Getting car insurance is a relatively simple process, but it's important to do your research and understand your needs and requirements. First, you'll need to gather information about yourself and your vehicle, including your driver's license, the vehicle's make and model, and safety features. You'll also need to decide on the level of coverage you need, including liability, comprehensive, and collision insurance. It's a good idea to compare quotes from multiple providers to find the best rate and ensure you're getting the coverage you need. You can do this through online comparison tools, captive agents, or independent agents/brokers. Once you've found the right policy, you can purchase it directly from the provider, and you'll receive proof of insurance, which you must carry with you when driving.

| Characteristics | Values |

|---|---|

| Website | www.nerdwallet.com |

| Headquarters | San Francisco, California |

| Founders | Tim Chen and Jacob Gibson |

| Year founded | 2009 |

| Type of company | Private |

| Industry | Financial services |

| Services | Insurance, banking, investing, loans, credit cards |

| Number of employees | 1,000+ |

What You'll Learn

How to get a car insurance quote

Car insurance quotes are personalised estimates of how much you'll pay for a car insurance policy. Each insurer has its own formula for calculating quotes, so no two quotes will be the same. This is why it's important to shop around and get quotes from multiple insurers.

How to get car insurance quotes

You can get auto insurance quotes online by visiting an insurer's website or working with an insurance agent or broker. It's recommended that you get quotes from several different companies so you can compare them and find the best fit for your needs and budget.

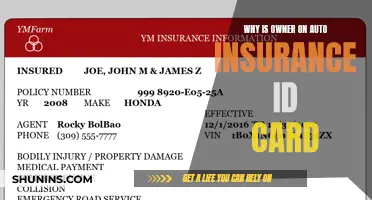

Information you'll need to provide

To get an accurate quote, you'll need to provide the following information:

- Basic personal information such as your name, address, occupation, and date of birth.

- Details about your current auto insurance policy, if you have one.

- Driver's license information for all drivers on the policy.

- Annual and current mileage, vehicle identification number, and information about safety features for the car(s) you want to insure.

- A driving history for all drivers on the policy, including any tickets, accidents, or violations within the past five years.

- The amount of coverage you need.

Where to get auto insurance quotes

There are several ways to get free car insurance quotes:

- Online or over the phone: Most companies offer free quotes through their websites or by calling them directly.

- Captive insurance agents: These agents work for a specific insurance company and can provide quotes and help you navigate your options.

- Independent insurance agents or brokers: They work with multiple insurers and can offer a wider range of options and policies.

- Comparison websites: You can use sites like NerdWallet to compare quotes from multiple insurers at once.

Tips for getting cheaper quotes

To get the cheapest car insurance quote possible, consider the following strategies:

- Shop around regularly: Compare quotes from different insurers at least once a year to find the best rates.

- Improve your credit score: A good credit score can help lower your insurance rate.

- Choose your car wisely: Certain cars are cheaper to insure than others due to factors like safety features and repair costs.

- Drive safely: A history of accidents, speeding tickets, or DUIs will increase your insurance rate.

- Look for discounts: Many insurers offer discounts for things like bundling policies, having a clean driving record, or being a member of certain organisations.

- Raise your deductible: Opting for a higher deductible can lower your monthly premium, but make sure you can afford the higher out-of-pocket cost if you need to file a claim.

Transferring Auto Insurance: A Quick Guide

You may want to see also

How to compare car insurance rates

Comparing car insurance rates can help you find the best price. Each company has its own method for setting rates, and these recipes change over time. Comparing rates from two car insurance companies may reveal vastly different results for the same driver.

Gather your information:

Have the following information on hand for a quick and easy online insurance comparison:

- Personal information, including the address, date of birth, occupation, driver's license, and marital status of everyone you want included in the policy.

- Vehicle information, including mileage, date of purchase, and vehicle identification number (VIN) for each car. If you haven't purchased the car yet, have the mileage, make, model, and year ready.

- Driving history, including all claims, violations, and tickets received over the past five years, as well as any completed driving courses.

- Current or previous insurer's name for anyone on the policy or in your household. Some insurers require coverage history, and if you want to exclude anyone living with you from the policy, you'll need to prove they have separate coverage.

Choose the right liability car insurance coverage levels:

Liability auto insurance protects you financially in the event of a serious accident by providing a cushion between your assets and the amount you're liable for. When comparing insurance rates, consider the following:

- Understand the different types of liability coverage, such as bodily injury liability, total bodily injury liability, and physical damage liability.

- Determine the appropriate liability coverage limits based on your net worth. Select coverage limits where the middle number is equal to or greater than your net worth and is also the highest number in your policy's coverage limits.

- Check your state's minimum car insurance requirements, as they vary by state. In certain states, you may be required to have additional coverage, such as personal injury protection (PIP) or medical payments coverage (MedPay).

Decide if you need full coverage car insurance:

Full coverage insurance typically refers to policies that include liability, comprehensive, and collision coverage. When deciding on full coverage:

- Consider whether you need comprehensive and collision coverage, especially if your car is leased or financed.

- Choose appropriate deductible amounts for collision and comprehensive coverage, keeping in mind that these deductibles are amounts you'll pay out of pocket for each claim.

Collect and compare car insurance quotes:

- Obtain car insurance quotes from at least two or three companies, including regional and national insurers, to ensure a comprehensive comparison.

- Ensure that each quote includes the same levels of liability and uninsured/underinsured motorist protection, deductibles, drivers, cars, and applicable discounts for an accurate comparison.

- Utilize online tools and websites that allow you to compare quotes from multiple insurers simultaneously.

Remember that car insurance rates are influenced by various factors, including age, location, driving history, vehicle type, and credit score. Shopping around and comparing rates from multiple insurers is the best way to find the most affordable and suitable car insurance policy for your needs.

Safeco's Gap Insurance: What You Need to Know

You may want to see also

How to choose an insurance company

Choosing an insurance company can be a tricky task, especially with the variety of options available. Here are some tips to help you select the right insurance company for your needs:

- Shop around and compare prices: It is important to get quotes from multiple insurance companies and compare their prices, coverage options, discounts, and benefits. This will help you find the most affordable option with the best value.

- Check for complaints: Research the insurance company's reputation and read reviews from other customers. Look for any red flags, such as a high number of complaints or negative experiences. You can check complaint data on your state insurance commissioner's website.

- Consider the financial strength of the company: Choose an insurance company with strong financial backing and a good credit rating. This indicates their ability to pay out claims. You can check financial strength ratings through agencies like AM Best, Moody's, and Fitch.

- Evaluate customer satisfaction: Opt for an insurance company with high customer satisfaction ratings, as this suggests they provide good service and handle claims efficiently. You can refer to studies by J.D. Power, which surveys thousands of customers annually.

- Look for coverage options and discounts: Select an insurance company that offers a range of coverage options to suit your specific needs. Additionally, look for companies that provide various discounts to help lower your premium, such as bundling policies or having a good driving record.

- Consider smaller insurance companies: Smaller insurance companies often offer competitive prices and can provide more personalized customer service. They may also have fewer complaints compared to larger companies.

- Check the claims process: Understand the claims process of the insurance company, including how easy it is to file a claim and the speed of their response and payout. A smooth and efficient claims process is essential when you need to utilize your insurance.

- Assess your unique needs: Consider your personal circumstances, such as your age, location, vehicle, driving history, and financial situation. Different insurance companies weigh these factors differently, so finding one that aligns with your specific needs is crucial.

Auto Insurance: Can You Trust the Seller?

You may want to see also

How to get the cheapest car insurance quote possible

Getting a good deal on car insurance can be tricky, but there are several ways to get a cheaper quote. Here are some tips to help you get the lowest rate possible.

Shop around

Even if you're happy with your current insurance company, it's always worth comparing rates from different insurers. Each company uses a different formula to calculate quotes, so you might be surprised at how much you can save by switching.

Choose a smaller, regional insurer

While Allstate, Geico, Progressive, and State Farm are some of the biggest names in car insurance, smaller, regional insurers often have higher customer satisfaction ratings and may offer lower rates.

Ask about discounts

Most insurance companies offer a range of discounts. For example, you might be able to get a discount for bundling your car insurance with another policy, such as homeowners insurance, or for insuring multiple cars. Other common discounts include those for having a clean driving record, paying your premium in full, agreeing to receive documents online, or owning a car with certain safety features.

Improve your credit score

In most states, your credit score will impact your insurance quote. Building your credit history by paying bills on time and reducing debt can help lower your insurance rate.

Skip comprehensive and collision coverage for older cars

If your car is older and has a low market value, it might not be worth paying for comprehensive and collision coverage, which covers the cost of repairing or replacing your car.

Raise your deductible

Opting for a higher deductible can lower your monthly premium, but make sure you can afford to pay more if you need to file a claim.

Consider usage-based or pay-per-mile insurance

If you don't drive much, you could save money by switching to a usage-based or pay-per-mile insurance program. These programs track your driving behavior and offer discounts for safe driving habits and low mileage.

Check insurance costs when buying a car

The type of car you drive will impact your insurance rate. Some cars are cheaper to insure than others, so it's worth considering insurance costs when choosing a new vehicle.

By following these tips, you can increase your chances of getting the cheapest car insurance quote possible. Remember to compare rates from multiple insurers and ask about any available discounts to get the best deal.

Auto Insurance and Animal Encounters: What's Covered?

You may want to see also

How to get cheap car insurance

The cost of car insurance can vary widely depending on several factors, including your age, gender, location, and driving history. Here are some tips to help you get cheap car insurance:

Shop Around for Quotes

The best way to find cheap car insurance is to compare quotes from multiple insurance companies. Get at least three quotes from different insurers to evaluate their prices and coverage options. You can use online comparison tools or work with insurance agents or brokers to get these quotes.

Choose a Higher Deductible

Opting for a higher deductible will lower your monthly premium. This means you'll pay more out of pocket if you need to make a claim, but it can reduce your overall insurance costs.

Improve Your Credit Score

In most states, insurance companies use your credit score to determine your insurance risk. Building a good credit score can help lower your auto insurance rate.

Drive Cautiously

Maintaining a clean driving record is crucial for getting cheap car insurance. Accidents, speeding tickets, and DUIs will increase your insurance rates.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, calculates your premium based on your driving behaviour. This can be a good option if you don't drive frequently or have a short commute.

Look for Discounts

Insurers often offer discounts for various reasons, such as owning a home, taking a driver's safety course, or bundling policies (e.g., combining auto and home insurance). Ask about what discounts you may be eligible for.

Choose a Cheaper Car

The type of car you drive also affects your insurance rate. Some cars are cheaper to insure due to their safety features or low theft rates.

Get Quotes Before Buying a Car

When purchasing a new or used car, consider the cost of insurance for that vehicle. Get insurance quotes for different cars to factor into your budget and choose a vehicle that is cheaper to insure.

Compare Coverage Options

When comparing insurance quotes, make sure each policy has similar liability limits and deductibles. This will ensure that you're getting an accurate idea of the cost and coverage across different insurers.

Choose a Reputable Company

While cost is important, it's also crucial to choose a reputable insurance company with good customer service. Cheap insurance may come at the cost of quality, so research the company's reputation and read reviews before committing.

Becoming an Auto Insurance Broker: Steps to Independence

You may want to see also

Frequently asked questions

You'll need to gather information about yourself and your vehicle, choose the coverage you need, compare companies and their policies, and then buy a policy.

At the very least, you should have your personal information (e.g. name, date of birth, and driver's license number). You should also know how many miles you plan on driving your car and other vehicle information like the make, model, year, and vehicle identification number.

When shopping for auto insurance, check that the coverages, deductibles, and discounts are the same for each policy you're comparing.