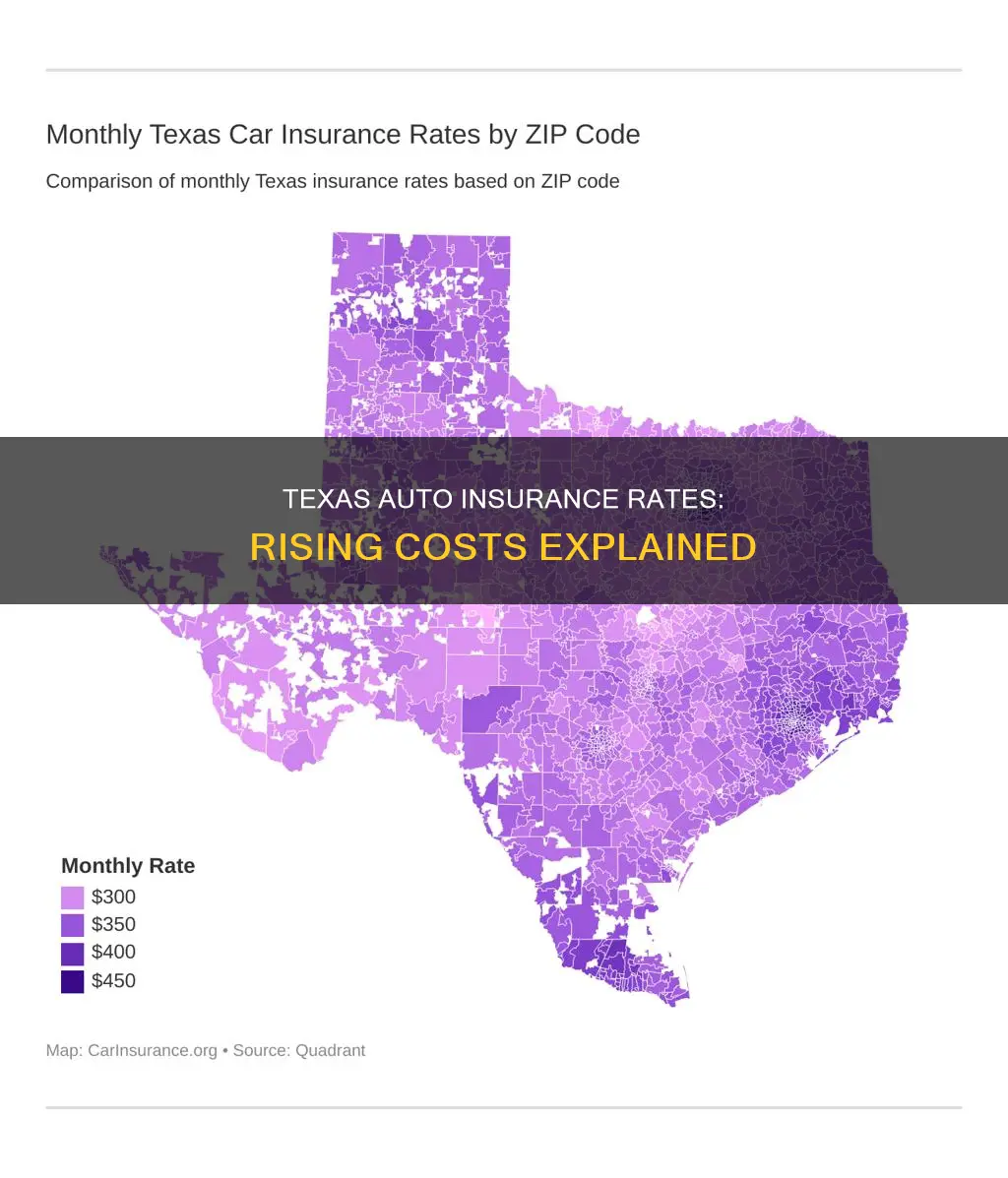

Auto insurance rates in Texas have been on a steep upward trajectory, with the average cost of auto insurance in the state being $1,316 per year. While this is lower than the national average of $1,424, Texans are facing a financial pinch due to the sharp increases. The Texas Department of Insurance reported an average statewide increase of 23.8% in 2022, with some insurers planning another round of hikes in 2023. These hikes are attributed to various factors, including inflation, the higher cost of car repairs, natural disasters, and the increased risk of accidents.

What You'll Learn

Texas has a high urban population density

Texas is the second-largest US state in terms of population size, with a population of over 30 million people as of 2023. The state is home to several major cities, including Houston, San Antonio, Dallas, Austin, and Fort Worth, which form the Texas Triangle megaregion. These urban centers have high population densities, contributing to the overall high urban population density in Texas.

The high urban population density in Texas has implications for auto insurance rates in the state. Urban areas tend to have higher rates of accidents, car thefts, and vandalism. This means that insurance companies receive more claims from these areas, leading to higher premiums for residents. The high population density in Texas's urban centers increases the likelihood of crashes and accidents, which are more frequent in areas with higher traffic volumes.

In addition to the high urban population density, other factors contributing to the increase in auto insurance rates in Texas include the state's high speed limits, frequent natural disasters, and high vehicle theft rates. The combination of these factors results in a higher risk of claims being filed, leading to higher insurance premiums for Texas residents.

The rising cost of auto insurance in Texas can be a significant financial burden for residents, especially those living in high-density urban areas. It is important for individuals to understand the factors contributing to the increase in insurance rates and to explore ways to mitigate these costs, such as shopping around for quotes, bundling policies, or increasing their deductibles.

Choosing the Right Auto Insurance: Navigating Coverage and Costs

You may want to see also

Natural disasters are common in Texas

Texas is prone to disasters such as wildfires, hurricanes, winter storms, and tornados. These disasters increase the risk of vehicular damage and lead to higher insurance rates. For example, in July 2024, Category 1 Hurricane Beryl made landfall in Texas, causing widespread high wind damage and power outages affecting millions. Texas is also susceptible to flooding, which is the most common disaster in the state. Flooding can cause extensive damage to vehicles and infrastructure, leading to increased insurance claims and rates.

The state's high frequency of natural disasters is a significant factor in the high cost of auto insurance in Texas. These disasters increase the likelihood of accidents and vehicle damage, leading to more insurance claims. As a result, insurance companies charge higher premiums to cover the increased risk and potential payouts.

In addition to natural disasters, other factors contributing to high auto insurance rates in Texas include the state's high urban population density, highway density, vehicle theft rate, and high speed limits. These factors collectively increase the risk of accidents and insurance claims, making Texas a costly state for auto insurance.

How to Report Auto Insurance Coverage Scams

You may want to see also

Inflation is a key factor

The Insurance Council of Texas has been monitoring the increasing auto insurance rates, and its communications director, Rich Johnson, has stated that the hikes are due to several factors, including the ongoing issue of inflation. He notes that the cost of everything has gone up, including gas, rental cars, and used cars. The cost of repairs and replacement parts for vehicles has also increased, with replacement parts up by 50% in 2021. This is due to supply chain issues and labour shortages.

Insurers are facing increasing expenses, and as the cost of repairs and replacements rises, their loss ratio, which compares claims and costs to premiums, gets worse. This means insurers are making less money, and they are passing these costs on to consumers in the form of higher premiums.

Inflation is not the only factor contributing to rising auto insurance rates in Texas, but it is a significant one. The higher cost of living, driven by inflation, is making auto insurance less affordable for many Texans.

Income and Auto Insurance: The Premium Connection

You may want to see also

The cost of car repairs is rising

The cost of car repairs is a significant factor in the rise of auto insurance rates in Texas. This is due to a combination of factors, including the higher value of cars, particularly used cars, which increased during the pandemic, and the rising cost of car parts and repairs.

The cost of car repairs has been impacted by supply chain issues, which have caused parts shortages, especially with electronic components. This has been exacerbated by labour shortages, which have made it more expensive to fix cars. The replacement parts for cars were up 50% in 2021, and the supply chain issues have also affected home repairs in the same way.

The increase in the value of cars and the higher cost of repairs and parts have contributed to the rise in insurance rates. As the cost of repairing vehicles has increased, so too has the cost of insurance, as insurers need to pay out more when a claim is made. This is a particular issue in Texas, where there is a high rate of vehicle theft and accidents, and natural disasters are frequent, leading to more claims.

The cost of car repairs is just one factor in the rise of auto insurance rates in Texas, but it is a significant one, and it is having a noticeable impact on the cost of insurance for drivers in the state.

Switching Auto Insurance: When Liability is a Better Option

You may want to see also

Texas has a high vehicle theft rate

Texas has the second-highest number of motor vehicle thefts in the US, with around 85,000 motor vehicles stolen each year. This works out to 287 car thefts for every 100,000 registered vehicles, making Texas the state with the 13th highest rate of motor vehicle theft.

The high rate of vehicle theft in Texas is a significant issue, with certain models being more popular targets. Full-size pickup trucks from Chevrolet, Ford, and GMC are the most frequently stolen vehicles in the state. Other commonly targeted models include compact sedans such as the Honda Accord, Honda Civic, and Toyota Camry.

The high vehicle theft rate in Texas impacts the cost of car insurance in the state. Insurance companies use the rate of car thefts to calculate premiums because it increases the number of claims they are likely to receive. As a result, when car theft rates are high, insurance companies charge higher premiums for car insurance.

The high vehicle theft rate in Texas is just one of several factors contributing to the increase in auto insurance rates in the state. Other factors include the state's high urban population density, high speed limits, and frequent natural disasters.

The Complex World of Totaled Cars: Navigating Insurance and Salvage

You may want to see also

Frequently asked questions

Auto insurance rates in Texas are going up due to a variety of factors, including the high cost of car repairs, inflation, and an increase in accidents.

The Texas Department of Insurance (TDI) reported an average statewide increase of 23.8% in 2022. The average increase requested by insurers in 2023 so far is 10.3%.

The primary reason for the increase in auto insurance rates is the rising cost of car repairs. This is due to higher production costs and supply chain issues, particularly with electronic parts.

Yes, there are several other factors contributing to the rise in auto insurance rates in Texas. These include inflation, an increase in accidents and their severity, and the high cost of medical care.

Drivers in Texas can shop around for the best rates, raise their deductibles, take a defensive driving course, and look for discounts such as student discounts or bundling policies.