Driving without valid insurance can lead to serious legal and financial penalties, so it's important to keep your insurance documents up to date. If your proof of auto insurance has expired, you'll need to renew your insurance coverage and obtain a new insurance ID card. This can usually be done by logging into your online account with your insurance provider, or by contacting their customer service team. Keeping your insurance documents valid and easily accessible is essential to avoid fines, higher rates, and the inability to file an accident claim.

| Characteristics | Values |

|---|---|

| What to do if your auto insurance has expired | Contact your insurance provider, do not drive without insurance, explore renewal or new policy options, provide necessary information, and ensure continuous coverage. |

| Consequences of driving without insurance | Fines and penalties, license suspension or revocation, vehicle impoundment, legal liabilities, and jail time. |

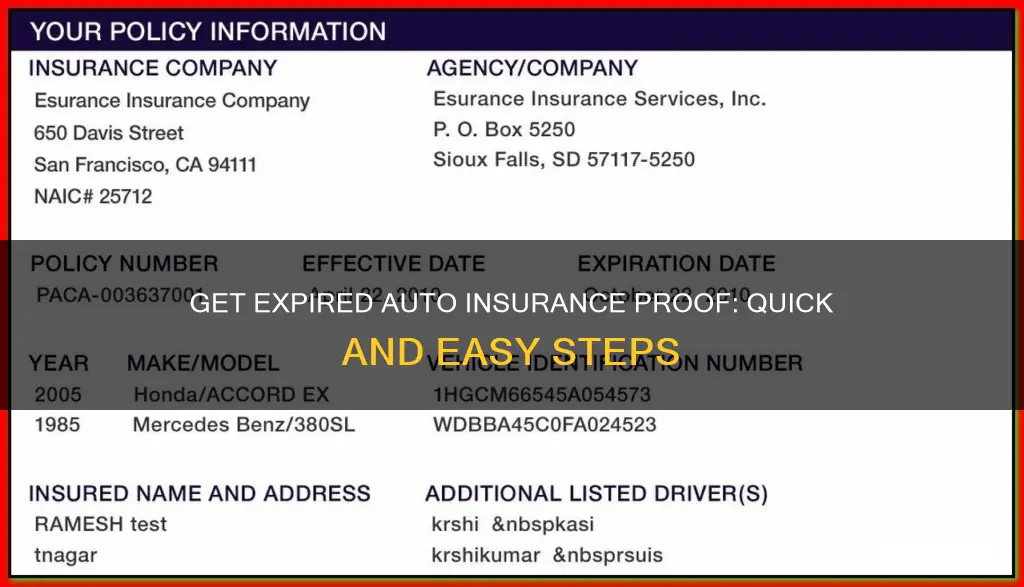

| How to get proof of insurance | Obtain it from your insurance company after buying a policy. You can get it via fax, email, or electronically through your insurance company's mobile app. |

| Information included in proof of insurance | Insurance company's name and address, effective date and expiration of the policy, policy number and NAIC number, policyholder's name, insured vehicle's year, make, model, and VIN. |

| What to do if you can't show proof of insurance | You could face fines or jail time, depending on the state. Contest the ticket by mailing a copy of your proof of insurance or by attending the court hearing. |

What You'll Learn

Contact your insurance provider

If your auto insurance has expired, it is important to act quickly to avoid any legal and financial repercussions. Here are the steps you can take to contact your insurance provider and get an expired proof of auto insurance:

- Reach out to your insurance provider: Contact your insurance company as soon as possible. Inform them about the expiration and inquire about your options to reinstate coverage. Be prepared to provide any necessary documentation or information they may request.

- Understand the consequences of a lapse in coverage: Driving without valid insurance is illegal in most states and can result in serious penalties. These consequences may include fines, license suspension, vehicle impoundment, and even jail time.

- Inquire about grace periods: Ask your insurance provider if there is a grace period during which you can reinstate your insurance without penalty. Grace periods typically last between three and ten days, but not all insurers offer them.

- Discuss renewal or new policy options: Consider renewing your policy with your current provider or exploring new insurance quotes. Compare rates and coverage options to find the best plan for your needs.

- Maintain continuous coverage: Once you have reinstated or obtained a new policy, ensure there are no gaps in coverage going forward. Set up automatic payments to avoid missing future renewal dates.

- Understand the impact on your premium: Allowing your insurance to expire before renewal may result in higher premiums when you reinstate or obtain a new policy. Insurance companies consider lapses in coverage as an increased risk, which may lead to higher rates.

- Keep necessary documents: Your insurance provider will likely require certain documents to process your request for expired proof of insurance. Keep your insurance card, policy documents, and billing statements easily accessible.

- Provide required information: Be responsive and provide any requested information or documentation promptly. This may include details about your vehicle, driving history, and previous insurance coverage.

Remember, driving without valid insurance can lead to significant legal and financial consequences. Contacting your insurance provider and taking the necessary steps to reinstate coverage is crucial to protect yourself and comply with state requirements.

Get Your Georgia Auto Insurance License: A Guide

You may want to see also

Don't drive without insurance

Driving without insurance is illegal in most US states and can lead to serious financial and legal consequences. Here are some reasons why you should not drive without insurance:

Financial Consequences

License Suspension

Driving without insurance can result in the suspension or revocation of your driver's license. This can impact your ability to drive legally and may require you to go through a reinstatement process to regain your driving privileges.

Vehicle Impoundment

If caught driving without insurance, law enforcement may impound your vehicle. This means your car will be towed and held until you can provide proof of insurance and pay any associated fines and fees.

Higher Insurance Rates

A lapse in auto insurance coverage can lead to higher insurance rates in the future. Insurance companies consider individuals with lapsed coverage as high-risk, and your rates may increase significantly when you try to obtain insurance after a lapse.

Jail Time

In some states, driving without insurance can result in jail time. This is a serious criminal consequence that can have a significant impact on your life.

Limited Recourse After an Accident

If you are uninsured and involved in an accident that is not your fault, you may still face challenges in obtaining compensation for damages. In "no pay, no play" states, uninsured drivers are prevented from suing insured at-fault drivers for non-economic damages such as pain and suffering.

What to Do if Your Insurance Has Expired

If your insurance has expired, it is crucial to act quickly to renew your coverage. Contact your insurance provider immediately and inquire about options to reinstate your policy. Avoid driving without valid insurance. If you need to obtain coverage from a new provider, compare quotes from multiple companies to find the best rates. Remember to always carry proof of your current insurance with you when driving, such as an updated insurance card.

Auto Insurance in PA: How Much Does It Cost?

You may want to see also

Explore renewal or new policy options

Renewing your car insurance is typically an easy process. Here are some tips to help you explore renewal or new policy options:

Contact your current insurer:

Before your renewal date, get in touch with your current insurance provider. They will send you a notice with updated rates and terms a few weeks before your policy expires. Review the changes and decide if you want to continue with them. If you're happy with the offer and want to stay with your current insurer, simply pay the renewal premium before the expiration date to avoid a lapse in coverage.

Shop around for quotes:

It's a good idea to compare rates and coverage options from different insurance companies. By shopping around, you can ensure you're getting the best deal for your needs. You can do this by visiting insurer websites, using online comparison tools, or contacting insurance agents.

Review your coverage needs:

Consider any changes in your life circumstances that may impact your insurance needs. For example, if you've moved to a new area, purchased a new car, or had a change in your driving record, these factors can affect your premium and coverage options. Review your coverage limits and consider if you need to make any adjustments, such as adding or removing certain coverages or increasing your liability limits.

Take advantage of discounts:

Look for opportunities to lower your premium by taking advantage of discounts offered by insurance companies. For example, you may be eligible for discounts if you have a good driving record, install safety or anti-theft devices in your car, or bundle your car insurance with other policies such as home or life insurance.

Understand the renewal process and deadlines:

Be sure to understand the steps and deadlines for renewing your policy. Some insurers may require signed forms or other actions for renewal. Pay attention to the grace period, as most insurers offer a short window of time after your policy expiration date to renew without losing coverage. If you miss the grace period, you may have to undergo a car inspection or face higher premiums.

Remember, driving without active auto insurance is illegal in most places and can result in financial and legal consequences. By proactively exploring your options, you can make an informed decision about renewing your current policy or switching to a new insurer.

Direct Auto Insurance: Grace Period?

You may want to see also

Provide necessary information

If your auto insurance has expired, it is important to take immediate action. Here are the steps you can take to provide the necessary information to your insurance provider:

Contact your insurance provider:

Reach out to your insurance company as soon as possible to inform them about the expiration. Ask about any available options to reinstate your coverage and find out what documentation or information they require from you.

Provide required documentation:

Be prepared to provide any documentation that your insurance company may request. This could include proof of your previous insurance coverage, such as your insurance ID card, policy documents, or declarations page. Keep in mind that your insurance company will have copies of all your paperwork on file, and you may also be able to access them through your online account.

Share relevant information:

Your insurance company may ask for specific details about your vehicle, driving history, or any recent accidents or claims. Be ready to provide information such as your vehicle's make, model, vehicle identification number (VIN), and any relevant dates related to your insurance coverage.

Explore renewal or new policy options:

Discuss the possibility of renewing your existing policy or explore new policy options with your insurance provider. They may offer a grace period during which you can reinstate your insurance without penalty. If you intend to switch insurance providers, be prepared to provide proof of insurance from your previous company.

Remember, it is crucial to act quickly and provide all the necessary information to your insurance company to ensure you have valid insurance coverage in place. Driving without insurance can lead to serious legal and financial consequences.

Manitoba's Cheapest Vehicle to Insure

You may want to see also

Ensure continuous coverage

Ensuring continuous coverage is crucial to avoid the legal and financial repercussions of driving without insurance. Here are some steps to ensure continuous auto insurance coverage:

Keep Track of Your Insurance Expiration Date

Mark your calendar or set reminders for your insurance expiration date. This proactive step will help you stay on top of your policy's status and prevent accidental lapses. Check your insurance card for the expiration date, as some insurers require you to print an updated card when renewing your coverage.

Set Up Automatic Payments or Renewal

Consider enrolling in autopay or autorenewal to ensure timely payment of your insurance premiums. This way, you can avoid accidental lapses due to missed payments. Many insurers offer discounts for customers who opt for automatic payments.

Understand Grace Periods and Reinstatement Options

In some cases, your insurance company may provide a grace period, typically ranging from three to ten days, during which you can reinstate your policy without penalty. Contact your insurance provider to inquire about their specific grace period policies. If your policy has been cancelled, ask if it can be reinstated by paying past-due balances, ensuring continuous coverage without any gaps.

Explore Renewal or New Policy Options

If your insurance has expired, you may be able to renew your policy with your current provider or shop for new insurance quotes. Compare rates and coverage options from different insurers to find the best fit for your needs.

Maintain Continuous Coverage

Once you have reinstated or obtained a new policy, it is crucial to maintain continuous coverage going forward. Gaps in coverage can lead to increased rates, as insurers consider uninterrupted coverage as a sign of lower risk. Avoid cancelling your old policy before your new policy takes effect to prevent even a single day of lapse.

Take Advantage of Discounts

Insurers often offer discounts for various factors, such as enrolling in autopay, holding multiple policies, insuring multiple cars, or keeping your mileage low. Taking advantage of these discounts can help offset any rate increases due to lapses in coverage.

Texas Auto Insurance Recognition: Out-of-State Policies Explained

You may want to see also

Frequently asked questions

Contact your insurance provider and inquire about any available options to reinstate your coverage. Do not drive without insurance and explore renewal or new policy options.

Yes, driving without insurance is illegal in most jurisdictions and can lead to fines, license suspension, vehicle impoundment, and legal liabilities in case of an accident.

It may still be possible to renew your policy, but this depends on the insurance provider’s policies and your specific circumstances. Contact your insurance provider as soon as possible to discuss your options.

Generally, if your policy expires before renewal, it may result in higher premiums when you reinstate or obtain a new policy, as insurance companies consider lapses in coverage as an increased risk.