AAA auto insurance is available exclusively to AAA members. While the costs to join vary by ZIP code, AAA offers a wide range of discounts for safe drivers, including a safe driving discount of up to 20% and a driver training discount of 5%. AAA auto insurance has earned a 94% satisfaction rate from customers. The company is ranked #1 in customer satisfaction for Digital Insurance Shopping Experience by J.D. Power. AAA's insurance rates are higher than in 47 other states. In this article, we will explore whether AAA of Michigan is the highest auto insurer in the state.

| Characteristics | Values |

|---|---|

| Customer Satisfaction | AAA is ranked #1 in customer satisfaction for Digital Insurance Shopping Experience by J.D. Power. AAA Car Insurance has a 94% satisfaction rate from customers. |

| Discounts | AAA offers a wide range of discounts, including a safe driving discount of up to 20% and a driver training discount of 5%. |

| Coverage Options | AAA offers Enhanced Total Loss Replacement, Loan Lease Gap, and Enhanced Exterior Repair coverage options. |

| Services | AAA offers roadside assistance, towing, rental car, and auto repair services. |

What You'll Learn

AAA's customer satisfaction

AAA, or the American Automobile Association, has received a large number of reviews on ConsumerAffairs, with 2,397 reviews and 3,402 ratings as of July 2024. The reviews are mostly positive, with many customers praising AAA's roadside assistance services. One customer wrote that they "can't be more grateful" for the premium package, detailing how AAA rescued them from several situations, including towing and bringing fuel. Another reviewer praised AAA's timely and friendly service, stating that the driver was "extremely friendly and got my car on his truck within a matter of minutes".

However, there are also negative reviews, with some customers expressing dissatisfaction with their experiences. One reviewer mentioned issues with their insurance claim, stating that AAA tried to "screw them over big time" and that the company showed a lack of concern for their situation. Another customer shared a similar sentiment, noting that they felt like AAA was doing them a "huge favor" when they called for assistance and that the benefits were not worth the cost.

Overall, while there are some negative reviews, the majority of customers seem to have had positive experiences with AAA's services, particularly with their roadside assistance offerings. The company's long history, vast network, and range of services, including insurance, trip planning, and driver training, continue to make it a popular choice for many individuals.

Wheel Well Rust: Insurance Claim?

You may want to see also

AAA membership and costs

AAA offers three membership plans: Classic, Plus, and Premier. Each plan provides varying levels of coverage and benefits, with the Classic plan offering essential services and the Premier plan providing the highest level of coverage and perks.

Classic Membership

The Classic plan is ideal for individuals who frequently drive short distances of 5 miles or less. It offers benefits such as 24/7 roadside assistance, including up to 5 miles of free towing (4 times per year), free jumpstart for a dead battery, free flat tire removal and spare installation, and free emergency fuel deliveries (fuel cost extra). Classic members also receive up to $50 coverage for vehicle entry services, extraction service with up to one truck and driver, and assistance for bicycle breakdowns.

The plan includes trip interruption protection coverage, reimbursing members for lodging, food, and other expenses up to $200 when their car breaks down more than 100 miles away from home. Classic members also have access to identity theft protection through Experian's ProtectMyID service, which monitors millions of online data points to identify signs of fraud.

In terms of cost savings, Classic members can enjoy discounts at hotels, supermarkets, restaurants, retail stores, and theme parks. Additionally, they receive 20% off Hertz rental cars and a free Hertz Gold Plus Rewards membership.

The annual cost of the Classic Membership varies depending on location, ranging from $44.99 to $65 per year.

Plus Membership

The Plus Membership is designed for individuals who drive more than 5 miles on a given trip, offering valuable extras beyond the Classic coverage. This plan provides benefits such as up to 100 miles of free towing (4 times per year), free fuel delivery service (including fuel cost), and up to $100 coverage for vehicle entry services. Plus members also receive extraction service with up to two trucks and drivers, and Automobile Accident Protection for up to $600.

The annual cost of the Plus Membership varies, with prices ranging from $64.99 to $99.99 per year.

Premier Membership

The Premier Membership is AAA's highest level of coverage, perfect for those who frequently drive long distances or desire a comprehensive package of roadside and travel assistance benefits. This plan includes all the benefits of the Plus Membership, along with additional perks. Premier members receive up to 200 miles of free towing (once per year), with the remaining 3 tows limited to 100 miles. They also get Automobile Accident Protection for up to $1,500, up to $100 reimbursement for home lockout services, and a free one-day emergency car rental.

The Premier plan offers vehicle return protection for up to $500, free concierge services in the US or internationally, and Travel Emergency and Medical Assistance services. These services include arrangements for emergency medical transportation, medical provider referrals, translation services, and prescription replacement.

The annual cost of the Premier Membership ranges from $84.99 to $135 per year, depending on the region.

Optional Assistance Plans

AAA also offers optional assistance plans that extend coverage to registered recreational vehicles (RVs), motorcycles, motor homes, travel trailers, and pickup trucks with campers. These plans, known as Plus RV and Premier RV, can be added to either the Plus or Premier Membership for an extra $35 per year.

Additional Membership Information

It's important to note that AAA membership covers the individual, not the vehicle. This means that members are covered in anyone's vehicle, whether they are the driver or passenger, as long as the type of vehicle is included in their membership plan.

The cost of AAA membership can vary depending on the region and the specific benefits offered. Additionally, there may be a one-time enrollment fee of $15, and new members may be charged an admission fee for their first year, in addition to the annual dues.

AAA also offers discounted rates for additional household members, with prices varying by membership level and location.

Overall, AAA membership provides a range of benefits, including roadside assistance, travel planning, discounts, and additional perks, making it a valuable option for individuals seeking peace of mind while on the road.

The Progressive Auto Insurance-George Soros Connection: Ownership and Influence

You may want to see also

Safe driver discounts

AAA Insurance offers a range of discounts to its customers, including safe driver discounts. While the exact discount amount for safe driving is not mentioned, AAA does offer a "Good Driver" discount based on how long you have been licensed and your driving activity. This suggests that safe driving history and experience are rewarded with lower insurance rates.

In addition to the "Good Driver" discount, AAA offers several other auto insurance discounts that can help reduce your overall insurance costs. For example, if you are a AAA Member, you can save 5% on your auto insurance policy. If you have multiple cars insured with AAA, you can take advantage of the Multi-Car discount. Teen drivers who complete a qualified program by the age of 19 can benefit from the Teen Smart discount, which offers a substantial 20% reduction in rates.

Furthermore, AAA also provides discounts for students and mature policyholders. Full-time students in high school or college with a GPA of 3.0 or higher are eligible for a 10% Good Student discount. The Mature Policyholder discount is based on the age of the oldest insured individual on the policy.

By offering these various discounts, AAA Insurance aims to reward customers for their safe driving habits, membership loyalty, and other factors, making their auto insurance more affordable.

Foremost Auto Insurance: What You Need to Know

You may want to see also

AAA's insurance coverage

AAA offers a wide range of insurance coverage options to its members. With over 100 years of experience, the company provides comprehensive coverage for vehicles, including cars, motorcycles, and RVs. In addition to standard auto insurance, AAA also offers supplemental coverage for specific vehicle types, such as boats and mobile homes.

For homeowners, condo owners, mobile home owners, renters, and landlords, AAA provides peace of mind through its home insurance policies. Their plans include protection against natural disasters like earthquakes and floods, ensuring that individuals' homes and belongings are safeguarded.

Life insurance is another important aspect of AAA's offerings. They assist individuals in planning for the future and protecting their loved ones with term, whole, or universal life insurance policies. Additionally, AAA provides commercial and business insurance, helping business owners protect their investments with competitive rates on commercial auto, workers' compensation, and general liability insurance.

AAA also offers exclusive travel insurance plans through Allianz Global Assistance, providing coverage for unexpected cancellations, delays, and medical emergencies while travelling. Recognized for their financial strength and excellence, AAA provides rock-solid insurance coverage that customers can depend on. They offer personalized service through their expert insurance agents and provide self-serve online tools and mobile apps for customers to manage their policies conveniently.

Auto Insurance: Getting Prescriptions Covered

You may want to see also

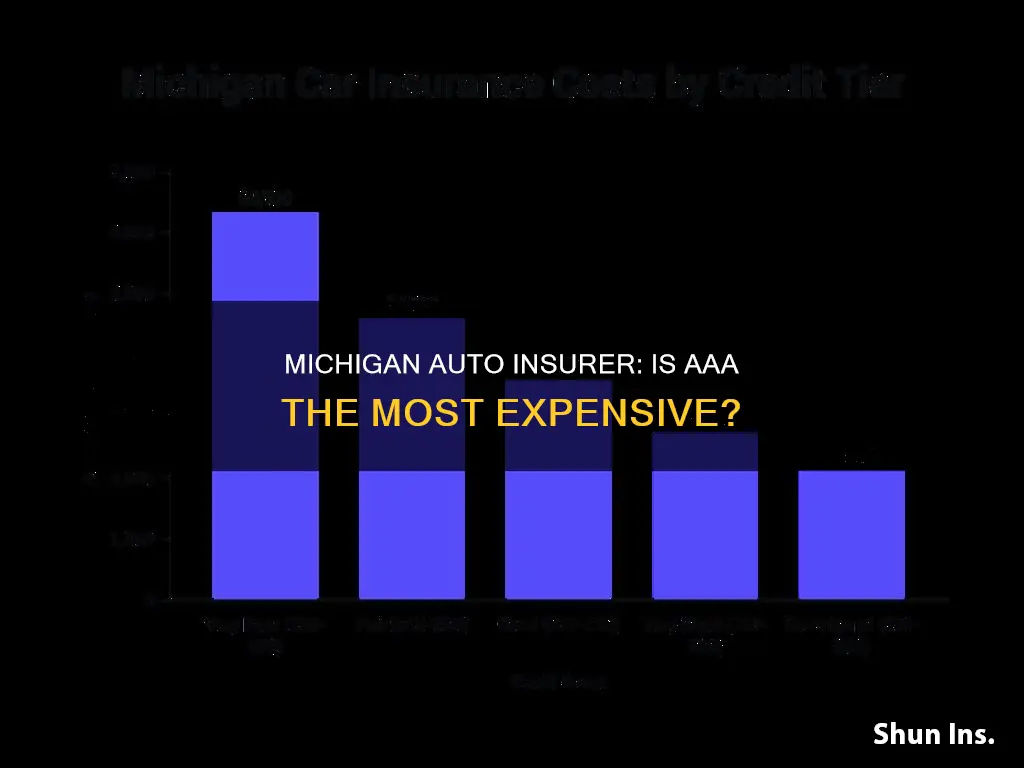

Comparing auto insurance in Michigan

The average annual rate for car insurance in Michigan is $1,920, which is 25% more than the national average. Michigan ranks fifth in the nation for the highest percentage of uninsured drivers, which leads to more expensive premiums for insured drivers.

Cheapest car insurance in Michigan

According to US News, Geico offers the cheapest car insurance in Michigan, with an average annual rate of $1,066. The most expensive car insurance in Michigan is Allstate, with an average annual rate of $3,170.

Factors that affect car insurance rates in Michigan

There are several factors that affect car insurance rates in Michigan, including age, location, driving history, and where you live.

Car insurance requirements in Michigan

Michigan is a no-fault state, which means that drivers are required to carry personal injury protection (PIP) and property protection insurance (PPI) in addition to standard liability coverage.

Finding the best car insurance in Michigan

To find the best car insurance in Michigan, it is recommended to compare quotes from multiple companies. Other factors to consider include the company's customer satisfaction ratings, financial strength, and coverage options. It is also important to understand the state's minimum insurance requirements and to consider any additional coverage that may be needed, such as gap insurance or ridesharing coverage.

Hail Damage: Auto Insurance Rates Impact

You may want to see also

Frequently asked questions

No, AAA is not the highest-rated auto insurer in Michigan. However, it is a leading insurance carrier that offers a wide range of discounts, especially for safe drivers.

AAA is considered the best auto insurance in Michigan for safe drivers. It offers various discounts, including a safe driving discount of up to 20% and a driver training discount of 5%.

The average cost of car insurance in Michigan is $3,010 per year for full coverage. This is significantly higher than the national average of $2,329.

Michigan's auto insurance rates are high due to its no-fault insurance laws, a high percentage of uninsured or underinsured drivers, and costly medical expenses.

USAA is considered the best auto insurance company for military-based coverage in Michigan. It offers specialized coverage options and lower-than-average rates for active-duty military members, veterans, and their families.