Getting a life insurance license in Oklahoma is a four-step process that can be completed in a few weeks. First, you need to complete an Oklahoma insurance pre-license course, which costs $149 or more. Then, you must take the Oklahoma Life Insurance Licensing Exam, which costs $41 and consists of 100 multiple-choice questions. After passing the exam, you can apply for your Oklahoma life insurance license online via the National Insurance Producer Registry (NIPR). The application fee is $60 plus a $5.60 transaction fee. Finally, you need to wait for your application results, which usually takes one to five business days.

| Characteristics | Values |

|---|---|

| First Step | Decide which insurance license you need |

| Second Step | Complete a pre-licensing education course |

| Third Step | Pass the relevant Oklahoma Insurance License Exam(s) |

| Fourth Step | Submit your insurance license application |

| Fifth Step | Application Review |

What You'll Learn

Decide which insurance license you need

To get a life insurance license in Oklahoma, you must first decide what type of insurance policies you want to sell. This is because the type of insurance policies you want to sell will determine the type of license you need.

For example, if you want to sell auto, home, or business insurance, you'll need a Property & Casualty (P&C) license. If you want to sell life and health insurance, you'll need a Life and Health license. If you want to offer clients a wider range of common insurance products, you can obtain both a P&C and a Life and Health license. However, if you want to specialize in a particular type of policy, you can focus on the specific license that's relevant to that insurance type.

It's important to note that if you want to work as an insurance adjuster, you'll need to obtain a separate license, which has its own requirements.

Here's a list of the different types of insurance producer lines available in Oklahoma:

- Accident & Health or Sickness

- Variable Life and Variable Annuity

- Property / Casualty – Personal Lines

- Limited Lines Producer

Life Insurance and Disclaimers: What You Need to Know

You may want to see also

Complete a pre-licensing education course

To get a life insurance license in Oklahoma, you must complete a four-step process. While pre-licensing education is not mandatory, it is highly recommended. Here's a detailed guide on pre-licensing education courses:

Pre-licensing education courses are designed to provide you with the knowledge and tools to effectively prepare for and pass the life insurance licensing exam. These courses are self-paced and typically include study materials such as practice exams and flashcards. While not mandatory, pre-licensing education is highly recommended as it can enhance your understanding of the material and increase your chances of passing the exam on the first attempt.

When choosing a pre-licensing education course, consider factors such as flexibility, price, and the reputation of the course provider. The course should allow flexible learning and not require completion within a short time frame. While price is an important consideration, it's worth noting that cheaper options may not provide comprehensive or reliable resources. Therefore, it's advisable to opt for reputable providers with a track record of successful exam preparation.

Kaplan's online courses are a popular choice, with over 81% of readers using their programs. These courses offer a 93% pass rate and comprehensive study packages. The cost of the course starts at $149, and you can find more information on their website.

Other options for exam preparation include purchasing books or self-study materials, as well as live tutoring and study calendars. Agent Broker Training Center also offers study guides, exam prep materials, and online lectures based on actual questions that are likely to appear on the Oklahoma exam.

Benefits of Pre-Licensing Education

Pre-licensing education courses provide specific industry knowledge that will be essential for your role as a life insurance agent. The exam covers both general and state-specific sections, and the course material is tailored to ensure you are well-prepared for both. The general section focuses on basic life insurance product knowledge, while the state-specific section covers insurance concepts, terms, rules, regulations, and practices unique to Oklahoma.

By investing in a pre-licensing education course, you'll gain a solid understanding of your future duties and responsibilities as a life insurance agent. This knowledge will not only help you pass the exam but also build a strong foundation for your career.

Life Insurance in Johor Bahru: Your Ultimate Guide

You may want to see also

Pass the relevant Oklahoma insurance license exam(s)

To pass the relevant Oklahoma insurance license exam, you must first decide on the type of insurance policies you want to sell. This is because the type of insurance policies you want to sell will determine the type of license you need. For example, to sell auto, home, or business insurance, you will need a Property & Casualty (P&C) license.

- Accident & Health or Sickness

- Variable Life and Variable Annuity

- Property/Casualty – Personal Lines

- Limited Lines Producer

The majority of insurance agents will obtain a Property and Casualty (P&C) or Life and Health license. Many agents opt for both licenses to offer their clients a wider range of insurance products. However, if you want to specialize in one type of policy, you can focus on the specific license relevant to that insurance type.

It is important to note that if you plan to work as an insurance adjuster, you will need to obtain a separate license.

Once you have decided on the type of license you need, you can prepare for the exam. Oklahoma does not require candidates to complete pre-licensing education to sit for the state exam. However, it is highly recommended that you complete an educational course before attempting the exam, as it can increase your chances of passing on your first try.

You can prepare for the exam by reviewing the Candidate Information Bulletin (CIB) and the Examination Content Outline (ECO), which provides detailed information on the exam process and subject outline, respectively. You can also purchase self-study materials, such as the Kaplan study manuals, which are available in physical and electronic formats. These manuals are the primary source of material used in exam development and can be useful for both Adjusters and Producers.

When you are ready to take the exam, you can schedule it by creating an account on the PSI Exams website, choosing a test center, and selecting a date and time. You can also book an exam over the phone by calling (833) 333-4754. The exams are administered by PSI and cost $38 to apply for (except for the Bail Bondsman exam, which costs $100). Keep in mind that you will need to bring a valid form of government-issued photo identification to the exam, such as a driver's license, passport, or military ID.

The Oklahoma insurance licensing exams are multiple-choice and are typically 105 total questions (100 scored, 5 pretest) with a time limit of 2 hours and a passing score of 70%. The breakdown of the exam, including the number of questions and the passing score, may vary depending on the specific license you are pursuing.

If you do not pass the exam on your first attempt, you can retake it. There is no limit to the number of times you can sit for the exam. However, you must wait until the day after your failed attempt to call and book a new exam appointment.

Life Insurance Options for People with Health Issues

You may want to see also

Submit your insurance license application

Once you've passed your Oklahoma insurance licensing exam, you can move on to the next step: submitting your application.

In Oklahoma, applications are submitted online through the National Insurance Producer Registry (NIPR) and come with the following processing fees:

- Major Line Producers: $60

- Limited Lines Producers: $40

- Surplus Lines Producers: $100

If you've passed the licensing exams for multiple lines of authority, you'll need to submit a separate application (and pay a filing fee) for each one.

After passing your insurance exam, you'll need to wait three business days before you can submit your license application through the Oklahoma Insurance Department's website. This is the amount of time it takes for NIPR to send your exam results to the state.

If you need any support or assistance with your online application, you can contact NIPR over the phone by calling (816) 783-8500.

Application review

After submitting your application and satisfying all other requirements, all that's left to do is wait for the Oklahoma Department of Insurance to review your application.

If everything on your application has been filled out correctly, your license should be issued within five to seven days. This is the typical amount of time it takes for a license application and background check to be reviewed.

Issuing your insurance license can take longer if there are any items from your background check that need to be looked into further. However, the state will likely get in touch with you to provide some context if they run into any issues.

Once the review is complete, the state will send you an email regarding the status of your license.

Since you won't be sent a physical copy of your license by mail, you'll need to print one from the Oklahoma Insurance Department website.

Privacy Concerns: Life Insurance and Social Media

You may want to see also

Application review

After you have completed the previous steps and submitted your application, the Oklahoma Insurance Department (OID) will review your application. The OID reviews applications in the order they are received, and this process usually takes one to five business days from the date you submit your application.

Once the OID finishes reviewing your application, they will email you with their decision or ask you to provide more information. If everything on your application has been filled out correctly, your license should be issued within five to seven days. This is the amount of time it typically takes for a license application and background check to be reviewed.

It’s important to be aware that the issuance of your insurance license can take a bit longer than this if there are any items from your background check that need to be looked over. However, the state will likely get in touch with you to give some context if they run into any issues.

In any case, the state will send you an email regarding the status of your license once this review has been completed, so keep an eye out for that!

Note: Since you won’t be sent a copy of the license by mail, you’ll need to print one from the Oklahoma Insurance Department website.

After Getting Your Oklahoma Insurance License

Once you’ve passed all your exams and your licensing application has been approved, you’ll be a qualified insurance agent in Oklahoma. At this point, there are four main steps that we recommend new insurance agents take:

- Obtain any relevant securities licenses: If you’re planning on selling advanced life insurance products, you’ll need to pass the Securities Industry Essentials (SIE) exam and obtain the relevant securities licenses (e.g. Series 6, 7, and 63).

- Choose a means of selling: You’ll have to decide whether you’d prefer working as a captive agent employed by one company, or running your own business as an independent agent.

- Develop your marketing approach: To succeed as an insurance agent, you’ll need to adopt a marketing approach that’s effective for you. Finding and sticking to a niche, as well as organizing all client appointments for the start of your week, are two great ways to do this.

- Keep your license valid: In Oklahoma, you’ll be required to complete 24 hours of continuing education (except for Title Producers, who must complete 16 hours). These 24 hours should consist of three hours of ethics, two hours of legislative updates, and 19 hours of general producer education.

Lincoln Heritage Life Insurance: Can You Cancel Your Policy?

You may want to see also

Frequently asked questions

The Oklahoma Insurance Department (OID) requires you to complete a four-step process to become a life insurance agent in Oklahoma. First, complete an Oklahoma Insurance Pre-license Course (e.g. Kaplan Education Company). Second, take the Oklahoma Life Insurance Licensing Exam (Prometric). Third, complete an Oklahoma Life Insurance License Application via the National Insurance Producer Registry (NIPR). Finally, wait for your application results.

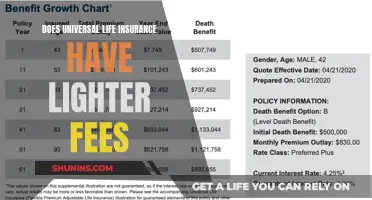

Obtaining a life insurance license in Oklahoma requires the following fees: Insurance Pre-license Education Course Fee: $149+ via Kaplan Education Company, Exam Fee: $41 via Prometric, Application Fee: $60 + $5.60 transaction fee via the NIPR.

With an Oklahoma life insurance license, you can sell life insurance policies, retirement plans, and annuities. You cannot sell other types of insurance.