If you're an international visitor to the US and plan on driving, you'll need to get car insurance. This is true whether you're renting a car or bringing your own. The easiest way to get insured is through the rental company, but you can also buy a standalone policy.

If you're only in the US for a short time, you can drive with a valid driver's license from your home country. If you're staying longer, you may need to apply for an International Driving Permit (IDP) and a US driver's license.

Insurance companies in the US offer various coverage options for international drivers, and you can buy a policy online or through a licensed agent. When choosing a policy, consider the different types of coverage available, such as liability insurance, collision insurance, and personal effects coverage.

| Characteristics | Values |

|---|---|

| Is auto insurance required for international driver license? | Yes |

| Who needs an international driving permit? | Laws vary from state to state, but it is recommended that anyone planning to drive while visiting the U.S. obtains an IDP before leaving their home country. |

| What is an international driving permit? | An IDP is a translation of a driver's foreign license. It doesn't replace the original license but acts as a supplement. |

| How to get an international driving permit? | Contact your home country's automobile association or similar regulatory body before travelling. |

| Is car insurance required for short-term visitors? | Yes, but short-term visitors can obtain auto insurance from rental companies. |

| Is car insurance required for long-term visitors? | Yes, and it is recommended to buy a long-term policy. |

| What are the common types of auto insurance coverage for international drivers in the U.S.? | Liability, Collision, Comprehensive, Personal Injury Protection (PIP), and Uninsured/Underinsured. |

What You'll Learn

- What type of auto insurance is required for an international driver's license?

- How do international drivers obtain auto insurance?

- Is an international driver's license valid in the US?

- What are the penalties for driving without insurance in the US?

- What is the average cost of auto insurance for international drivers in the US?

What type of auto insurance is required for an international driver's license?

The type of auto insurance required for an international driver's license depends on the country and the insurance provider. It is essential to note that auto insurance requirements vary across different countries and states. Here is a comprehensive overview of auto insurance for international drivers:

Understanding Auto Insurance for International Drivers

Before travelling to a new country, it is crucial to understand the auto insurance requirements and regulations of that country. In most countries, auto insurance is mandatory for all drivers, regardless of citizenship. Therefore, international drivers must ensure they have the necessary auto insurance coverage before getting behind the wheel.

Temporary Auto Insurance for International Drivers

If you are only visiting a country for a short period, temporary auto insurance options are available. Rental car companies typically offer rental car insurance, which can be purchased when renting a vehicle. This type of insurance usually includes collision damage waiver, personal injury protection, and personal effects coverage. It serves as liability insurance, covering damage or injuries caused to other vehicles or drivers in an accident. However, additional optional coverage can be purchased for extra financial protection.

Long-Term Auto Insurance for International Drivers

For international drivers planning an extended stay in a country, purchasing long-term auto insurance is generally recommended. This type of insurance can be more comprehensive and provide better financial protection in the event of an accident. It is important to note that auto insurance rates may vary based on factors such as location, driving history, credit score, and the make and model of the vehicle.

Common Types of Auto Insurance Coverage for International Drivers

When insuring a vehicle in a new country, several types of auto insurance coverage are typically available:

- Liability insurance covers the cost of repairs and medical expenses for other drivers and their passengers in the event of an accident.

- Collision insurance covers repairs to your vehicle, even if you are at fault for the accident.

- Comprehensive insurance covers damage to your vehicle caused by incidents such as vandalism, natural disasters, or inclement weather.

- Personal injury protection (PIP) covers your medical expenses after an accident, regardless of who is at fault.

- Uninsured/underinsured motorist coverage protects you if the other driver in an accident does not have insurance or does not have sufficient coverage.

International Driving Permits

To drive with an international driver's license, you may need an International Driving Permit (IDP). An IDP translates your driver's license into multiple languages and is recognised in many countries. It is important to note that an IDP does not replace your driver's license but complements it. Always carry your driver's license along with the IDP when driving.

Auto Insurance for Foreigners

Foreign nationals can typically obtain auto insurance in most countries. Insurance providers often offer coverage options specifically for international drivers or non-residents. These policies may have terms and conditions tailored to the needs of international drivers, such as short-term coverage or coverage for foreign-registered vehicles.

Impact of Foreign Driving Record on Insurance Rates

In most cases, insurance providers do not consider foreign driving records when determining insurance rates. International drivers are usually treated as new drivers, which may result in slightly higher insurance rates. However, it is important to note that insurance rates can vary based on personal factors, and the best way to determine the cost of auto insurance is to request a quote.

Auto Insurance: Understanding the Impact of Motor Vehicle Violations

You may want to see also

How do international drivers obtain auto insurance?

International drivers can obtain auto insurance in the U.S. by following a few steps. First, it is essential to understand the requirements for driving in the U.S. as a foreign national. To operate a vehicle in the U.S., you will need a valid driver's license from your home country and proof of car insurance. Depending on the state you are visiting or relocating to, you may also need an International Driving Permit (IDP). An IDP is not a replacement for your original license but acts as a supplement, allowing you to drive in many countries, including the U.S. You can apply for an IDP from your home country's relevant authority, typically the department of motor vehicles.

Once you have the necessary documentation, you can purchase auto insurance from an insurance company. Most major insurance companies, such as Progressive and State Farm, offer car insurance to international drivers with a valid foreign license or an IDP. You can compare quotes from multiple insurance providers to find the best rate and coverage for your needs. It is recommended to get insurance that meets the state-minimum requirements, as driving without insurance can lead to fines, vehicle impoundment, and even jail time.

If you are a short-term visitor to the U.S., you may not need a long-term auto insurance policy. Rental car companies typically offer insurance options, and this can be a convenient way to ensure you are legally covered during your stay. However, if you are relocating to the U.S. or staying for an extended period, you will need to purchase an auto insurance policy that meets the requirements of the state you are residing in.

When purchasing auto insurance as an international driver, consider the different coverage types available and choose the ones that best suit your needs. Additionally, look for insurers that offer discounts, such as those for paying the premium in full or bundling policies. Reading customer reviews and comparing rates from multiple insurers can also help you find the best deal.

Massachusetts Auto Insurance: Exploring General Coverage Options

You may want to see also

Is an international driver's license valid in the US?

An International Driving Permit (IDP) is a document that translates your identifying information into different languages. It is not considered a valid driver's license in the United States but acts as a bridge between your native driver's license and the requirements of the country you are visiting.

The requirements for driving in the US vary from state to state. Some states require an IDP, while others do not. It is important to check the requirements of the specific state you plan to drive in before your trip. You can do this by contacting the state's department of motor vehicles.

If you are a short-term visitor to the US, you can get temporary car insurance coverage from a car rental company, which will cover any accidents during your stay. If you plan to stay in the US for an extended period, you may need to purchase a car insurance policy that meets the state-mandated requirements. Most states require drivers to carry liability coverage, which typically includes property damage and bodily injury protection.

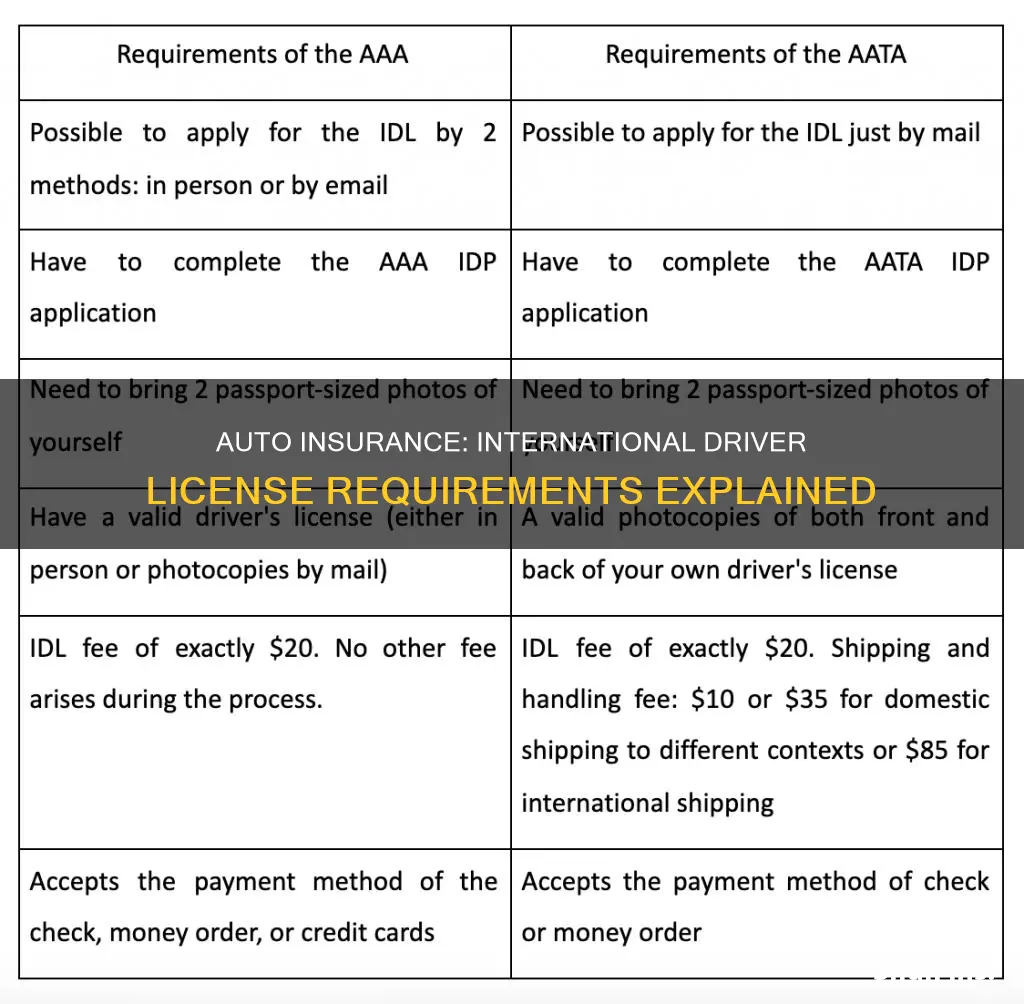

To obtain an IDP, you must contact the motor vehicle department of the country that issued your driver's license. The fees and processing time will depend on the issuing country. In the US, the American Automobile Association (AAA) is the only entity authorized to issue IDPs. The IDP is valid for a limited time, typically one year.

Amica Insurance: Unlocking Auto and Home Bundling Benefits

You may want to see also

What are the penalties for driving without insurance in the US?

Driving without insurance in the US can result in serious penalties, including fines, suspension of driving privileges, and legal trouble. While the specific consequences may vary by state, here is a general overview of the penalties for driving without insurance in the US:

First Offense

For a first-time offender, the typical penalty includes a fine ranging from $500 to $1,000. Additionally, the driver's license, vehicle registration, and license plates may be suspended for up to three months. To reinstate driving privileges, individuals may need to pay fees ranging from $50 to $85, along with the fine.

Second Offense

The penalties increase for a second offense, with fines typically ranging from $750 to $1,400. The suspension period also lengthens to six months. The reinstatement process and associated fees remain similar to those of the first offense.

Third and Subsequent Offenses

For a third or subsequent offense, the penalties become more severe. Fines can reach $1,000 or more, and the suspension of driving privileges can extend to a full year. Reinstating driving privileges will again require paying the necessary fees and providing proof of insurance.

It is important to note that some states, like Arizona, have specific additional requirements. For example, drivers in Arizona may be required to maintain an SR-22 certificate for 36 months, which demonstrates financial responsibility and future insurance coverage. Failure to maintain this certificate during the specified period can result in further suspension of driving privileges.

Driving without insurance not only incurs legal consequences but can also lead to financial strain and significant disruptions to one's daily life. It is crucial for individuals to prioritize maintaining valid insurance coverage to avoid these penalties and ensure they are compliant with their state's requirements.

Auto Insurance: Your Rights as a Consumer

You may want to see also

What is the average cost of auto insurance for international drivers in the US?

The average cost of auto insurance in the US varies depending on the type of coverage. The average cost of full coverage car insurance is $2,329 per year, according to Bankrate, while Forbes Advisor puts the figure at $2,150 per year. Minimum coverage, on the other hand, has an average annual cost of $633, according to Bankrate, and $467, according to Forbes Advisor.

These figures are for US drivers in general and may not be reflective of the costs for international drivers. International drivers may find it more difficult to obtain car insurance, and some companies may refuse to provide coverage if they do not have a US driver's license. It is also important to note that the cost of car insurance can vary depending on various factors such as age, gender, driving history, and credit score.

According to MoneyGeek, international drivers should expect to pay more for car insurance than US drivers. The monthly average cost of car insurance for local drivers ranges from $30 to $61, but foreign drivers will likely face higher rates. This is because it is more difficult for insurance companies to find information about the driving history and credit score of international drivers.

Calculating Vehicle Repair Insurance Claims

You may want to see also

Frequently asked questions

Yes, auto insurance is required for international driver's licenses in the US. This applies to both short-term visitors and long-term residents.

You can obtain an international driver's permit (IDP) by contacting your home country's traffic or motor vehicles agency. The processing time is usually around two weeks, and the permit is valid for one year.

It depends on the state you are visiting and the length of your stay. Some states require an IDP, while others accept a valid foreign driver's license. It is recommended to have an IDP as it serves as an official translation of your license.

The type of auto insurance you need depends on the state you are visiting and the duration of your stay. Most states require liability insurance, while some also mandate underinsured/uninsured motorist coverage. If you are renting a car, you can purchase insurance from the rental company, which typically includes liability insurance.

To find the best auto insurance rates, it is recommended to compare quotes from multiple insurance companies. You can do this online or by contacting a licensed insurance agent, who can guide you through the process and ensure you meet the necessary requirements.