Auto insurance is a contract between you and your insurance company. By applying for coverage, you agree to pay a premium to the insurance company, and in return, the company agrees to pay for covered costs associated with an auto accident once the deductible has been met under the policy terms. There are several common terms used in auto insurance that are important to understand. Here are some key terms to help you navigate the world of auto insurance:

- Liability Insurance: This provides protection in case others hold you legally responsible for bodily injury and/or damage to property resulting from a motor vehicle accident. It covers bodily injury (BI) liability and property damage (PD) liability.

- Bodily Injury (BI) Liability Insurance: This coverage pays for injuries to other people when the insured vehicle's driver is at fault. It is mandatory in some states.

- Property Damage (PD) Liability Insurance: This coverage is for when you damage someone else's property with your vehicle. It usually covers damage to another vehicle, but it can also apply to other property such as buildings, utility poles, fences, etc.

- Comprehensive Coverage: This is optional coverage for when your car is stolen or damaged in ways that don't involve a collision. It includes damage from hail, glass breakage, fire, vandalism, animal damage, floods, earthquakes, falling objects, and theft.

- Collision Coverage: This is also optional coverage for when your car collides with another object, such as a brick wall or a pothole. It only applies to your car and not the object it collides with.

- Medical Payments Coverage (MedPay): This optional coverage pays for the medical and funeral expenses of you and your passengers, regardless of who is at fault in the accident, up to the policy limits.

- Personal Injury Protection (PIP): This coverage is similar to MedPay and is usually associated with no-fault auto insurance systems. It pays for medical costs, lost wages, loss of essential services, and funeral costs for you and your passengers, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage comes into play when you are in an accident with a driver who does not have insurance or has insufficient insurance. It pays for your injuries, your passengers' injuries, and, in some cases, damage to your vehicle.

- Declarations Page (Dec Page): This is the first page of your insurance policy, containing important information such as your name, address, insured property details, policy period, coverage amounts, and premiums.

- Deductible: This is the out-of-pocket expense that you agree to pay for losses up to a set amount. Choosing a higher deductible can lower your insurance costs.

- Actual Cash Value (ACV): The value of a car considering factors like age, mileage, make, model, and overall condition.

- Replacement Cost (RC): This refers to the cost of actually replacing a damaged or destroyed vehicle, which may differ from the ACV.

| Characteristics | Values |

|---|---|

| Bodily injury liability coverage | Pays damages for injury or death resulting from an accident for which you are at fault. |

| Comprehensive coverage | Pays to repair your car after animal collisions, and also covers a specified list of non-collision issues, including car theft, falling objects, and fire, among others. |

| Medical payments coverage | Pays medical expenses related to an automobile accident. |

| Personal injury protection | Pays for medical treatment, lost wages, or other accident-related expenses regardless of who caused the accident. |

| Property damage liability coverage | Pays for damage to someone else's property resulting from an accident for which you are at fault. |

| Uninsured motorist coverage | Pays for your injuries or property damage caused by an uninsured motorist or, in some states, an unidentified driver. |

| Underinsured motorist coverage | If a driver or owner of a vehicle is legally liable for an accident but does not have enough insurance, you can use underinsured motorist coverage for injuries, including death, up to the limits you select. |

What You'll Learn

Liability insurance

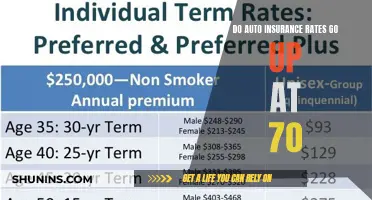

When purchasing liability insurance, it's important to consider the liability limits, which refer to the maximum amount of coverage provided per person and per accident. These limits are typically broken down into bodily injury liability per person, bodily injury liability per accident, and property damage liability per accident. For example, a policy might offer $25,000 for injuries to one person, $50,000 for injuries to multiple people, and $20,000 for property damage per accident. It's recommended to choose liability limits that match or exceed your net worth to ensure adequate protection.

Student Discounts: Farmer Auto Insurance Savings

You may want to see also

Collision coverage

When choosing collision coverage, it's important to consider the cost of your car and the potential cost of repairs. Opting for a higher collision deductible can lower your monthly premium, but it also means you'll cover more of the repair costs when needed.

While collision coverage focuses on accidents involving objects or other vehicles, comprehensive coverage complements it by insuring against other types of damage, such as theft, animal collisions, natural disasters, and civil disturbances. Together, collision and comprehensive coverage provide a comprehensive safety net for vehicle owners.

Aspen Insurance Auto: Understanding SR-22 Requirements

You may want to see also

Comprehensive coverage

The cost of comprehensive coverage is based on the risk of loss, meaning the likelihood that your insured car will be stolen or damaged, as well as the car's value at the time of the loss. You will also need to pay a deductible, which is the amount you agree to pay before the insurance company starts paying for damages. A higher deductible can lower your insurance costs, but you will have to pay more out of pocket if an accident occurs.

Auto Insurance and Bankruptcy: What's the Link?

You may want to see also

Medical payments coverage

MedPay covers expenses such as hospital visits, nursing services, ambulance fees, surgery, x-rays, and dental procedures. It is important to note that MedPay does not cover lost wages due to injuries forcing you to miss work.

While MedPay is not offered in every state, it is available in most. States that don't offer MedPay usually have personal injury protection (PIP) coverage available instead. PIP is similar to MedPay but also covers lost income and physical therapy, and it is mandatory in no-fault states.

Carshield Auto Insurance: Is It Worth the Cost?

You may want to see also

Uninsured/underinsured motorist coverage

Understanding Uninsured/Underinsured Motorist Coverage

Uninsured motorist coverage comes into effect when you are involved in an accident with a driver who does not have auto insurance. This coverage ensures that your injuries and those of your passengers are taken care of, and it may also cover damage to your vehicle. Underinsured motorist coverage, often offered alongside uninsured coverage, comes into play when the at-fault driver does not have enough insurance to cover the damages or injuries they caused.

Benefits of Uninsured/Underinsured Motorist Coverage

This coverage is essential as it protects you from financial burden in the event of an accident with an uninsured or underinsured driver. Without it, you could be left paying for medical bills or vehicle repairs out of your own pocket. Even if you have health insurance, it may not fully cover injuries sustained in an auto accident, and you may have to meet a deductible. Uninsured/underinsured motorist coverage typically does not include a deductible, ensuring you have one less thing to worry about.

Understanding UMBI, UIMBI, UMPD, and UIMPD

- Uninsured Motorist Bodily Injury (UMBI): This covers medical bills for you and your passengers if you are hit by an uninsured driver.

- Uninsured Motorist Property Damage (UMPD): This covers damage to your vehicle caused by an uninsured driver.

- Underinsured Motorist Bodily Injury (UIMBI): This covers medical bills for you and your passengers if you are hit by a driver with insufficient insurance.

- Underinsured Motorist Property Damage (UIMPD): This covers damage to your vehicle if you are hit by a driver with insufficient insurance.

When to Purchase Uninsured/Underinsured Motorist Coverage

While not all states mandate this coverage, it is a wise decision to opt for it. In states where it is not required, you still run a significant risk if you choose to drive without it. According to the Insurance Information Institute, nearly 13% of drivers countrywide are uninsured, and this number rises above 20% in certain states. Therefore, it is in your best interest to include uninsured/underinsured motorist coverage in your auto insurance policy to ensure you are protected in case of an accident.

Auto Insurance Costs for a Dodge Dart: What to Expect

You may want to see also

Frequently asked questions

Auto insurance is a contract between you and your insurance company. By applying for coverage, you agree to pay an auto insurance premium to the insurance company. In return, the company agrees to pay covered costs associated with an auto accident once the deductible has been met under the policy terms.

A deductible is the amount you agree to pay out of pocket for damage resulting from a specific loss or accident. Choosing a higher deductible will lower your premium.

A premium is the money paid to an insurance company in return for insurance protection.

Liability insurance provides protection from claims arising from injuries or damage to other people or property.

Comprehensive coverage is optional coverage for when your car is stolen or damaged in ways that don't involve a collision. Examples include hail damage, glass breakage, fire, vandalism, damage from an animal, flood, earthquakes, falling objects, and theft.