Cancelling your auto insurance policy is a straightforward process, but it's important to get it right to avoid a lapse in coverage, which could result in fines and even a licence suspension. There are several reasons why you might need to cancel your auto insurance policy, including selling your car, switching to a new insurance provider, or moving to a different state. Before cancelling your policy, it's recommended that you purchase a new policy to ensure continuous coverage. You can then contact your current insurance provider to initiate the cancellation process, which may involve submitting a written request or signing a cancellation form. By law, nearly all states require drivers to have a minimum amount of auto liability coverage, so it's important to make sure you have alternative coverage in place before cancelling your existing policy.

| Characteristics | Values |

|---|---|

| Reasons to cancel your auto insurance policy | Switching insurance companies, covered under someone else's policy, moving out of the country, selling your car, getting a different policy, moving to a new state |

| When to cancel your auto insurance policy | When you have a new policy in place to avoid a lapse in coverage |

| How to cancel your auto insurance policy | Contact your insurance company by phone, email, postal mail, or in person; sign a cancellation form, if required; request a policy cancellation notice |

| What happens after cancelling your auto insurance policy | You may be eligible for a refund or a cancellation fee, depending on the insurer and the state |

What You'll Learn

- Cancelling your auto insurance policy: contact your insurance company and follow their rules for cancellation

- Avoid a lapse in coverage: ensure you have a new policy before cancelling your old one

- Cancelling for the right reasons: valid reasons include switching insurance companies, being covered under someone else's policy, or moving out of the country

- Cancelling fees and refunds: you may be charged a fee for cancelling and could be eligible for a refund on the unused portion of your policy

- Notify your insurer: let your old insurer know if you sell your car or switch companies

Cancelling your auto insurance policy: contact your insurance company and follow their rules for cancellation

Cancelling your auto insurance policy is a simple process and can be done at any time. However, it is important to follow the correct procedure to avoid problems and extra charges.

Firstly, you should ensure that you have a new insurance policy in place, or that you no longer need insurance. This is because a lapse in coverage can result in higher rates in the future, and driving without insurance is illegal in many states. If you are switching providers, make sure there is some overlap between your old and new policies to avoid this.

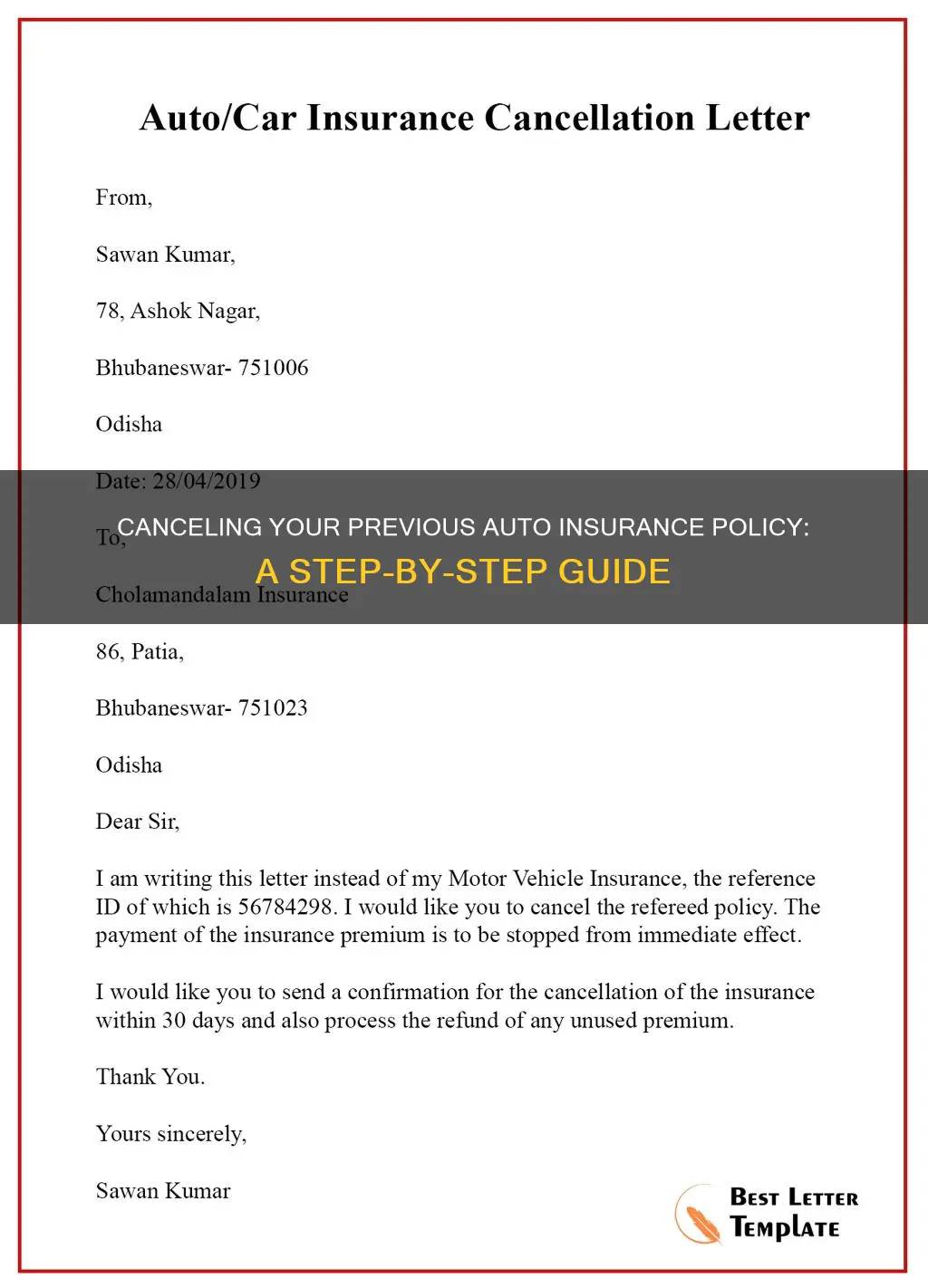

Next, contact your insurance company to find out their specific cancellation procedure. Most major companies will ask that you speak with an insurance agent, either over the phone, by mail or fax, or in person. The phone number will likely be found on your insurance card, as well as on the company's website or app. Some companies may allow you to cancel online through their website.

When you get in touch, ask about the cancellation process and any requirements they have. Some companies may charge a cancellation fee, which can be a flat fee or a percentage of your remaining premium. They may also require a notice period, such as 30 days, and a signed cancellation letter.

Once you have followed their procedure, make sure you receive confirmation of your policy cancellation. This will include details of any refund you are owed for unused premiums, minus any fees.

If you are cancelling because you are switching providers, your new insurance company may be able to assist in the transition and help you cancel your old policy.

Force-Placed Auto Insurance: Understanding the Risks and Costs

You may want to see also

Avoid a lapse in coverage: ensure you have a new policy before cancelling your old one

When switching auto insurance providers, it is crucial to avoid a lapse in coverage. This means ensuring that your new policy is in effect when the old one is cancelled. The best way to do this is to purchase a new policy before ending your old one. Ideally, your new policy should begin on the same date that your old policy ends.

Having a gap in your insurance coverage can have several negative consequences. Firstly, it can result in fines and penalties, including suspension of your license and even jail time, as a minimum amount of car insurance coverage is mandatory in almost all states. Secondly, if you cause an accident while uninsured, you will be responsible for paying for any injuries or damage out-of-pocket, which could be financially devastating. Finally, a lapse in coverage may make it more difficult and expensive to purchase a new policy in the future, as some providers may consider you a higher risk and charge higher rates.

Therefore, when switching insurance providers, it is important to carefully time the cancellation of your old policy. Be sure to check if your auto insurance company has a notice requirement for cancellation, as some require up to 30 days' notice. You should also consider any potential fees associated with cancelling your old policy, as some companies charge a flat fee or a percentage of the remaining policy premium.

In summary, to avoid a lapse in coverage, be sure to purchase a new policy before cancelling your old one, ensuring that the start date of your new policy matches the intended cancellation date of the old policy. This will help you to avoid the negative consequences of a coverage gap and ensure continuous protection.

Short-Term Insurance: Avoid Gaps, Stay Covered

You may want to see also

Cancelling for the right reasons: valid reasons include switching insurance companies, being covered under someone else's policy, or moving out of the country

Cancelling your auto insurance is simple, but it's important to understand the valid reasons for doing so to avoid unnecessary costs and maintain adequate coverage. Here are some scenarios where cancelling your current auto insurance policy may be the right decision:

Switching Insurance Companies

If you find a better deal or are dissatisfied with your current insurer, switching insurance companies is a common reason to cancel your existing policy. It's crucial to ensure that your new policy is in effect before ending the old one to avoid a lapse in coverage, which could result in higher rates and legal consequences.

Being Covered Under Someone Else's Policy

If you are a member of a household where another person has coverage, you may be added to their policy. This often happens when people get married or when adult children move back home. While adding a driver may increase the premium, there are also potential discounts to mitigate the increase. Remember that insurance follows the vehicle, so ensure the car you drive is included in the other person's policy.

Moving Out of the Country

Relocating abroad is another valid reason to cancel your auto insurance policy. However, if you are moving to another state within the country, you may not need to change insurers unless your current company doesn't offer coverage in that state. Contact your insurer to understand their policies and ensure a smooth transition.

Other Considerations

When cancelling your auto insurance policy, it's essential to follow the proper procedures, which may include contacting your insurer, submitting a cancellation form, and understanding any applicable fees or refunds. Additionally, remember that most states require a minimum level of auto insurance coverage, so ensure you have adequate coverage through another company before cancelling your existing policy.

College Kids: Vehicle Insurance Dependants?

You may want to see also

Cancelling fees and refunds: you may be charged a fee for cancelling and could be eligible for a refund on the unused portion of your policy

Cancelling your car insurance policy may come with a fee, and you could be eligible for a refund on the unused portion of your policy.

Cancelling Fees

Whether or not you will be charged a fee for cancelling your car insurance policy depends on the insurance company and the laws in your state. Some companies do not charge a cancellation fee, but it is always best to check with your insurance provider. If you took out your policy through a broker, they may charge a cancellation fee on top of the insurance provider's fee.

Cancellation fees are sometimes called short-rate penalties. The amount of the fee depends on the insurer's rules and the laws in your state. For example, South Carolina allows companies to charge a $20 fee at the beginning of your policy term, which is generally not refunded.

Refunds

If you paid your premium in advance and cancel your policy before the end of the term, you will typically get a refund for the remaining time in your policy. The amount of the refund will depend on how much time is left on your policy and the company's rules about refunds.

If you pay your premium monthly, you may or may not get a refund depending on when you cancel. If you cancel in the middle of the month or billing cycle, you may get a partial refund for that month.

If your insurance company cancels your policy, you will usually receive a refund unless they cancel for non-payment. In this case, you will not receive a refund and will continue to owe the insurer any unpaid premiums.

Auto Insurance: Adding Names, What You Need to Know

You may want to see also

Notify your insurer: let your old insurer know if you sell your car or switch companies

When selling your car or switching insurance companies, it's important to notify your old insurer. Here are some detailed steps and considerations to help you through the process:

Understand the Importance of Notification:

Letting your old insurer know about the sale of your car or your decision to switch is crucial. This helps prevent any lapse in coverage, which could result in fines and legal issues. Most states require a minimum level of insurance, and a gap in coverage may lead to higher future premiums as insurers consider such lapses as high-risk behaviour.

Timing is Key:

When switching insurance providers, ensure your new policy is in effect before ending the old one. Ideally, have them overlap by starting the new policy a day before cancelling the old. This avoids any period where you are uninsured. If you're selling your car, maintain coverage until the sale is complete, including signing over the title to the new owner.

Be Aware of Potential Fees:

Some insurers may have a 30-day notice requirement for cancellation, so check your policy. Also, while many insurers don't charge cancellation fees, some may, so be prepared for a potential flat fee or a percentage-based fee deducted from any refund.

Request Documentation:

When you do cancel, ask for a policy cancellation notice for your records. This confirms that you've terminated the policy and can be useful if any issues arise regarding the cancellation.

Expect a Possible Refund:

If you've paid your coverage in advance, you may be eligible for a refund, especially if switching providers. The refund will often be prorated, but your new insurer may offer a policy credit instead.

Communicate with Your Lender:

If you have a car loan or lease, be sure to inform your lender of the insurance change. Lenders usually require collision and comprehensive insurance, so they'll need to know the details of your new coverage.

In summary, notifying your old insurer when selling your car or switching companies is a critical step to ensure compliance with insurance requirements and to avoid any financial penalties or legal issues. By following the above steps, you can effectively manage the transition to your new insurance coverage.

Find Auto Insurance Leads: Strategies for Success

You may want to see also

Frequently asked questions

Contact your insurance company to understand their specific cancellation process. Most companies will require a phone call, and some may ask you to submit a request for cancellation in writing. If you are switching insurers, it is best to set up your new policy before cancelling your old one to avoid a lapse in coverage.

It is best to contact your insurer and communicate your intention to cancel. If you simply stop paying, your insurance provider will eventually cancel your policy for non-payment, but there may be charges for coverage up until that point, along with possible late fees.

Yes, you can cancel your auto insurance policy at any time and for any reason. You do not need to wait until the end of your policy period.

Your insurer will likely notify your state, and your state's Department of Motor Vehicles may ask you for proof that you either sold the vehicle or have obtained other insurance. If you had paid your premium in advance, your insurer might refund the remaining balance, prorated for the number of days your policy was in effect. However, some insurers may charge a cancellation fee.