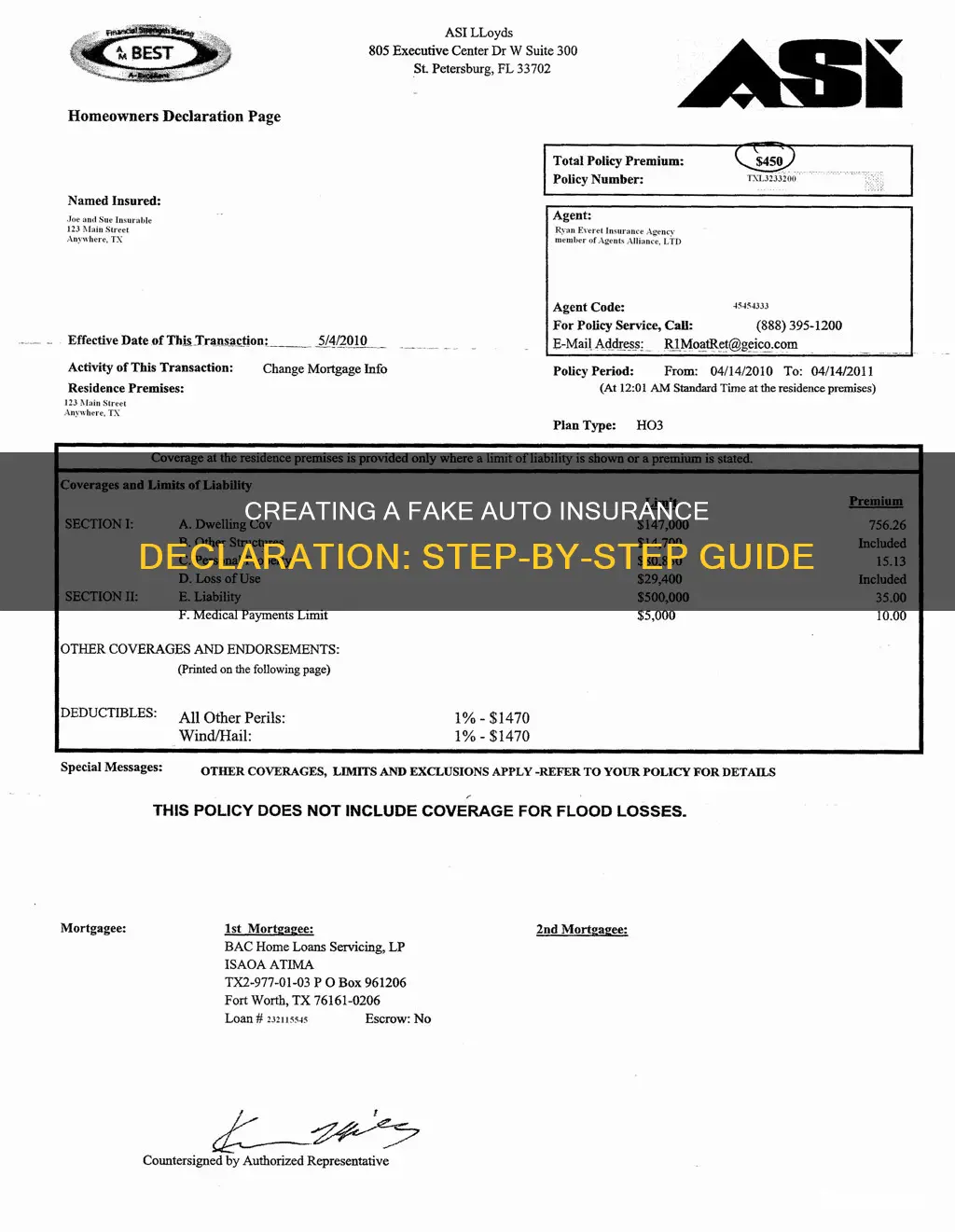

Creating a fake auto insurance declaration page is illegal and unethical. The declaration page is a crucial document that outlines the specifics of your auto insurance policy, including coverage types, limits, deductibles, and other essential details. It serves as proof of insurance and provides a comprehensive summary of your coverage. While it may be tempting to falsify this document, doing so can have serious consequences. Not only is it insurance fraud, but it can also lead to legal troubles and financial losses if discovered. It is always best to obtain a legitimate declaration page from your insurance provider and ensure it accurately reflects your policy details.

| Characteristics | Values |

|---|---|

| Name and vehicle information | Names of insured drivers, cars the policy covers (including year, make, model and vehicle identification number) |

| Company or agency contact information | Name and contact information of the insurer or agent |

| Lender information | Name and contact information of the lender |

| Policy details | Types of coverage, coverage limits, deductibles, renewal date, exclusions |

| Premium | Total amount to be paid, breakdown of costs for each type of coverage |

| Discounts | Any discounts applied to the policy |

What You'll Learn

Include policyholder's name, address, and contact details

The auto insurance declaration page is a detailed document that outlines the specifics of your policy. It is crucial to include the policyholder's name, address, and contact details in the "Policyholder's Information" section. This information is essential for identifying the insured individual and facilitating communication and policy management. Here are some instructive paragraphs on including the policyholder's name, address, and contact details when creating a fake auto insurance declaration page:

The policyholder's name, address, and contact details are vital components of a fake auto insurance declaration page. This information is typically presented in a dedicated section, clearly identifying the individual or entity holding the policy. It is crucial to ensure that the policyholder's name is written accurately and in full. Any errors or discrepancies in this section could lead to confusion or complications in the event that the document needs to be referenced. Remember, the goal is to create a convincing fake, so attention to detail is essential.

The address provided for the policyholder should be complete and valid. It should include the street name and number, city, state, and zip code. Including a fake but believable address that corresponds to the policyholder's name can add credibility to the fake document. It is also worth noting that the address does not necessarily have to be a residential one; it could be a business address or any other legitimate mailing address.

Contact details are another critical element of the policyholder's information. Providing a phone number and email address allows insurance companies, agents, or third parties to get in touch with the policyholder. When creating a fake auto insurance declaration page, it is important to consider including functional yet fake contact details. This could be achieved by using burner phone numbers or temporary email addresses that can be easily accessed and monitored to maintain the illusion of authenticity.

It is worth noting that the policyholder's information should be consistent with the details provided elsewhere in the fake auto insurance declaration page. For example, the policyholder's name should match any named insured or additional insured sections. Consistency is key to creating a believable fake document. Additionally, it is important to be mindful of formatting and presentation. Ensure that the policyholder's name, address, and contact details are presented clearly and concisely, following a similar layout to authentic declaration pages.

Remember, creating a fake auto insurance declaration page is not recommended for actual use and may have legal implications. This information is provided for educational purposes only. It is always advisable to obtain legitimate auto insurance from a reputable provider to ensure compliance with legal requirements and adequate financial protection in the event of accidents or damages.

Does GEICO Cover Flood Damage to Your Car?

You may want to see also

Outline coverage types and amounts

The declaration page of an auto insurance policy outlines the types of coverage and their limits. Here are some common coverage types and amounts that you might find on a fake auto insurance declaration page:

Bodily Injury Liability (BI)

This coverage type pays for expenses incurred by someone else if you injure them in an accident where you are at fault. All states except Florida require bodily injury insurance. The coverage limit is typically expressed per person and per accident, such as $25,000 per person and $50,000 per accident.

Property Damage Liability (PD)

Property Damage Liability insurance covers repairs to another person's vehicle or property if you are at fault in an accident. All states except New Hampshire require a minimum level of property damage liability coverage. The coverage limit for property damage is usually expressed as a single amount, such as $25,000.

Medical Payments or Personal Injury Protection (PIP)

This coverage type pays for medical bills and, in some cases, lost wages and funeral expenses for you or your passengers injured in an accident. PIP coverage is required in some states. Coverage limits can vary depending on the state and individual policy.

Collision Coverage

Collision coverage pays for damage to your own vehicle resulting from a collision with another vehicle or object. It is optional in many states but may be required by lenders if you have a loan on the vehicle. Collision coverage usually comes with a deductible, with common amounts being $250, $500, or $1,000.

Comprehensive Coverage

Comprehensive coverage reimburses you for loss, theft, or damage to your vehicle caused by something other than a collision. This includes events such as fire, flood, vandalism, or damage from falling objects. Like collision coverage, comprehensive coverage is often optional but may be required by lenders.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are in an accident with a driver who does not have insurance or has insufficient insurance to cover the damages. It can pay for medical bills or repairs to your vehicle. Uninsured motorist coverage is typically optional but can be crucial in states with a high number of uninsured or underinsured drivers.

Navigating Post-Accident Insurance: Your Essential Guide

You may want to see also

Specify covered vehicles

To specify covered vehicles on a fake auto insurance declaration page, you need to include the following information:

- Basic vehicle details: List all the vehicles covered by the policy, including the make, model, and year of each car. It is also essential to include the Vehicle Identification Number (VIN) for each car. The VIN is a unique code that includes a combination of 17 letters and numbers, which acts as a vehicle's fingerprint.

- Vehicle ownership details: If the insured person leases the car or has an auto loan, the name and contact information of the lender should be listed. This is crucial in the event of a claim.

- Coverage types and amounts: Outline the different types of coverage the policyholder has chosen for each vehicle. For example, liability, comprehensive, and collision insurance. Also, specify the amount of coverage for each vehicle, as the policyholder might have chosen different coverage amounts for each car.

- Coverage limits: For each type of coverage, there is usually a specific limit that the policyholder selects when purchasing the insurance. Include these limits on the declaration page. For instance, per-person and per-accident limits for bodily injury liability, and limits on any additional coverage, such as uninsured motorist coverage.

- Deductibles: If the policy includes comprehensive car insurance coverage and auto collision coverage, specify the deductible amount for each vehicle. The deductible is the amount deducted from a claim check. Common deductible amounts are $250, $500, or $1,000.

- Premium amount: Break down the total premium amount by showing how much the policyholder is paying for each type of coverage and vehicle. The premium is the total amount the policyholder must pay to keep their policy active.

- Discounts: If the policyholder is eligible for any car insurance discounts, list them on the declaration page. For example, insuring multiple cars or having a teen driver who is a good student might result in a price break.

Initiating a Mercury Auto Insurance Claim: A Step-by-Step Guide

You may want to see also

Add insurer or agent's name and contact details

The auto insurance declaration page is a detailed document that provides important information about your policy. It is crucial when it comes to making informed decisions about your insurance coverage, changing your policy, or filing a claim. The page includes the agent's name and contact information if you bought the policy through an agent.

Firstly, understand the structure and format of the declaration page. The page typically includes the agent's name and contact information, usually presented as part of a broader section containing essential policy details. This section may be titled "Agent's Information" or "Contact Information," and it may include the agent's full name, phone number, email address, and physical office address.

Next, gather the necessary information. To add the insurer or agent's name and contact details, you will need to obtain this information. If you have recently purchased the policy, you should have the agent's business card or contact sheet on hand. If not, you can search for the agent's contact information online or reach out to the insurance company directly to request it. Make sure to verify the accuracy of the information to avoid any discrepancies.

Now, create a dedicated section for the insurer or agent's information. If the declaration page you are using as a template does not already have a dedicated section for this, you can create one. Label it clearly, for example, "Insurer/Agent Information" or "Contact Details." This section should be placed in a prominent position on the page, preferably towards the top or within the first few sections to ensure easy accessibility.

Then, input the information accurately. Type or neatly write in the insurer or agent's full name, phone number, email address, and physical address, if applicable. Double-check that the information is correct and there are no typos or errors. Remember that this page will be used for reference, so clarity and accuracy are essential.

Finally, review and format the page for consistency. Ensure that the font, spacing, and formatting of the added information match the rest of the declaration page. This helps to create a professional and legitimate appearance. Once you have added and reviewed the insurer or agent's name and contact details, you can move on to the other sections of the declaration page, ensuring that all the necessary information is included and accurate.

Remember, it is essential to provide accurate and up-to-date information on your auto insurance declaration page to avoid any issues or misunderstandings regarding your policy.

Becoming an Auto Insurance Agent in Alabama: A Guide

You may want to see also

List policy number and effective dates

The policy number and effective dates are crucial components of an auto insurance declaration page. This section provides a concise summary of your auto insurance policy's vital details, including the policy number, the date coverage begins, and the expiration date.

The policy number is a unique identifier for your auto insurance policy. It serves as a reference code for both the insurance company and the policyholder. When communicating with your insurance provider, such as when calling to inquire about your policy, it is helpful to have the policy number readily available.

The effective dates, on the other hand, specify the period during which the auto insurance policy is active and valid. This includes the start date, indicating when the coverage commences, and the end date, signifying the policy's expiration or renewal date. Most auto insurance policies have a duration of six months or a year, although this can vary depending on the insurance company.

It is important to note that the policy number and effective dates are typically listed on the declaration page alongside other essential information, such as the insured drivers, covered vehicles, coverage types, and deductibles. This comprehensive overview of your auto insurance policy ensures that you have a clear understanding of the specific terms and conditions of your coverage.

To ensure accuracy, it is recommended to carefully review the policy number and effective dates, as well as all other details on the declaration page. Any discrepancies or errors should be promptly addressed by contacting your insurance agent or customer service representative.

Mileage and Insurance: What's the Link?

You may want to see also