A Certificate of Insurance (COI) is a document that proves a contractor has insurance coverage. It is normal for a contractor to change the COI additional insured, as the contractor may need to meet certain requirements to qualify for a contract, sign a lease, or take out a loan. The additional insured is typically the client, landlord, or lender, who is entitled to the same coverage benefits as the contractor. This provides protection for both the contractor and the additional insured in the event of unforeseen setbacks, such as injuries or property damage.

| Characteristics | Values |

|---|---|

| What is a Certificate of Insurance (COI)? | A document that proves a contractor has insurance coverage. |

| Who needs a COI? | Independent contractors who want to work with certain clients, sign a lease, or take out a loan. |

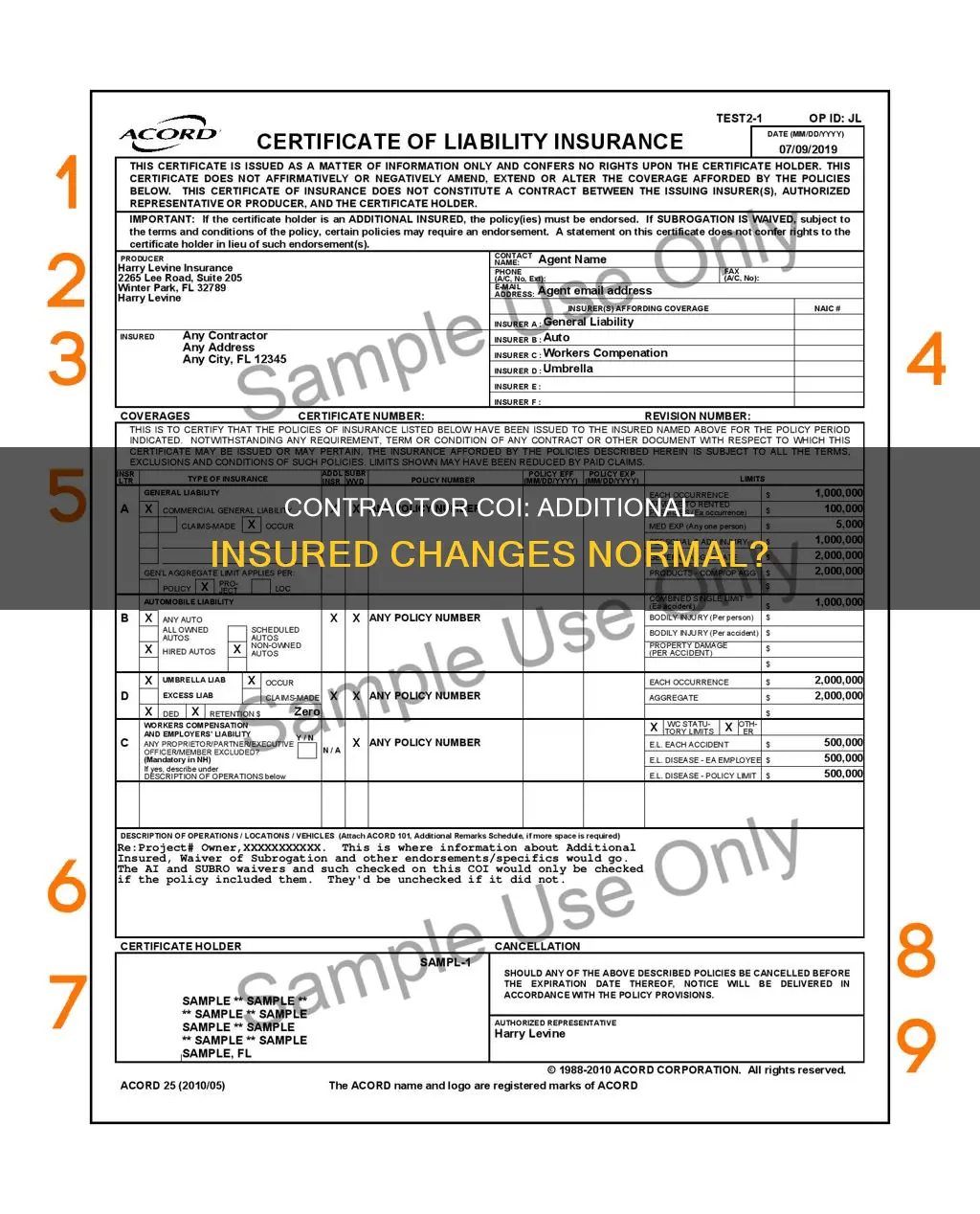

| What does a COI include? | Per-occurrence and aggregate coverage limits, effective date and expiration date, business name, name of the insurance company, policy number, coverage period, policy limit, and a summary of coverage. |

| What is an additional insured? | Another individual or business added to an insurance policy by the policyholder, who is entitled to the same coverage benefits. |

| Who can be an additional insured? | Clients, owners, landlords, lenders, general contractors, subcontractors, investors, or government entities. |

| Why do additional insureds request a COI? | To ensure they won't be financially responsible for any incidents or accidents caused by the contractor. |

What You'll Learn

What is a certificate of insurance?

A certificate of insurance (COI) is a document issued by an insurance company or broker that verifies the existence of an insurance policy. It is a summary of the key aspects and conditions of the policy, such as the policyholder's name, the effective date, the type of coverage, and policy limits. It is typically no more than one page long and is used as proof of insurance coverage.

Small business owners and contractors usually require a COI to protect themselves against liability for workplace accidents or injuries. It also helps them secure clients, as the clients will want to ensure that the business owner or contractor has adequate insurance before hiring them.

A COI can be used in various business partnerships and is especially important when hiring contractors or service providers to ensure that your project is adequately covered in case of any accidents or losses. It provides security to all the parties listed in the contract and involved in the project.

When reviewing a COI, it is important to check that the name of the insured matches the person or company you are contracting with, the policy is in effect and will not expire before the project is completed, all necessary coverages are listed, and the issuing insurer is legitimate.

COIs are commonly used in the construction industry, where contractors are required to provide proof of insurance to meet the requirements of a contract. It is also used to show that a contractor has named the client as an additional insured on their policy, providing coverage to the client in case of any claims.

Maximizing Telehealth Nutrition Counseling Reimbursement: A Guide to Efficient Insurance Billing

You may want to see also

Why do contractors need a COI?

A certificate of insurance (COI) is a document that proves a contractor has insurance coverage. It is issued by an insurance company or broker and verifies the existence of an insurance policy. It is also known as an ACORD 25 form.

Contractors may need a COI to work with certain clients, as it is often requested as a first-step prerequisite. It is also required to sign a commercial lease or take out a loan. A COI provides peace of mind to the people they work for or rent from, as well as their own business. It is a crucial part of a contractor's financial strategy.

A COI includes important information about the certificate holder's policy, such as per-occurrence and aggregate coverage limits, effective and expiration dates, and the type of coverage. The most common type of insurance for independent contractors is commercial general liability insurance, which protects contractors against legal costs when someone blames them for bodily injury, property damage, defamation, or copyright infringement.

Some clients may ask contractors to carry professional liability insurance, also known as errors and omissions insurance (E&O), which covers the cost of lawsuits related to unsatisfactory work, missed deadlines, and mistakes.

COIs are especially common in contracting due to the dangerous nature of construction work. They are often required by businesses hiring contractors to protect themselves from financial losses. A COI helps protect all parties involved in a business partnership from financial risks associated with accidents or losses.

If a contractor does not have a COI, it can result in a breach of contract, leading to legal disputes and financial losses. For example, if a contractor without liability coverage for property damage causes an accident, the property owner may be held responsible for the damages.

In addition to providing proof of insurance, a COI can also be used to include an additional insured (AI) endorsement, adding another party (such as an owner, investor, or general contractor) to the contractor's policy. This provides protection for the additional insured in the event of a claim.

The Intricacies of Insurance Aggregates: Unraveling the Concept for a Clearer Understanding

You may want to see also

Who is an additional insured?

An additional insured is a person, group, or location that is added to a business insurance policy purchased by the primary insured. It is a way of extending the named insured's coverage to others. Typically, an additional insured is added to a commercial general liability (CGL) policy, but they can also be added to tenant insurance, professional liability, errors and omissions, and more.

An additional insured is not automatically included in an insurance policy but is added at the request of the named insured. This may be because of a close relationship with the party to be insured or to comply with a contractual agreement.

An additional insured endorsement protects the additional insured under the named insurer's policy, allowing them to file a claim if sued. This is particularly useful in the case of third-party liabilities, such as claims of bodily injury, property damage, or advertising injury to a client, customer, or another third party.

For example, a general contractor might require subcontractors to name the general and the owner on the subcontractor's policies. If the general contractor or owner is sued due to accidents arising from the work of the subcontractor, the subcontractor's insurance will protect the general contractor and owner.

It is important to note that an additional insured cannot be included in a professional liability policy.

Maximizing Reimbursement: Navigating Insurance Billing for EMDR Therapy

You may want to see also

How to add an additional insured to a policy?

Adding an additional insured to your insurance policy means extending your liability coverage to them. This protects them from potential lawsuits arising from your operations. For example, if a visitor to a construction site trips on a contractor's equipment and gets injured, they could sue the contractor and the project owner. If the project owner is listed as an additional insured on the contractor's policy, they would also be protected by the contractor's insurance policy.

To add an additional insured to your insurance policy, you typically need to notify your insurance provider. They will likely ask for details about the additional insured, such as their name, address, and other key information. This will likely increase your insurance premium, but it is usually less expensive than the additional insured purchasing their own coverage.

The insurance company will then add the additional insured to your Certificate of Insurance (COI). A COI is a document that proves you have insurance coverage and is often required by clients, landlords, or lenders. It includes important information about the policy, such as coverage limits, effective dates, and the type of insurance.

It is important to note that additional insured status is typically limited to general liability insurance policies and cannot be added to professional liability policies. Additionally, the coverage provided to the additional insured may be limited to a single event or the lifetime of the policy, depending on the specifics of the policy.

Navigating ADP Insurance Changes: A Comprehensive Guide

You may want to see also

What is a certificate holder?

A certificate holder is a third party that may be named on a certificate of insurance (COI). They are the party to which the COI is provided as evidence of insurance. In other words, they are the ones who request the COI from the insured. The insured gives the COI to the certificate holder to prove they have the correct coverage.

A COI is a document that proves you have insurance coverage. It is also known as an ACORD 25 form. Independent contractors use these forms to show clients, landlords, and lenders that they are insured. It includes important information about the certificate holder's policy, such as per-occurrence and aggregate coverage limits, effective and expiration dates, the name of the insurance company, the policy number, and a summary of coverage.

While a certificate holder is named on the COI, they do not have protection or coverage under the policy and cannot file a claim. They simply hold the certificate to assure the policyholder they are working with has their own coverage. An additional insured, on the other hand, is covered under the policy and has the right to file a claim.

Understanding Insurance Billing for Procedure Code 54235: A Comprehensive Guide

You may want to see also

Frequently asked questions

A Certificate of Insurance is a document that proves you have insurance coverage. It is often required by clients, landlords, or lenders before they agree to work with you, sign a lease, or give you a loan.

An Additional Insured is a person or entity added to an insurance policy by the policyholder. They are entitled to the same coverage benefits as the primary insured and can make a claim against the policyholder's insurance if something goes wrong.

A common requirement in construction contracts is for any hired contractor to provide additional insured status to the Owner, General Contractor, and/or another Trade Contractor. This protects them from potential claims arising from the work carried out by the hired contractor.