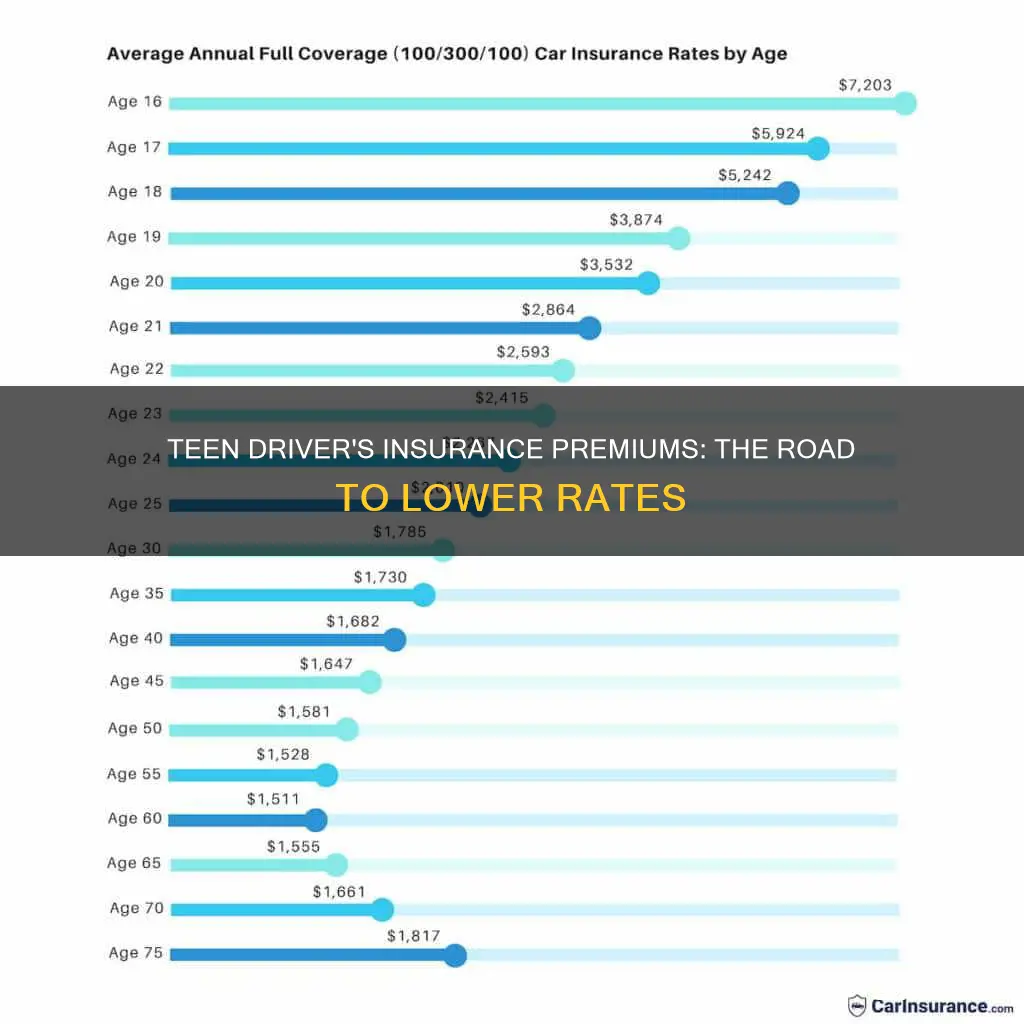

Auto insurance rates are highest for teens and young adults due to their increased likelihood of being involved in accidents. As drivers age, their insurance rates tend to decrease, with the most significant drops occurring around the ages of 19, 21, and 25. At 25, drivers are considered less risky, and insurance rates stabilise or decrease slightly until the age of 65. However, it's important to note that insurance rates can also be influenced by factors such as driving history, gender, and location.

| Characteristics | Values |

|---|---|

| Age when auto insurance starts to drop | Between 18 and 25 |

| Average annual drop in insurance rates | $814 between the ages of 16 and 21 |

| Average annual drop in insurance rates for 18-year-olds | $1,595 |

| Average annual drop in insurance rates for 25-year-olds | 9% |

| Average monthly rate for 16-20-year-olds | $396 |

| Average monthly rate for 25-year-olds | $194 |

| Average monthly rate for 30-65-year-olds | $154 |

| Average cost of car insurance for 18-year-old males | 15% more than for females |

| Average cost of car insurance for 50-year-old males | $8 more than for females |

What You'll Learn

Auto insurance rates for 18-year-olds

Factors Affecting Insurance Rates for 18-Year-Olds

Age

Age is one of the most significant factors in determining insurance rates. Younger drivers are generally more likely to have accidents or take risks on the road. As a result, insurers frequently charge more to insure teen drivers to offset the higher costs associated with claims.

Gender

In most states, gender is also used as a factor when determining insurance rates. Men tend to have higher rates than women due to a greater propensity for risky driving. However, this difference narrows as drivers age.

Driving Record

A clean driving record is essential for keeping insurance rates low. Accidents, speeding tickets, and other traffic violations can lead to higher insurance rates, with some violations affecting rates for up to three years.

Credit Score

In many states, an individual's credit score can also impact their insurance rate. A higher credit score may result in lower insurance rates, as it reflects financial responsibility and stability.

Education

Some insurance companies offer lower rates to students who can maintain a certain grade point average, usually a "B" average or above. This is because students with higher grades are seen as more responsible and less likely to engage in risky behaviour.

Marital Status

Insurance providers often consider married individuals to be safer drivers and offer them lower rates. This is because married people are perceived to be more financially stable and likely to drive more carefully.

Driving Experience

While age is a factor, the number of years an individual has been driving is also important. For example, a 26-year-old who has been driving for a decade will likely have lower insurance rates than an 18-year-old who has been driving for only a few years.

Ways to Save on Auto Insurance for 18-Year-Olds

Student Discounts

Many insurance companies offer discounts for students who maintain good grades, assuming that they are more responsible and less likely to take risks while driving.

Driver Training Discounts

Taking a defensive driving or driver training course can help lower insurance rates, as it demonstrates a commitment to safe driving.

Usage-Based Insurance

Signing up for a usage-based insurance program can provide discounts for safe driving habits. These programs monitor driving behaviour and reward those who drive safely.

Policy Bundling

Bundling auto insurance with other types of insurance, such as home insurance, from the same company can often result in lower rates for both policies.

Comparison Shopping

Comparing rates from multiple insurance providers can help identify the most affordable option. Insurance rates can vary significantly between companies, so it is beneficial to shop around.

Comparing Vehicle Insurance: A Quick Guide

You may want to see also

How auto insurance rates decrease over time

Auto insurance rates decrease over time, but the extent and speed of the decrease depend on several factors. The most significant factor is age, with rates tending to decrease as drivers get older and gain more experience.

Age

Younger drivers, especially teens, typically have the most expensive car insurance rates due to their lack of experience behind the wheel, which is seen as a risk factor by insurance companies. As a result, insurance rates usually decrease gradually as drivers age, with significant drops often occurring around the ages of 18, 19, 21, and 25. The rates then remain relatively stable until the driver reaches their senior years.

Driving Record

Maintaining a clean driving record is crucial for keeping insurance rates low. Accidents, speeding violations, reckless driving, and driving while intoxicated can all lead to increased premiums. Most tickets, claims, and citations will stay on your insurance record for three years, impacting your rates during that time. However, insurance companies may increase your rates after a single incident, especially if it is a major one. Therefore, it is essential to drive safely and maintain good driving habits to minimize the chances of accidents and violations.

Insurance Company

Switching insurance companies can also help lower your rates. Different insurance providers use different rating factors and methods to calculate risk, so shopping around and comparing quotes from multiple companies can help you find more affordable coverage. Additionally, insurance companies may offer introductory discounts or other promotions that can lower your rates.

Other Factors

Several other factors can affect your auto insurance rates over time, including:

- The car you drive: Newer cars tend to be more expensive to insure due to higher repair costs and an increased risk of theft.

- Number of drivers: Adding additional drivers, especially teenage drivers, to your policy can increase your rates.

- Location: Statistics and factors related to your location, such as accident rates, the number of uninsured drivers, and natural disasters, can impact your insurance rates.

- Discounts: Taking advantage of discounts offered by insurance companies, such as good student discounts, driver training discounts, and safe driver discounts, can help lower your premiums.

- Credit score: In some states, your credit score can influence your insurance rates, as it is seen as a factor in determining your financial responsibility and stability.

Insurers Return Premiums Amidst Pandemic

You may want to see also

How to save money on auto insurance

Auto insurance rates are highest for teens and young adults due to their lack of experience behind the wheel. However, there are several ways to save money on auto insurance. Here are some tips to help you get cheaper car insurance:

- Shop around for quotes: Compare rates from multiple insurance providers, as rates can vary significantly between companies. Getting quotes from several providers will help you find the best deal.

- Take advantage of discounts: Most insurance companies offer various discounts, such as good student discounts, driver training discounts, and safe driving discounts. Ask your insurance agent about any applicable discounts and check the company's website for more information.

- Maintain a clean driving record: Safe drivers pay significantly lower premiums than those with violations. Avoid speeding tickets, accidents, and other traffic violations to keep your rates low.

- Improve your credit score: In most states, insurance companies use credit scores as a factor in determining insurance rates. Improving your credit score can help lower your insurance premiums.

- Bundle your insurance policies: Consider bundling your auto insurance with your homeowner's or renter's insurance. Many companies offer discounts when you purchase multiple types of insurance from them.

- Increase your deductible: Raising your deductible will lower your insurance premium. However, make sure you can afford to pay the higher deductible in the event of a claim.

- Drop unnecessary coverage: If your car is older or has a low value, consider dropping collision and comprehensive coverage. These coverages may not be worth the cost if your car is not worth much.

- Choose a cheaper car to insure: Certain vehicles are cheaper to insure than others. When buying a car, compare insurance rates for different models to find one with lower insurance costs.

- Consider usage-based insurance: If you don't drive a lot, you may benefit from usage-based or pay-per-mile insurance. These programs track your driving behaviour and offer discounts for safe driving.

- Take a defensive driving course: Completing a defensive driving course can help lower your insurance rates. Some states even offer significant discounts for motorists who take state-approved courses.

Auto Insurance: Scratches Covered?

You may want to see also

Why auto insurance rates increase for seniors

While auto insurance rates are highest for teens and young adults, they also increase for seniors. Here are some reasons why:

Higher Risk of Accidents

According to the Insurance Institute for Highway Safety (IIHS), older drivers may have a higher risk of being involved in accidents than some younger adult drivers. This is further supported by data from the National Household Travel Survey, which found that the crash rate per mile was 1.5 times higher for 16-year-old drivers than for 18 to 19-year-olds.

Increased Severity of Injuries

The Centers for Disease Control and Prevention (CDC) notes that older adults are more prone to serious injuries in the event of an accident. This can lead to more costly hospital bills, which insurance companies have to take into account when setting rates.

Declining Physical Abilities

As people age, they are more likely to experience declining vision, memory impairments, and mobility issues, all of which can negatively impact their driving abilities. This increased risk of accidents and injuries leads to higher insurance rates.

Medication Side Effects

Seniors are also more likely to be taking medications that can impact their reaction time and hand-eye coordination, further increasing the risk of accidents.

Age-Related Factors

In addition to physical changes, aging-related factors like vision or hearing loss and slowed response time can make seniors more likely to get into accidents.

Higher Fatality Rates

According to AAA, the chance of a fatal crash increases at age 75 and spikes considerably at age 80, leading to sharp increases in auto insurance rates.

While auto insurance rates may increase for seniors due to these factors, it's important to note that not all insurance companies use age as a rating factor. Additionally, there are ways for seniors to save on their auto insurance, such as taking advantage of discounts, maintaining a safe driving record, and comparing rates from different providers.

Vehicle Licence: Insurance's Missing Piece

You may want to see also

How to get cheaper auto insurance for young drivers

Young drivers are considered high-risk by auto insurance providers due to their lack of experience behind the wheel, and this is reflected in their insurance premiums. However, there are ways to get cheaper auto insurance for young drivers. Here are some tips to help you get started:

Shop Around for the Best Rates

Don't just settle for the first insurance company you come across. Take the time to request quotes from various insurers and compare their costs and coverages. This will help you find the most affordable option that suits your needs. Keep in mind that rates can vary significantly from one insurer to another.

Stay on Your Parent's Policy

If possible, consider staying on your parent's auto insurance policy instead of getting your own separate policy. This can be a great way to save money, as your parents may already be established with a company and eligible for various discounts. Being added to an existing policy can also help you benefit from any multi-vehicle or multi-driver discounts they may have.

Choose the Right Car

Insurance premiums are based in part on the car being covered. Opting for an older, more affordable car with good safety features can help lower your insurance costs. Look for vehicles with airbags, anti-lock brakes, power steering, and a seatbelt alarm. These safety features reduce the risk of accidents and can result in lower monthly premiums.

Ask About Discounts

Inquire about potential discounts with your insurance provider. Some common discounts for young drivers include good student discounts, driver training discounts, and safe driver history discounts. If you're a full-time student, you may also be eligible for insurance discounts.

Review Your Coverage and Deductibles

Consider adjusting your coverage and deductible levels to save money. For example, you may want to raise your deductible, which will lower your premium. Just remember that the deductible is the amount you'll need to pay in case of a claim before your insurer covers the rest. Additionally, if you have an older vehicle that's paid off or isn't worth much, you might consider dropping full coverage and switching to liability coverage instead.

Use Technology to Your Advantage

Adopting specific technology, such as telematics apps or devices, can help you monitor your driving habits and generate valuable data for insurance companies. Many insurers offer discounts for drivers who agree to use these tracking tools, as it allows them to assess your driving behaviour and reward safe practices.

By following these tips and comparing options, young drivers can find ways to reduce their auto insurance costs and secure more affordable coverage. It's important to remember that insurance rates can vary based on individual factors, so it's always a good idea to shop around and explore all available options.

Infinity's Gap Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Yes, auto insurance rates tend to decrease as you get older, with the most significant drops occurring at ages 19 and 21. This is because younger drivers are considered riskier to insure due to their inexperience.

Other factors that can impact auto insurance rates include gender, driving experience, driving history, and credit score. Male drivers tend to have higher rates due to a greater propensity for risky driving behaviour. Additionally, drivers with a history of accidents, violations, or claims on their record will typically pay higher rates.

To lower your auto insurance rates, it is essential to maintain a clean driving record and improve your credit score. Taking a defensive driving course, seeking out available discounts, and shopping around for quotes from multiple providers can also help reduce your insurance costs.

The cost of auto insurance varies depending on age, gender, and other factors. For 18-year-old drivers on their own policy, the average annual cost is around $2,014 for full coverage and $622 for minimum coverage.