The cost of home insurance in the UK has been rising, with the average premium for buildings and contents policies increasing by 6% in the past year. This is due to a number of factors, including extreme weather events, rising costs of building materials and labour, inflation, and an increase in insurance claims. While the price of home insurance did reach record lows in 2022, it is now on an upward trajectory.

What You'll Learn

Extreme weather events and climate change

Insurers are facing the challenge of rising costs associated with extreme weather events. The cost of putting things right has increased due to the rising prices of building materials and labour. Construction essentials, such as screws, ready-mixed concrete, and door frames, have become more expensive, largely due to the increased energy costs required to produce them. Additionally, there is a skilled labour shortage across the construction industry, driving up the prices of builders' services.

In response to the increasing frequency and severity of weather-related claims, insurance providers have been forced to re-evaluate their risk assessments and make adjustments to their policies. Some insurers have chosen to exclude coverage for specific weather-related events, such as hurricanes, wind, and hail damage, in certain high-risk areas. Others have increased premiums and deductibles to offset the rising costs of claims.

The impact of climate change on insurance is not limited to a single region but is a global issue. For example, the UK experienced a triple storm – Storms Ciara, Dennis, and Jorge – in February 2020, resulting in significant flooding. The Association of British Insurers (ABI) received over 80,000 claims due to flood and wind damage, with payouts estimated at £363 million.

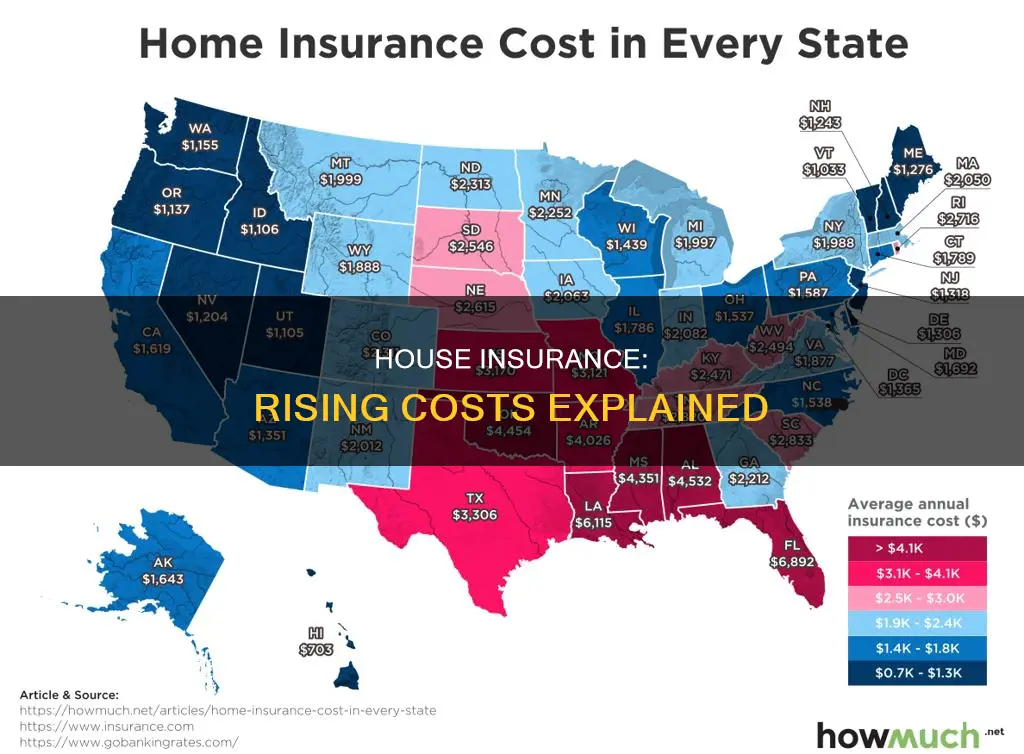

In the United States, extreme weather events, such as hurricanes, floods, storms, and wildfires, have caused widespread destruction. A report released in 2022 analysed 120 million homes and found that one in ten properties were impacted by natural disasters. The increasing frequency and severity of these events have led to a rise in insurance claims, with US insurers disbursing $295.8 billion in natural disaster claims over the past three years.

The surge in claims and payouts has had a significant impact on the insurance industry. Insurers are facing the challenge of rising costs and are taking various approaches to mitigate their risks. Some companies are choosing to exclude certain types of weather-related damage from their policies, while others are increasing premiums or even withdrawing from high-risk markets altogether.

As a result, some homeowners, particularly those in vulnerable areas, are facing challenges in obtaining adequate insurance coverage. This situation underscores the growing impact of climate change on the insurance industry and the need for innovative solutions to address the changing risk landscape.

RV Insurance Options for Farmers: Exploring Coverage for Mobile Homes on Wheels

You may want to see also

Rising costs of building materials and labour

The rising costs of building materials and labour have significantly impacted the house insurance landscape. The cost of construction has increased due to the rising prices of materials such as lumber, steel, fuel, and iron. For instance, in just one year, the cost of crude petroleum increased by 49%, lumber by 29%, and iron and steel by 14%. This has resulted in a rise in the total cost of construction projects, with some regions experiencing even higher increases. The volatility in material costs is influenced by factors such as tariffs, trade issues, environmental regulations, and changing demand.

The construction industry is facing challenges in acquiring qualified candidates, leading to increased wages and benefits to attract and retain employees. This further squeezes profit margins, and if labour costs continue to rise, it will inevitably lead to increased prices in the industry.

The impact of the COVID-19 pandemic has also played a role in the rising costs. During the pandemic, many sawmills and factories were closed, and natural disasters like wildfires disrupted production. Additionally, the easing of lockdowns and the resumption of construction projects have increased the demand for resources, contributing to the rise in material costs.

The situation varies across different regions, such as North America, Hong Kong, China, and Australia, each with its unique set of challenges and dynamics. For instance, in North America, the cost of lumber increased due to the US not ratifying a soft timber supply agreement with Canada and the impact of wildfires. In Australia, labour costs are a significant issue, with a labour shortage and increasing wages in the mining sector influencing other industries.

The rising costs of building materials and labour have had a ripple effect on the house insurance industry, contributing to the overall increase in insurance premiums. As the cost of construction rises, insurers face higher claims and pass these costs on to their customers in the form of higher insurance premiums.

The Farmers Insurance Blimp: A Skyward Marketing Strategy

You may want to see also

Inflation

The increase in inflation and supply chain issues has also contributed to a rise in the cost of building materials and labour, which in turn has impacted the cost of home insurance. The cost of construction materials such as screws, ready-mixed concrete, and door frames has increased, with a large part of this increase due to the higher cost of energy needed to produce them. Along with more expensive supplies, there is also a shortage of skilled labour in the construction industry, which has led to higher prices and reduced availability of builders.

Usaa: Insuring Florida Homes

You may want to see also

Increased insurance claims

Extreme weather events have contributed to an increase in insurance claims. The UK has experienced several named storms in recent years, including Storms Dudley, Eunice, and Franklin in February 2022, which led to 170,000 property damage claims totalling £473 million in payouts. The summer heatwave in 2022 also resulted in wildfires and subsidence issues, while the cold snap in December 2022 caused a surge in claims for burst frozen pipes. These weather events have led to a rise in the number and cost of claims, impacting insurance premiums.

In addition to extreme weather, the increasing cost of building materials and labour has also contributed to higher insurance claims. Construction costs rose by 15% in 2022 compared to the previous year due to factors such as the war in Ukraine and the fallout from the Covid pandemic. This has made repairing damaged homes more expensive, with insurers paying out £2.5 billion to customers in 2022, a 6% increase from 2021.

The rising cost of household appliances and furniture, as well as inflation, have also played a role in increasing the value of home contents claims. The depreciation of the pound has made imported parts and materials more expensive, and skilled labour shortages have driven up construction costs. These factors have contributed to higher insurance claims and, subsequently, higher premiums.

Furthermore, advancements in vehicle technology have led to the use of more complex and expensive components, which can increase the cost of motor insurance claims. Improvements such as LED matrix headlamps and automated headlight systems often require full replacement, even in cases of minor damage. Advanced Driver Assistance Systems (ADAS) and LiDAR technology, which are becoming more common in newer vehicles, can also result in higher repair costs if damaged.

While technology has made roads safer, it has also increased the financial loss when accidents or crimes occur. The cost of traditional repairs is also on the rise, with paint prices increasing due to a shortage of pigments and higher prices for resins and solvents. All these factors have contributed to the overall increase in insurance claims and, consequently, insurance premiums.

Farmers Insurance and Canine Constraints: Understanding Restricted Breeds

You may want to see also

Shortage of parts, materials, and workers

The shortage of parts, materials, and workers is a multifaceted issue with several contributing factors. One significant factor is the COVID-19 pandemic, which caused major disruptions to global supply chains and manufacturing processes. The pandemic led to a shortage of computer chips, affecting various industries, including the automotive industry. The auto industry faced challenges in repairing vehicles due to the difficulty in obtaining certain parts, with some parts on backorder.

The pandemic also resulted in a labour crisis, known as the "Great Resignation," where millions of workers quit their jobs in 2022 and 2021. This trend continued, albeit at a slower pace, in 2023. Industries such as food service, hospitality, and construction have been particularly affected by this labour shortage. The construction industry, for example, faced a surplus of unemployed workers but a shortage of workers with the required skills and in the necessary geographic locations.

Another factor contributing to the shortage of parts and materials is the increase in energy prices. The war in Ukraine and the fallout from the COVID-19 pandemic, including factory closures during lockdowns, have led to surging energy prices, impacting the production and transportation of goods.

Additionally, extreme weather events, such as storms and heatwaves, have resulted in more insurance claims, putting pressure on the availability of building materials and labour. The increase in weather-related claims, along with rising building material and labour costs, have contributed to the overall rise in home insurance prices.

Understanding Installment Fees in Farmers Insurance Policies

You may want to see also

Frequently asked questions

There are a multitude of reasons why house insurance has increased. Firstly, the rise in subsidence claims, frozen pipe payouts, and the increasing costs of building materials and labour have contributed to the rise in insurance premiums. Secondly, the rise in inflation has also played a role, as the higher inflation rate has decreased the value of the pound, making it more expensive to replace items. Thirdly, the increase in weather-related home insurance claims due to climate change has also impacted insurance prices. Finally, the rise in household burglaries and vehicle theft has also contributed to the increase in insurance premiums.

The average home insurance premium was £300 in 2022, according to the Association of British Insurers. In the first quarter of 2024, the average price paid for home insurance was £315, which is a 6% increase compared to the same quarter in the previous year.

Several factors are considered when calculating the cost of house insurance. These include the likelihood of the policyholder making a claim, the total cost of all claims made during the previous year, the cost of repairs, and the impact of severe weather events. Additionally, external factors such as changes to regulations, inflation, and the local neighbourhood's average claim costs are also taken into account.

To lower your house insurance premium, consider the following:

- Pay annually instead of monthly.

- Combine your buildings and contents insurance policies.

- Take advantage of a no-claims discount by avoiding making any claims.

- Utilise cashback offers from websites like TopCashback and Quidco.

- Ensure you don't overpay by accurately calculating the value of your belongings and the rebuild cost of your home.