Auto & General Insurance is a company that provides car insurance to drivers with poor credit scores and high-risk drivers who may struggle to find insurance elsewhere. The company offers flexible payment options, including low down payments, and has been in business since 1963.

The General Insurance has been described as a good option for high-risk drivers, including drivers who need to file an SR-22 form. The company has an A+ rating from the Better Business Bureau and is owned by PGC Holdings, a subsidiary of American Family Insurance.

However, there are some negative reviews of the company, with some customers complaining about unexpected fees when cancelling policies early, and poor customer service.

What You'll Learn

The General's customer service

The General Insurance has been in business since 1963 and has over a million drivers insured. The company provides auto insurance coverage for high-risk drivers and those with poor credit. Its coverage includes collision, comprehensive, liability, personal injury protection, and roadside assistance options. It also offers SR-22 filing.

The General has an A+ rating from the Better Business Bureau and an average of 3.9 stars out of 5 from 421 customer reviews. Reviews on the BBB website mention reasonable prices and an easy process to get covered.

The General has a mobile app with high customer satisfaction, holding a 4.7-star average score on the App Store and a 4.8-star rating on Google Play. The app allows customers to receive auto insurance quotes, make payments, file car insurance claims, and find nearby locations to pay their bill in cash.

The General has an overall score of 7.9 out of 10, with high ratings for coverage, cost, availability, reputation, and customer experience. However, some reviews mention that the company has higher-than-average premiums for most drivers and a below-average customer service reputation.

Does GEICO Auto Insurance Cover Motel Stays?

You may want to see also

The General's pros and cons

The General Insurance: The Pros

The General Insurance is a good option for high-risk drivers, including those who need to file an SR-22 form, as it provides solid coverage options and strong discount opportunities. The company has an A+ rating from the Better Business Bureau and has been in business since 1963, so it has a long track record of providing insurance. The General offers flexible payment options, including low down payments, and provides an easy and quick claims process. It also has a strong online presence and accepts a wide range of credit scores.

The General Insurance: The Cons

The General Insurance has higher-than-average premiums, especially for low-risk drivers, and has been criticised for its below-average customer service and lack of coverage options, benefits, and discounts. There are also limited opportunities for policy customisation, and the company is not available in Alaska, Michigan, Maryland, or Hawaii.

Creating False Vehicle Insurance

You may want to see also

The General's insurance coverage

The General Insurance offers a range of car insurance coverage options, including liability, collision, comprehensive, and full coverage. Full coverage includes liability, collision, and comprehensive insurance, as well as uninsured or underinsured motorist insurance. The General also offers rental car coverage, gap insurance, and roadside assistance.

The General caters to high-risk drivers, including drivers who need to file an SR-22 form, and those with poor credit. The company provides affordable rates, low down payments, and flexible payment options. It has an A+ rating from the Better Business Bureau and is owned by PGC Holdings, a subsidiary of American Family Insurance.

Visa's Rental Auto Insurance: Global Coverage and Peace of Mind

You may want to see also

The General's insurance claims

The General Insurance has been in the business of providing auto insurance for nearly 60 years. The company offers a quick and easy claims process, which can be done online through their website or app, or by calling their 24/7 claims hotline. The General also has an award-winning mobile app that allows customers to make a payment, report a claim, and manage their policy anywhere, at any time.

The first step after filing a car insurance claim is usually the assignment of a claims adjuster who will get in touch with you within a few days after the accident. The adjuster will want to get your account of what happened, take pictures of the damages to your car, talk to the other drivers involved or any witnesses, and more.

The General Insurance's hours of operation for existing claims are Monday to Friday, 8 am to 5 pm (local time). Their contact information is as follows:

Email: [email protected]

Address: 6000 American Parkway Madison, WI 53783‑0001

Please include your claim number on all correspondence.

It's important to note that filing a claim can raise your car insurance rates. It's good to be aware of a company's policy on how claims will affect rates before buying insurance.

Umbrella Insurance: New Vehicle, New Policy?

You may want to see also

The General's website and mobile app

The General has an iOS and an Android app with high customer satisfaction ratings. The iOS app has a 4.7-star rating, and the Android version has a 4.8-star rating. The app is easy to use and allows users to pay bills, display their ID card, and enroll in paperless billing. Users can also sign in using their Facebook, Google, or Apple profile. The General's website is also user-friendly and provides useful information, including minimum state requirements, an FAQ page, and a live chat feature. The website also allows customers to get a quote, purchase a policy, and manage their policy.

Marital Status and Auto Insurance: Understanding the Impact of Separation

You may want to see also

Frequently asked questions

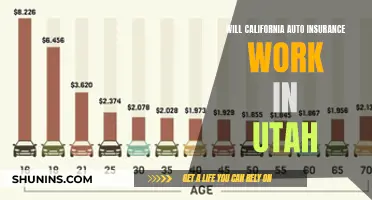

The average cost of The General's car insurance depends on the type of coverage and the driver's history. For full coverage, the average annual cost is $3,069, while for minimum coverage, it is $1,606. The General also offers rental car coverage, gap insurance, and roadside assistance.

The General's car insurance is a good option for high-risk drivers or those with poor credit. It offers affordable rates, low down payments, and flexible payment options. However, it has higher-than-average prices and limited coverage options compared to other providers.

You can file a claim with The General online, through their mobile app, or by calling their 24/7 claims number. The claims process can take a few weeks to a few months, depending on the complexity of the incident.