Liability car insurance is a mandatory part of car insurance in most states. It covers injury and damage caused by the policyholder in a car accident, as well as the cost of settling lawsuits brought against them as a result. Liability insurance is broken down into bodily injury liability and property damage liability. The former covers the cost of the other party's injuries, including emergency care, continued medical costs and lost wages, while the latter covers the cost of damage to the other party's property, including their vehicle, buildings, guardrails, utility poles and fences. Liability insurance does not cover damage to the policyholder's own vehicle, for which separate collision coverage is needed.

| Characteristics | Values |

|---|---|

| What is liability insurance? | A mandatory part of car insurance in most states. It covers injury and damage you cause in a car accident, as well as the cost to defend or settle lawsuits brought against you because of the accident. |

| What does liability insurance cover? | Injury and damage you cause in a car accident, including medical expenses, property damage, and legal expenses. |

| What doesn't liability insurance cover? | Damage caused by intentional acts, damage to your own vehicle, damage to vehicles insured on your policy, and injuries to passengers in your vehicle. |

| How much does liability insurance cost? | The average cost for minimum coverage in the US is $644 per year, while full coverage costs an average of $2,314 per year. |

| How to calculate the amount of liability insurance you need | Consult a licensed insurance professional to determine how much coverage you need based on your net worth and financial situation. |

| Best providers for liability insurance | Varies depending on individual needs; consider companies with available discounts and third-party rankings. |

What You'll Learn

Understanding the difference between liability insurance and other types of car insurance

Liability insurance is a type of car insurance that covers the costs of injuries and damages you cause to another vehicle or another person's property. It does not cover damage to your own car. It is required in most states and protects you from financial risk in the event of an accident.

Full coverage insurance, on the other hand, includes liability coverage as well as comprehensive and collision coverage, which protect your own vehicle in the event of a collision or non-collision incident, such as theft, fire, or vandalism. Full coverage insurance is generally more expensive than liability-only insurance but offers more financial protection. It is often required if you lease or finance your vehicle.

In addition to liability, comprehensive, and collision coverage, there are several other types of optional car insurance coverages you can add to your policy, including:

- Personal injury protection (PIP) or medical payments coverage (MedPay): Covers medical expenses for you and your passengers after an accident, regardless of who was at fault.

- Uninsured and underinsured motorist coverage: Covers expenses if you are hit by a driver who does not have insurance or has insufficient insurance to cover the costs of the accident.

- Collision coverage: Pays for damage to your car after a collision, regardless of who was at fault.

- Comprehensive coverage: Pays for damage to your car from non-collision incidents such as weather, fire, or vandalism.

- Rental reimbursement: Covers the cost of a rental car while your car is being repaired.

- Roadside assistance: Covers the cost of emergency aid if you are stranded on the road.

- Gap insurance: Covers the difference between the actual cash value of your car and the amount you owe on a loan or lease if your car is totaled or stolen.

When deciding between liability and full coverage insurance, consider the level of protection you want for yourself, others, and your vehicle, as well as your financial situation and the requirements of your state.

Unearned Gap Insurance: What You Need to Know

You may want to see also

What liability insurance covers and what it doesn't

Liability insurance is a mandatory part of car insurance in most states. It covers injury and damage caused by the policyholder in a car accident, along with the cost of defending or settling lawsuits brought against them as a result. It is typically broken down into two categories: bodily injury liability and property damage liability.

What Liability Insurance Covers

Bodily Injury Liability

- Emergency medical expenses, including an ambulance, an emergency room visit, and hospital care

- Ongoing medical expenses, such as doctor visits and rehabilitation

- Lost wages

- Legal expenses, like lawsuits and attorney and court fees

Property Damage Liability

- The other party's vehicle damage

- The cost for the other party to rent a replacement vehicle while repairs are completed

- Damage to buildings, homes, businesses, fences, mailboxes, and other structures

- Lost business revenue due to physical storefront damage

- Related legal expenses, such as court and attorney fees

What Liability Insurance Doesn't Cover

- Damage caused by intentional acts

- Damage to any vehicles insured on your policy if they are damaged in an accident

- Damage to your own vehicle or a vehicle owned by a family member who lives in the same household as you

- Injuries to passengers in your vehicle

Mas Auto Insurance: The Evolution of Their Rating System

You may want to see also

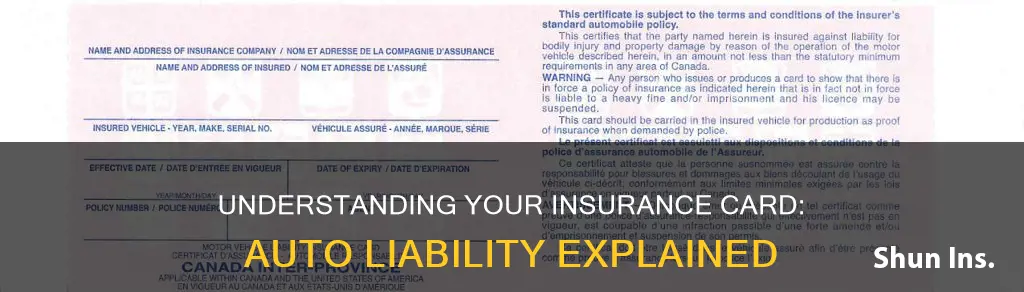

How liability insurance works

Liability insurance is a mandatory part of car insurance in most states. It covers injury and damage caused by the policyholder in a car accident, as well as the cost of defending or settling any lawsuits brought against them as a result of the accident. It is broken down into two categories: bodily injury liability and property damage liability.

Bodily injury liability covers the cost of other parties' injuries that are caused by the policyholder when they are at fault in an accident. This can include emergency care, continued medical costs, lost wages, and legal expenses. Property damage liability covers the cost of damage to other parties' property when the policyholder is at fault in an accident. This includes damage to vehicles as well as other types of property such as buildings, guardrails, utility poles, and fences. It is important to note that liability insurance does not cover damage to the policyholder's own vehicle or property.

Liability insurance is typically included as standard in car insurance policies and is required in almost every state to legally operate a vehicle. However, even in states where it is not required, having this coverage can provide peace of mind and protection in the event of a future at-fault accident. While purchasing only the minimum liability coverage levels required by a particular state is an option, it could leave the policyholder vulnerable to potentially devastating financial loss due to the rising costs of medical care and litigation.

In the event of an accident, it is important to act swiftly and responsibly, especially if one only has a basic liability insurance policy. Essential steps to take include ensuring the safety of oneself and others, calling the police, gathering information from all drivers involved, documenting the accident and any property damage, and contacting one's insurance company. It is also important to familiarize oneself with the claims process and closely follow the insurance agent's instructions.

Finding Affordable Full Coverage: Unlocking the Secrets to Cheap Auto Insurance

You may want to see also

How much liability insurance you need

Liability insurance is a mandatory part of car insurance in most states. It covers injury and damage you cause in a car accident, as well as the cost of defending or settling lawsuits brought against you as a result of the accident. It is typically broken down into two categories: bodily injury liability and property damage liability.

Bodily injury liability covers the cost of other parties' injuries that you cause when you are at fault in an accident. This can include emergency care, continued medical costs, and lost wages. Property damage liability covers the cost of damage to other parties' property when you are at fault in an accident. This can include vehicle damage, as well as damage to buildings, guardrails, utility poles, and fences.

When determining how much liability insurance you need, it is important to consider your state's insurance laws, your financial situation, and your net worth. In terms of insurance laws, it is important to understand the minimum coverage required by your state, as well as whether your state is a no-fault or tort state. In a no-fault state, in addition to liability coverage, you may also be required to carry personal injury protection, uninsured motorist coverage, or underinsured motorist coverage.

Your financial situation and net worth will also play a role in determining how much liability insurance you need. If you have a tight budget, you may want to consider purchasing only the minimum coverage required by your state. However, keep in mind that this could leave you vulnerable to financial loss if you cause an accident. On the other hand, if you have a significant amount of assets, you may want to purchase more liability insurance to protect your net worth.

It is generally recommended that you have enough liability insurance to cover your net worth. Consulting a licensed insurance professional can help you determine the appropriate amount of coverage for your specific situation.

Massachusetts Auto Insurance Law: Understanding the Requirements

You may want to see also

The cost of liability insurance

Auto Liability Insurance Cost:

The average cost of minimum coverage auto insurance in the United States is $644 per year, while full coverage costs an average of $2,314 per year. Liability coverage is a mandatory part of auto insurance in most states, and it covers injury and damage caused by the insured in a car accident. The cost of auto liability insurance is influenced by factors such as age, type of car, driving history, location, and credit score.

General Liability Insurance Cost:

For small businesses, the average cost of general liability insurance is $500 annually or $42 per month. However, the cost can vary based on factors such as policy limits, location, industry, and risk factors. The cost of a $1 million liability insurance policy for small businesses is approximately $69 per month or $824 per year. The industry a business operates in has the most significant impact on premium costs, with high-risk industries paying higher premiums than low-risk ones.

USSSA and Auto Insurance: Shore Veterans' Unique Needs

You may want to see also

Frequently asked questions

Auto liability insurance is a type of car insurance that covers injury and damage caused by the policyholder in a car accident, as well as the cost of defending or settling any related lawsuits.

Auto liability insurance covers the medical expenses and property damage of the other driver and their passengers. It does not cover damage to the policyholder's vehicle or their own injuries.

Auto liability insurance is typically divided into bodily injury liability and property damage liability. Bodily injury liability covers the cost of the other party's injuries, while property damage liability covers the cost of damage to their property.

The amount of auto liability insurance you need depends on your state's minimum requirements and your financial situation. It's generally recommended to have enough liability insurance to cover your net worth.