When it comes to house insurance in Ireland, it's important to calculate the rebuilding cost of your home to ensure you have the right level of protection. The rebuilding cost is the amount of money needed to rebuild your home from scratch, including the price of labour, materials, and site clearance. This is different from the current market value of your home, which takes into account the land the property is built on. To calculate the rebuilding cost, you can use tools such as the Society of Chartered Surveyors Ireland's (SCSI) Rebuild Calculator, which provides a guide to give you an indication of the cost. However, for a more accurate assessment, you may need to consult an independent surveyor. It's also important to consider additional costs, such as professional fees and the value of any outbuildings or contents, which may not be covered by the rebuilding cost calculation.

| Characteristics | Values |

|---|---|

| Purpose | To calculate the rebuilding cost of a house in Ireland |

| Who is it for? | Homeowners with estate-type houses built in Ireland since the 1960s |

| What does it cover? | Rebuilding costs, including labour, materials, site clearance, outbuildings, boundary walls, driveways, and fencing |

| What does it not cover? | Contents (e.g. carpets, curtains, furniture), unique or period properties, non-standard fittings and fixtures |

| How to use it | Measure the internal area of each floor, consult the calculator, choose the appropriate house type and region, and input the total floor area |

| Additional considerations | Re-assess the level of cover annually, considering any improvements or extensions |

What You'll Learn

Using the SCSI House Rebuild Calculator

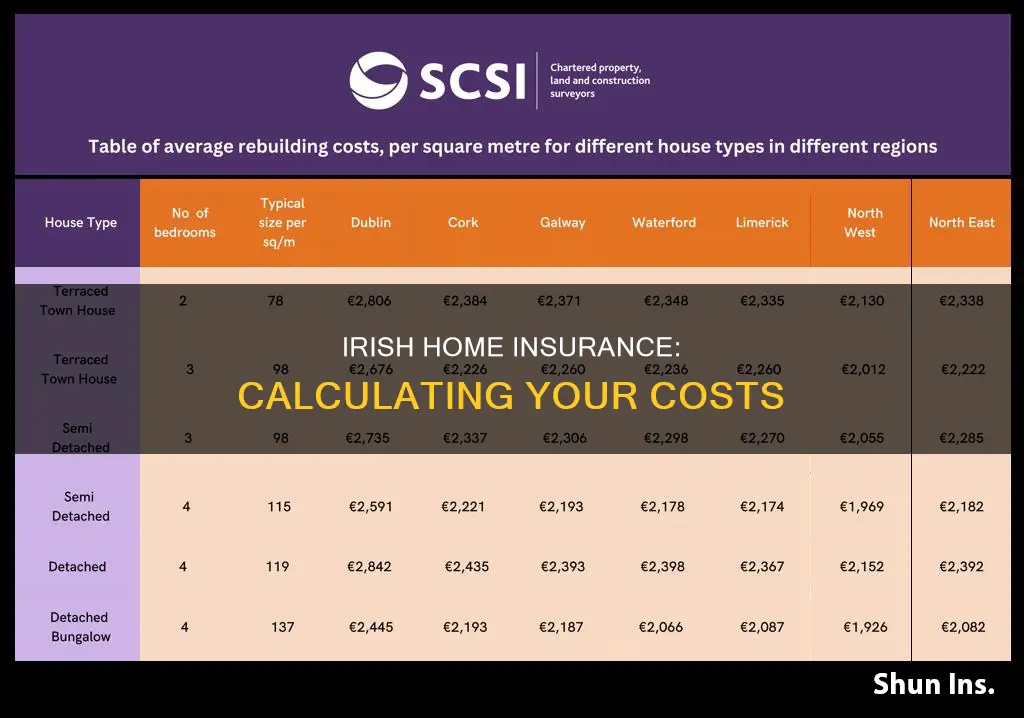

The Society of Chartered Surveyors Ireland (SCSI) provides a House Rebuild Calculator to help you calculate the rebuilding cost of your home. This is particularly useful if you are renewing your home insurance and are unsure what rebuilding costs are needed in case of a major incident such as a fire.

The calculator provides average rebuilding rates for speculatively built homes, or estate-type homes. It should not be used for other house styles, such as one-off homes in the countryside or period properties, in which case you should consider seeking professional advice. The costs are provided by region, and you should determine which region is most appropriate for your location.

The figures provided by the calculator are a minimum base cost guide for your house insurance. They assume a standard quality specification, including normal foundations, timber frame or brick/block walls, a slate/concrete tiled roof, concrete ground floor and timber first floor, softwood flush doors and double-glazed windows, painted plaster walls, plastered ceilings, and standard electrics.

The sum insured should be increased to allow for better-than-average kitchen fittings, built-in wardrobes, finishes and any other items not normally included in an estate-type house. House contents such as carpets, curtains, and furniture are not covered by these figures and are often insured separately under the contents portion of the insurance.

No allowance has been made for the cost of outbuildings (e.g. garages or sheds), but these can be added to the calculator with a best-estimated cost. The figures do allow for a concrete path around the house, driveway, re-grassing, and fencing. They also allow for demolition costs, professional fees incurred in reinstatement, and VAT on building costs and professional fees.

To use the calculator, you will need to calculate the internal area of your property by measuring the internal finish of the perimeter or party walls within the property, ignoring skirting boards, at each floor level. If your house has more than one storey and the upper floor is different from the ground floor, you should calculate each storey separately to get a more accurate area calculation. Once you have all the areas, add them together to get the total square meter area.

Next, consult the SCSI calculator and choose the appropriate house type and region. Insert your total floor area and add the cost of a garage if applicable. You should also add higher-than-average kitchen fittings, finishes, etc. if appropriate, as well as any other outbuildings such as a studio or office.

Insurers recommend that you re-assess your level of cover every year, based on current average rebuilding costs, and make allowances for any improvements or extensions made since your last renewal date.

Home Insurance: What's Covered?

You may want to see also

Insuring house contents separately

When it comes to insuring the contents of your house, there are a few things to keep in mind. Firstly, it's important to understand that household insurance is typically divided into two parts: building insurance and contents insurance. Building insurance covers the physical structure of your house, while contents insurance covers your belongings inside the house.

In Ireland, contents insurance is not legally required. However, it is highly recommended to protect your valuable possessions. When insuring your house contents separately, you will need to create an inventory of your belongings and estimate their total value. This value will determine the amount of coverage you need. It is important to review and update this inventory regularly, as the value of your belongings can change over time.

When calculating the value of your house contents, consider all your personal possessions, including furniture, electronics, jewellery, clothing, and other valuable items. Don't forget to include items that you may have stored away, such as seasonal clothing or hobby equipment. It is also a good idea to keep receipts, photographs, or records of your possessions as proof of ownership in case of a claim.

Most insurers offer contents insurance on a "new-for-old" basis. This means that if your belongings are stolen or destroyed, the insurer will cover the cost of replacing them with equivalent new items. It's important to review the terms and conditions of your policy to understand what is covered and what exclusions may apply.

Additionally, consider adding optional extensions to your contents insurance policy. These can include coverage for personal money and credit cards, food loss due to freezer breakdown, accidental damage to items such as pedal cycles, and personal accident coverage, among others. These extensions will provide more comprehensive protection for your belongings and give you added peace of mind.

Navigating Pet Insurance: A Guide to Understanding Farmers' Quotes

You may want to see also

Calculating the internal area of your property

To calculate the internal area of your property, you will need to measure the internal finish of the perimeter or party walls within the property, ignoring skirting boards, at each floor level. If your house has two or three storeys, and the upper floor is the same size as the ground floor, you can simply double the area of the ground floor. However, if the upper floor is a different size, you should calculate each storey separately to get a more accurate total area. Once you have the area for each floor, simply add them together to get the total square meterage of your property.

For example, let's say your house has two floors, and the length of your ground floor is 7 metres and the width is 5 metres. The formula for calculating the area of a rectangle is:

> area = length × width

So, for this example:

> area = 7 metres × 5 metres = 35 square metres

Now, we need to do the same calculation for the upper floor. Let's say the length is 7 metres and the width is 4 metres:

> area = 7 metres × 4 metres = 28 square metres

Finally, add the areas of both floors together:

> total area = 35 square metres + 28 square metres = 63 square metres

So, the total internal area of your property is 63 square metres.

It is important to note that this calculation assumes a rectangular floor plan and that the upper floor is directly above the ground floor. If your house has a more complex shape or a different floor plan, you may need to calculate the area of each room separately and then add them together. Additionally, if you have a loft or attic space, you may need to include that in your calculations as well.

Farmers Insurance: Navigating the 'Do Not Mail' List Complaints

You may want to see also

Adding extra cover for outbuildings

When it comes to outbuildings, it's important to ensure that you have the right level of cover. Outbuildings insurance is a type of coverage that specifically protects structures on your property that are separate from your main property, such as sheds, detached garages, barns, or any other buildings that are not connected to your home. While your buildings insurance will usually cover outbuildings, it's important to check with your provider as the level of cover can vary.

- Nature of the Outbuildings: The type of outbuildings you have can impact whether they are covered under a standard home insurance policy. Outbuildings that may not be covered include those with non-standard construction, those not used for domestic purposes, those containing valuable items worth more than a certain amount (e.g., over £500), and those used as habitable accommodation.

- Value of Contents: Outbuildings often store valuable items such as power tools, sports equipment, and bicycles. It's important to calculate the total value of the contents in your outbuildings to ensure they are adequately covered. Creating an inventory of the possessions can help determine if additional contents cover is needed.

- Security Measures: Implementing security measures can help reduce the risk of theft or damage to your outbuildings. This includes using locks on doors and windows, installing alarms and security lighting, and taking steps to protect against weather damage.

- Policy Exclusions: It's important to carefully review the terms of your policy, as certain high-value items may have specific requirements for coverage. For example, bicycles may need to have adequate locks in place to be covered in the event of theft.

- Separate Insurance: In some cases, you may need to purchase separate outbuildings insurance if your current home insurance policy does not provide sufficient coverage. This is particularly important if you have unique or valuable outbuildings.

- Referral and Assessment: Increasing your contents cover may trigger a referral, where an underwriter assesses the risk to your belongings and outbuildings. Additionally, making significant changes to your policy, such as adding extra cover for outbuildings, may require a site visit or further assessment by the insurance provider.

- Calculating Rebuild Costs: When insuring outbuildings, consider not only the value of the contents but also the cost of rebuilding the structure in the event of a total loss. This includes factoring in professional fees, such as those for architects or engineers.

Home Insurance: Hazard Cover Basics

You may want to see also

Consulting an independent surveyor

- The Society of Chartered Surveyors Ireland (SCSI) provides a House Rebuild Calculator, which is a useful tool for estimating the rebuilding cost of your home. However, for a more precise calculation, it is recommended to consult an independent surveyor.

- An independent surveyor can provide a detailed assessment of your property's specific characteristics, including size, layout, and construction materials. This is especially beneficial for homes with unique features or those located in rural areas, such as one-off houses in the countryside.

- When choosing a surveyor, consider their qualifications and experience. Look for professionals like architects, structural engineers, or building surveyors with expertise in house surveying.

- The surveyor will need access to your property to inspect various aspects, including the internal finish of perimeter or party walls, floor levels, and any unique features or premium materials used.

- The surveyor's report will include their findings, such as visible defects, and provide recommendations or suggestions for improvements. This report is essential for calculating the rebuilding cost accurately.

- It is advisable to discuss the report with the surveyor to clarify any points and understand the implications of their findings. This discussion will also help you make informed decisions about your insurance coverage.

- The surveyor's fees will depend on the scope of their work and may vary based on the property's unique characteristics. It is essential to discuss and agree on the approximate cost beforehand.

Farmers Insurance Drug Testing Policy: What You Need to Know

You may want to see also

Frequently asked questions

The rebuild cost is the amount of money needed to rebuild your home from scratch. You can calculate this by taking into account the price of labour and materials, as well as the cost of site clearance. You can use the Society of Chartered Surveyors Ireland's (SCSI) Rebuild Calculator to help you work out this cost.

You should consider the costs of outbuildings such as garages and sheds, as well as boundary walls, driveways, and patios. You should also ensure that you have separate insurance for the contents of your house, such as carpets, curtains, and furniture.

Calculating the exact rebuild cost is essential to ensure that you have the right level of protection for your home. If your home is not adequately insured, your insurance company may apply a deduction in the event of a claim.

The rebuild cost is the amount of money needed to rebuild your home from scratch, while the resale value is the current market value of your home, which includes the land it is built on.

While the SCSI Rebuild Calculator can provide a guide to the rebuilding cost of your house, an independent surveyor can calculate the exact cost. An independent surveyor will also be able to factor in the costs of professional services, such as solicitors or architects, which may be required during the rebuild process.