If your car has been damaged by hail, you can file an auto insurance claim with Safeco. You can file your claim online or through the Safeco mobile app. Once you've filed, you can track your claim's progress in your online account. You can also call Safeco at 1-800-332-3226 or get in touch with your agent to file. When it's safe to do so, call Safeco as soon as you can. Be prepared to provide a general description of the hail damage and, if possible, take photographs and videos of the damage to help expedite the claims process.

| Characteristics | Values |

|---|---|

| How to file a claim | File online or through the Safeco mobile app |

| When to file a claim | At any time |

| What to do after a hailstorm | Make safety a priority, get in touch with Safeco, safeguard your property from further damage |

| How to repair hail damage to your house | Clean up broken glass, board up broken windows and doors, cover roof damage with tarps or plywood, move wet items to a dry location, place damaged items in a safe area for inspection |

| How to repair hail damage to your car | Cover broken windows with tarps or plastic sheeting, move wet items to a dry place, place damaged items in a safe area for inspection |

| How to get in touch with Safeco | Call 1-800-332-3226 |

What You'll Learn

File a claim online or through the Safeco mobile app

Filing an auto claim online or through the Safeco mobile app is fast, simple, and convenient. Here's a step-by-step guide to help you through the process:

Step 1: Log in to Your Account

If you don't already have an online account, you can create one on the Safeco website. It only takes a few minutes to sign up and manage your policy online. You can also download the Safeco mobile app, which is available for iOS and Android devices.

Step 2: Start the Claims Process

Once you're logged in, select the appropriate option to start the claims process. You'll be guided through the process step-by-step, and you can make updates to the information at any time.

Step 3: Provide Necessary Information

You'll need to provide details about the incident, such as the date, time, location, and a description of what happened. You may also be asked to provide photos or other supporting documentation.

Step 4: Track Your Claim

After filing your claim, you can easily track its progress through your online account or the mobile app. Log in at any time to check the status and see the latest updates.

Step 5: Work with Your Claims Representative

Your Safeco Claims Representative will contact you and any other parties involved to collect additional information and guide you through the next steps. They may request a recorded statement or additional documentation to support your claim.

Step 6: Get Your Vehicle Repaired

If your vehicle is safe to drive, don't take it for repairs until the parts have been delivered to the repair shop. If your vehicle is not drivable, make sure it is taken to a repair shop that can start the repairs immediately. You can choose any repair shop you prefer, but Safeco also offers a Guaranteed Repair Network of approved shops that provide convenience, negotiated rates, and guaranteed work.

Step 7: Manage Your Claim to Completion

Throughout the claims process, you can manage your claim online or through the mobile app. This includes updating your information, tracking the claim's progress, and communicating with your Claims Representative. Remember that you can always reach out to your Safeco agent or call the customer support line at 1-800-332-3226 if you have any questions or concerns.

Auto Insurance: How Long Should Your History Be?

You may want to see also

Contact your agent to file

If you need to make a hail auto insurance claim with Safeco, you can contact your agent to file. You can find your agent's contact information by logging into your online account or downloading the Safeco mobile app. If you don't have an online account, you can sign up in just a few minutes. Once you're logged in, you can also pay your bill, get policy documents, and file a claim.

If you prefer, you can also call Safeco at 1-800-332-3226 to file your claim. When you call, be prepared to provide at least a general description of the hail damage. Take photographs and videos of the damage if possible, as this can help expedite the claims process. If your car has been damaged by hail, cover any broken windows with tarps or plastic sheeting and move any wet items to a dry place. If possible, place any damaged items in a safe, secure area where they can be inspected at a later time.

In some states, you may also have a responsibility to file an accident report with the state. For example, in California, you are required to file an SR-1 any time you are in an accident that results in injuries or property damage exceeding $1,000. The form must be completed and sent to the Department of Motor Vehicles within 10 days of the accident. Similarly, in Tennessee, you must file a personal report with the Department of Safety and Homeland Security if you were involved in an automobile crash involving death, injury, or property damage exceeding $1,500. Failure to file a report in a timely manner may result in penalties, so be sure to check with your state's motor vehicle department to understand your obligations.

Once you've filed your claim, a Safeco Claims Representative will contact you to collect all the necessary information and guide you through the claims process. They may ask for a recorded statement to capture the details of the incident. If your vehicle is not drivable, be sure to notify Safeco of its location and let them know if it is in a place that is charging storage fees. Remember, do not authorize any repairs until Safeco has reviewed the damage, determined coverage, and provided an estimate of repair costs.

U.S. Auto Insurance: Who Qualifies?

You may want to see also

Call Safeco at 1-800-332-3226

If you need to make a hail auto insurance claim with Safeco, the first step is to call Safeco at 1-800-332-3226. You should do this as soon as possible after the hail damage has occurred, and when it is safe to do so. When you call, be prepared to provide a general description of the damage. It is also helpful to take photographs and videos of the damage, as this will help expedite the claims process.

Once you have made contact with Safeco, a Claims Representative will get in touch with you to collect all the information they need to resolve your claim. In some cases, they may ask for a recorded statement to capture the details of the incident. If your vehicle is not drivable, you should have it moved to a storage facility or repair shop of your choice and notify Safeco of the location. Remember, do not authorize any repairs until Safeco has had a chance to review the damage, determine coverage, and estimate repair costs.

After your initial contact with Safeco, the next steps in the claims process will be to:

- Have your damage reviewed

- Get an estimate at a repair shop

- Schedule your repairs if your vehicle isn't a total loss

- Manage your claim online through completion

You can also file your auto claim online or through the Safeco mobile app. However, if you prefer to speak to someone directly about your claim, calling 1-800-332-3226 is the best way to reach Safeco and initiate the claims process.

Understanding Auto Liability Insurance: Your Guide to Coverage and Claims

You may want to see also

Provide a general description of hail damage

Hail is a form of precipitation consisting of solid ice that forms inside thunderstorm updrafts. It can cause damage to aircraft, homes, and cars, and can be deadly to people and animals. The size of hailstones varies, with some being as small as a pea and others as large as softballs. Most hailstones do not have smooth edges, which can impact the type of damage they cause.

Hail damage to property can vary depending on several factors, including wind conditions, building materials, and the presence of natural barriers. For example, hail can cause dings in aluminum siding, gutters, or asphalt shingles, while also having the potential to crack vinyl siding or wood shakes. Larger hailstones can even puncture a roof.

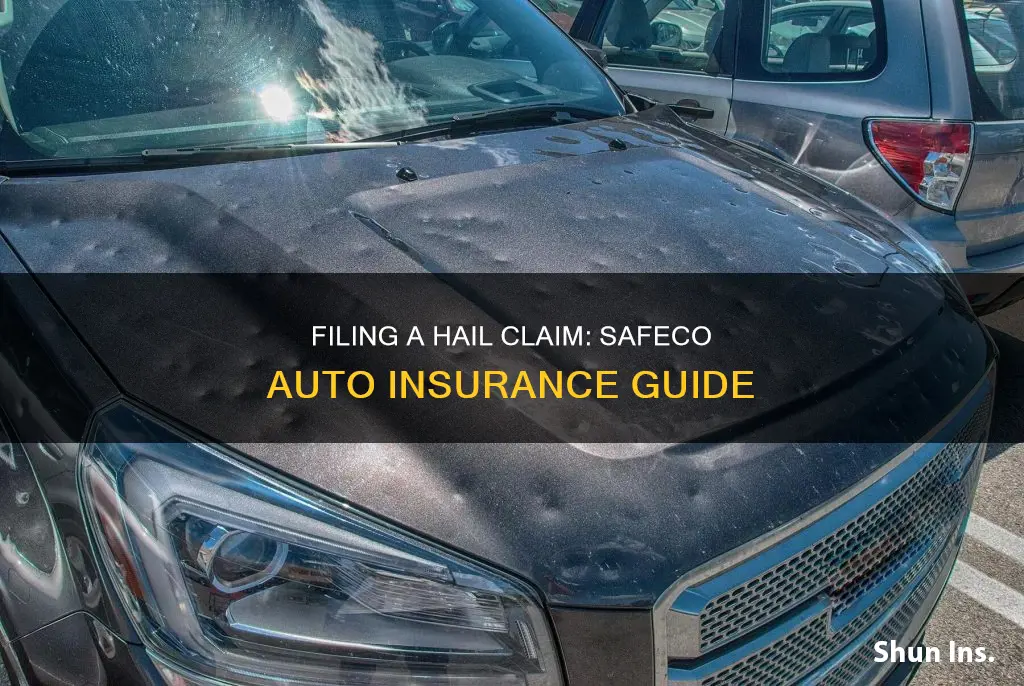

Hail damage to vehicles can also vary in severity. Cosmetic damage may include small dents in the exterior of the car, with the paint remaining intact. In other cases, hail can cause scratches to the paint or more severe mechanical damage. When car hail damage results in a total loss designation, these vehicles are often branded with a salvage title, deemed uninsurable, and lose a significant amount of their value.

Michigan's Annual Auto Insurance: A 12-Month Option

You may want to see also

Take photos and videos of the damage

When it's safe to do so, call Safeco as soon as you can at 1-800-332-3226. Be prepared to provide at least a general description of your hail damage. Taking photographs and videos of the hail damage is a great way to help the company understand what happened and expedite the claims process.

- Wear proper shoes and gloves for your safety.

- Capture images and footage of all damaged areas, including your roof, siding, windows, and personal belongings.

- Take close-up photos of any hailstones that are still present, as well as any broken glass, sharp objects, or exposed electrical wires.

- If possible, place any damaged items in a secure area where they can be inspected later.

- Include photos of any temporary repairs you make, such as tarps or plywood covering damaged areas, and save all receipts for these repairs.

- For car hail damage, cover any broken windows with tarps or plastic sheeting and move any wet items to a dry place.

- If you have comprehensive car insurance, your policy may cover hail damage to your vehicle. Take detailed photos of the damage from multiple angles to support your claim.

- If you have home insurance, document any damage to your property, such as holes in screens or damage to exterior fixtures.

- Capture the extent of the damage by taking photos from different distances and angles.

- Ensure the lighting is adequate for the damage to be clearly visible in the photos and videos.

- If possible, include a measuring tape or ruler in the photos to provide scale and help assess the size of the damage.

Direct Auto Insurance: 24/7 Support

You may want to see also

Frequently asked questions

You can file your auto claim online at any time or through the Safeco mobile app. You can also get in touch with your agent to file, or call 1-800-332-3226.

Once you file your claim, Safeco will work with your agent to help you have your damage reviewed, get an estimate at a repair shop, and schedule your repairs if your vehicle isn't a total loss.

A Total Loss Adjuster will contact you and provide you with a detailed explanation of their evaluation.

You can log in to your online account to track and manage your claim or contact your agent for answers.

Make safety your first priority. Cover any broken windows with tarps or plastic sheeting and move any wet items to a dry place. If possible, place any damaged items in a safe, secure area where they can be inspected at a later time.