Hazard insurance is an essential component of homeowners insurance, providing financial protection against damage to the structure of your home caused by fires, storms, and natural disasters. While it is not sold as a stand-alone policy, lenders often require hazard insurance as a condition for approving a mortgage. This coverage is designed to protect homeowners from the financial burden of unexpected disasters, ensuring peace of mind and safeguarding their property investment. However, it's important to note that hazard insurance doesn't cover all risks, and additional policies may be needed for floods or earthquakes.

| Characteristics | Values |

|---|---|

| What is hazard insurance? | A specialised form of insurance that provides coverage against property damage caused by various natural events and specific perils. |

| Is hazard insurance the same as homeowners insurance? | No, hazard insurance is a subsection of homeowners insurance. |

| What does hazard insurance cover? | Fire, wind, hail, lightning, snow, etc. |

| What doesn't hazard insurance cover? | Personal belongings, liability claims, theft, vandalism, damage to personal property, injuries sustained on property, water damage caused by flooding, damage from vehicles, damage caused by heating, AC units or electric currents, general wear and tear over time, and pest infestations. |

| Is hazard insurance required by mortgage lenders? | Yes, mortgage lenders usually require a minimum amount of hazard insurance before issuing a loan. |

| How much does hazard insurance cost? | The cost of hazard insurance depends on factors such as location and credit score. |

What You'll Learn

Hazard insurance is a subsection of homeowners insurance

Hazard insurance specifically covers damage to the home's structure from natural disasters and other hazards. These include fires, storms, lightning, and other perils such as theft and vandalism. It is important to note that hazard insurance does not cover damage to personal belongings, liability claims, or additional living expenses if the home becomes uninhabitable due to damage.

Mortgage lenders typically require a minimum amount of hazard insurance as a condition for approving a home loan. This is to protect their financial interests and ensure the property is adequately insured. The amount of hazard insurance required depends on the cost of replacing the home in the event of a total loss, which may differ significantly from its market value.

Homeowners should review their hazard insurance coverage regularly to ensure it meets their needs and covers common hazards in their area. While hazard insurance is essential, it does not cover all risks, and additional policies may be necessary for floods, earthquakes, or hurricanes in some regions.

In summary, hazard insurance is an integral part of homeowners insurance, providing financial protection against damage to the home structure. It is a crucial component of the homeownership journey, offering peace of mind and safeguarding the property investment.

Roadside Rescue: Exploring Farmers Insurance's Roadside Assistance Offerings

You may want to see also

It covers damage to the structure of the house

Hazard insurance is an essential part of protecting your property as a homeowner. It is not the same as homeowners insurance, but it is a subsection of it. This means that it cannot be purchased separately and is bundled as part of a homeowners insurance policy for a more comprehensive coverage plan.

Hazard insurance specifically covers damage to the structure of the house itself. This includes the home's structure, roof, and foundation. It is important to note that it does not cover damage to personal property. If you want to protect your belongings, you will need to rely on the personal property coverage provided by your homeowners insurance policy.

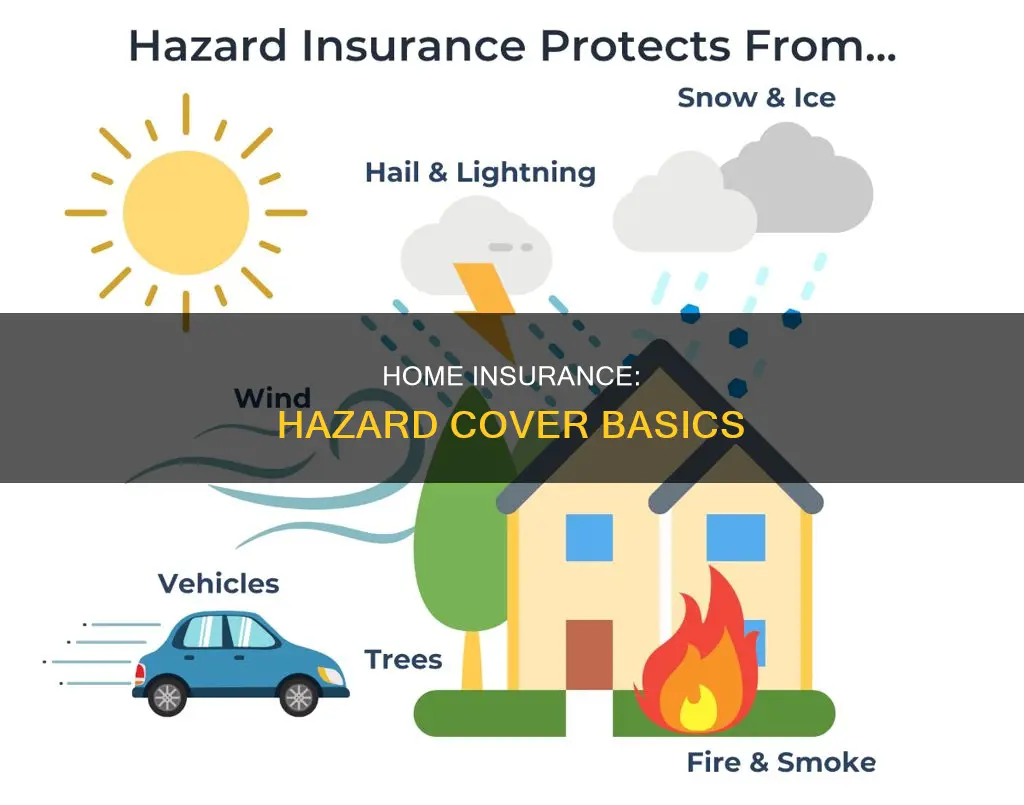

The structure of your house is protected from a range of hazards, including:

- Fire and smoke damage

- Severe storms and hail

- Lightning

- Snow, ice, or sleet

- Explosions, often from gas leaks

- Fallen trees and other objects

- Vehicles that run into your home

However, it is important to remember that not all hazard insurance policies are the same. Some types of damage are not covered by hazard insurance, and you may need to purchase additional coverage or separate policies. For example, damage from flooding, earthquakes, mudslides, and pests is typically not covered by hazard insurance.

To ensure you have the necessary coverage, carefully review your homeowners insurance policy, pay attention to what is excluded or considered a risk, and speak with your insurance agent.

Unraveling the Truth Behind Farmers Insurance Rates

You may want to see also

It does not cover damage to personal property

Hazard insurance is a type of coverage that is part of a homeowners insurance policy. It is not the same as homeowners insurance, but it is bundled with it. Hazard insurance specifically covers damage to the structure of your home, while homeowners insurance covers home, personal property, and liability damages.

Hazard insurance does not cover damage to personal property. This means that your belongings are not covered by hazard insurance. If you want coverage for your personal belongings, you would need to purchase a separate policy or add additional coverage to your existing homeowners insurance policy.

For example, if you experience a fire in your home and your personal belongings are damaged or destroyed, hazard insurance would not cover the cost of replacing those items. In this case, you would need to rely on your homeowners insurance policy or another form of coverage to protect your personal property.

Additionally, hazard insurance does not cover liability claims. So, if someone is injured on your property, hazard insurance would not cover the associated costs. Liability coverage, which is typically included in a homeowners insurance policy, would be more appropriate in such cases.

It is important to understand the limitations of hazard insurance when it comes to personal property coverage. While it provides valuable protection for the structure of your home, it does not extend to the items within it. Therefore, if you are concerned about protecting your belongings, you should consider additional coverage options beyond just hazard insurance.

In summary, hazard insurance is an important component of homeowners insurance, but it has its limitations. By understanding what is not covered, you can make more informed decisions about your insurance needs and ensure that you have adequate protection in place for your home and personal belongings.

Florida Home Insurance: Is It Mandatory?

You may want to see also

It is required by mortgage lenders

Hazard insurance is typically required by mortgage lenders as it is the only portion of the homeowners insurance policy directly related to the home structure itself. This means that if the home is damaged or destroyed, the homeowner can receive compensation to cover the cost of repairs or rebuilding. Lenders require this insurance to protect their investment.

Mortgage lenders will often ask for proof of hazard insurance before issuing a loan. This is usually provided in the form of an insurance binder, which details the type and amount of hazard insurance that the homeowner has as part of their broader homeowners policy.

The amount of hazard insurance required depends on what it would cost to replace the home in the event of a total loss. This dollar amount may differ significantly from the property's current real estate market value.

If a homeowner fails to maintain their hazard insurance, the lender may purchase a homeowners insurance policy on their behalf (called force-placed insurance) and pass the cost on to the homeowner.

In some cases, a standard homeowners insurance policy may not be enough to satisfy the lender's requirements. For example, if the property is in an area prone to certain risks, such as floods or earthquakes, the lender may require the homeowner to take out separate or additional hazard insurance.

It is important to note that hazard insurance is not the same as mortgage insurance, which applies specifically to the home loan.

Farmers Insurance's Presence in Alaska: Statewide Coverage and Benefits

You may want to see also

It does not cover damage from flooding

Hazard insurance is a subsection of homeowners insurance that covers damage to the structure of your house. It is often required by mortgage lenders to protect their investment. However, it is important to note that hazard insurance does not cover damage from flooding.

Flooding is a common risk for homes located in low-lying areas, near bodies of water, or in regions prone to heavy rainfall and storms. Since hazard insurance does not cover flood damage, homeowners in these areas are advised to purchase separate flood insurance to protect their homes adequately.

The exclusion of flood damage from hazard insurance policies is standard across the industry. This exclusion typically includes flooding from external sources, such as heavy rain, storms, or natural disasters. Homeowners in high-risk flood areas may need to purchase additional coverage to protect their homes fully.

In addition to flood insurance, homeowners in certain regions may also need to consider earthquake insurance. Hazard insurance typically does not cover earthquake damage, and regions prone to seismic activity may require separate coverage to safeguard against this specific risk.

It is essential for homeowners to carefully review their hazard insurance policies and understand the specific perils covered. While hazard insurance provides financial protection for various disasters, there are exclusions, and additional policies may be necessary to ensure comprehensive coverage for their homes.

Farmers Insurance Availability in Montana: What You Need to Know

You may want to see also

Frequently asked questions

Hazard insurance is not the same as homeowners insurance, but it is a part of a homeowners insurance policy. If you have homeowners insurance, you already have hazard insurance.

Hazard insurance covers damage to the structure of your home from natural events such as fires, storms, and other hazards. It does not cover damage to personal belongings, liability claims, theft, or vandalism.

If you own a home, it's a good idea to have hazard insurance to protect your investment. Mortgage lenders also typically require a minimum amount of hazard insurance if you're getting a loan to buy a house.