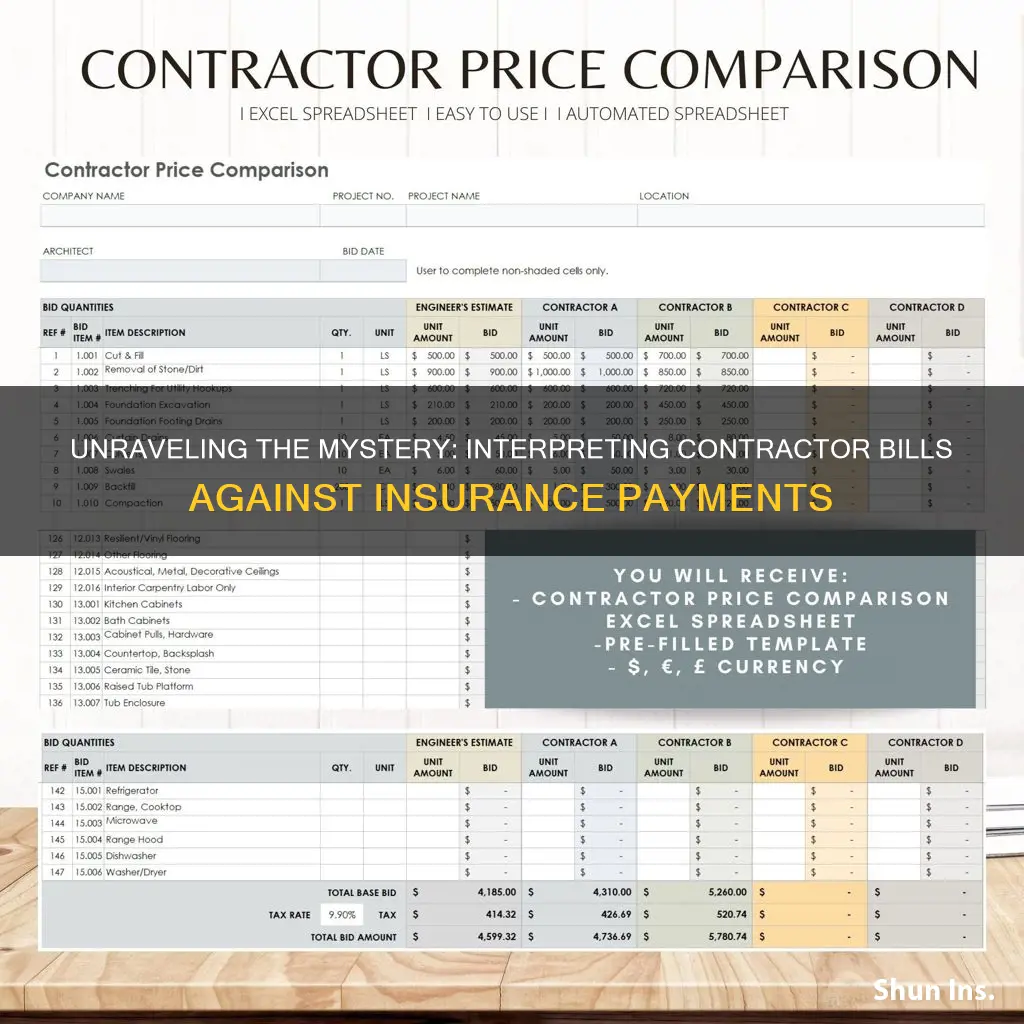

| Characteristics | Values |

|---|---|

| Who gets the insurance claim check | The contractor, homeowner, or mortgage lender |

| Who controls the insurance claim payment | The insurance company, homeowner, or contractor |

| What if the contractor doesn't take the insurance | Establish a repair payment schedule with the contractor |

| How to reduce the pay cycle | Send preliminary notices to improve communication and set expectations |

| How to speed up insurance claims and get paid | Send a notice of intent to lien (NOI) |

| How to protect yourself when hiring a contractor | Inspect the contractor's work before agreeing to payment |

| How to protect yourself from non-payment | File a mechanics lien on a property |

What You'll Learn

Understanding the insurance claims payment process

The insurance claims payment process can be confusing, especially if you've never had to deal with it before. Here's a step-by-step guide to help you navigate the process and ensure you're getting what you're entitled to.

Step 1: Contact your insurance company

As soon as you suffer a loss or damage, you should get in touch with your insurance company. It's important to do this promptly, as there may be time limits on filing a claim. Let them know the details of what happened, and they can guide you through the next steps.

Step 2: Document the damage

Take photos or videos of the damage to your property. This will serve as evidence for your insurance company and help them assess the extent of the damage. If your claim involves a car accident, take pictures before moving your vehicle, if it's safe to do so. For property damage, document the damage before cleaning up or making any temporary repairs.

Step 3: Review your coverage

Before filing a claim, make sure you understand your insurance policy, including what's covered, your deductibles, and your limits. This will help you avoid filing a claim that isn't covered or where the cost of repairs is less than your deductible.

Step 4: File a police report (if necessary)

If your claim involves a car accident, theft, or any illegal activity, contact the police and file a report. This is often required by insurance companies and will be helpful in the claims process.

Step 5: Submit necessary paperwork

You may need to fill out forms and provide additional information, such as receipts or proof of ownership, to support your claim. Stay organized and provide as much detail as possible to help expedite the process.

Step 6: Adjustor assessment

Your insurance company will send an adjustor to evaluate the damage and determine how much they will pay out. They will inspect the property, review your policy, and may interview you and any witnesses. You can also provide repair estimates from contractors at this stage.

Step 7: Receive a settlement offer

After the adjustor's assessment, your insurance company will send you a settlement offer. Review this offer carefully, as accepting it will close your claim. If you're not satisfied with the offer, you can dispute it and request a second review or hire a public adjustor or attorney.

Step 8: Pay your deductible

Before receiving the claim payment, you'll need to pay your deductible, if applicable. This is the amount you're responsible for paying out of pocket before your insurance coverage kicks in.

Step 9: Receive the claim payment

Once the settlement is agreed upon, your insurance company will issue the claim payment. For property damage claims, you may receive multiple payments throughout the repair process, especially if there are complex or lengthy repairs involved.

Step 10: Make repairs or replacements

Use the claim payment to hire contractors and make the necessary repairs or replacements to your property. Keep in mind that you may need permits or licenses for certain types of repairs, especially if they are major or technical, like plumbing or electrical work.

Step 11: Final inspection

Once the repairs or replacements are complete, inspect the work to ensure it meets your satisfaction. This is important, especially if your insurance company is paying the contractor directly. Don't sign off on the final payment until you are happy with the results.

Understanding the process can help you effectively navigate the insurance claims payment process and ensure you're getting the compensation you're entitled to. Remember to stay organized, provide detailed information, and be your own advocate throughout the process.

Unlocking Spravato's Insurance Coverage: A Guide to Navigating Billing Procedures

You may want to see also

Overhead and profit expenses

Understanding your overhead expenses is crucial for effective financial management and ensuring profitability. It is recommended to allocate overhead expenses across all projects proportionally. Additionally, it's important to note that labour burdens can account for a significant portion of total project expenditures, so accurate time tracking and labour cost estimation are vital.

Profit, on the other hand, is the amount of money left over after subtracting all operational costs, including overhead, labour, and materials. To ensure profitability, construction bids should not only cover these costs but also include a margin for profit, enabling the business to reinvest and grow.

To calculate your profit, subtract your total expenses (including overhead) from your total revenue. For example, if your revenue is $500,000 and your total expenses, including overhead, amount to $450,000, your profit would be $50,000.

It's important to set a target profit margin to guide your pricing and ensure profitability. A minimum net profit objective of 8% is recommended, with 10% being average and 15% considered ideal. To achieve your desired profit margin, you may need to adjust your pricing or find ways to reduce overhead expenses.

To summarise, understanding and effectively managing your overhead and profit expenses are critical to the success of your construction business. By carefully tracking and allocating these expenses and setting clear profit margin targets, you can make more informed decisions about pricing and ensure the long-term viability of your business.

The Perils and Pitfalls of Insurance: Understanding the Risks Covered by Your Policy

You may want to see also

When to hire a public adjuster

Hiring a public adjuster is a good idea when you need help understanding the language of your insurance policy, want assistance with filing a claim, or feel that your insurance company's payout is unfair. Public adjusters are licensed professionals who work exclusively for policyholders and can help ensure that your claim is settled in a fair and timely manner. Here are some scenarios in which hiring a public adjuster may be beneficial:

- Large, Complex, or High-Value Claims: If you are filing a large or complex insurance claim for significant damage to your home, such as fire damage, hiring a public adjuster can be advantageous. They can help you navigate the complexities of the claim process and ensure your interests are represented.

- Disputed Assessment: If you disagree with the assessment performed by your insurance company's adjuster or feel that your claim has been underestimated, a public adjuster can provide an independent evaluation of your property loss. They can also assist in negotiating with your insurance company to achieve a fairer payout.

- Lack of Confidence or Understanding: Public adjusters can be especially helpful if you don't fully understand the language or depth of coverage of your insurance policy. They are trained to interpret policy language and can help you maximize your claim settlement.

- Time Constraints: If you don't have the time or energy to deal with the insurance claims process, a public adjuster can be a valuable asset. They can handle the paperwork, communications, and negotiations with the insurance company, allowing you to focus on other priorities, such as recovering from your loss.

- Inadequate Settlement or Delayed Response: When you feel that your insurance company is not responding in a timely manner or is not adequately evaluating your claim, a public adjuster can step in. They can take over the task of communicating with the insurance company and work to get you a more satisfactory settlement.

- Expert Opinion: Public adjusters are experts in the field and often have construction or related experience. They can identify structural damage, assess losses, and help you claim the correct amount of insurance money. This is especially useful if the damage to your property is severe.

- Quick Payoff Offers: Be cautious of quick settlement offers from insurance companies, as they may pressure you to accept a lower payout. A public adjuster can review these offers and ensure you are not being taken advantage of.

It's important to note that public adjusters typically charge a fee for their services, often a percentage of the total claim payout. However, they can save you money in the long run by helping you secure a fair settlement. Remember, you have the right to hire a public adjuster to advocate on your behalf and ensure your best interests are represented throughout the claims process.

Maximizing Reimbursement: Navigating Insurance Billing for Surgery at ASCs

You may want to see also

Protecting your payment rights

Get Everything in Writing:

Having a solid, legally binding contract is crucial. Ensure your contract includes project details, duties, timelines, payment terms, methods, and termination clauses. Get all agreements in writing, including any changes or additions to the original scope of work.

Understand Your Rights:

As an independent contractor, you have the right to make decisions about how and when you work. You are your own boss and should not allow clients to control your business or treat you as an employee. Know your legal rights and tax responsibilities to avoid being taken advantage of.

Choose Your Clients Wisely:

Trust your instincts when interacting with potential clients. If something feels off, consider walking away. It's often better to pass on a job than deal with a difficult or unreliable client.

Get Paid Upfront:

Consider asking for a percentage of the overall fee as a non-refundable deposit. This protects you in case the client backs out or payment issues arise. The deposit size can range from 10-50%, depending on the work and your location.

Communicate and Inspect:

Keep lines of communication open with clients, especially regarding expectations and satisfaction with your work. Face-to-face conversations are best for addressing concerns and finding solutions. Always inspect the work and ensure it meets your standards before agreeing to payment.

Protect Your Lien Rights:

Sending preliminary notices is crucial for protecting your lien rights and speeding up payment. These notices improve communication, establish your professionalism, and set payment expectations. They also remind involved parties of your rights and can be sent before or after completing the project.

Be Aware of "Direction to Pay":

Some contractors use a document called "Direction to Pay" or "Direct Payment Authorization," which allows them to bill insurance companies directly. However, homeowners should be cautious when signing this as they may unknowingly agree to pay any portion of the invoice not covered by insurance.

Know Your Legal Options:

If payment issues persist, understand your legal options, such as filing a mechanics lien, breach of contract claim, or prompt payment claim. Consult a lawyer specialising in construction law to guide you through the process.

Enforce Your Business Rights:

If a client fails to pay for work performed, you have the right to sue for breach of contract. Knowing your rights and enforcing them is crucial for protecting your payment as a contractor.

Remember, protecting your payment rights involves understanding your legal rights, having clear contracts, and taking proactive steps to secure compensation for your work.

Negotiating Power: Strategies for Requesting Lower Insurance Premiums

You may want to see also

Permission to do your own repairs

Another important consideration is whether it is legal for you to do the repairs. Depending on how serious the damage is and the laws where you live, you may need to get a permit from your city or have a license to carry out the necessary repairs. Your city may require all electrical work to be done by a licensed electrician, for example. If you can't get these approvals, you may not be legally allowed to do the repairs yourself, so check with your local department of buildings or development services to see what permissions are necessary.

If you have a mortgage on your home, your lender may also have a say in who performs the repairs. It is common for mortgage contracts to include a clause stating that the lender must be named on insurance claim checks. In this case, the bank will usually place the money in escrow and pay the contractor directly once the repairs are completed. Since the bank controls the money and has an interest in making sure your house is repaired well, it may not allow you to do the work yourself.

Even if you are given permission to do your own repairs, there are several things to keep in mind. Firstly, consider the financial costs, local regulations, and, most importantly, the safety of the work. Repairing a home can be dangerous, especially if you are inexperienced, so it is best to leave it to the professionals if the work involves anything hazardous like electrical systems. You should also assess whether the amount of money you'll save is worth the time and effort, especially if you are not an accomplished DIYer.

It is also important to be honest with your insurance company about your plans to do the repairs yourself. While doing the work yourself may save you money, it is not always the best option and could end up costing you more in the long run if something goes wrong.

Understanding Extended-Term Insurance: Unraveling the Dividend Option Mystery

You may want to see also

Frequently asked questions

A "Direction to Pay" form is a document that gives contractors the right to bill insurance companies directly for their repair services. By signing this form, customers also agree to pay the portion of the contractor's invoice that the insurer does not cover.

Overhead and Profit Expense (O&P) is intended to cover the general contractor's overhead and operating costs, as well as profit. It is typically estimated at 20% of the total amount of the contractor's own rebuild or renovation estimate.

A mechanics lien is a contractor's best protection against non-payment. It is a legal claim against a property that gives the contractor the right to enforce the lien and foreclose on the property to collect payment.

A "Notice of Intent to Lien" (NOI) is a notice that details how close a contractor is to placing a lien against a customer's home. Sending an NOI to the customer's mortgage company or bank is an effective way to speed up the payment process.

A "Direction to Pay" form is a document that gives contractors the right to bill insurance companies directly. By signing this form, customers also agree to pay any portion of the contractor's invoice that is not covered by the insurance company.