Writing an appeal letter for an auto insurance claim can be a challenging and daunting task. However, with the right approach and organisation, it is possible to get your claim reviewed and hopefully approved. This process usually begins with checking that you have followed the rules and regulations regarding your claim, and if the insurance company still refuses to pay, you should write an appeal letter to refute their decision. This letter should be addressed to the relevant customer service representative and include specific information and documentation regarding your claim.

| Characteristics | Values |

|---|---|

| Tone | Polite, professional, calm, respectful |

| Content | Reason for the letter, overview of the case, proposal to amend the error, supporting evidence, explanation of any errors or omissions |

| Addressee | Insurance company and the person who denied the claim |

| Contact Information | Patient name, policy number, policyholder name, accurate contact information for patient and policyholder |

| Date of Denial | Date the application was denied |

| Agent | Name of the agent who rejected the claim |

| Documentation | Supporting documentation, medical records, diagnoses, bills, test results, police reports, photographs, repair estimates, appraisals, state laws |

| Deadlines | Set a deadline for a response, follow up with the insurance company, be mindful of the deadline for filing a claim |

| Conclusion | Thank the insurance company, provide contact information |

What You'll Learn

- Include the date of the request, the date of denial, and the name of the rejecting agent

- Address the letter to the relevant customer service representative

- Provide a calm, respectful tone and overview of your case

- Attach supporting documentation, e.g. medical records, police reports, etc

- Explain any errors or omissions on your part

Include the date of the request, the date of denial, and the name of the rejecting agent

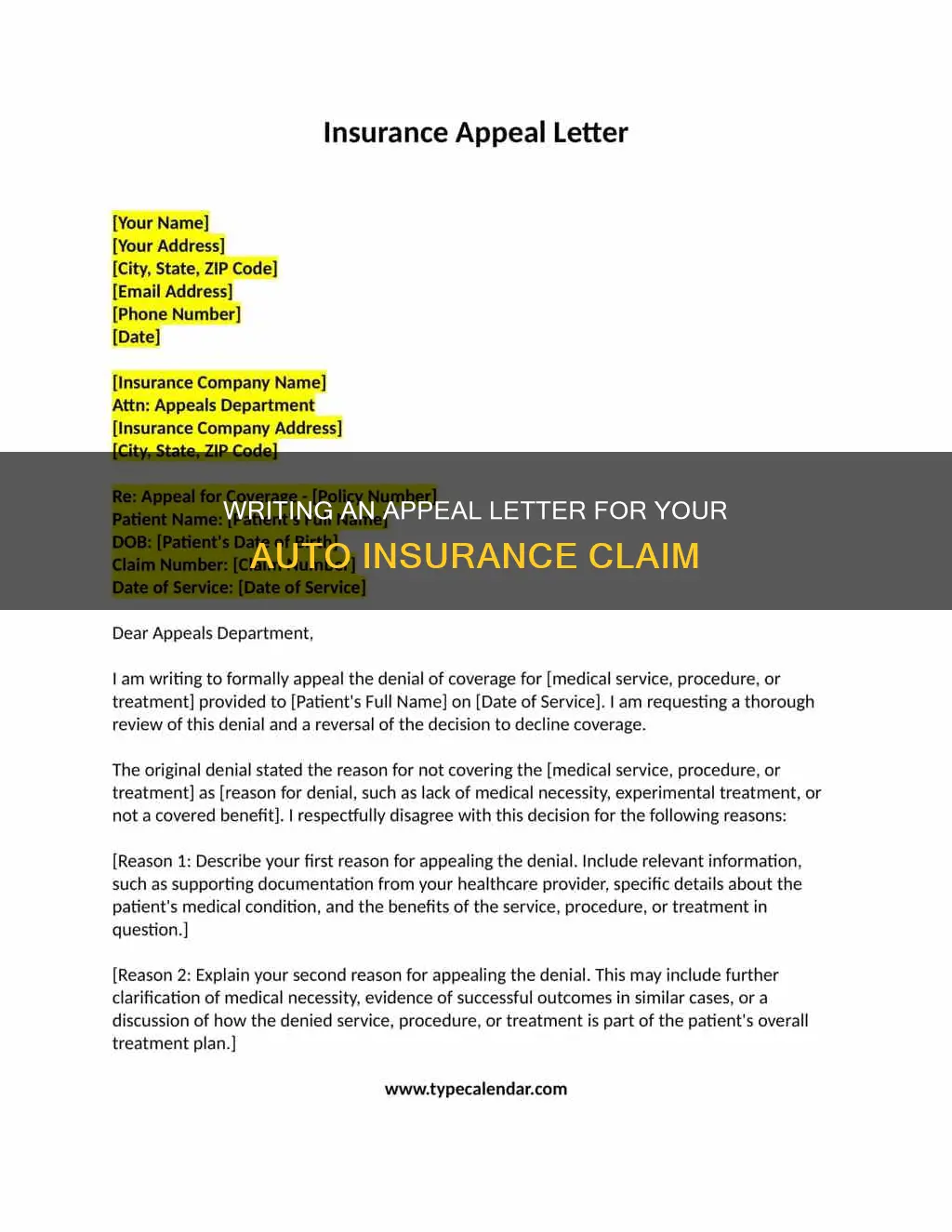

When writing an appeal letter for an auto insurance claim, it is important to include key dates and names to ensure clarity and precision. This includes the date of the initial request, the date of denial, and the name of the agent who rejected the claim.

The dates you provide will give a clear timeline of events, helping the insurance company to understand the context of your appeal. Be sure to include the date your original request was made, which triggered the claims process. This date is significant as it marks the beginning of the entire process and can be used as a reference point for the insurance company to locate your file and track the progress of your claim.

Additionally, including the date of denial is crucial. This date signifies a turning point in the process, where the insurance company made a decision that led to your need to appeal. Providing this date helps the insurance company identify when and why their initial assessment may have fallen short, and it also demonstrates your attention to detail and organisation.

Moreover, the name of the rejecting agent is an essential component of your appeal letter. Addressing your letter to the specific customer service representative or agent who handles claim denials ensures your letter reaches the appropriate person promptly. This prevents delays that could occur if your letter is sent to the wrong department or individual. It also demonstrates your knowledge of the process and your commitment to efficiency.

By including these key dates and the name of the rejecting agent, you provide important context for your appeal. This information helps the insurance company navigate their records and quickly identify the specifics of your case, which can improve the efficiency of the appeals process and increase your chances of a successful outcome.

Canceling State Farm Auto Insurance: A Step-by-Step Guide

You may want to see also

Address the letter to the relevant customer service representative

When writing an appeal letter for an auto insurance claim, it is important to address the letter to the relevant customer service representative. This is crucial to ensure your letter reaches the right person and avoids any delays in the process. Here are some tips to help you address the letter effectively:

- Find the Correct Contact: Before drafting your letter, make sure you have the name and designation of the specific customer service representative who handles claim denials. This information can usually be found on the insurance company's website or by contacting their customer service team.

- Use a Formal Greeting: Begin your letter with a professional greeting such as "Dear [Name of Representative]." Using their professional title, such as "Ms." or "Mr." followed by their last name, is also appropriate.

- Include Their Full Address: Make sure to include the representative's full address, including the name of the insurance company, department (if applicable), street address, city, state, and zip code. This ensures your letter reaches the correct destination.

- Be Clear and Concise: In the body of your letter, clearly state the reason for your appeal and provide a concise overview of your case. Explain why you are writing to this particular representative and how they can assist in resolving the issue.

- Maintain a Professional Tone: Throughout your letter, maintain a polite and respectful tone. Remember that the goal is to present your case effectively and work collaboratively towards a resolution.

By addressing your appeal letter accurately and professionally, you increase the chances of your letter being taken seriously and expediting the appeals process. Remember to keep a copy of your letter for your records and follow up as needed.

Auto Insurance and Employment Perks: Unlocking Discounts and Benefits

You may want to see also

Provide a calm, respectful tone and overview of your case

When writing an appeal letter for an auto insurance claim, it is important to remember that this is a formal document and should be written in a polite, professional, and respectful tone. Begin the letter by addressing the insurance company and the person who denied your claim. State the reason for your letter and then provide a concise and calm overview of your case.

In your overview, be sure to include the following:

- Patient name, policy number, and policyholder name

- Accurate contact information for the patient and policyholder

- Date of the denial letter, specifics on what was denied, and the cited reason for the denial

- Doctor or medical provider's name and contact information

In addition, you should state why you need the prescribed service and why you believe your insurance policy covers the treatment. Cite plan language to support your argument. It is also helpful to ask your medical provider to prepare a letter of medical necessity, explaining prior treatments, the reason for the treatment in question, and why it is necessary for your situation.

Remember, the goal is to present your case clearly and respectfully. Avoid expressing any frustration or negative emotions towards the insurance company or the person who denied your claim. Maintaining a calm and respectful tone will improve your chances of a successful appeal.

Insuring Without a Social Security Number

You may want to see also

Attach supporting documentation, e.g. medical records, police reports, etc

When writing an appeal letter for an auto insurance claim, it is important to include any supporting documentation that will strengthen your case. This can include a range of materials, such as medical records, police reports, photographs, witness statements, repair estimates, appraisals, and state laws. Organising and attaching the right documents can make a compelling case and improve your chances of a successful appeal.

Firstly, gather all the relevant information. This includes any documentation you have relating to the incident, such as police reports, photographs, and witness statements. If you have any medical records relating to injuries sustained in the incident, be sure to include these. If your claim involves vehicle damage, include repair estimates and appraisals. Also, consider including any relevant state laws that support your position. Organise these documents in a chronological order with specific dates, so the insurance company can easily understand the timeline of events.

Secondly, review the facts of the case. In your appeal letter, you will need to explain the incident and why you believe the insurance company's decision should be overturned. Refer to the supporting documentation you have gathered to back up your explanation. For example, if you are appealing a denied claim for vehicle damage, include repair estimates and photographs of the damage. If you are appealing a denied claim for medical expenses, include medical records and bills. Be sure to reference these documents in your letter and explain how they support your claim.

Finally, remember that the purpose of your appeal letter is to present a strong case and convince the insurance company to honour their claims promise. Choose the most compelling documents that will help you achieve this. For instance, if there are eyewitness accounts that support your version of events, be sure to include these. If you have statements from independent insurance adjusters or other experts who can verify that your claim is reasonable, include these as well. The more evidence you can provide, the stronger your appeal will be.

Auto Insurance Obligations in Washington State: What You Need to Know

You may want to see also

Explain any errors or omissions on your part

When writing an appeal letter for an auto insurance claim, it is important to explain any errors or omissions on your part. This section of the letter can make or break your appeal, so it's crucial to be thorough and take ownership of any mistakes. Here are some detailed instructions and tips to help you craft this section effectively:

Firstly, begin by clearly describing any errors that you made in the initial claim submission. Be honest and upfront about any inaccuracies, late payments, or missing documentation that may have contributed to the denial of your claim. By acknowledging your mistakes, you can build trust and credibility with the insurance company.

For instance, if you missed a deadline for filing a claim due to personal reasons or oversight, explain the circumstances and take responsibility for the delay. It is important to provide a valid reason for the error, but avoid making excuses or shifting blame. Remember, the goal is to demonstrate accountability and provide context for the issue.

In addition to acknowledging your errors, it is crucial to offer solutions or corrective actions. Explain the steps you have taken or plan to take to rectify the situation. For example, if you forgot to include certain documents with your initial claim, mention that you are now providing the missing documentation along with any other relevant evidence. Show that you are proactive in resolving the issue and committed to following the necessary procedures.

Provide as much detail as possible when explaining the errors or omissions. Cite specific dates, amounts, or other relevant information to support your explanation. For instance, if there was a misunderstanding regarding the circumstances of the accident, clarify the details and provide additional evidence to support your account. The more specific and well-documented your explanation is, the stronger your case will be.

Remember to maintain a polite and professional tone throughout your letter, even when addressing your own mistakes. Express regret for any inconvenience caused by the errors and emphasize your willingness to cooperate and provide any additional information or documentation that may be required.

Finally, it is essential to learn from your mistakes to avoid repeating them in the future. Review your insurance policy thoroughly to understand your coverage, rights, and responsibilities. Stay organized and keep track of important deadlines and documentation to prevent similar issues from occurring again.

Auto Insurance: Personal vs Commercial

You may want to see also

Frequently asked questions

The purpose of an appeal letter is to present a case that your insurance was current at the time of the accident, that you filed the paperwork promptly, and that you are deserving of the claim due to the accident's circumstances.

Your letter should include the date the request was made, the date the application was denied, the name of the agent who rejected the claim, and any documentation connected with the incident, such as photos and police reports.

Your letter should be polite and professional. Begin by addressing the insurance company and the person who denied your claim. State the reason for your letter and provide a concise overview of your case.

Before writing your letter, gather all the information related to your claim, including the original claim form, supporting documentation, and the letter of rejection from the insurance company. Contact your insurance provider to ask for more information about the denial and check that you understand the process and deadlines for filing an appeal.

You should receive an official notice within 7-10 days that your appeal has been received. If you do not hear back, contact your insurance company to confirm that they have received your appeal. Keep a copy of all correspondence in a safe place.