To make a house FHA insurable, it must meet the Federal Housing Administration's (FHA) minimum property standards, which include safety, security, and soundness. Safety refers to the house providing a safe and healthy environment for its occupants. Security means the property should offer protection to its occupants. Soundness indicates that the home should not have any structural defects.

To ensure a property meets these standards, an appraisal must be done by a licensed, HUD-approved property appraiser. The appraiser will use a dedicated handbook to determine if the property meets the necessary standards and will also calculate the home's market value. If the property does not meet the minimum standards, the issues will need to be addressed before the appraisal and purchasing of the home can move forward.

| Characteristics | Values |

|---|---|

| Safety | The home should protect the health and safety of its occupants. |

| Security | The home should protect the security of the property. |

| Soundness | The property should not have physical deficiencies or conditions affecting its structural integrity. |

| Roof | Must keep moisture out and be expected to last for at least two more years. |

| Water | There must be a sufficient supply of safe running water, including hot water. |

| Sanitation | There must be a safe method of sewage disposal. |

| Heating | Each inhabitable room must have an adequate heating source. |

| Electricity | There must be adequate electricity for lighting and mechanical equipment. |

| Kitchen | There must be a functioning kitchen with a sink, running water, and stove. |

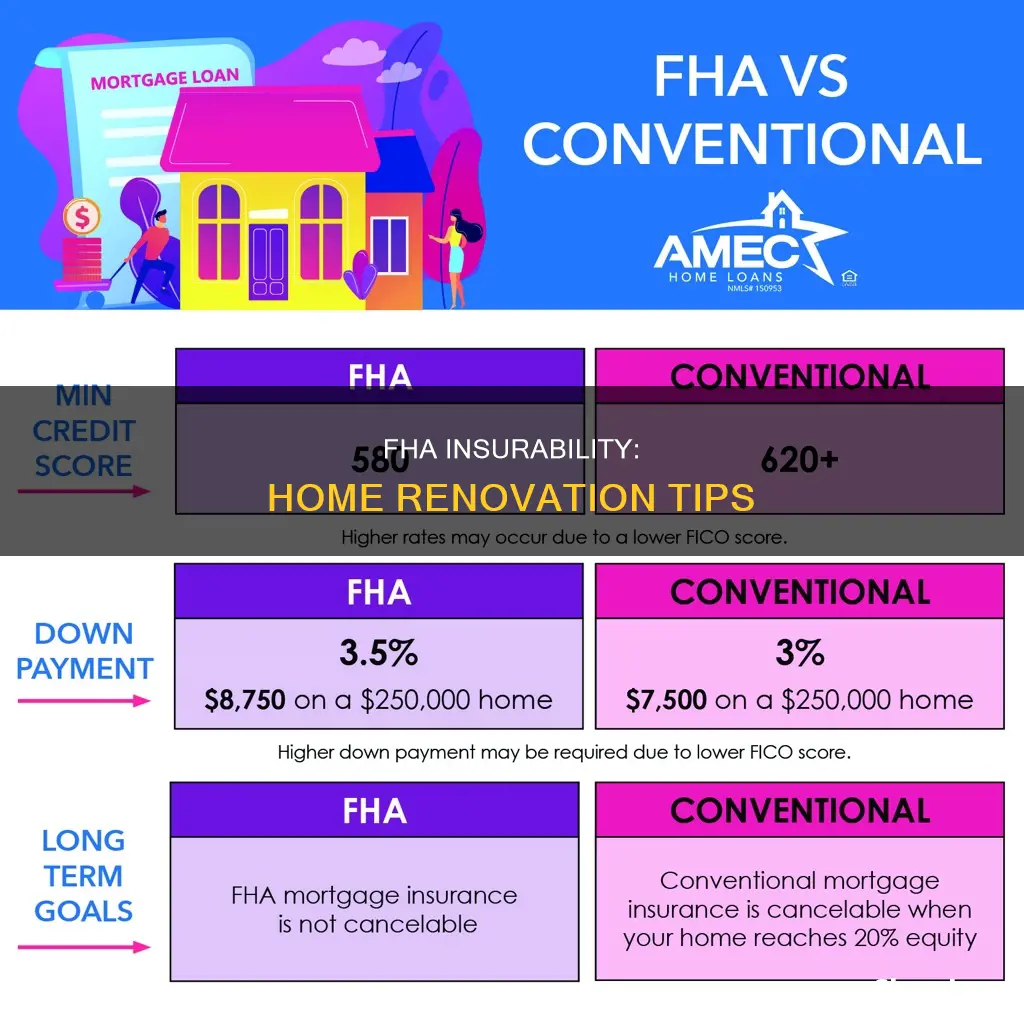

| Credit Score | A minimum FICO score of 580 is required to qualify for an FHA loan. |

What You'll Learn

- Meet the minimum property standards: safety, security, and soundness

- Have a FICO score of at least 580 for a 3.5% down payment?

- Ensure the home has basic amenities like electricity, drinkable water, and adequate heat

- Make sure the roof is stable and has no more than three layers of roofing

- Address any issues with the home's structural integrity

Meet the minimum property standards: safety, security, and soundness

To make a house FHA insurable, it must meet the FHA's minimum property standards, which include safety, security, and soundness. Here are some detailed guidelines on meeting these standards:

Safety

The home should protect the health and safety of its occupants. This includes having a sufficient supply of safe running water, including hot water, and a sanitary facility with a safe method of sewage disposal. Each home must have at least one bathroom with a shower or bathtub. All habitable rooms must have a functioning heat source, except for a few select cities with mild winters. The electrical box should not contain any frayed or exposed wires. The roofing must keep moisture out and be expected to last for at least two more years. The roof cannot have more than three layers of roofing. The water heater must have a temperature and pressure relief valve with piping for safety.

Security

The home should protect the security of the property. This includes safe and adequate access for pedestrians and vehicles. The street must have an all-weather surface to allow emergency vehicles access under any weather conditions.

Soundness

The property should not have physical deficiencies or conditions that affect its structural integrity. Any defective structural conditions and any other conditions that could lead to future structural damage must be remedied. These include defective construction, excessive dampness, leakage, decay, termite damage, and continuing settlement. If there is any damaged or deteriorating asbestos in the home, it must be inspected by an asbestos professional. The home must also have essential fixtures, such as a toilet, sink, and shower.

Vacant Lot Conundrum: Exploring Insurance Options with Farmers for Unused Land

You may want to see also

Have a FICO score of at least 580 for a 3.5% down payment

A FICO score of 580 is the minimum requirement for a low down payment of 3.5% on an FHA loan. This is the most recognised type of mortgage loan in the country, and it is a good option for first-time homebuyers.

A FICO score of 580 or higher is considered technically good enough to qualify for the lowest down payment offered. However, it is important to note that many participating FHA lenders require a FICO score of at least 620 to qualify for an FHA home loan. This is because the FHA loan program is voluntary, and lenders are not required to participate. Therefore, even if you meet the FHA's minimum score requirement, a particular bank may not be willing to issue credit to you.

If your FICO score is below 620, you can call the FHA for assistance. They can refer you to an FHA-approved housing counsellor who can help you learn how to raise your credit score and make yourself a better credit risk in the eyes of a participating FHA lender. Credit counselling and housing counselling can help borrowers with credit issues take the necessary steps towards becoming homeowners. It is important to remember that improving your credit score takes time, so it is recommended to start working on it early in the process.

In addition to a FICO score of 580 or higher, there are other requirements that must be met to qualify for an FHA loan. These include:

- The home must be the borrower's primary residence.

- The borrower must have a steady income and proof of employment.

- The debt-to-income ratio must be less than 43%.

- The borrower must obtain mortgage insurance.

Farmers Insurance Under Scrutiny: Examining the Track Record of a Trusted Insurer

You may want to see also

Ensure the home has basic amenities like electricity, drinkable water, and adequate heat

To make a house FHA insurable, it is important to ensure that the property meets the basic requirements for livability, including access to essential utilities like electricity, potable water, and adequate heating. Here are some detailed instructions to help you through the process:

Electricity

The presence of electricity is a fundamental requirement for any habitable home. An inspector will verify that the electrical system is functional and meets the necessary safety standards. This includes checking for issues such as outdated or exposed wiring, which could pose a safety hazard. Ensure that all electrical components, including lighting and mechanical equipment, are in proper working order.

Drinkable Water

Potable water is essential for any household. The water supply should be sufficient, and the water should be safe for drinking and other domestic use. An inspection will typically involve checking for running water in the kitchen and bathrooms, as well as testing water pressure and flow. Make sure there are no leaks or signs of structural damage around water fixtures.

Adequate Heat

A proper heating system is crucial for maintaining a comfortable and healthy living environment. The FHA has specific guidelines for heating systems, which include:

- Heating all living areas to a minimum temperature of 50 degrees Fahrenheit.

- Providing healthy and comfortable heat without producing foul odours or fumes.

- Being safe to operate, posing no health or safety risks to occupants.

- Using a fuel source that is readily obtainable to maintain consistent heating.

- Being acceptable and marketable within the local area.

- Operating without human intervention, such as a wood-burning fireplace that requires constant monitoring.

- Being permanently installed and not easily removed, as this could affect the value of the property.

In addition to these guidelines, it is important to ensure that the heating system is adequate for the size of the home and can maintain the minimum temperature in all living areas.

By following these guidelines and ensuring that the home has basic amenities like electricity, drinkable water, and adequate heat, you can take a significant step towards making the house FHA insurable. These measures not only increase the chances of obtaining insurance but also provide a safe and comfortable living environment for the occupants.

Home Insurance: Pre-Closing Sign-Up

You may want to see also

Make sure the roof is stable and has no more than three layers of roofing

To make a house FHA insurable, it is important to ensure that the roof is stable and meets the FHA's minimum property standards. This means that the roof should be in good condition, with no signs of damage or leaks, and should have a remaining physical life of at least two years.

The FHA guidelines state that the roof must prevent moisture from entering the home and provide reasonable future utility, durability, and economy of maintenance. The appraiser will visually examine the roof to identify any deficiencies that may pose health and safety hazards or affect the future utility of the property. If the roof has less than two years of remaining life, the appraiser must recommend repairs or re-roofing in their report.

In addition, the FHA has specific requirements for the number of layers of roofing. The maximum number of allowed layers is three. If there are more than two layers and repairs are necessary, all the old roofing must be removed as part of the re-roofing process.

It is important to note that FHA appraisers may not be experts in roofing issues, so it is recommended that homeowners hire a home inspector to thoroughly evaluate the roof and other critical areas of the property. By addressing any issues related to the roof and ensuring it meets the FHA's standards, homeowners can increase the chances of making their house FHA insurable.

The Mystery of Depreciation: Unraveling Roof Replacement Coverage with Farmers Insurance

You may want to see also

Address any issues with the home's structural integrity

To make a house FHA-insurable, it is important to address any issues with the home's structural integrity. This means ensuring that the property does not have any physical deficiencies or conditions that could affect its structural soundness. Here are some detailed steps to address these issues:

- Inspect the property for any structural defects: This includes checking for cracks in the foundation, bulging walls, defective construction, or any other signs of damage. It is important to hire a professional inspector to thoroughly examine the property and identify any potential issues.

- Address water damage: Look for signs of water damage, such as damp basements, leaking roofs, or water against the foundation. Make sure to repair any plumbing issues and ensure proper drainage systems are in place to prevent future water damage.

- Ensure the roof is in good condition: The roof should be expected to last for at least two more years and keep moisture out. Address any issues, such as holes, loose or missing shingles, and ensure proper connections to gutters and downspouts.

- Fix defective structural conditions: Identify and repair any defective structural conditions, such as excessive dampness, leakage, decay, or termite damage. It is important to address these issues to prevent further structural damage and ensure the safety of the home.

- Asbestos inspection: If there is asbestos present in the home, it is important to have it inspected by a professional. Damaged or deteriorating asbestos can pose health risks and may need to be removed or encapsulated to ensure the safety of the occupants.

- Secure necessary permits and approvals: Depending on the scope of the repairs, you may need to obtain permits and approvals from local authorities. Ensure that you are complying with all relevant building codes and regulations to avoid any delays or legal issues.

- Major repairs: For extensive repairs, consider applying for an FHA 203(k) loan. This type of loan allows borrowers to finance both the purchase of the home and the cost of repairs. It is designed for homes that require significant maintenance and repairs.

By following these steps and addressing any structural integrity issues, you can increase the chances of making a house FHA-insurable. It is important to consult with professionals and experts throughout the process to ensure that all necessary repairs and improvements are made to meet the FHA's minimum property standards.

Irish Home Insurance: Calculating Your Costs

You may want to see also

Frequently asked questions

The FHA's minimum property standards are safety, security, and soundness. Safety means the home should protect the health and safety of its occupants. Security means the home should offer protection to its occupants and their property. Soundness means the home should not have any structural defects.

An FHA inspector will check that the property meets the FHA's minimum property standards. They will also check for particular hazards that must be addressed before an FHA loan will be approved. This includes checking the roof for sturdiness, the overall structure of the property for any signs of severe structural damage, and the heating, water, and electric systems.

If a home doesn't pass an FHA inspection, the first step is to understand why. The seller may need to make repairs, or the buyer may need to continue house hunting or repair their credit score before applying for a conventional mortgage.