Auto insurance rates in Michigan have been a topic of discussion and concern for many drivers in the state. While there have been reports of increasing insurance rates, there are also indications that rates may be decreasing for some drivers. The dynamic nature of auto insurance premiums in Michigan can be attributed to various factors, including legislative reforms, the impact of the no-fault insurance system, rising repair costs, and medical expenses. Understanding these factors provides valuable insights into the auto insurance landscape in the state and how it affects drivers' finances.

| Characteristics | Values |

|---|---|

| Auto insurance rates in Michigan | Decreased by 17.8% since 2021 |

| Reason for decrease in auto insurance rates | A 2019 State Law that made changes to Michigan's no-fault insurance rules |

| Auto insurance rates in summer 2023 | Increased |

| Reason for increase in auto insurance rates | Rise in traffic accidents and claims |

| Rising repair costs and medical expenses | |

| Changes in credit score and driving record | |

| Increase in car thefts |

What You'll Learn

The impact of the no-fault insurance system

The no-fault insurance system in Michigan has had a complex impact on auto insurance rates in the state. This system, implemented in 1970, was designed to streamline the claims process and reduce costs for drivers. While it has achieved some of these goals, it has also faced challenges and criticism over the years.

One of the primary goals of the no-fault insurance system in Michigan was to reduce the cost of auto insurance for drivers. Under this system, drivers are reimbursed by their own insurance company, regardless of who is at fault in an accident. This was expected to lower premium costs by avoiding litigation and providing quick payments. Initially, after the changes in 2019, drivers did see a decrease in their insurance rates. However, the impact on insurance rates has been mixed, with some drivers experiencing increases in their insurance fees, especially those with unlimited personal injury protection coverage.

The no-fault system has also faced challenges due to the high cost of medical services in Michigan. One of the main reasons for the high cost of no-fault insurance is that auto insurance pays for a broader range of medical services compared to traditional tort systems. Additionally, auto insurance pays more for the same medical services in no-fault states, and this difference has increased over time. This has resulted in higher insurance costs for drivers, even though the number of claims may remain unchanged.

Another challenge for the no-fault system in Michigan is the impact on caregivers and medical providers. The reforms have reduced compensation for some caregivers, making it difficult for catastrophically injured crash victims to access care. This has led to a legislative push to increase reimbursement rates for medical care, which may result in higher auto insurance premiums for drivers.

In conclusion, while the no-fault insurance system in Michigan has achieved some of its goals, such as streamlining the claims process, it has also faced challenges due to the high cost of medical services and the impact on caregiver compensation. The impact on insurance rates has been mixed, and it remains to be seen if the system will ultimately result in lower costs for drivers. The ongoing legal and legislative developments will likely shape the future of auto insurance rates in Michigan.

Reporting Uninsured Drivers: Your Steps to Take

You may want to see also

The role of PIP coverage

Michigan's auto insurance rates have been a rollercoaster for drivers over the past few years, with some decreases and increases. The Michigan Catastrophic Claims Association (MCCA) fee has been a significant factor in these fluctuations. The MCCA is a nonprofit corporation controlled by the insurance industry that manages the catastrophic care fund.

Now, let's delve into the role of PIP coverage in Michigan's auto insurance landscape:

Personal Injury Protection (PIP) coverage plays a crucial role in Michigan's auto insurance framework. Here are some key points outlining the significance of PIP coverage:

- Mandatory Coverage: PIP insurance is mandatory for all Michigan drivers. It is a requirement for drivers to carry this coverage type as part of their auto insurance policy. This requirement stems from Michigan being a no-fault state, where personal injury protection is essential to cover injuries regardless of fault in an accident.

- Injury Coverage: PIP coverage pays for medical costs incurred by the driver of the insured vehicle and their passengers in the event of an accident. It covers medical expenses up to the selected coverage limit, ensuring that individuals receive the necessary financial support for their medical needs.

- Swift Payment: One of the advantages of PIP coverage is its swift payment process. It is designed to provide payments within 30 to 60 days following an accident. This timely payment helps individuals manage their medical expenses without delay.

- Lost Wages and Essential Services: In addition to medical costs, PIP coverage may also provide financial assistance for lost wages due to injuries sustained in a covered claim. Furthermore, it can help cover necessary routine household services if individuals are unable to maintain their regular responsibilities during their recovery.

- Coverage Options: Michigan drivers have the flexibility to choose from different PIP coverage options. The state offers six PIP medical coverage levels, ranging from $50,000 to $500,000 in coverage, as well as an unlimited coverage option. This allows individuals to select the level of protection that suits their needs and budget.

- Reduced Premiums: The introduction of PIP coverage options has helped reduce insurance premiums for Michigan drivers. By giving drivers the choice to opt for lower coverage limits, insurers have been able to offer less expensive policies. This reduction in overall risk has resulted in more affordable premiums across the state.

- Opt-Out Possibility: Under certain circumstances, individuals may be able to opt out of PIP coverage. If a driver has both Part A and Part B of Medicare coverage, and other household members have qualified health coverage for auto injuries, they may not need PIP. However, specific criteria must be met, and evidence of eligibility must be presented to the insurance company.

- Consumer Choice and Protection: The availability of PIP coverage options empowers Michigan drivers to make informed choices based on their personal circumstances and financial capabilities. It ensures that individuals are not burdened with excessive insurance costs while still providing them with the necessary protection in the event of an accident.

In summary, the role of PIP coverage in Michigan's auto insurance landscape is to provide mandatory protection for individuals involved in automotive accidents, regardless of fault. It ensures that medical expenses and other related costs are covered promptly, giving peace of mind to drivers and their passengers. The availability of coverage options allows for a balance between adequate protection and affordability, contributing to a more sustainable auto insurance market in the state.

Arizona Gap Insurance: What's Covered?

You may want to see also

Rising repair costs and medical expenses

Michigan's auto insurance landscape has witnessed significant adjustments in recent years, which have directly influenced insurance rates. The rising cost of vehicle parts and repair work has led to notable insurance price hikes across the nation. This is due to the fact that inflation has driven up the cost of automotive repairs, with the consumer price index for automotive repair and maintenance increasing by 12% between August 2022 and August 2023. As a result, even if the number of claims in Michigan remains unchanged, insurance companies must pay out more for each individual property damage claim.

In addition to the increasing cost of car repairs, the rising cost of medical care has also had an impact on auto insurance rates. Medical expenses coverage is designed to assist with the costs of medical treatment for injuries sustained in an accident, including hospital bills, doctor visits, medication, and rehabilitation services. This coverage is particularly important for individuals who may not have health insurance or who have high deductibles. With advancements in automotive technology, the complexity of vehicle repairs has increased, requiring specialized knowledge and tools, and leading to higher insurance premiums.

Furthermore, Michigan's No-Fault insurance system, which was controversially overhauled in 2019, mandates that insurers cover various costs associated with accident-related injuries, treatment, and recovery, including medical expenses, time-limited wage loss benefits, replacement services, home modifications, and survivor's loss benefits. This system has historically contributed to higher insurance rates in the state, as it requires drivers to carry personal injury protection (PIP) coverage, which provides benefits such as medical expenses, lost wages, and rehabilitation services.

While the recent reforms have provided drivers with more flexibility in managing their insurance costs, the rising repair and medical costs continue to be a significant factor in the increasing auto insurance rates in Michigan.

Massachusetts Auto Insurance Law: Understanding the Requirements

You may want to see also

Changes in credit score and driving record

Michigan drivers have experienced a decrease of almost 18% in their car insurance rates since 2021, resulting in average savings of $787 per year on full-coverage insurance. However, this downward trend may not continue, as various factors could cause rates to stabilise or even increase.

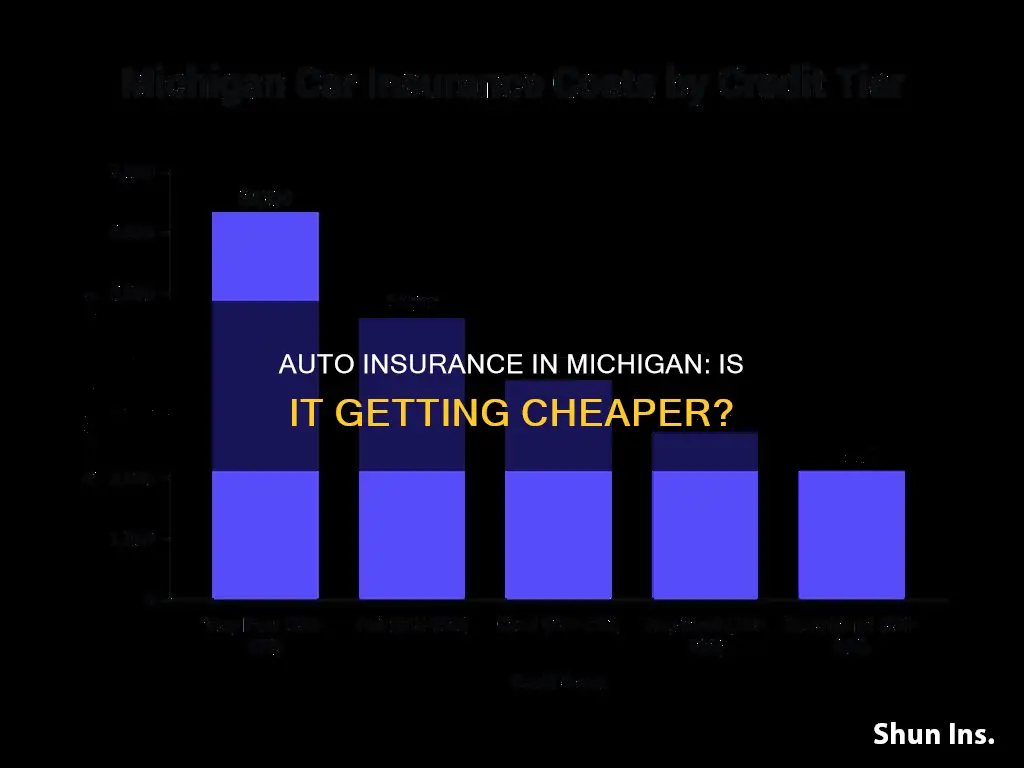

In most US states, insurance companies can legally consider a driver's credit score when determining their car insurance premium rates. A higher credit score typically leads to a lower car insurance rate. Poor credit can increase rates by up to 88% compared to good credit, resulting in an average monthly difference of $144 for full coverage. Insurance companies believe that drivers with poor credit tend to file more claims and will cost them more money.

However, Michigan is one of the four states, along with California, Hawaii, and Massachusetts, that ban insurance companies from using credit scores or credit history to determine insurance rates. Instead, companies in these states base rates on factors such as driving record, location, and other characteristics.

While getting a quote does not affect your credit score, insurance companies almost always perform a "soft pull" of your credit history when you buy a new policy. This does not influence your credit score but allows them to calculate a credit-based insurance score that assesses the risk of you filing a claim.

Therefore, while changes in credit score will not directly impact auto insurance rates in Michigan, maintaining a good credit score is still beneficial for residents in most other areas of their financial lives, such as applying for loans.

When it comes to driving records, Michigan drivers did experience an increase in insurance rates in July 2023 due to changes in the Michigan Catastrophic Claims Association (MCCA) fee. The MCCA fee increase was a result of a Michigan Court of Appeals ruling that prevented the retroactive application of no-fault auto insurance reforms, leading to higher costs for insurance providers that were passed on to consumers.

In summary, while changes in credit score will not directly impact auto insurance rates in Michigan due to legal protections, maintaining a good credit score is still beneficial for overall financial health. On the other hand, changes in driving records, such as those resulting from the MCCA fee increase, can and do impact auto insurance rates in the state.

Comparing Auto Insurance Plans: Consumer Reports Guide

You may want to see also

Increase in traffic accidents and claims

Michigan auto insurance fees are going down in 2024. The Michigan Catastrophic Claims Association (MCCA) has announced it will lower its annual per-vehicle assessments on auto insurance policies. This comes after a surprise court case outcome regarding medical price controls for those with catastrophic injuries from auto accidents. The Michigan Supreme Court ruled in July that price controls in Michigan's 2019 no-fault insurance overhaul do not apply to injuries that occurred before the overhaul. This ruling caused a projected $3.7 billion cost to the MCCA, contributing to an actuarial deficit.

Despite this, insurance prices have been increasing nationwide due to rising vehicle repair and part costs. In 2023, Michigan saw a total of 287,953 vehicle crashes, a 2% decrease from 2022. However, the number of injuries increased by 1%, and there was an 11% increase in pedestrian-involved crashes. Distracted driving, particularly cell phone use, remains a significant issue in the state, causing 15,136 accidents in 2023. Young drivers aged 16-20 also continue to cause a disproportionate number of crashes and fatalities, with over 15% of all car crashes in Michigan attributed to this age group.

There has been a rise in traffic accidents and claims in Michigan, with a total of 287,953 vehicle crashes recorded in 2023, including cars, trucks, motorcycles, buses, and other vehicles. This number represents a slight decrease from 2022, but the number of injuries has increased by about 1%. Distracted driving, particularly cell phone use, remains a leading cause of accidents, with 15,136 crashes attributed to it in 2023.

Young drivers aged 16-20 cause a disproportionately high number of crashes and fatalities, with over 15% of all car crashes in Michigan caused by this age group. There has also been an increase in work-zone accidents, with an 8% increase from 2022 to 2023, and a dramatic rise in pedestrian-involved crashes, with an 11% increase in the number of crashes and a 6% increase in fatalities.

While there has been a welcome decrease in alcohol and drug-related crashes, the number of drug-related crashes resulting in fatalities has increased by 3%. Additionally, with more older drivers on the road, accidents caused by individuals aged 65 and above have increased across all categories.

The increase in traffic accidents and claims in Michigan has contributed to the financial strain on insurance providers, leading to higher insurance rates for drivers. The MCCA, for example, has had to increase rates to recoup losses after being ordered to continue paying benefits to individuals injured before the 2019 insurance changes.

The rise in accidents and claims also puts a strain on the state's healthcare system, with more people requiring medical attention and care due to crash-related injuries. This, in turn, can lead to increased costs for medical providers and insurance companies, which may be passed on to consumers in the form of higher insurance rates or medical fees.

To mitigate the impact of rising insurance rates, drivers in Michigan have been given a choice in the amount of Personal Injury Protection (PIP) coverage they purchase. Those who choose limited PIP coverage can now fall back on their health insurance for auto accidents, potentially saving money on their auto insurance. Additionally, the MCCA has lowered its fees for 2024-2025, providing some relief to drivers.

Auto Insurance: Progressive's Point System and Your Premiums

You may want to see also

Frequently asked questions

The Michigan Catastrophic Claims Association (MCCA) has announced that it will lower its annual per-vehicle assessments on auto insurance policies. This means that drivers with unlimited, lifetime medical coverage, or personal injury protection (PIP), will be charged less, and drivers choosing any other PIP option, or opting out, will be charged a lower "deficit recoupment" fee.

The decrease in rates is due to a combination of factors. Firstly, the MCCA's finances have stabilized following a surprise court case outcome related to medical price controls for individuals with catastrophic injuries from auto accidents. Secondly, the state's no-fault insurance reforms in 2019 gave drivers more choices in PIP coverage levels, reducing the overall claims liability for insurers.

While the rates are currently decreasing, several risk factors could lead to higher rates in the future. These include an increase in car thefts, rising repair costs due to inflation, changes in credit scores or driving records, and an increase in traffic accidents and claims.