Navigating the challenges of a service job in insurance can be a rewarding experience, but it also demands a unique set of skills and strategies. This guide will provide essential tips and insights on how to excel in customer service within the insurance industry. From understanding the importance of empathy and active listening to mastering effective communication and problem-solving techniques, you'll learn how to build strong client relationships, manage difficult situations, and ensure customer satisfaction. Whether you're a seasoned professional or new to the field, these strategies will empower you to thrive in your role and deliver exceptional service.

What You'll Learn

- Customer Service: Prioritize client satisfaction through friendly, efficient interactions

- Product Knowledge: Master insurance products to provide accurate guidance

- Problem-Solving: Address client issues promptly and creatively

- Documentation: Maintain accurate records to ensure compliance and smooth operations

- Team Collaboration: Foster a cohesive team for seamless service delivery

Customer Service: Prioritize client satisfaction through friendly, efficient interactions

In the insurance industry, customer service is a cornerstone of success, and prioritizing client satisfaction is paramount. Here's a guide on how to excel in this role:

Master the Art of Communication: Effective communication is key. Train yourself to be an active listener, paying close attention to clients' needs and concerns. Use clear and concise language, avoiding insurance jargon that might confuse customers. A friendly and approachable tone can instantly put clients at ease, making them feel valued and understood. Practice empathy; imagine yourself in their shoes to offer tailored solutions.

Efficiency is Essential: Time is precious, especially for busy clients. Learn to prioritize tasks efficiently. Respond promptly to inquiries, ensuring that no customer is left waiting for extended periods. Implement streamlined processes to handle common issues quickly. For instance, develop a standardized system for policy updates or claim submissions, minimizing the time clients spend on administrative tasks.

Go Beyond Basic Needs: Strive to exceed expectations. Anticipate clients' needs and offer proactive solutions. For instance, if a customer is about to renew their policy, reach out with a personalized quote and highlight any relevant discounts or benefits. This level of service demonstrates your commitment to their long-term satisfaction.

Personalize the Experience: Make each interaction unique. Remember personal details about your clients, such as their policy history or specific insurance preferences. This personalized approach shows that you care about their individual circumstances. For example, if a client mentions a recent home renovation, offer tailored advice on coverage enhancements without being overly pushy.

Continuous Learning: The insurance industry evolves, so stay updated on industry trends and product changes. Attend workshops or webinars to enhance your knowledge. Being well-informed allows you to provide accurate advice and build trust with clients. Additionally, gather feedback from customers to identify areas for improvement in your service delivery.

Remember, in insurance, building strong client relationships is vital. By focusing on friendly, efficient interactions, you can create a positive and lasting impression, ensuring client satisfaction and loyalty.

**Billing Insurance for Couples Counseling: Navigating the Process Together**

You may want to see also

Product Knowledge: Master insurance products to provide accurate guidance

To excel in a service role in the insurance industry, a deep understanding of the products you offer is paramount. This knowledge is the cornerstone of providing accurate guidance to clients, ensuring their needs are met with the most suitable solutions. Here's a structured approach to mastering product knowledge:

- Comprehensive Product Study: Begin by thoroughly examining the entire product portfolio of your insurance company. This includes health, life, auto, home, and any specialized insurance offerings. Understand the features, benefits, coverage options, and exclusions of each product. For instance, grasp the nuances of health insurance plans, such as HMO and PPO structures, deductibles, copayments, and network coverage.

- Customer-Centric Perspective: Shift your focus to how these products impact customers. Consider the diverse needs and concerns of your target audience. For example, explain how life insurance can provide financial security for families, how auto insurance protects drivers from financial losses due to accidents, and how home insurance safeguards homeowners against property damage and liability risks. This customer-centric view will enable you to offer tailored advice.

- Continuous Learning: The insurance industry is dynamic, with products evolving to meet changing market demands. Stay updated by regularly reviewing product manuals, attending training sessions, and participating in industry workshops. Many insurance companies provide online resources and webinars to educate their employees. Engage with colleagues who have extensive product knowledge to learn from their experiences.

- Practice and Application: Knowledge is most powerful when applied. Role-play scenarios with colleagues to simulate customer interactions. Practice explaining complex product features in simple terms. For instance, if you're selling life insurance, demonstrate how different coverage amounts and term lengths can provide financial security for various life stages. This practical approach will enhance your confidence and ability to offer precise guidance.

- Stay Informed on Market Trends: Keep abreast of industry trends and changes in regulations. Insurance products are often influenced by market shifts and regulatory updates. For instance, understanding the impact of healthcare policy changes on insurance offerings is crucial. Being well-informed allows you to anticipate customer needs and provide relevant solutions.

Mastering product knowledge is a continuous journey, and it empowers you to deliver exceptional service. It ensures that you can accurately assess a customer's situation and recommend the most appropriate insurance products, fostering trust and long-term client relationships.

HIV Test: Insurance Coverage?

You may want to see also

Problem-Solving: Address client issues promptly and creatively

In the insurance industry, addressing client issues promptly and creatively is a cornerstone of exceptional customer service. When clients reach out with problems, it's crucial to respond quickly, as delays can often escalate concerns and lead to dissatisfaction. A swift response demonstrates your commitment to their needs and can turn a potentially negative experience into a positive one. Here's a detailed guide on how to tackle this aspect of customer service:

Understand the Issue: Begin by thoroughly understanding the client's problem. Encourage them to explain their situation in detail, asking relevant questions to gather all necessary information. Active listening is key; pay attention to their concerns, tone, and any specific requests they might have. This understanding forms the basis of your problem-solving strategy.

Prioritize and Triage: Prioritization is essential, especially in a busy service environment. Assess the urgency and severity of the issue. For instance, a client reporting a significant loss or a critical policy issue should be addressed immediately. Triage ensures that you allocate your time and resources effectively, providing the most immediate and necessary support.

Offer Creative Solutions: Problem-solving in insurance often requires creativity, especially when dealing with unique or complex situations. Brainstorm potential solutions with the client, considering their specific circumstances. For example, if a client is facing a claim denial, explore alternative coverage options or suggest adjustments to their policy that could better suit their needs. Creative problem-solving can lead to client satisfaction and foster long-term loyalty.

Provide Timely Updates: Keep the client informed throughout the problem-solving process. Provide regular updates on the steps you're taking to resolve their issue. This transparency builds trust and reduces anxiety. For instance, if you're waiting for additional information or external approvals, let the client know and set clear expectations for when they can expect a resolution.

Empower Your Team: Effective problem-solving often involves collaboration. Ensure your team members are trained to handle client issues and empowered to make decisions. Cross-training can ensure that multiple team members can assist in various scenarios, allowing for quicker response times. Regular team meetings can also foster a culture of creative problem-solving, where ideas and solutions are shared and refined.

Learn and Improve: After addressing a client's issue, conduct a post-incident review. Analyze what went well and what could be improved. This reflective practice helps in refining your problem-solving skills and ensures that similar issues are handled more efficiently in the future. Learning from each interaction is vital to providing consistently excellent service.

By implementing these strategies, insurance professionals can ensure that client issues are not just resolved but also transformed into opportunities to enhance the customer experience. Prompt and creative problem-solving is a powerful tool for building a positive reputation and fostering long-term client relationships.

Protect Your Unlocked Phone: A Guide to Insurance

You may want to see also

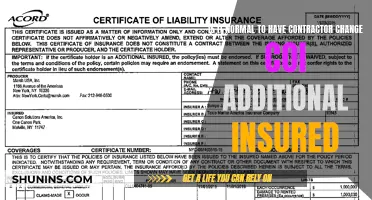

Documentation: Maintain accurate records to ensure compliance and smooth operations

Documentation is a critical aspect of any service job in the insurance industry, as it ensures compliance with regulations, facilitates smooth operations, and provides a clear record of your work. Here's a guide on how to excel in this area:

Organize and Structure Your Records: Create a comprehensive filing system that categorizes documents based on their content and purpose. For instance, you might have separate folders for customer information, policy details, claims, and correspondence. Within each category, further organize files by date or client name for easy retrieval. This structured approach will save time and reduce the risk of errors when searching for specific documents.

Maintain Accuracy and Consistency: Accuracy is paramount in insurance documentation. Double-check all data entered into records, ensuring it is correct, up-to-date, and free from errors. Consistency in formatting and terminology is also essential. Establish a style guide or template for document creation, ensuring all relevant information is included and presented uniformly across all records. This consistency will make it easier for colleagues to understand and interpret the documentation.

Secure and Protect Sensitive Information: Insurance jobs often deal with sensitive customer data, including personal details, financial information, and medical records. Ensure that all documentation is stored securely, both physically and digitally. Implement access controls to restrict who can view or modify sensitive records. Regularly back up data to prevent loss and consider using encryption for digital files to safeguard customer privacy.

Implement Regular Audits: Conduct periodic audits of your documentation to verify its accuracy and completeness. This process should be a standard part of your operational routine. During audits, review records for any discrepancies, outdated information, or missing elements. Address any issues promptly and update the records accordingly. Regular audits help identify potential problems early on and ensure that your documentation remains reliable.

Utilize Technology for Efficiency: Leverage digital tools and software designed for insurance documentation management. These tools can streamline the process, making it more efficient and user-friendly. For example, use customer relationship management (CRM) systems to organize and access customer data, or employ document management software to automate record-keeping and retrieval. Technology can also facilitate collaboration, allowing multiple team members to work on the same documents simultaneously.

By implementing these documentation practices, you will not only ensure compliance with industry standards but also contribute to the overall efficiency and success of your insurance service role. Accurate and well-organized records are essential for providing excellent customer service, managing operations effectively, and maintaining a positive reputation for the insurance company.

Understanding Your Insurance Bill: A Comprehensive Guide

You may want to see also

Team Collaboration: Foster a cohesive team for seamless service delivery

In the insurance industry, effective team collaboration is the cornerstone of delivering exceptional service to clients. A cohesive team dynamic ensures that every member understands their role and works in harmony to provide seamless support. Here's a guide on fostering such a collaborative environment:

Establish Clear Roles and Responsibilities: Begin by defining the roles within your team. Each team member should have a clear understanding of their duties and how they contribute to the overall service delivery process. For instance, in a claims processing team, roles might include claims adjusters, investigators, and customer service representatives. By outlining these roles, you ensure that everyone knows their place in the service chain, reducing confusion and potential errors.

Encourage Open Communication: Effective communication is vital for team cohesion. Create an environment where team members feel comfortable sharing ideas, concerns, and feedback. Regular team meetings, both formal and informal, can facilitate this. For instance, a weekly team huddle can be a platform for quick updates, addressing immediate issues, and brainstorming solutions. Additionally, encourage cross-functional communication, where team members from different departments collaborate to solve complex problems, ensuring a holistic approach to service delivery.

Promote a Culture of Continuous Learning: Insurance is a dynamic field, with regulations, products, and client needs constantly evolving. Foster a learning culture where team members are encouraged to stay updated with industry trends, new product launches, and regulatory changes. Provide resources and training programs to enhance their skills. For example, organize workshops or online courses to educate the team on emerging trends in the insurance market, ensuring they are equipped to handle diverse client needs.

Recognize and Celebrate Achievements: Acknowledging and celebrating team successes can significantly boost morale and foster a positive work environment. Recognize individuals or teams who have gone above and beyond to deliver exceptional service. This can be done through simple gestures like public appreciation, team outings, or small rewards. Celebrating achievements not only motivates the team but also reinforces the value of collaboration, encouraging everyone to work together towards common goals.

Implement Feedback Mechanisms: Regular feedback is essential for improvement and growth. Encourage team members to provide constructive feedback to one another and to management. This can be done through anonymous feedback forms, one-on-one meetings, or team surveys. By actively listening to feedback, you can identify areas of improvement and make necessary adjustments to processes and team dynamics, ensuring a more cohesive and efficient service delivery.

By implementing these strategies, you can create a highly collaborative team within the insurance service sector, leading to improved client satisfaction, increased efficiency, and a more positive work environment. Remember, a cohesive team is the key to delivering exceptional service in a competitive industry.

Insurance: A Financial Services Sector Overview

You may want to see also

Frequently asked questions

In the insurance sector, customer-facing roles demand a unique set of skills. Excellent communication and active listening abilities are essential to understand clients' needs and provide tailored solutions. Empathy and patience are crucial for building rapport and handling diverse customer inquiries. Additionally, strong organizational skills, attention to detail, and the ability to manage multiple tasks efficiently are highly valued.

Providing exceptional customer service in a fast-paced insurance setting requires a strategic approach. Firstly, develop a thorough understanding of the products and services offered by your company. This knowledge will enable you to provide accurate and timely information to clients. Secondly, maintain a calm and professional demeanor, even under pressure, to ensure a positive customer experience. Quick thinking and adaptability are key to handling unexpected situations. Regularly seek feedback from customers and colleagues to identify areas for improvement and implement necessary changes.

Dealing with difficult customers and complaints is an inevitable part of service jobs in insurance. Firstly, remain composed and empathetic, actively listening to the customer's concerns. Apologize sincerely and acknowledge their frustration. Offer immediate solutions or alternatives and ensure the customer feels heard and valued. It's important to remain calm, patient, and professional throughout the interaction. If the issue is complex, escalate it to a supervisor or manager who can provide further assistance and guidance. Regularly review and learn from challenging situations to improve your handling of similar scenarios in the future.