When you receive an auto insurance check, the process of cashing it can vary depending on several factors, including the type of claim, the number of parties listed on the check, and the insurance company's procedures. In this paragraph, we will discuss the steps involved in endorsing and cashing an auto insurance check, including the requirements for signatures, the role of lienholders, and the options for utilizing the insurance payout.

When you receive an auto insurance check, it is important to carefully review the payees listed on the check. In some cases, the check may be made out to you alone, especially if you are the sole owner of the vehicle. In this case, you typically have the freedom to decide how to use the funds, whether it is for repairing the vehicle or other relevant costs. However, it is essential to ensure that the funds are utilized responsibly and in line with the intended purpose. On the other hand, if there are two parties listed on the check, such as yourself and a lienholder or a repair shop, both signatures are usually required to endorse and cash the check. This is to ensure that the funds are used for their intended purpose, which is often to repair or replace the vehicle. The process of obtaining signatures from all parties and cashing the check can sometimes be time-consuming, especially if the check needs to be mailed between parties. Additionally, there may be state laws or insurance company requirements that dictate how the funds can be used. For example, some states require a two-party endorsement to ensure that the funds are used for repairs, while other states allow more flexibility in how the insurance payout is utilized. Understanding your insurance policy and your rights is crucial before cashing an auto insurance check, as cashing the check may waive your right to receive additional compensation for the same incident.

| Characteristics | Values |

|---|---|

| Who the check is made out to | You, the approved body shop, the lienholder, or a combination of these |

| What to do with the check | Cash it, use it to pay for repairs, cover medical expenses, or other relevant costs |

| Cashing process | Get the correct endorsements, then cash the check at a bank or credit union |

| Cashing location | Bank or credit union |

| Check expiration | Usually 60 days |

| Check usage | Depends on whether you own the car outright, or have a loan or lease |

What You'll Learn

What to do if the check is made out to two parties

If the auto insurance claim check is made out to two parties, the first step is to check whether the names are joined with "and" or "or". If “or” is present, you should be able to cash the check alone. If the names are joined with "and", you may be expected to complete the repairs at the named body shop by signing the check over to them.

In some cases, the check may be made out to you and the approved body shop. Auto insurers tend to issue two-party checks to reduce the chances that the funds are used for something other than the intended repair. However, the check is not always written to you and the mechanic. In some situations, such as a total loss, the check might be written out to you and your lender, and you will be expected to use the check to help pay off your auto loan.

If the check is made out to you and your auto loan provider, you might be unable to access the funds from the check by yourself. Because it includes both of your names, the check will likely need to be endorsed by both you and your lender. Once the check has been sent to your lender and has the appropriate signatures, it can be cashed and used to pay toward your car loan or pay it off entirely.

If the check is for a repair rather than a loan payoff, you will need to get the lienholder (or leaseholder, if it is a lease) to sign the check, which could take several weeks if handled by mail. Here are the steps you can follow:

- Send the lienholder the check.

- Have the vehicle repaired.

- Take your vehicle to a dealership when repairs are complete and ask a representative to inspect the repair and sign off on it.

- Send the lienholder the statement from the dealer, repair bill and photos.

- Wait for the lienholder to review your documents, sign off on the check and mail it back to you.

- Cash the check and pay the repair shop when you receive it.

New York Auto Insurance: Understanding State-Mandated Coverage

You may want to see also

How to cash a check with a lienholder

If you've taken out a loan to buy a car, you don't fully own the vehicle until you've paid off the loan. The lender has a financial stake in the car, making them the lienholder. In the event of damage to your car, the insurance company will often issue a "two-party" check, which includes both your name and the lienholder's name. This is to ensure that the funds are used to repair or replace the vehicle and protect the lienholder's interest.

Contact Your Lienholder

The first step is to get in touch with your lienholder, which could be the bank or financial institution that provided the loan. Explain that you have received an insurance check and request their cooperation to cash it. Provide them with relevant details such as the claim number and the amount. Be prepared to answer any questions about the nature of the loss and the required repairs. Ask about the specific steps and documentation needed to endorse the check.

Provide Necessary Documentation

Gather and submit any requested documentation, which may include proof of insurance coverage, damage assessment, repair estimates, and proof of ownership. This documentation helps verify the validity of the claim and ensures that the funds will be used appropriately.

Follow Lienholder Instructions

Pay close attention to the lienholder's instructions regarding endorsing the check and allocating the funds. They may provide specific forms or procedures to follow. Follow these instructions carefully to avoid processing delays.

Submit the Check

Once you've completed the necessary paperwork and endorsed the check according to the lienholder's instructions, submit the check securely, including any required documentation. Keep a copy of the check and documents for your records, and use a secure and traceable mailing method.

Monitor Progress

Stay in regular communication with the lienholder to track the progress of the check. Keep a record of important dates, maintain open lines of communication, and promptly provide any additional information they request.

Communicate with Lienholder and Insurance Company

Effective communication with both the lienholder and the insurance company is crucial. Proactively reach out, provide updates, and address any concerns or issues. Keep a record of all conversations, dates, names of representatives, and details of discussions.

Release of Funds

Once the lienholder has processed the check and completed the necessary verifications, they will confirm that the funds are ready for release. Choose your preferred payment method, ensure the accuracy of your information, and monitor your account for the arrival of the funds.

Unmarried Females: Higher Auto Insurance Rates?

You may want to see also

What to do if the check is made out to a lienholder

If a car insurance check is made out to you and your auto loan provider, you might not be able to access the funds from the check by yourself. This is because the check includes both your names, and so it will likely need to be endorsed by both you and your lender. Once the check has the appropriate signatures, it can be cashed and used to pay off your car loan or pay it off entirely.

However, if the check is for a repair rather than a loan payoff, you will need to get the lienholder (or leaseholder, if it is a lease) to sign the check, which could take a few weeks if handled by mail. Here is a step-by-step process for this scenario:

- Send the lienholder the check.

- Have the vehicle repaired.

- Take your vehicle to a dealership when repairs are complete and ask a representative to inspect the repair and sign off on it.

- Send the lienholder the statement from the dealer, the repair bill, and photos.

- Wait for the lienholder to review your documents, sign off on the check, and mail it back to you.

- Cash the check and pay the repair shop when you receive it.

It's important to note that if your vehicle was leased or financed, your lienholder may have stipulations for how the check can be used and may require proof that the damage was repaired. If your vehicle was totaled and you receive a check for the loss, you will be responsible for paying your lender the money owed to them.

Insuring Teen Drivers: What You Need to Know

You may want to see also

What to do if the check is made out to a third party

If the auto insurance check is made out to a third party, it's likely because the other driver was at fault and their insurance is paying the claim. This is known as a "third-party" claim, where you, the damaged party, are seeking payment from the at-fault driver and their insurance company, with whom you have no contractual agreement.

Since there's no contractual agreement, the at-fault driver's insurance company is not obliged to pay anyone other than you, so the settlement check should be made out in your name alone, even if there's a lien on your car. However, if you have a car loan, the payment is typically made out to both you and the lienholder, who also signs the check to ensure the money is used for repairs.

If your car is financed, the lender will usually make the check out to you and the lienholder. In this case, both parties must endorse the check before it can be cashed. The lienholder will want to ensure that the vehicle is repaired to their standards and may require the use of original equipment (OEM) parts rather than aftermarket.

If your vehicle is a total loss, the insurance company will write the check for the vehicle's actual cash value (ACV) minus your deductible and send it to you. You will then sign the check and forward it to your lender to pay off the loan.

If the third-party insurance check is made out to you alone, you may have the option to decide how to use the money. However, if you have a lease or loan, your lienholder may require proof that the damage was repaired and may demand the money owed to them.

Teen Driver's Insurance Premiums: The Road to Lower Rates

You may want to see also

What to do if the check is made out to you

If the auto insurance check is made out to you, you typically have the freedom to decide how to utilize the funds. You can cash the check and use the money as needed, whether it's for repairing the vehicle, covering medical expenses, or any other relevant costs. However, it's important to ensure that you're using the insurance check responsibly and in line with the purpose for which the insurance payout was intended.

If you own your vehicle outright, you can use your car insurance check to pay for its repairs or cash the check if you have already repaired the vehicle. If the check is made out for a total loss, you can cash it.

If you have financed your vehicle, it's common for the lender to require that you list them on your car insurance policy, which means they will also be named on claims checks. In this case, the insurance check will likely be made out to both you and the lienholder or sometimes directly to the repair facility. The check is valid only when both parties endorse it to prove that the money will be used for repairs. Remember, the lienholder has a vested interest in ensuring that the vehicle is in top-class condition at all times and may require the use of original equipment (OEM) parts rather than aftermarket.

If the check is made out to you and the approved body shop, you can determine what to do with it by checking whether the names include "and" or "or." If "or" is present, you should be able to cash the check alone. If the names are joined with "and", you may be expected to complete the repairs at the named body shop by signing the check over to them.

If the check is made out to you and your auto loan provider, accessing the funds independently may not be possible. The check will need to be endorsed by both you and your lender. Once the check has the necessary signatures, it can be cashed and used to pay toward your car loan or pay it off entirely.

Auto Insurance for Young Adults

You may want to see also

Frequently asked questions

Anyone listed as a "'payee' on the check must endorse it. This could include you, the policyholder, as well as any other individual or entity with an insurable interest in the vehicle, such as a lienholder or repair shop.

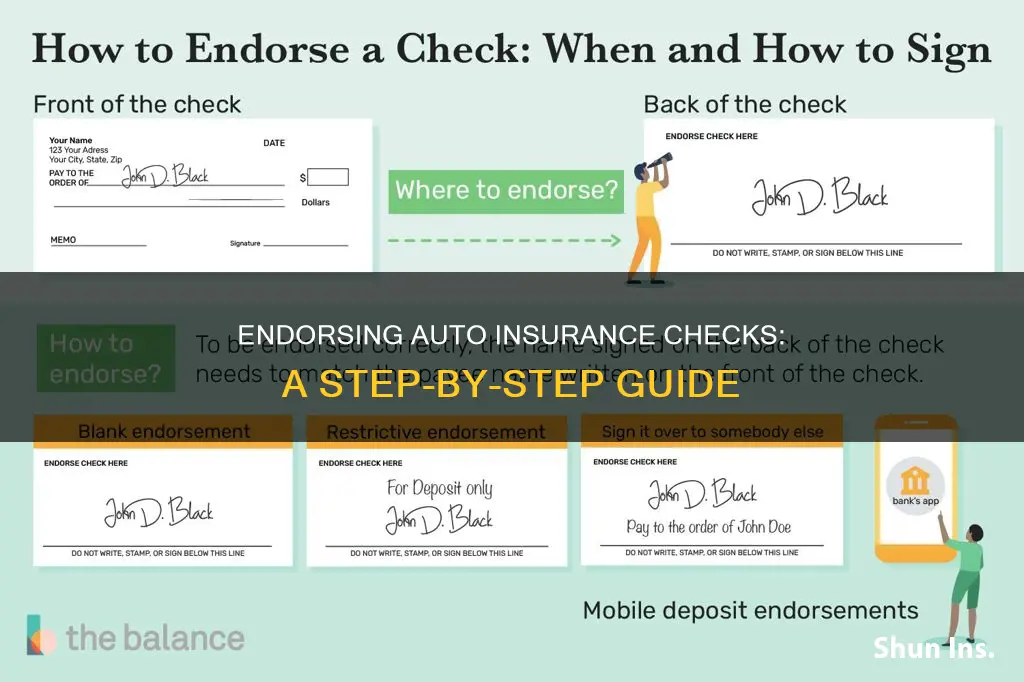

Endorsing a check typically involves signing the back of the check to indicate approval and allow the funds to be deposited or cashed.

If you own your car outright, you are generally not required to use the insurance money for repairs. However, if you have a loan or lease, your lienholder may impose restrictions and require proof of repairs.

No, if there is a lienholder listed on the check, their endorsement is required as they have a vested interest in ensuring the vehicle is properly repaired.

Both parties listed on the check should endorse it and then visit the bank together to receive the funds.