There are many reasons why you might want to cancel your auto insurance policy. You may have found a better rate with a different insurer, moved to a different state, or sold your car. Whatever the reason, you’ll probably want to know if you’ll be charged for cancelling.

The short answer is that, yes, you can cancel your auto insurance at any time. However, you may be charged a cancellation fee, and you may not get a refund. It’s important to check your provider’s cancellation policy to avoid paying unnecessary fees and to see if you’re entitled to a refund.

| Characteristics | Values |

|---|---|

| Can you cancel your auto insurance at any time? | Yes, but you should look into your provider’s cancellation policy to avoid paying unnecessary fees and missing out on refunds. |

| How to cancel your auto insurance? | Contact your insurance provider via call, mail, or in person. Ask to speak with an agent about cancellation. You may be required to sign a cancellation letter. |

| Do you get charged for cancelling auto insurance? | You may be charged an early cancellation fee. The fee is usually a flat fee or a short-rate fee. |

| Do you get a refund for cancelling auto insurance? | If you paid your premium in advance, you may receive a refund. The refund will be prorated for the amount of time that you prepaid. |

| What happens if you stop paying your premiums without cancelling your car insurance policy? | Your insurance company will eventually cancel your policy for non-payment. There may be charges for insurance coverage and late fees. |

What You'll Learn

Cancelling auto insurance: when and how

When to cancel your auto insurance

There are several reasons why you might want to cancel your auto insurance policy. You may have switched to a new provider, moved to a different state, or sold your car. You may also be unhappy with the service or found a better deal with another insurance company. Whatever the case, it's important to know when and how to cancel your auto insurance to avoid unnecessary fees and penalties.

How to cancel your auto insurance

- Purchase a new policy before cancelling the existing one to protect yourself from experiencing a lapse in coverage, which could cause your insurance rates to increase since driving without insurance is illegal in most states.

- Contact your insurance provider by calling your insurer, using their mobile app or website, mailing in a cancellation request, or speaking to an agent in person.

- Ask to speak with an agent about cancellation as each provider will likely have different requirements, such as paying a cancellation fee or giving a 30-day notice ahead of your cancellation date.

- Sign a cancellation letter requesting your coverage to end, which typically includes your policy number, name, and the date you want your policy cancelled. You may also include a refund request for the unused portion of your policy if you paid for it upfront.

- Request a policy cancellation notice from your auto insurer to ensure you have a written record of the transaction.

When not to cancel your auto insurance

While you can cancel your auto insurance at any time, there are some situations where it may not be the best idea:

- When you will be driving – Cancelling coverage on a vehicle you still plan to drive can put you at financial risk and potentially violate state laws.

- When you get married or divorced – Instead of cancelling your policy, you can add or remove your spouse from your current policy and may even qualify for a discount.

- When you're only temporarily not driving – Some car insurance companies will allow you to suspend your policy and put your vehicle on a storage plan instead of cancelling it.

- When your premium is high – Consider other options such as discounts, changing your coverage, or shopping for a better rate before cancelling your policy.

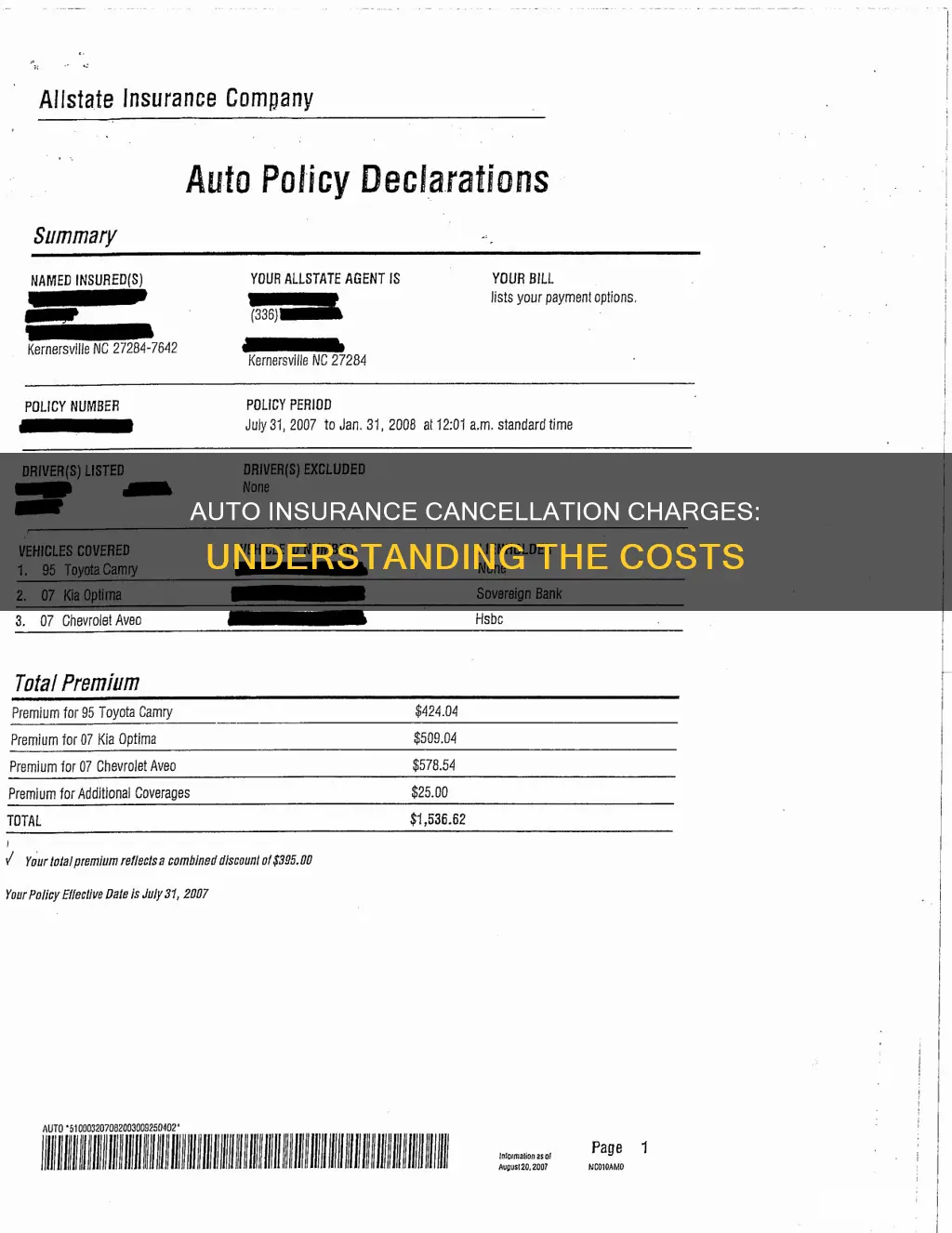

If you cancel your auto insurance policy, you may be charged an early cancellation fee for breaking a contract. The amount of the fee will depend on the insurer and the timing of the cancellation, with higher fees typically charged for cancelling early in the policy term. You may also lose any loyalty or multi-vehicle credits you were receiving from your current provider. Additionally, having a lapse in coverage can result in fines and increased premiums in the future.

What to do before cancelling your auto insurance

Before cancelling your auto insurance, it's important to:

- Check your policy for any cancellation fees or penalties and read through the entire document to understand the process and any potential consequences.

- Find another insurance provider and set up a new policy to ensure continuous coverage and avoid fines and difficulties in finding insurance later on.

- Call your current provider and inform them of the date your new policy takes effect so that you can cancel your existing policy as of that day.

Border Crossing: Mexican Auto Insurance

You may want to see also

Refunds: when you might get one

Whether you receive a refund when cancelling your auto insurance depends on several factors, including the reason for cancellation, your payment schedule, and the laws in your state.

If you have paid your premium in advance and cancel your policy before the end of the term, you will likely receive a refund for the remaining amount. This refund may be prorated based on the number of days your policy was in effect. However, some companies may charge a cancellation fee that will be deducted from your refund.

If you pay your premium monthly, you may or may not get a refund depending on when you cancel. If you cancel in the middle of the month or billing cycle, you may receive a refund for the remaining days. On the other hand, if you cancel at the end of the month or billing cycle, you probably won't get a refund.

The laws in your state may also impact whether you receive a refund. For example, in Nebraska, the insurance company must contact you within 15 business days of cancellation to inform you about any eligible refunds. In Texas, if you finance your premium through a premium finance company, the refund may be returned to the finance company instead of directly to you.

It's important to review your insurance company's rules and your state's laws regarding cancellations to understand if and when you might receive a refund.

File Claims: Car Damage

You may want to see also

Cancelling early: fees and penalties

Cancelling early can come with fees and penalties, but this depends on your insurer and where you live. It's important to check your insurer's rules regarding cancellations. Some insurers may charge a cancellation fee that could offset your refund amount. This fee can be a flat fee or a short-rate fee. With short-rate cancellations, the insurer will charge the policyholder a percentage of the unearned premium — usually 10%. This amount will be taken from the remaining refund, or the policyholder will receive a bill if there isn't a refund owed.

In Ontario, you will probably be charged an early cancellation fee as you are breaking a contract. Provincial insurance regulators allow insurers to charge a fee to cover some costs if you cancel your policy early.

Some insurers require 15 or 30 days' notice when you cancel. If you cancel your auto insurance soon after buying the policy, you are likely to incur high fees. In most cases, you won't have to pay a cancellation fee, and if you do, it will likely be nominal — around $50, or a small percentage of your final premium.

If you cancel your insurance policy, you may be required to sign a cancellation letter. This typically includes your policy number, your name and the date you want your policy cancelled.

If you cancel your insurance policy early, you will need to choose a cancellation date and send your request in writing. The company will then confirm the transaction in writing and issue a refund for any amounts you are owed after the cancellation fees. If you're paying using a monthly payment plan, you will likely need to make one final payment after the cancellation to cover the fees.

Auto Insurance Payments: Taxable or Not?

You may want to see also

Cancelling your insurance: what to do

There are many reasons why you might want to cancel your auto insurance policy. Perhaps you've found a better deal with another insurance company, or you're moving to a different state or country. Maybe you've sold your car or had a bad customer service experience. Whatever the reason, there are a few things you should know and some steps you should take before cancelling your policy.

Know the potential consequences

Cancelling your insurance policy can result in a few negative consequences. Firstly, you will likely be charged an early cancellation fee for breaking your contract. This fee can vary depending on the company and the timing of the cancellation, and it may eat into any savings you expected to make by switching insurers. Additionally, if you have been with your current provider for several years, you may lose any loyalty discounts that you were receiving. Cancelling your auto insurance can also result in increased premiums in the future, as insurance companies may consider you a high-risk customer.

Check your provider's cancellation policy

Before cancelling your policy, be sure to look into your provider's cancellation policy to avoid paying unnecessary fees and to ensure you receive any refunds you are entitled to. Most insurance companies will require you to give proper notice, usually 15 or 30 days in advance. Some companies may also require written notice or a signed letter of cancellation. Check with your provider to ensure you follow all the necessary steps and provide the required information.

Have a new policy in place

Before cancelling your current policy, it is crucial that you set up a new insurance policy to avoid a lapse in coverage. Driving without insurance is illegal in most states and can result in fines and increased premiums in the future. Ensure that your new policy begins precisely when your old coverage ends to avoid any gaps in coverage.

Contact your current provider

Once you have a new policy in place, you can contact your current insurance provider to cancel your existing policy. Provide them with the date that your new policy takes effect, and request that your current policy be cancelled as of that day. Be aware that your current provider may try to retain your business by offering discounts or other benefits.

Wait for reimbursement

If you have paid your premiums in advance, you may be entitled to a refund from your insurance company. However, this will depend on the company's policies and any applicable state laws. Most insurance companies will charge an early cancellation fee, which will be deducted from any refund owed to you. It may take several days or weeks to receive your refund, so don't count on this money to pay for your new policy.

Full Coverage Auto Insurance: When to Drop

You may want to see also

Continuous coverage: avoiding a lapse

Lapses in car insurance coverage can have several negative consequences, so it's important to maintain continuous coverage. An insurance lapse can occur when you neglect to pay your premiums, when your insurer cancels your policy, or when you switch between two policies and cancel your existing cover before your new policy goes into effect.

If you have a lapse in coverage, your car insurance company may perceive you as a higher-risk driver and may charge you more as a result. Policyholders with a lapse in car insurance pay an average of $602 per year for minimum coverage, which is almost $60 more than the national average. Those with full coverage pay an average of $1,949 annually, nearly $200 more than average.

In some states, insurers are required to notify the Bureau of Motor Vehicles when you drop insurance or change companies, so a lapse in car insurance may be noted on your driving record. In some cases, your car could be seized or your license suspended.

To avoid a lapse in coverage, it's important to practice responsibility and consistently pay your car insurance premium. If you're switching policies, make sure there's no time unaccounted for between the ending of the old policy and the beginning of the new one.

If you're struggling to pay your premiums, consider shopping around for a cheaper policy, lowering your policy limits, or looking for discounts.

If you're going to be out of the country for an extended period, call your insurance company. If your car is going to be in storage, you may be able to switch to a simple policy with just comprehensive coverage, which could maintain your coverage and offer a reduced premium.

If you expect to stop driving entirely, you'll need to contact your insurance company to cancel your policy, but make sure there's no lapse in coverage. Contact your DMV to find out if there are any state requirements you need to handle first, such as handing in your license or cancelling your registration.

Women Pay Less for Car Insurance

You may want to see also

Frequently asked questions

Yes, you can cancel your auto insurance at any time. However, you may be charged a cancellation fee, and you will need to give proper notice to your insurance provider.

Yes, most insurance companies will charge an early cancellation fee, which could be a flat fee or a percentage of the remaining premium.

If you don't pay your premium, your insurance policy may be cancelled for non-payment. Before cancelling your policy, your insurance provider will notify you in writing, including information about any outstanding balance and late fees.

If you've paid your premium in advance, your insurance provider will likely issue a refund for the remaining amount. However, this may be subject to cancellation fees.

In most cases, your insurance provider will notify the DMV on your behalf when you cancel your policy. However, it's important to ensure there is no lapse in coverage to avoid fines and increased premiums.