Auto insurance is a requirement in most states, and it's easy to see why. It provides financial protection in the event of an accident or theft, covering property damage, liability, and medical costs. But how do you go about claiming it? Well, the first step is to write a formal letter to your insurance provider, explaining what happened and providing any relevant documentation. This letter is important as it forms the basis for your assessment. You'll also need to provide additional documents as evidence, such as photos of property damage and injuries, and possibly a police report if the incident involved a collision.

| Characteristics | Values |

|---|---|

| Tone | Formal and respectful |

| Language | Simple and comprehensive |

| Content | Facts, circumstances before, during, and after the collision, physical and emotional injuries, key information about the vehicle and the policyholder |

| Additional documents | Photos of property damages and injuries, a valuation report for the vehicle, receipts for repairs |

| Structure | Well-structured document with subtitles and paragraphs |

What You'll Learn

How to write a car insurance claim letter

Writing a car insurance claim letter is an important step in the aftermath of an accident or other unfortunate event. Here are some guidelines on how to write a compelling and effective letter to support your claim:

Preparation:

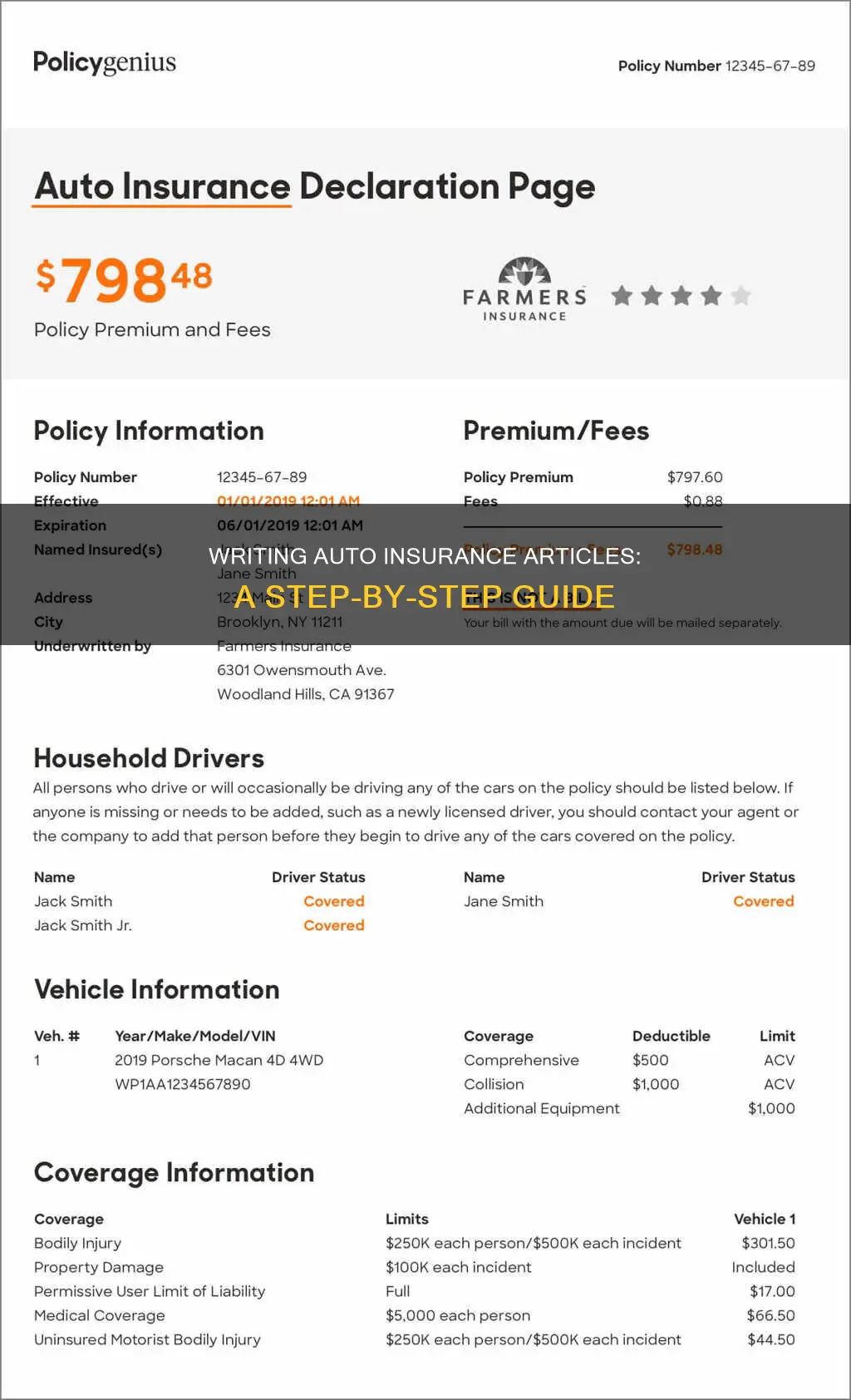

Before writing your letter, it is crucial to gather all the necessary documents and information. This includes your policy number, details of the incident (date, time, location, and a brief description), and any supporting documentation such as medical reports, police reports, photos of the damage, repair estimates, and receipts.

Letter Structure:

Start your letter by providing your personal information, including your name, address, and contact number, followed by the current date. Below your details, include the insurance company's name and the address of their claims department.

In the body of the letter, clearly state that you are writing to file a claim and mention your policy number and insurance type. Briefly describe the reason for your claim, such as a car accident, property damage, or medical procedure. Provide a detailed and factual account of the incident, including specific details like the date, time, and location. List the damages or losses you are claiming and explain how you arrived at the estimated values, referencing any attached evidence and documents.

Tone and Language:

Maintain a professional, respectful, and clear tone throughout your letter. Avoid using abusive language, dramatization, or overly emotional language. Use simple and concise language to explain the facts and circumstances of the incident.

Conclude your letter with a call to action, politely requesting the processing of your claim and mentioning any attached documentation. State your expectation for a reply within a specific timeframe. End with a courteous sign-off, your name, and your preferred contact method.

Proofreading and Submission:

Before submitting your letter, carefully proofread it to ensure there are no mistakes or inaccuracies. Double-check all the necessary elements, such as the date of the incident, policy information, and total amount of the claim. Making errors in these critical areas may delay the processing of your claim.

By following these guidelines, you can increase your chances of submitting a successful car insurance claim letter, which is an essential step in seeking financial recovery after an unforeseen event.

Erase Auto Insurance Claims History: A Step-by-Step Guide

You may want to see also

Understanding the basics of auto insurance

Auto insurance is a requirement in most states, and for good reason. It provides financial protection in the event of an accident or theft, ensuring you don't have to pay out of pocket for expenses that arise.

Auto insurance provides coverage for:

- Property damage or theft: This includes damage to or theft of your vehicle.

- Liability: Your legal responsibility to others for bodily injury or property damage.

- Medical costs: The cost of treating injuries, rehabilitation, and sometimes lost wages and funeral expenses.

Who is Covered by Auto Insurance?

Your auto insurance policy typically covers you and other family members listed on the policy, whether driving your car or someone else's with their permission. It also provides coverage if someone who is not on your policy is driving your car with your consent.

It's important to note that personal auto insurance does not cover commercial use, such as delivering pizzas, or providing transportation services through ride-sharing apps like Uber or Lyft. However, some insurers offer supplemental products for ride-sharing at an additional cost.

Mandatory Auto Insurance Coverage

The specific requirements vary from state to state, but nearly every state mandates the following:

- Bodily injury liability: Covers costs associated with injuries or death caused by you or another driver operating your car.

- Property damage liability: Reimburses others for damage caused by you or another driver operating your car to another vehicle or property, such as a fence or building.

In addition, many states require medical payments or personal injury protection (PIP), which reimburses medical expenses for injuries to you or your passengers, as well as lost wages and other related costs.

Optional Auto Insurance Coverage

While basic auto insurance covers the damage your car inflicts on others, it typically does not cover damage to your own car. For this, you can opt for:

- Collision coverage: Reimburses you for damage to your car resulting from a collision with another vehicle or object when you are at fault.

- Comprehensive coverage: Protects against theft and damage caused by incidents other than collisions, such as fire, flood, vandalism, or falling objects.

- Glass coverage: Specifically for windshield damage, which is common. Some policies include this with no deductible, while others offer it as a supplemental coverage option.

Understanding the Value of Your Auto Insurance

When considering the value of your auto insurance, it's important to remember that collision and comprehensive coverage only cover the market value of your car, not what you originally paid for it. New cars depreciate quickly, so there may be a "gap" between what you owe and your insurance coverage. To address this, you can purchase gap insurance to pay the difference.

Claiming Auto Insurance: Police Report Needed?

You may want to see also

What to do after a car accident

Being in a car accident can be a distressing experience. It is important to keep a clear head and take the following steps to ensure your safety and well-being, as well as to fulfil any legal requirements.

Firstly, do not leave the scene of the accident. Pull over and stop your vehicle, being mindful not to block traffic. Check yourself for any injuries and, if safe to do so, move as close to the accident site as possible.

If there are other parties involved, try to assist them. If anyone is injured, call the emergency services immediately. If the accident is blocking traffic or involves multiple vehicles, contact the local police. If you are injured, refrain from moving unless your vehicle is causing an obstruction.

Once the situation is under control, exchange information with any other drivers. This should include names, addresses, and other contact details, driver's license numbers, license plate numbers, and auto insurance information. Also, make a note of the make, model, and body style of the vehicles involved, as well as the Vehicle Identification Number (VIN) and a description of the damage.

It is important to gather as much information as possible at the scene. Take photographs of the accident site, the vehicles involved (including license plates), and any damage. If there are witnesses, ask for their names and phone numbers. Write down details such as the location, time, and weather conditions, as well as what you recall happening before, during, and after the accident.

Finally, contact your insurance company to report the accident. They will provide you with further instructions and guidance on the claims process. It is important to be thorough and honest when providing information to your insurance company.

Gap Insurance: VW Loan Standard?

You may want to see also

How to choose the right auto insurance for you

Auto insurance is a balancing act between your needs and preferences, and the cost. Here are some steps to help you choose the right auto insurance policy for your specific needs and situation.

Know Why You Need Auto Insurance

Understanding why you need auto insurance is an important first step. You need insurance to drive legally, as most states require at least a minimum level of liability coverage. Auto insurance also ensures you can live up to your financial responsibilities if you are ever in an accident, and it helps protect your financial health.

Understand the Types of Insurance Coverage

There are several types of auto insurance coverage, but you may not need all of them. The core types of coverage to focus on include:

- Medical or Personal Injury Protection (PIP)

- Uninsured/Underinsured Motorist Coverage

- Collision Coverage

- Comprehensive Coverage

Medical or Personal Injury Protection

Personal Injury Protection, or PIP, covers your injuries and medical expenses after an accident, regardless of who was at fault. It can also cover funeral costs, lost wages, and more. PIP is similar to Medical Payments Coverage, or MedPay, but it offers higher policy limits and more comprehensive coverage, although this means higher premiums and a deductible to meet.

Uninsured/Underinsured Motorist Coverage

Uninsured Motorist Coverage helps pay for expenses if you are injured by an uninsured driver. Underinsured Motorist Coverage, on the other hand, applies when the at-fault driver's insurance limits are not high enough to cover all your damages.

Collision Coverage

Collision coverage covers damage to your own vehicle in an accident. It will pay for your vehicle repairs but not the other driver's vehicle. If the repair costs exceed your vehicle's value, your insurance company may declare it a total loss and pay you the vehicle's value. Collision coverage is essential if you own a new or relatively new vehicle.

Comprehensive Coverage

Comprehensive coverage is for non-accident damage to your vehicle. For example, if your vehicle is stolen or damaged by adverse weather conditions, comprehensive coverage will apply. Like collision coverage, it is considered first-party coverage.

Other Types of Coverage

In addition to the core coverages, there are several other types of coverage to consider, depending on your needs. These include Guaranteed Auto Protection (GAP) insurance, Mechanical Breakdown coverage, and Original Equipment Manufacturer (OEM) Endorsement.

Choose Your Coverage and Deductibles

When deciding on coverages and amounts, consider your financial situation. If you own a lot of assets, you may want higher liability limits to protect yourself. Regarding deductibles, think about your liquidity and what you can afford. A higher deductible will save you money on your monthly premiums, but consider whether you would want to claim for a small repair.

Shop Around for Insurance

When shopping for insurance, be prepared with the necessary information, including vehicle identification numbers, driver's license numbers, estimates of yearly mileage, and a copy of your current auto insurance policy if you have one. It is also helpful to have a copy of your state's insurance requirements.

Get quotes from multiple insurance companies and compare them to find the best rates and coverage for your needs. Remember to factor in the insurance company's customer service reputation and financial stability as well.

Lower Your Insurance Costs

Even after receiving quotes, there are ways to lower your auto insurance costs. Review your coverage limits and deductibles, and inquire about discounts. Common discounts include low mileage, professional or alumni affiliations, safe driving, and good student discounts.

Choose the Right Insurance Company

In addition to budget, look for an insurance company with a strong track record of financial stability and professionalism. Referrals from family and friends can be helpful, and trust your gut—choose a company you believe will be helpful and responsive in the event of an accident or loss.

Get Back on the Road: Auto Insurance After Cancellation

You may want to see also

How to submit a police report and evidence of damage to your insurance company

When it comes to car accidents, it's always a good idea to file a police report, even if it's not a legal requirement in your state or the accident was minor. A police report can speed up your insurance claim and strengthen your case if there's a dispute. It's important to know what to do after a car accident to ensure you're protected and can provide the necessary evidence to support your claim. Here's a step-by-step guide on how to submit a police report and evidence of damage to your insurance company:

Step 1: Call the Police

If possible, call the police to the scene of the accident, especially if there are injuries, major damage, or extenuating circumstances such as an uninsured driver or a criminal act. The police will document the details of the accident, including witness testimonies and a description of the scene. They will also provide their own observations and opinions, which can be valuable in determining fault.

Step 2: Gather Information

Whether the police attend the scene or you file a report at the station, make sure to gather key information. This includes the date, time, and location of the accident, as well as the contact and insurance information of all drivers involved. Take photos or videos of the scene, capturing vehicle damage, skid marks, and any relevant details. Also, take note of the road and weather conditions.

Step 3: Obtain a Copy of the Police Report

Ask the police officers for their names and badge numbers, and make sure to get a copy of the police report. This report will be a crucial piece of evidence when filing your insurance claim.

Step 4: Contact Your Insurance Company

Report the accident to your insurance company as soon as possible. They will guide you through their claims process and let you know what specific information or evidence they require. Provide them with the police report and any additional details or documentation they request.

Step 5: Work with an Adjuster

Your insurance company will assign an adjuster to your claim, who will investigate the accident and help determine fault. Continue to provide any necessary information or evidence to support your claim.

Step 6: Understand the Claims Process

Keep in mind that the claims process can vary in timing and complexity depending on the circumstances of the accident and your insurance company's procedures. Stay in communication with your insurance company and adjuster to understand the status of your claim.

Remember, while a police report is not always legally required, it can be invaluable in supporting your insurance claim and protecting your interests. It's also essential to gather as much evidence as possible at the scene to strengthen your case and facilitate a smoother claims process.

Non-Driver Auto Insurance: Am I Covered?

You may want to see also