A 760 credit score is considered very good and is above the average credit score. A score of 760 is not perfect, but it is high enough to qualify for the lowest interest rates and best deals on mortgages, car loans, credit cards, student loans, and personal loans. Credit scores in this range are also associated with timely bill payments and good credit management.

| Characteristics | Values |

|---|---|

| Credit Score Range | 740 to 799 |

| FICO Score Average Utilization Rate | 23.7% |

| Credit Score Compared to Average | Above average |

| Percentage of Consumers with FICO Scores in the Very Good Range | 25% |

| Percentage of Consumers with Very Good FICO Scores Likely to Become Seriously Delinquent in the Future | 1% |

| Credit Score Compared to Exceptional Range | Approaching exceptional |

| Credit Score Needed to Get Approved for Lowest Interest Rates | 760 |

| Credit Score Needed to Get Approved for Best Credit Cards | 760 |

| Credit Score Needed to Get Approved for Best Car Insurance Premiums | 760 |

| Credit Score Needed to Get Approved for Best Mortgage Rates | 760 |

| Credit Score Needed to Get Approved for Best Auto Loan Rates | 720 |

| Percentage of People with Credit Scores of 760 Who Pay Their Bills on Time | 75% |

| Credit Score Needed to Get Approved for Best Personal Loans | 750 |

What You'll Learn

- A 760 credit score is considered very good and can qualify you for lower interest rates and insurance premiums

- Credit Karma provides auto insurance scores, which are calculated using information from your credit report

- A 760 credit score is above the average credit score of 714 and is considered excellent credit

- A 760 credit score can qualify you for the best credit cards, loans, and interest rates

- To improve your credit score to 760, pay your bills on time, keep a low credit utilisation rate, and have a mix of credit

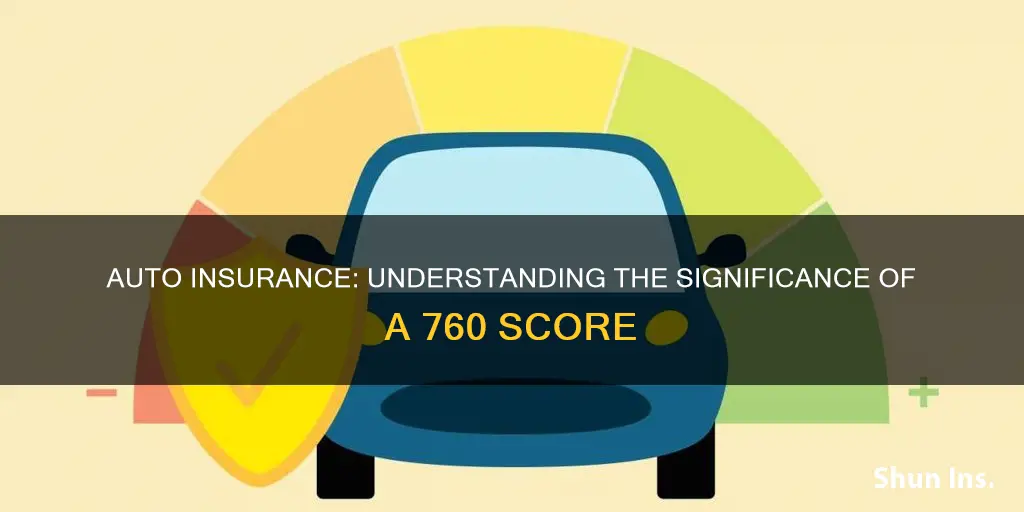

A 760 credit score is considered very good and can qualify you for lower interest rates and insurance premiums

A credit score of 760 is considered "very good", and it places you in the top 25% of consumers. This score is a good indicator of your ability to manage credit and make timely bill payments. It also means that you are likely to qualify for better interest rates from lenders. For example, you can save thousands a year by refinancing your mortgage with a credit score of 760. Additionally, you can qualify for the top balance transfer credit cards and pay off credit card debt without accruing interest.

Your credit score can also impact your car insurance rates. A higher credit score can lead to lower insurance premiums, as insurance companies use your credit score to determine your insurance score, which predicts the likelihood of you filing an insurance claim. While this is only one factor among many that insurance companies consider, it can still help you save money. However, it is important to note that some states, such as California, Hawaii, Washington, Massachusetts, and Michigan, limit or prohibit the use of credit scores in determining insurance rates.

To maintain and improve your credit score, it is essential to pay all your bills on time, keep low credit utilization ratios, maintain a mix of credit types, and limit credit applications.

Auto Insurance Payments: Exploring Their Impact on Income and Finances

You may want to see also

Credit Karma provides auto insurance scores, which are calculated using information from your credit report

It's important to note that auto insurance scores are not the same as credit scores and do not factor in your driving record. However, insurance companies in most states can use your auto insurance score, along with your driving record and other factors, to set your premium. California, Hawaii, and Massachusetts do not allow insurance companies to use credit-based scores to influence insurance rates.

Your auto insurance scores can have a direct impact on your insurance rates. The better your insurance scores are, the lower your auto insurance rate is likely to be. Conversely, if your insurance scores are low, your auto insurance rate will likely be higher.

In addition to insurance scores, insurance companies consider other factors when determining premiums, such as the age, make, and model of your vehicle, your driving experience, and your accident or claims history.

By understanding what factors influence your auto insurance scores and working on improving your credit health, you can positively impact your insurance rates and overall financial well-being.

Credit Karma provides users with access to their auto insurance scores and credit scores, empowering them to make informed decisions and take control of their financial journey.

Auto Insurance: Can It Be Cancelled?

You may want to see also

A 760 credit score is above the average credit score of 714 and is considered excellent credit

A 760 credit score is an excellent credit score. In fact, it is considered exceptional. A score of 760 is above the average credit score of 714-715 and is close to the highest possible score of 850.

Credit scores are important because they can impact your financial goals. A good credit score can be the difference between qualifying or being denied for a loan, such as a home mortgage or car loan. A good credit score can also affect the interest rate and fees you will pay if you are approved for a loan. For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 620 FICO® Score and a 670 FICO® Score could be $161 a month. Over the lifetime of the loan, having the better score would save you $57,842 in interest payments.

Credit scores are a tool that lenders use to make lending decisions. They are a numeric representation, based on the information in your credit reports, of how "risky" you are as a borrower. In other words, they tell lenders how likely you are to pay back the amount you take on as debt. A good credit score can help you get access to a greater variety of loan offers.

Credit scores range from 300 to 850. A score of 700 or above is generally considered good. A score of 800 or above is considered excellent. Most consumers have credit scores that fall between 600 and 750.

Credit scores are calculated using a variety of factors, including payment history, credit usage, the length of credit history, types of accounts, and recent activity. It is important to pay all your bills on time, keep your credit card balances low, and have a mix of different types of credit, such as revolving credit and installment loans.

In addition to affecting loan eligibility and interest rates, a good credit score can also impact non-lending decisions, such as whether a landlord will agree to rent you an apartment. In most states, insurance companies may also use credit-based insurance scores to help determine your premiums for auto, home, and life insurance.

While a 760 credit score is considered excellent, it is not necessary to have a perfect 850 score to qualify for great rates on loans and mortgages. Once you are in the "very good to excellent" range, you are likely to see minimal differences in interest rate offers.

The Sneaky Auto Insurance Trap: Why Rates Rise After Two Years

You may want to see also

A 760 credit score can qualify you for the best credit cards, loans, and interest rates

A 760 credit score is considered "very good" and is above the average credit score. This score can qualify you for lower interest rates, reduced insurance premiums, and more. Here are some of the benefits of having a 760 credit score:

Negotiate Better Terms on Your Credit Cards

You can call your credit card issuer and negotiate for lower annual percentage rates (APRs) and higher credit limits, especially if you have been receiving offers for other credit cards with similar or better benefits.

Apply for Better Credit Cards

With a 760 credit score, you may now be eligible for premium credit cards that were previously out of reach. These cards often come with elite rewards programs and relatively low annual fees and interest rates.

Refinance Your Mortgage to Reduce Your Monthly Payment

A higher credit score can lead to significant savings on interest rates for your mortgage. According to FICO, improving your credit score from 620 to 760 can save you thousands of dollars per year in interest.

Pay Off Credit Card Debt Without Paying Interest

With a 760 credit score, you can qualify for top balance transfer credit cards that offer 0% introductory APRs, helping you consolidate and pay off your credit card debt more efficiently.

Revisit Your Car Insurance Premiums

Your credit score can impact your car insurance rates. With a higher credit score, you may be eligible for lower insurance premiums. However, it's important to note that some states in the US, such as California, Hawaii, and Massachusetts, do not allow insurance companies to use credit-based scores when determining insurance rates.

In summary, a 760 credit score is highly advantageous and can provide you with access to the best credit cards, loans, and interest rates. It is a testament to your financial responsibility and can help you save money in various aspects of your financial life.

Canceling Auto Insurance: Fee or Free?

You may want to see also

To improve your credit score to 760, pay your bills on time, keep a low credit utilisation rate, and have a mix of credit

A credit score of 760 is considered "excellent", and it can open up a lot of borrowing options with attractive terms. For example, you may be able to qualify for the best credit cards and the best personal loans.

To improve your credit score to 760 and beyond, you should:

Pay your bills on time

Payment history is the most crucial factor in any credit score. It directly answers the question of whether a lender can expect to be paid back. Missed payments are a trademark of a risky borrower, indicating irresponsibility and potential financial distress. Late payments can cause a huge drop in your credit score. Set up automatic payments or reminders to ensure you never miss a payment.

Keep a low credit utilisation rate

Credit utilisation is the second most important factor in a credit score. It is calculated by dividing the total amount of credit you are using by your total credit limit. A ratio higher than 30% will lower your score. To get into the 800+ score range, aim to keep your credit utilisation under 10%. You can do this by spending less, increasing your credit limit, or opening a new credit account.

Have a mix of credit

The diversity of your credit mix accounts for about 10% of your credit score. It shows that you can responsibly manage several types of debt. The two main types of credit are "revolving" credit and "installment" credit. Credit cards are an example of revolving credit, while a car loan is an example of an instalment loan.

Slavage Vehicles: Insured in California?

You may want to see also

Frequently asked questions

According to TransUnion, insurance scores typically range from 200 to 997, with anything above 770 being considered a good score.

A 760 credit score is considered "very good" and is above the average credit score. Consumers with this score may qualify for better interest rates from lenders and are more likely to get approved for loans and credit cards.

Here are some tips to improve your credit score:

- Pay your bills on time.

- Keep a low credit utilization rate.

- Have a mix of credit products, such as credit cards and installment loans.

- Track your credit progress regularly.