Choosing the right auto insurance can be a challenging task, with a variety of companies and policies available. It's important to select a policy that includes all the benefits you need at a competitive price. Before choosing a policy, it's crucial to understand the different types of coverage available and determine the level of coverage you require. Some key considerations include collision coverage, comprehensive coverage, medical or personal injury protection, uninsured and underinsured motorist coverage, and liability coverage. It's also essential to review the financial health of insurance providers and compare multiple quotes to find the best value for your needs. Additionally, don't forget to ask about potential discounts and review your coverage regularly to ensure you're getting the best deal.

| Characteristics | Values |

|---|---|

| Coverage Type | Medical or personal injury protection, uninsured/underinsured motorist, collision, comprehensive, liability, UM, UIM, GAP, OEM, roadside assistance, rental car reimbursement, new car replacement |

| Coverage Amount | Consider the age of your car, your driving habits, and your current financial situation |

| Insurance Company | Customer service reputation, claims service, responsiveness, financial standing, affordability |

What You'll Learn

Understand the types of insurance coverage available

Understanding the types of insurance coverage available is essential when deciding on auto insurance. While some types of coverage are mandated by states, others are optional. Here is a rundown of the types of coverage available:

Bodily Injury Liability (BI)

This type of insurance covers the expenses for someone else's injuries if you are deemed at fault in an accident. It is required in all states except Florida, which only mandates it for taxi drivers. The coverage can extend to anyone listed as a driver on your policy. The minimum level of bodily injury liability insurance coverage is determined by state law.

Property Damage Liability (PD)

Property damage liability insurance covers repairs to other people's vehicles or property damaged in an accident where you are at fault. "Other property" can include equipment and mailboxes, and it can also cover damages to someone's home. New Hampshire is the only state that doesn't require a minimum level of property damage liability coverage.

Medical Payments or Personal Injury Protection (PIP)

Medical Payments coverage pays for medical bills if you or your passengers are hurt in an accident. It can also help cover lost wages and funeral expenses. In some states, PIP is mandatory, while in others, it is optional. The amount of coverage required can vary depending on the state.

Uninsured/Underinsured Motorist Coverage

This type of coverage protects you if you are in an accident with a driver who doesn't have insurance (uninsured) or doesn't have sufficient insurance (underinsured). It can pay for medical bills or repairs to your vehicle. This coverage may be mandatory or optional, depending on your state.

Collision Coverage

Collision coverage is optional in all states but may be required by lenders or leasing companies. It pays for damage to your vehicle after an accident, regardless of who is at fault. It also covers damage from hitting a stationary object, such as a tree or fence, or from potholes. Collision coverage usually has a deductible, which is the amount you must pay out of pocket before your insurer pays the rest.

Comprehensive Coverage

Comprehensive coverage is also optional but may be required by lenders or leasing agencies. It covers damage to your vehicle caused by something other than a collision, such as fire, flood, vandalism, hail, falling objects, or hitting an animal. Like collision coverage, it typically comes with a deductible.

Other Types of Coverage

In addition to the standard coverages mentioned above, there are other optional types of coverage you can add to your policy, such as roadside assistance, rental car reimbursement, new car replacement insurance, glass coverage, rideshare insurance, and mechanical breakdown coverage. The availability of these coverages may vary by state and insurance provider.

Insuring an Unregistered Vehicle

You may want to see also

Assess your financial situation and what you can afford

When choosing auto insurance, it's important to assess your financial situation and what you can afford. This involves considering your income, budget, and overall financial health. Here are some factors to keep in mind:

Income and Budget

Determine how much you can comfortably spend on auto insurance premiums each month. Review your income and expenses to allocate a realistic amount for insurance. Be sure to factor in other costs related to car ownership, such as fuel, maintenance, and repairs. Understanding your budget will help you choose an insurance plan that aligns with your financial capabilities.

Assets and Risk Tolerance

Consider your assets, such as property, investments, or savings. If you have significant assets, you may want to opt for higher liability limits in your insurance policy to protect yourself from potential lawsuits or financial claims resulting from an accident. Assess your risk tolerance and decide if you prefer to pay higher premiums for more comprehensive coverage or opt for lower coverage with the risk of higher out-of-pocket expenses in the event of an accident.

Deductibles and Out-of-Pocket Costs

When selecting an auto insurance policy, you will need to choose a deductible, which is the amount you pay out of pocket before the insurance company covers the remaining costs. Higher deductibles typically result in lower monthly premiums, while lower deductibles lead to higher premiums. Evaluate your financial liquidity and decide what deductible amount you can comfortably afford. Additionally, consider whether you prefer to pay a higher premium to avoid potential out-of-pocket expenses in the event of a claim.

Financial Stability of Insurance Company

Research the financial stability and reputation of the insurance companies you are considering. Check independent ratings from agencies like A.M. Best, Fitch, Moody's, and Standard & Poor's to assess their financial health. Opting for a financially stable insurance company reduces the risk of issues with claim payments down the line.

Discounts and Savings Opportunities

Explore opportunities to lower your insurance costs by taking advantage of discounts. Many insurance companies offer discounts for various factors, such as safe driving records, low annual mileage, good student grades, or bundling policies. By utilizing discounts, you can make your auto insurance more affordable while still obtaining the coverage you need.

Comparison Shopping

Finally, shop around and compare quotes from multiple insurance companies. Obtain quotes for similar coverage levels to understand the range of prices offered. This will help you identify the most competitive rates and choose a policy that aligns with your budget. Remember to consider not only the price but also the reputation of the insurance company for customer service, claims handling, and financial stability.

Your Auto Insurance: What's Covered and What's Not

You may want to see also

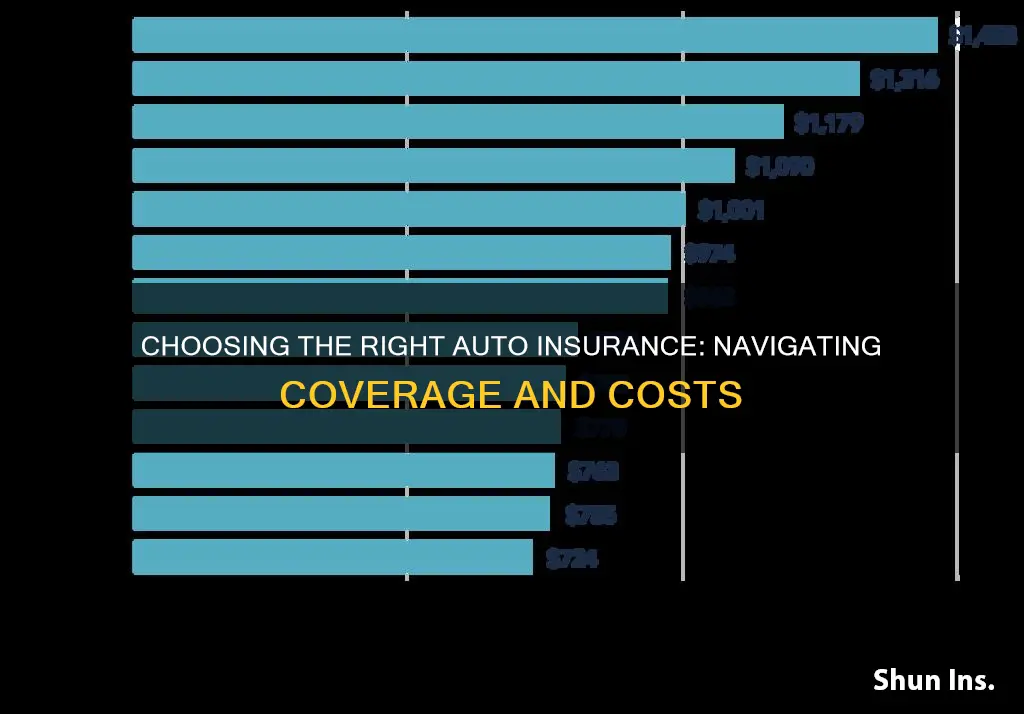

Compare quotes from multiple insurance companies

Comparing quotes from multiple insurance companies is a great way to find the best deal for your auto insurance. Prices can vary significantly from one company to another, so it's worth shopping around to get the most competitive rate. Here are some tips to help you compare quotes effectively:

- Determine your coverage needs: Before comparing quotes, decide on the level of coverage you require. Consider factors such as the age of your car, your driving habits, and your financial situation. For instance, if you have a new car, collision insurance is a must-have. On the other hand, if you own an older vehicle, comprehensive and collision coverage may not be worth the expense.

- Get quotes from multiple insurers: Aim to get quotes from at least three different insurance companies. This will allow you to see how their rates stack up and find the best balance between coverage and cost. You can shop for insurance online, over the phone, or directly through insurance agents.

- Provide accurate information: When requesting quotes, make sure to provide accurate and detailed information about yourself and your vehicle. This includes your driver's license number, driving history, vehicle information (make, model, and Vehicle Identification Number), and current insurance coverage (if any).

- Compare the same coverage amounts: To make a true comparison, ensure you are requesting quotes for the same coverage amounts across all companies. This means selecting the same coverage limits and deductibles, especially for collision and comprehensive insurance.

- Consider other factors: In addition to price, consider the insurance company's financial health, customer service, and claims satisfaction. Check independent ratings and reviews to assess their stability and how they handle customer claims.

- Ask about discounts: Many insurance companies offer discounts, so be sure to inquire about any available discounts you may qualify for. For example, you may be eligible for reduced rates if you have a teen driver with good grades, low annual mileage, or an anti-theft device installed in your car.

- Compare rates regularly: Insurance rates can change over time, so it's a good idea to compare quotes from different companies periodically. This will help ensure you're getting the best deal and allow you to take advantage of any new discounts or coverage options that may have become available.

New York Auto Insurance: Understanding the Empire State's Regulations

You may want to see also

Ask about discounts

Discounts are a great way to save money on your auto insurance without sacrificing coverage. Many insurance companies offer a range of discounts, so it's worth asking about them when choosing a policy. Here are some common auto insurance discounts to look out for:

Multi-Policy or Bundling Discounts

If you buy multiple policies from the same company, such as car insurance plus home, renters, condo, motorcycle, boat, RV, or life insurance, you can often get a discount. This is known as a multi-policy or bundling discount and can result in significant savings. For example, bundling car and home insurance can typically save you between 5% and 25% on your premium.

Vehicle Safety Discounts

Insurance companies often reward drivers who have cars with safety features such as anti-lock brakes, airbags, and daytime running lights. Airbag discounts can be substantial, offering up to 40% off your medical payments or personal injury protection coverage. Additionally, cars less than three years old may qualify for a new car discount, which is usually between 10% and 15%.

Anti-Theft Device Discounts

If your car has anti-theft features, you can often get a discount on your comprehensive coverage. This can range from 5% to 25% off. Some examples of anti-theft devices include GPS-based systems, stolen vehicle recovery systems, and VIN etching, which permanently engraves the vehicle identification number on the windows and windshield.

Good Driver Discounts

Insurance companies often reward good drivers with discounts. These discounts usually apply to drivers who have been incident-free for a certain period, typically three to five years. Good driver discounts can range from 10% to 40% off your premium.

Defensive Driver Discounts

Some insurance companies offer discounts to drivers who take approved defensive driving courses. These discounts are sometimes restricted to mature drivers aged 50 or over, and the discount is usually between 5% and 10%. In some states, this discount is mandated for older drivers.

Good Student Discounts

If you or your student driver is enrolled full-time in high school or college and maintains good grades (usually a B average or above), you may be eligible for a good student discount. This discount typically applies to students aged 16 to 25 and can range from 8% to 25% off your premium.

Student Away at School Discount

If your student is away at school and doesn't have regular access to your car, you may qualify for a discount. The requirements vary, but typically the student must be under 25 years old and live more than 100 miles from home, only using the car during school vacations and holidays.

Payment Discounts

Insurance companies often offer discounts if you pay your policy in full upfront or set up automatic payments. Paying in full can save you between 6% and 14%, while automatic payments can result in a discount of 3% to 6%. Going paperless and receiving documents via email may also result in a small discount.

Online Quote Discounts

Some insurance companies offer a discount if you get an online quote and sign up for a policy. This discount can range from 4% to 12% off your premium.

Advance Quote Discounts

Shopping around and buying a policy in advance of your current one expiring can also bring savings. Buying a policy around seven to 14 days before your current one expires can result in a discount of 2% to 15%.

Occupational Discounts

Your occupation may also qualify you for a discount. For example, Liberty Mutual offers special discounts for educators, and Geico offers up to 15% off for military personnel. It's worth asking your insurance agent if your occupation qualifies for any discounts.

Other Discounts

Other potential discounts include loyalty-based discounts, continuous insurance discounts, teen driver discounts, safe driving app discounts, and driver training discounts.

Filing Progressive Auto Insurance Claims

You may want to see also

Review the financial health of car insurers

When choosing an auto insurance policy, it is important to review the financial health of car insurers. This is because low rates won't be of any use if the company goes out of business and is unable to pay its claims.

There are several independent ratings companies that provide online reports on the financial health of insurers, including A.M. Best, Fitch, Moody's and Standard & Poor's. Each ratings agency uses its own standards for evaluating insurance companies and their financial health.

In addition to checking these ratings, it is also worth considering the size of the insurer. While large, well-known companies may seem like a safer bet, smaller insurers can also offer good coverage and competitive rates. When deciding between a small and large insurer, it is important to weigh up the benefits of each and choose the option that best suits your needs.

It is also worth noting that insurance rates are known to fluctuate, so it is important to keep up to date with the latest options and review your policy on a regular basis.

Auto-Owners Insurance: What Georgia Drivers Need to Know

You may want to see also

Frequently asked questions

The level of coverage you need depends on your financial situation and the age of your car. If you own a lot of assets, you might want higher liability limits. If your car is brand new or relatively new, you should consider collision coverage, which pays to fix your own car following an accident.

There are several core types of coverage to consider: medical or personal injury protection, uninsured/underinsured motorist, collision and comprehensive. Liability and UM coverage are also important, especially if you live in a state without no-fault laws.

Comprehensive and collision coverage are both parts of full-coverage insurance policies. Comprehensive coverage covers damage to your car not caused by accidents, such as theft or vandalism. Collision coverage, on the other hand, pays for repairs to your own vehicle in the event of an accident.

When choosing a car insurance company, consider the company's customer service reputation, claims service, responsiveness, and financial standing. It's also important to get quotes from multiple insurers to ensure you're getting the best rate.